Bid Ask Spread: What It Is and Why It Matters in Crypto and Stock Trading

When you buy or sell anything from Bitcoin to Apple stock, the bid ask spread, the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Also known as spread, it's not just a number on a chart—it's the hidden cost of every trade you make. If the spread is wide, you lose money the moment you click buy. If it’s tight, you get closer to the price you see. This isn’t theory—it’s cash in your pocket.

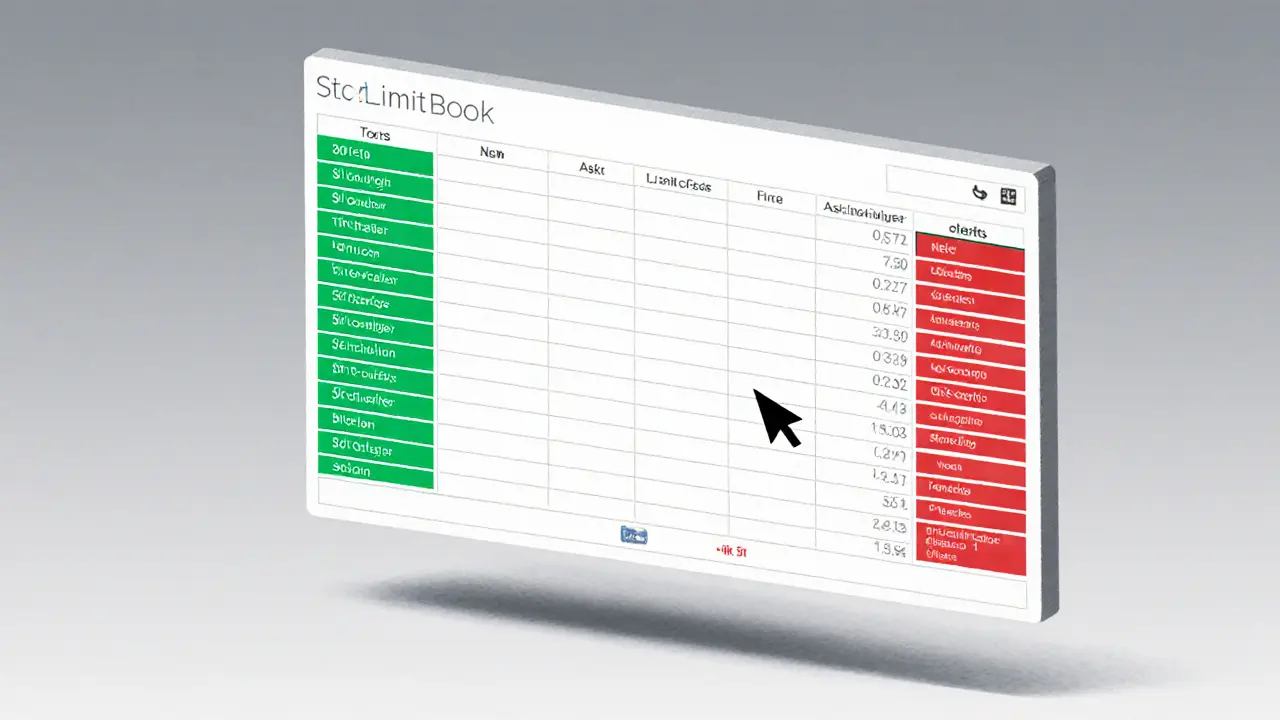

The order book, the live list of all buy and sell orders for an asset shows you exactly where the spread comes from. On a big exchange like Binance or Coinbase, you’ll see dozens of buyers and sellers stacked up, pushing the spread down. But on smaller platforms or low-volume coins, you might see just one buyer offering $29.50 and one seller asking for $30.50—that’s a $1 spread on a $30 coin. That’s 3.3% gone before you even move. And if you’re trading meme coins or tokens with no real liquidity, that spread can jump to 10%, 20%, even more. That’s why you see people losing money not because the price dropped, but because they bought high and sold low—just because the spread ate their profit.

liquidity, how easily an asset can be bought or sold without changing its price is the silent driver behind the spread. High liquidity? Tight spread. Low liquidity? Wide spread. That’s why Bitcoin’s spread is often just a few cents, but a new token with 500 traders might have a spread of $2. And market depth, how many orders sit above and below the current price tells you if that spread is safe. A deep order book means big buyers and sellers are ready to step in. A shallow one? You’re trading with ghosts.

What you’ll find in the posts below aren’t just definitions—they’re real stories. From P2P platforms where traders in restricted countries navigate wild spreads to exchanges like ZKSwap and Kava Swap that try to cut trading costs, you’ll see how the spread shapes decisions. You’ll learn why Cryptobuyer Pro is a scam (hint: fake spreads), how HyperBlast hides its fees in the spread, and why TokenSets works so well for beginners (it avoids the spread trap). This isn’t about memorizing terms. It’s about seeing the invisible cost in every trade—and how to beat it.

What Is an Order Book in Cryptocurrency Trading? A Clear Guide for Beginners and Traders

An order book in cryptocurrency trading shows all live buy and sell orders for a crypto pair. It reveals true market depth, bid-ask spreads, and potential price movements - essential for smart trading on exchanges like Binance and Coinbase.

VIEW MORE