Nigeria Digital Currency: Guide and Insights

When working with Nigeria digital currency, a government‑backed or private digital money that runs on blockchain technology. Also known as eNaira, it aims to boost financial inclusion and lower transaction costs. Nigeria digital currency encompasses blockchain, a decentralized ledger that records every transaction securely and draws on the broader cryptocurrency ecosystem of digital assets that can be traded or used for payments. This mix of tech and finance requires a clear regulatory framework, which the Central Bank of Nigeria is actively shaping.

Key Players and How They Connect

Besides the central bank, fintech firms and crypto exchanges act as digital payment providers, services that let users move money instantly via mobile apps or wallets. Their APIs link users to the eNaira network, turning everyday purchases into blockchain‑verified transactions. The success of Nigeria digital currency depends on three factors: the robustness of the blockchain infrastructure, the clarity of government regulations, and the adoption rate among merchants and consumers. When any of these shifts, the whole ecosystem feels the impact, influencing everything from transaction fees to cross‑border transfers.

Below you’ll find a curated set of articles that dig into these pieces – from regulatory updates and exchange reviews to step‑by‑step guides on using digital money in Nigeria. Whether you’re a beginner curious about how eNaira works or a trader looking for the latest market analysis, the collection gives you practical tools and up‑to‑date insights.

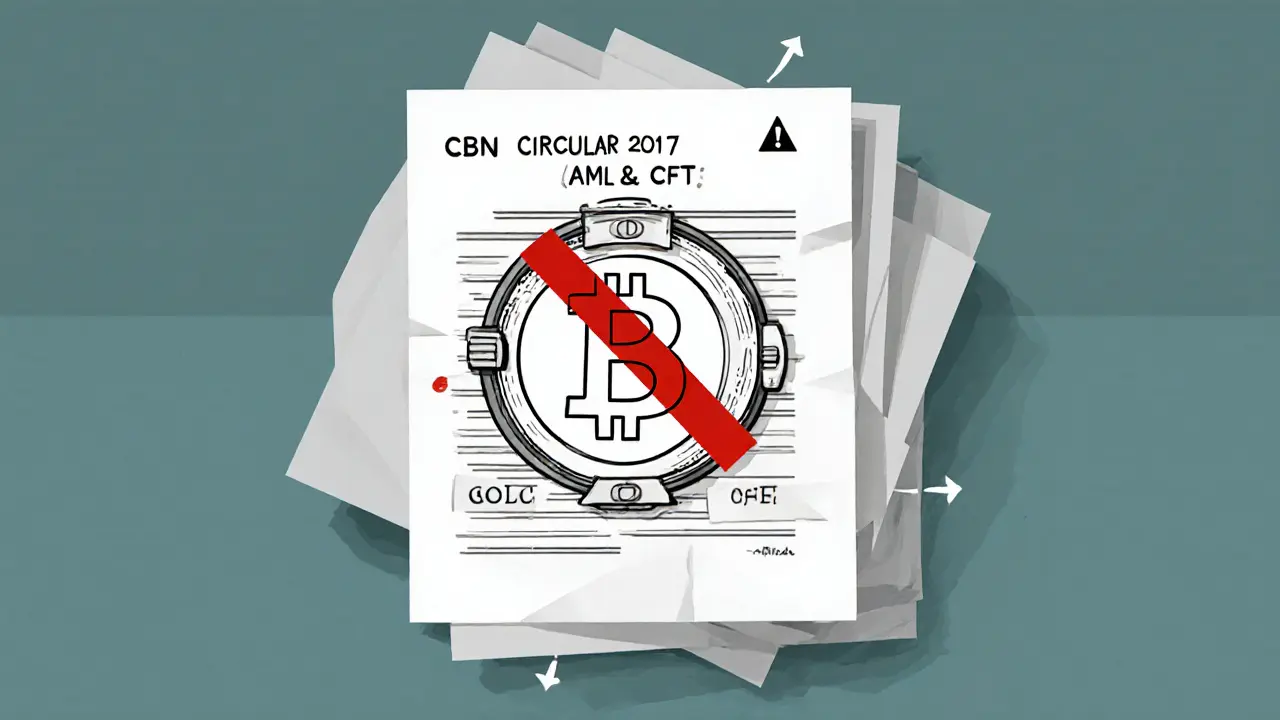

Nigeria’s Crypto Policy: From CBN Ban to VASP Guidelines (2017‑2025)

Explore how Nigeria's Central Bank shifted from a 2017 crypto ban to regulated VASP guidelines by 2025, covering key policies, compliance steps, and market impact.

VIEW MORE