Ethereum: What It Is, How It Works, and Why It Matters in Crypto Today

When you think of Ethereum, a decentralized blockchain platform that runs smart contracts and powers digital applications without intermediaries. Also known as ETH, it’s not just another cryptocurrency—it’s the backbone of most decentralized finance, NFTs, and Web3 projects. Unlike Bitcoin, which is mostly digital gold, Ethereum is a programmable network. Think of it like a global computer that anyone can build on. Developers write code—called smart contracts—that automatically run when conditions are met. No banks. No middlemen. Just code doing what it’s told.

This is why smart contracts, self-executing agreements coded directly into the blockchain are the heart of Ethereum. They power lending platforms like Aave, decentralized exchanges like Uniswap, and even NFT marketplaces like OpenSea. These aren’t theoretical ideas—they’re live, working systems handling billions in value every day. And because Ethereum is open, anyone can audit the code, use the apps, or build their own. That’s why over 70% of all DeFi activity happens on Ethereum, even after newer chains emerged.

It’s also why DeFi, a system of financial services built on blockchain without traditional banks exploded around Ethereum. Want to lend your crypto and earn interest? You don’t need a bank—you use a DeFi protocol on Ethereum. Want to trade tokens without a centralized exchange? You use a DEX like SushiSwap. These tools are all built on Ethereum’s foundation. Even when new blockchains promise faster or cheaper transactions, most still connect back to Ethereum because it’s the most trusted, battle-tested network out there.

But Ethereum isn’t perfect. It used to be slow and expensive during peak times, which is why you see so many posts here about layer-2 solutions, sidechains, and cross-chain bridges. The network upgraded to proof-of-stake in 2022, cutting energy use by 99.95% and making transactions smoother. Still, gas fees can spike. That’s why traders and developers keep testing alternatives—like Arbitrum, Optimism, and Polygon—while keeping their main assets on Ethereum for security.

You’ll find posts here about exchanges that support ETH, tax forms for Ethereum trades, how to buy it safely, and even how underground markets use it when local bans hit. Some articles dig into tokenomics, others show you how to interact with DeFi apps. Whether you’re new or experienced, Ethereum is the common thread. It’s not just a coin—it’s the infrastructure behind the crypto world’s most important innovations. What you’re about to read isn’t just about Ethereum. It’s about everything built on top of it.

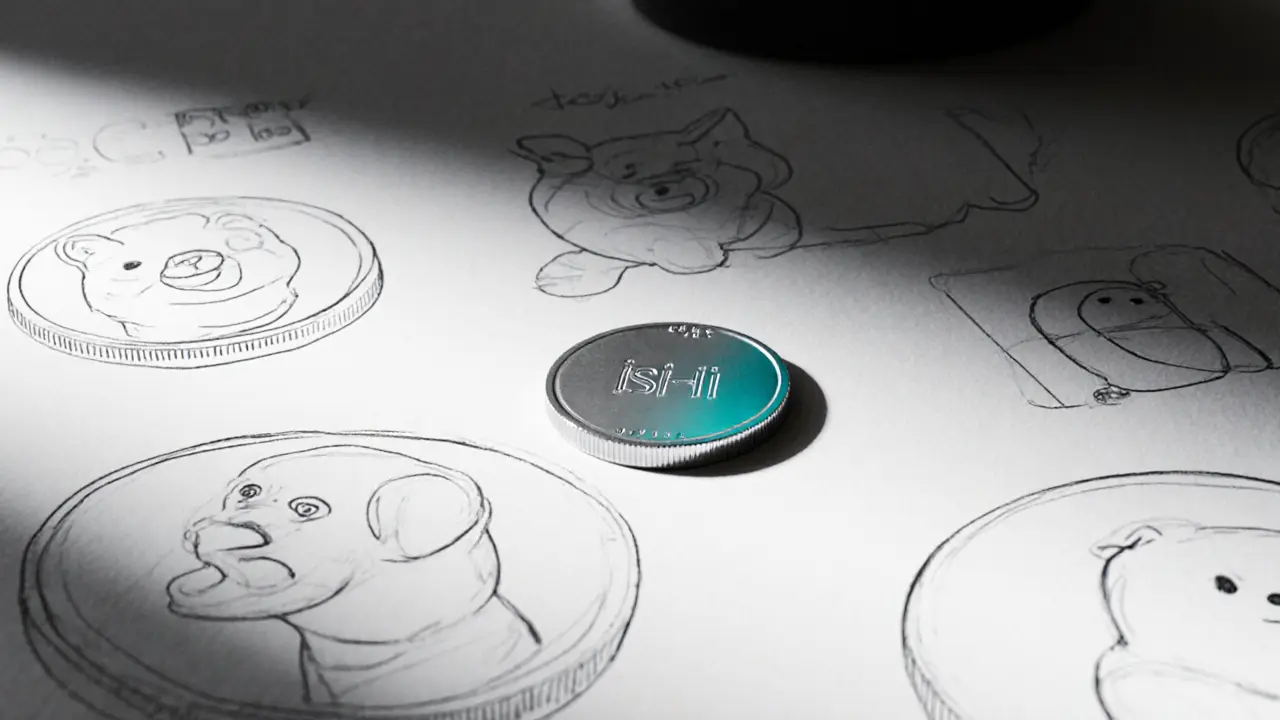

Ishi (ISHI) Crypto Coin Explained: Facts, Price, and Risks

Ishi (ISHI) is a tiny Ethereum meme token launched in 2024. Learn its price, market data, how to buy, risks, and how it stacks up against Shiba Inu and Dogecoin.

VIEW MORE