ERC-20 Token: What It Is, How It Works, and Why It Matters

When you buy a token on Ethereum—whether it’s a DeFi coin, a governance token, or even a meme coin—you’re almost certainly dealing with an ERC-20 token, a technical standard for creating fungible tokens on the Ethereum blockchain. Also known as Ethereum Request for Comments 20, it’s the reason thousands of coins can talk to each other, swap on exchanges, and live in the same wallet. Without ERC-20, crypto wouldn’t work the way it does today.

Think of ERC-20 as a rulebook. It doesn’t tell you what a token should do—only how it must behave. Every ERC-20 token must support basic functions like transferring coins between wallets, checking balances, and approving spending limits. This standardization is why you can send UNI, LINK, or AAVE to your MetaMask without worrying about compatibility. It’s also why exchanges like Gate.io or Mandala Exchange can list hundreds of tokens without building custom support for each one. The same standard applies whether it’s a billion-dollar project or a tiny experiment.

Behind every ERC-20 token is a smart contract, a self-executing code on Ethereum that enforces the token’s rules. This contract holds the total supply, tracks who owns what, and handles all transfers. It’s not magic—it’s code. But because it runs on a decentralized network, no single company can freeze your tokens or change the rules after launch. That’s why so many projects use it: it gives them freedom without needing to build their own blockchain.

ERC-20 isn’t perfect. It’s caused major issues—like accidental token burns when users send tokens to contracts that don’t know how to handle them. But its simplicity is also its strength. It’s the reason DeFi exploded. Uniswap, Aave, Compound—they all rely on ERC-20 tokens to function. Even NFTs, which use a different standard (ERC-721), often need ERC-20 tokens to pay for gas or buy into the ecosystem.

And while newer chains like Solana or Polygon have their own token standards, ERC-20 still dominates. Why? Because Ethereum’s network effect is massive. If you want your token to be seen, traded, and trusted, launching as an ERC-20 is still the fastest way there.

Below, you’ll find real-world examples of how ERC-20 tokens are used—from governance systems like Honey (HNY) to wrapped assets that move across chains, and even how regulatory bodies like PVARA or OFAC track them. You’ll see how exchanges like Leonicorn Swap or Jupiter Exchange interact with them, and how everyday users interact with them through wallets, swaps, and airdrops. This isn’t theory. It’s the foundation of what you’re already using.

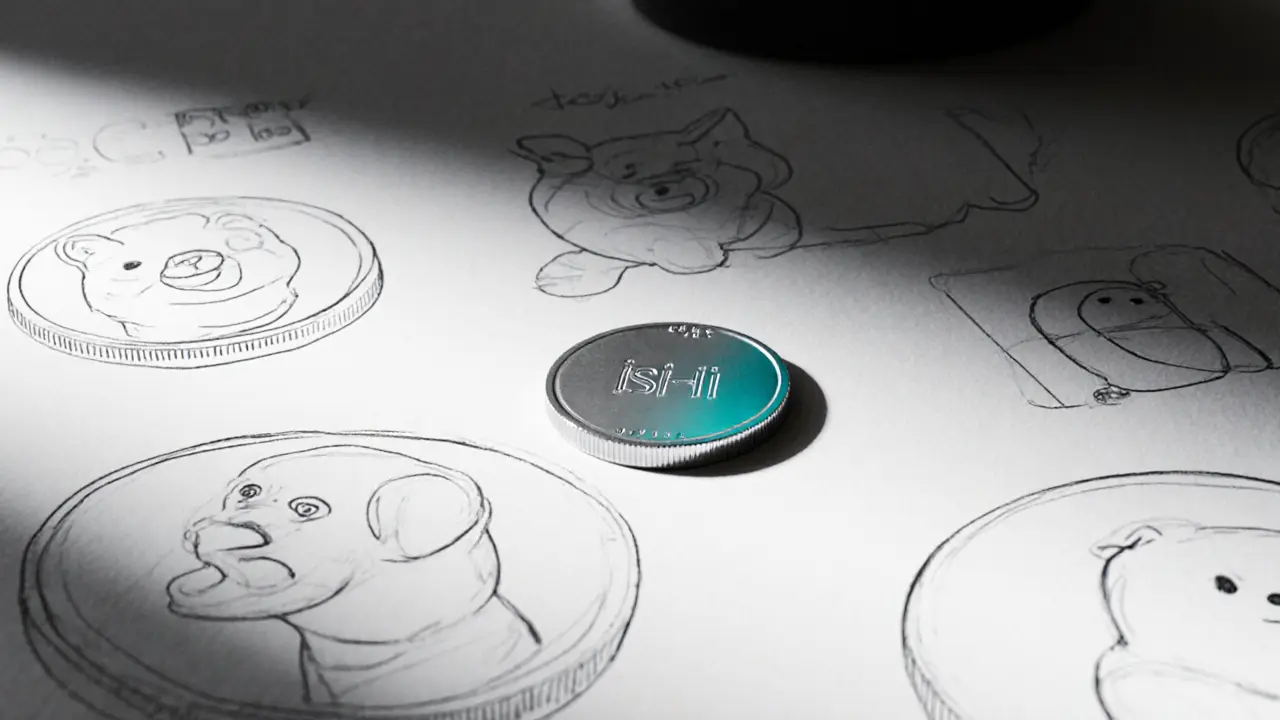

Ishi (ISHI) Crypto Coin Explained: Facts, Price, and Risks

Ishi (ISHI) is a tiny Ethereum meme token launched in 2024. Learn its price, market data, how to buy, risks, and how it stacks up against Shiba Inu and Dogecoin.

VIEW MORE