CBN cryptocurrency policy: What you need to know

When navigating CBN cryptocurrency policy, the set of rules issued by the Central Bank of Nigeria that govern how digital assets can be used, traded, and held within the country. Also known as Nigeria crypto regulations, it shapes everything from licensing requirements to tax treatment. Central Bank of Nigeria enforces these rules, aiming to protect investors while limiting illicit activity.

Key components and how they connect

The policy encompasses three core pillars: digital asset licensing, a framework that forces any platform dealing with crypto to obtain a formal permit from the regulator, crypto exchange compliance, a set of operational standards that include KYC, AML, and reporting obligations, and tax and reporting guidelines, rules that define how gains are declared and what penalties apply for non‑compliance. By requiring licensing, the CBN aims to filter out rogue operators; by imposing exchange compliance, it tries to keep the market transparent; and by setting tax rules, it seeks revenue and legitimacy. These three pillars are not isolated. Regulatory compliance influences crypto adoption because traders gravitate toward platforms that meet the law. In turn, higher adoption pushes the Central Bank to refine its policy, creating a feedback loop that shapes the entire ecosystem. For businesses, understanding the policy means knowing what documentation is needed for a license, how to set up KYC procedures, and which reporting forms the CBN expects. For everyday users, it means recognizing which exchanges are officially approved and why some services disappear overnight.

Below we break down the most common questions that arise when dealing with the CBN cryptocurrency policy, from how to apply for a digital‑asset licence to what penalties look like for missed reporting deadlines. Whether you are a trader, a fintech startup, or just curious about Nigeria’s stance on crypto, the collection of guides on this page will give you practical steps, real‑world examples, and up‑to‑date compliance checklists.

Ready to see how the policy plays out in real scenarios? Scroll down to explore detailed guides on licensing, exchange reviews, tax implications, and the latest regulatory updates that will help you stay ahead of the curve.

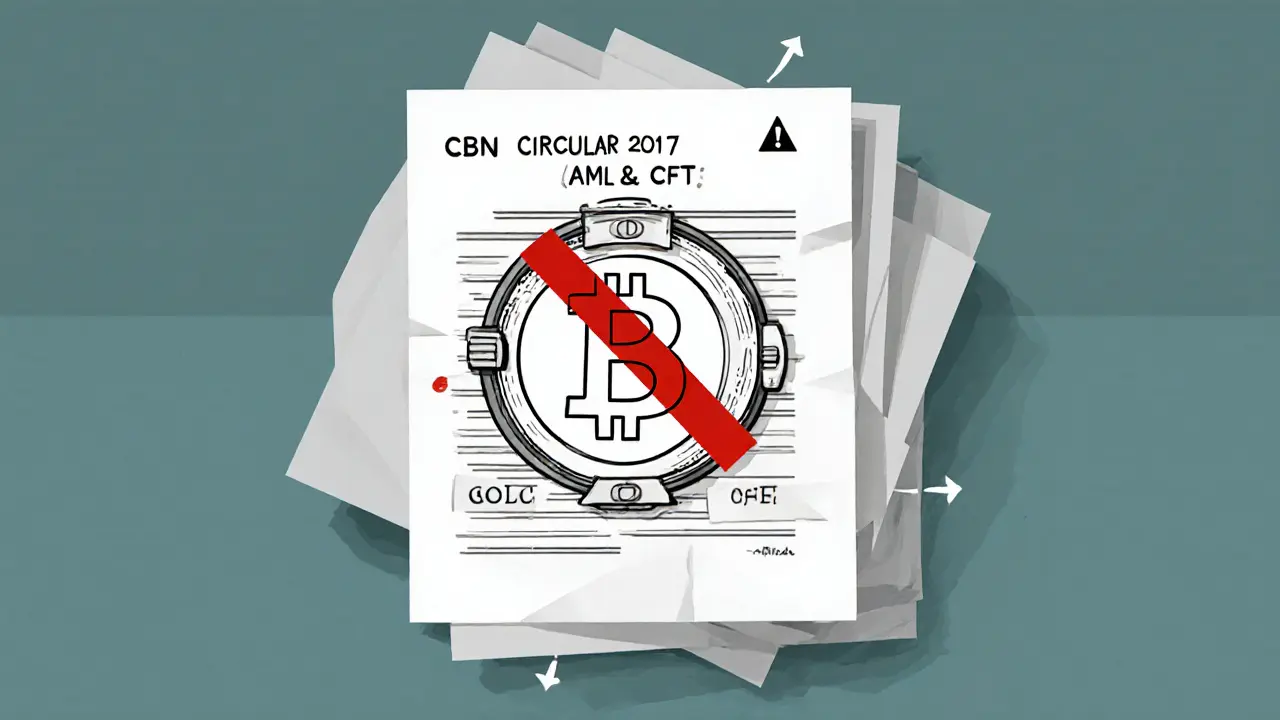

Nigeria’s Crypto Policy: From CBN Ban to VASP Guidelines (2017‑2025)

Explore how Nigeria's Central Bank shifted from a 2017 crypto ban to regulated VASP guidelines by 2025, covering key policies, compliance steps, and market impact.

VIEW MORE