Order Book Depth: What It Really Means for Crypto and Stock Trading

When you look at a trading chart, you’re seeing the past. But order book depth, the real-time list of buy and sell orders waiting to be filled. Also known as market depth, it shows you what’s coming next—before the price even moves. This isn’t just noise. It’s the hidden pulse of the market. If you’re trading crypto, stocks, or anything with a limit order system, ignoring order book depth is like driving with blinders on.

Think of it like a grocery store aisle. Price is the shelf tag. Order book depth is the stack of carts full of people waiting to grab that item. If there are 500 people lined up to buy at $10, but only 50 people willing to sell at that price, you know the price is about to rise. That’s not guesswork—it’s data. And platforms like ZKSwap, Mandala Exchange, and even Binance show this data clearly. The same applies to stocks. Institutional traders don’t just chase trends; they read the order book to find where the real pressure is hiding.

Some traders think volume is enough. It’s not. A coin can spike on low volume because one big buy order flooded the market. But if the order book shows shallow sell walls behind that spike, the rally won’t last. That’s why you’ll see posts here about order book depth in platforms like Blackhole DEX or XBTS.io—because liquidity isn’t just about how much is traded, it’s about how much is ready to trade. A deep order book means stability. A thin one means panic or manipulation. In crypto, where low-cap tokens like W Coin or Zeus can swing 30% in minutes, order book depth tells you if that move is real or just a pump.

It also reveals who’s in control. Big players don’t dump all at once—they spread it across hundreds of small sell orders. That’s called iceberg orders. If you see a thin buy side and a long line of tiny sell orders, you’re looking at a stealth exit. On the flip side, if you see one giant buy order sitting at $50 and nothing below it, you know someone’s trying to push the price up fast. That’s not luck. That’s strategy. And it’s visible if you know where to look.

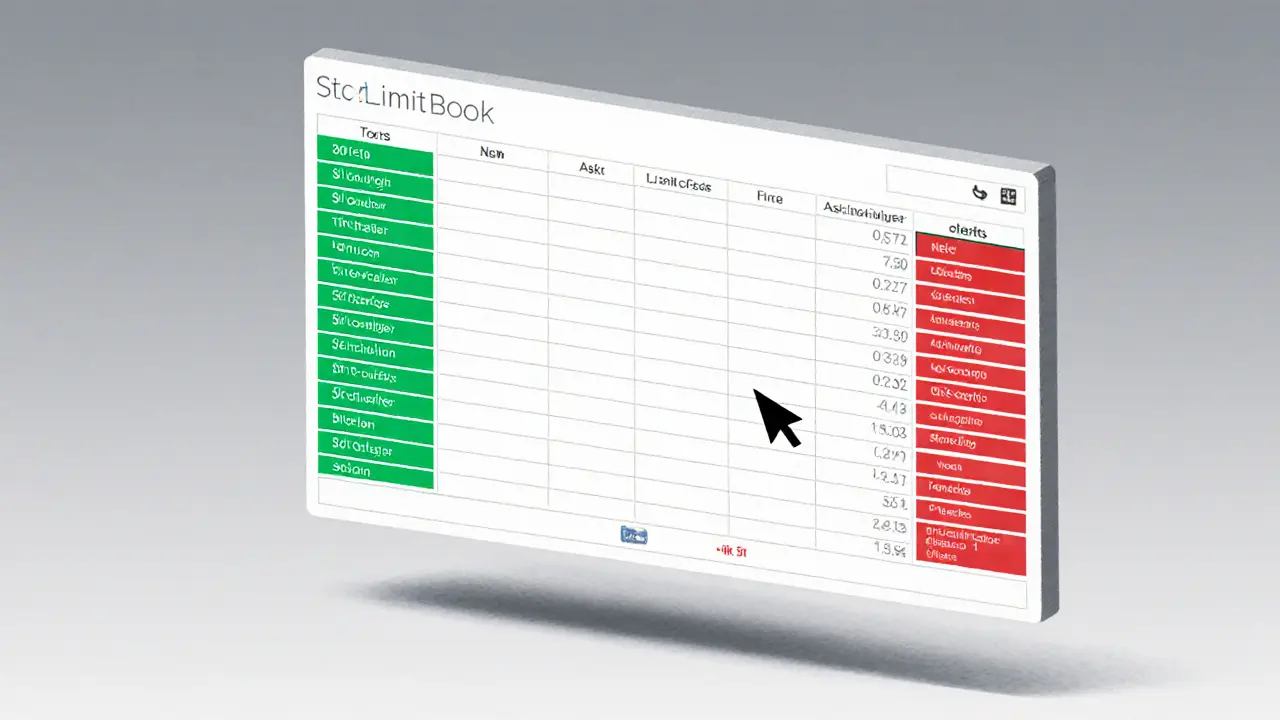

You don’t need fancy tools to see this. Most exchanges show it as a simple vertical bar chart on the side of the trading screen. Green for bids, red for asks. The longer the bars, the deeper the support or resistance. The trick is learning to read it without panic. A sudden drop in buy orders doesn’t always mean crash—it might mean traders are waiting for a better price. And that’s where the real edge comes in.

Below, you’ll find real-world examples of how order book depth played out in scams, exchanges, and market moves—from the quiet collapse of low-liquidity tokens like Ishi to the hidden mechanics behind P2P trading in restricted countries. These aren’t theories. They’re patterns you can watch for yourself, right now, on any platform that shows order flow. No indicators needed. Just your eyes and a little patience.

What Is an Order Book in Cryptocurrency Trading? A Clear Guide for Beginners and Traders

An order book in cryptocurrency trading shows all live buy and sell orders for a crypto pair. It reveals true market depth, bid-ask spreads, and potential price movements - essential for smart trading on exchanges like Binance and Coinbase.

VIEW MORE