Crypto Trading Order Book: How It Works and Why It Matters

When you trade crypto, you're not just clicking a button—you're interacting with a living, breathing system called the crypto trading order book, a real-time list of buy and sell orders for a specific asset, showing exactly how much people are willing to pay and accept. Also known as order book crypto, it’s the hidden engine behind every price move on exchanges like Binance, Kraken, or ZKSwap. If you don’t understand this, you’re trading blind.

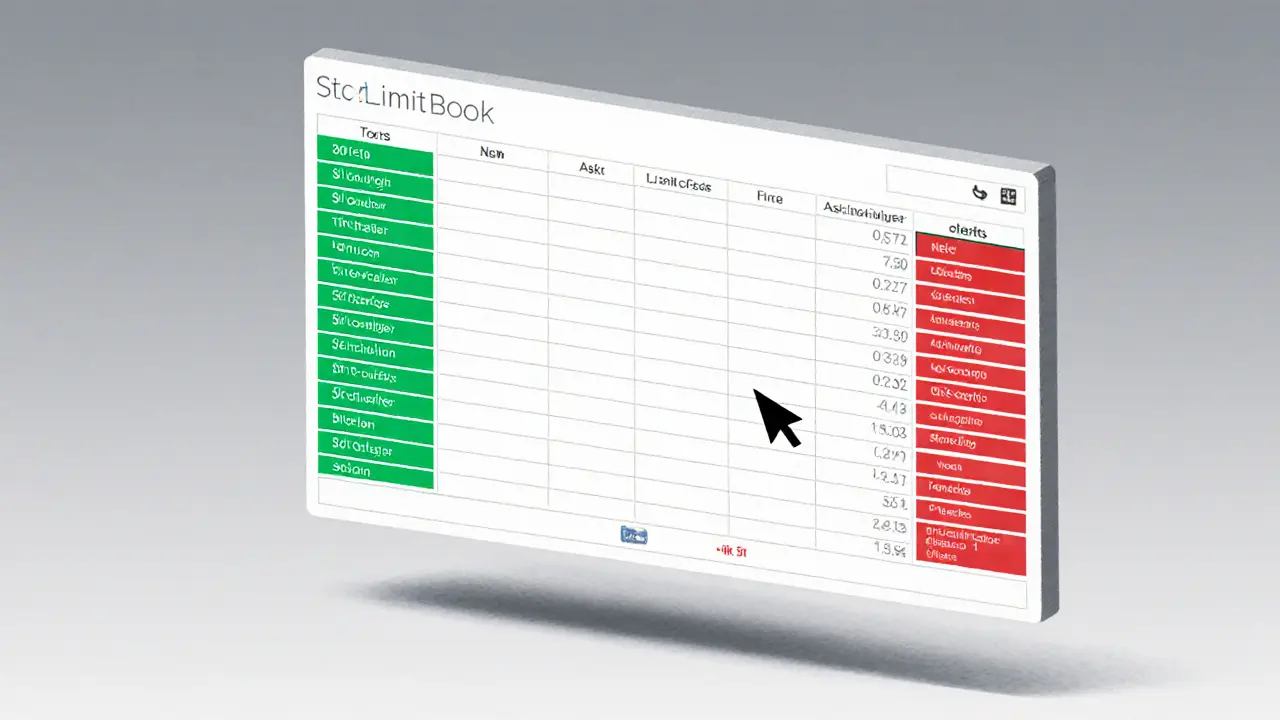

The order book, a dynamic record of unmatched buy and sell orders shows two sides: bids (what buyers offer) and asks (what sellers want). The gap between the highest bid and lowest ask is the spread. Tight spreads mean high liquidity—like on Bitcoin or Ethereum—where thousands of orders stack up. Wide spreads? That’s usually a low-volume token like W Coin or Zeus, where one big order can swing the price 20% in seconds. The liquidity depth, how much volume exists at each price level tells you if a trade will execute cleanly or get slippage. Look at the depth chart on any serious exchange, and you’ll see if there’s a wall of buy orders holding the price up—or if it’s just a few lonely sellers waiting to crash.

Pro traders watch the order book like a chess game. They see large hidden orders, fake bids meant to trick retail traders, and sudden spikes that signal institutional moves. You don’t need fancy tools—just open your exchange’s order book and ask: Is the buy side strong? Are sellers stacking up just above the current price? Is the volume thin? That’s how you know if a breakout is real or just noise. Even platforms like ZKSwap and Kava Swap, which hide some complexity, still rely on this same system behind the scenes. And if you’re trading on P2P platforms in places like China or Afghanistan, where banks are blocked, the order book is even more critical—because there’s no safety net.

Some posts in this collection show you how scams like Cryptobuyer Pro manipulate price by creating fake order book activity. Others reveal how low-liquidity tokens like Ishi or PunkCity have order books that look like empty parking lots—easy to drive through, hard to stop. Meanwhile, tools like TokenSets and ZKSwap use the order book’s structure to automate trades without you ever seeing it. The order book doesn’t lie. It doesn’t care if you’re new or experienced. It just shows what’s real. Learn to read it, and you stop guessing. You start knowing.

What Is an Order Book in Cryptocurrency Trading? A Clear Guide for Beginners and Traders

An order book in cryptocurrency trading shows all live buy and sell orders for a crypto pair. It reveals true market depth, bid-ask spreads, and potential price movements - essential for smart trading on exchanges like Binance and Coinbase.

VIEW MORE