Cryptocurrency Order Book: How It Works and Why It Matters for Traders

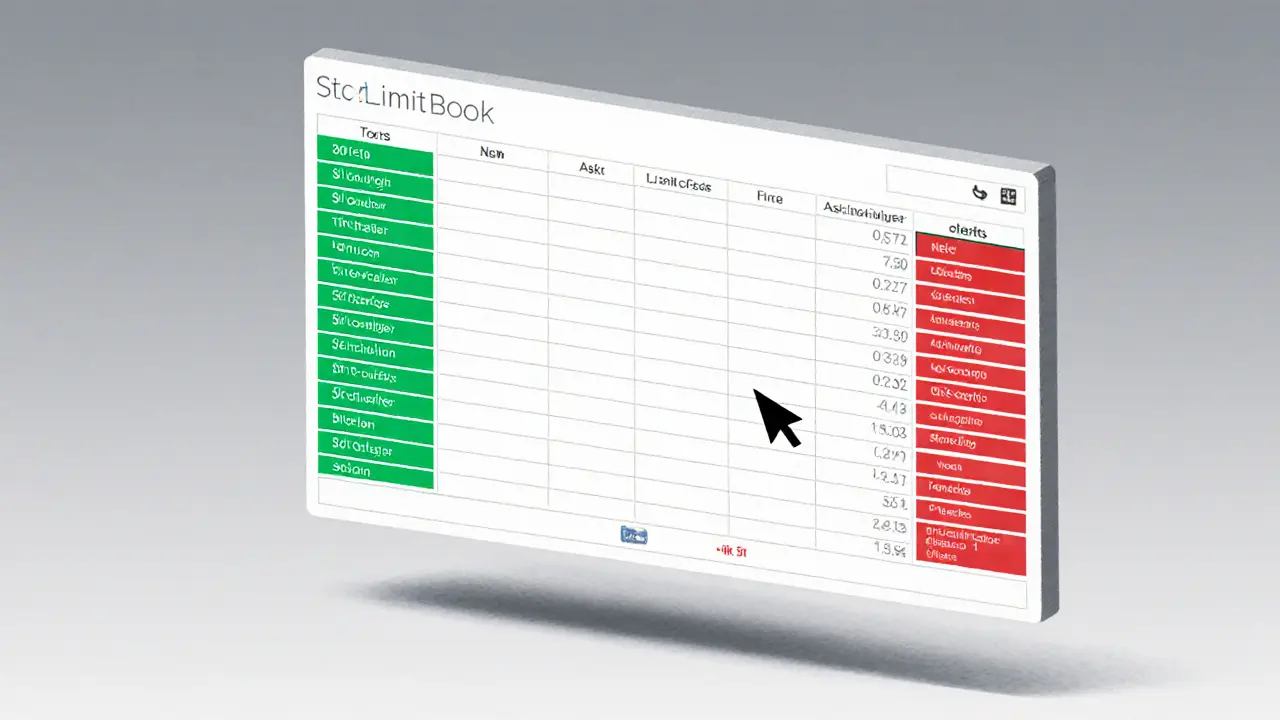

When you trade crypto, you're not just clicking a button—you're interacting with something called a cryptocurrency order book, a live, public list of all pending buy and sell orders for a specific asset at different prices. Also known as a depth chart, it shows exactly where the market stands at any second—no guesswork, no rumors. This isn’t just data; it’s the heartbeat of every trade on every exchange, from Binance to ZKSwap.

At its core, the cryptocurrency order book splits into two sides: bids (buyers) and asks (sellers). The highest bid is the most someone is willing to pay right now. The lowest ask is the least a seller will accept. The gap between them? That’s the spread. Tight spreads mean high liquidity—like on Bitcoin or Ethereum. Wide spreads? That’s usually a sign of low trading volume or a risky token like W Coin or Zeus. You’ll see this clearly in reviews of exchanges like HyperBlast or XBTS, where order book depth often reveals whether the platform is trustworthy or just a facade.

Order books don’t just show prices—they show intent. Large blocks of buy orders clustered near the current price? That’s support. A wall of sell orders just above? That’s resistance. Traders watch these levels like hawkers. If you’ve ever wondered why a coin suddenly drops 10% after a small sell order, it’s because the order book had no buyers lined up to absorb it. That’s what happened with low-cap tokens like Ishi or PunkCity—tiny order books mean tiny price stability. And when a platform like Cryptobuyer Pro claims to be fast but hides its order book? That’s a red flag. Real exchanges don’t hide liquidity; they display it.

Understanding the order book also helps you avoid getting trapped in fake volume. Some exchanges inflate numbers by creating fake trades. But a real order book can’t be faked. If the bids and asks look thin, scattered, or full of tiny orders, you’re dealing with a shallow market. That’s why ZKSwap’s gas-free trading only works well because it pulls from deep liquidity pools. And why P2P platforms in China or Afghanistan still rely on stablecoins like USDT—they’re the only assets with reliable order books under pressure.

Whether you’re buying Bitcoin on a P2P platform, trading meme coins with no team, or checking out a new DEX like TokenSets, the cryptocurrency order book is your first line of defense. It tells you who’s really in control of the price. No analyst, no influencer, no news headline can override what’s sitting in that book. The next time you open a trading app, look past the price chart. Dive into the bids and asks. That’s where the real story lives.

Below, you’ll find real-world examples of how order books shape trading outcomes—from the hidden liquidity in Blackhole DEX to the dangerous gaps in scam platforms. What you learn here isn’t theory. It’s what separates smart traders from those who get wiped out.

What Is an Order Book in Cryptocurrency Trading? A Clear Guide for Beginners and Traders

An order book in cryptocurrency trading shows all live buy and sell orders for a crypto pair. It reveals true market depth, bid-ask spreads, and potential price movements - essential for smart trading on exchanges like Binance and Coinbase.

VIEW MORE