Order Book Crypto: How It Works and Why It Matters in Trading

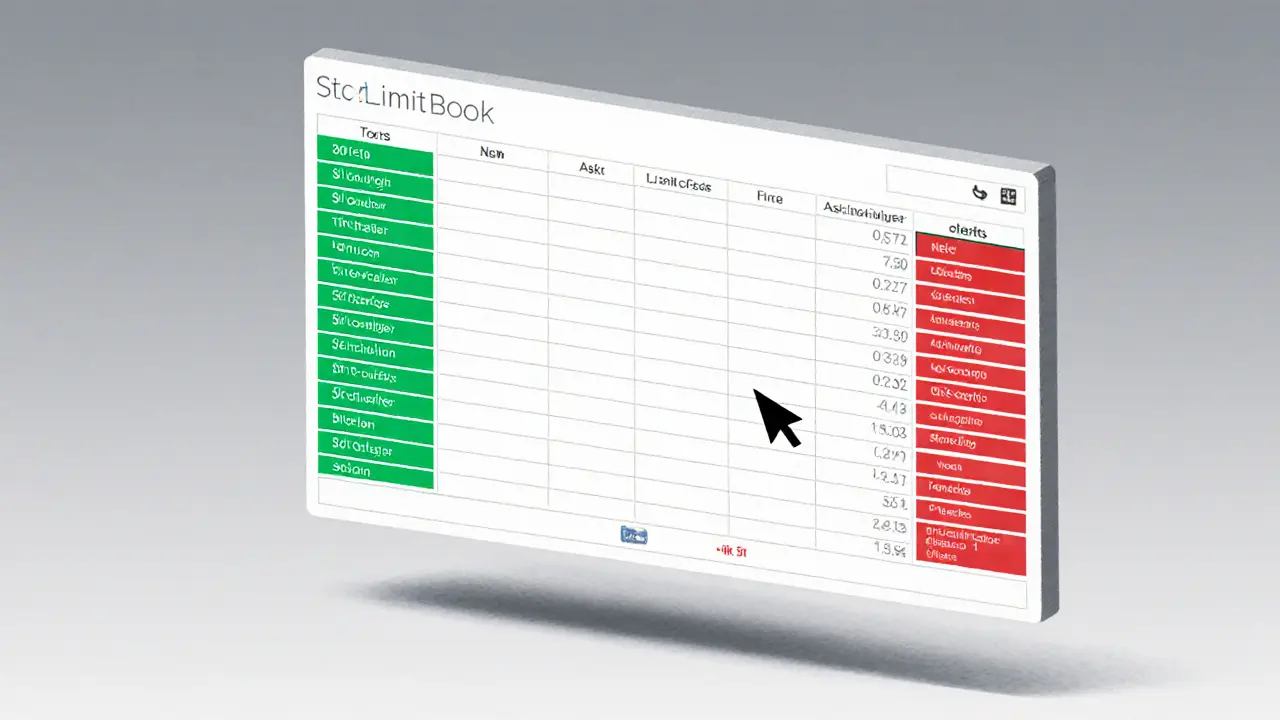

When you trade crypto, what you see on the screen — the price, the buy and sell buttons — is just the surface. What’s really driving that price is the order book crypto, a live list of all open buy and sell orders for a cryptocurrency at every price level. Also known as market depth, it shows you who’s willing to pay what, and how much they want to trade. This isn’t just noise — it’s the hidden engine behind every trade.

Think of it like a public auction for Bitcoin or Ethereum. On one side, buyers list how much they’re ready to pay (bids). On the other, sellers say how little they’ll accept (asks). The closer the bids and asks are, the tighter the market. A wide gap? That’s a sign of low liquidity or big uncertainty. You’ll see this in posts about exchanges like ZKSwap or Blackhole DEX — where gas-free trading only works if there’s enough order book depth to fill your trade without slippage. Even meme coins like ELON or ISHI have order books, and they’re often chaotic, with thin bids and sudden spikes. That’s why some traders ignore price charts entirely and just stare at the order book.

Knowing how to read an order book changes everything. Big buy walls? Maybe someone’s accumulating. A sudden flood of sell orders near your target price? That’s resistance. You’ll find real examples in reviews of Mandala Exchange or XBTS.io, where traders debate whether low-volume platforms hide manipulation behind fake liquidity. And it’s not just for pros — even if you’re buying USDT on a P2P platform in China or Afghanistan, the underlying exchange still runs on an order book. The difference? On centralized platforms, you see it. On decentralized ones, you often don’t — and that’s where risk hides.

What you’ll find below are real stories from traders who’ve been burned, saved, or learned the hard way because they ignored or misread the order book. From scams like Cryptobuyer Pro that fake depth to tools like TokenSets that automate trades based on order flow, these posts show you what actually happens behind the scenes. No theory. No fluff. Just what the numbers mean when you’re about to hit buy.

What Is an Order Book in Cryptocurrency Trading? A Clear Guide for Beginners and Traders

An order book in cryptocurrency trading shows all live buy and sell orders for a crypto pair. It reveals true market depth, bid-ask spreads, and potential price movements - essential for smart trading on exchanges like Binance and Coinbase.

VIEW MORE