SEC Digital Assets: Regulations, Filing Requirements, and Market Impact

When talking about SEC digital assets, digital tokens or cryptocurrencies that fall under the oversight of the U.S. Securities and Exchange Commission. Also known as SEC‑regulated digital assets, they sit at the crossroads of finance and tech, meaning every token sale, trade or fund must consider the SEC’s rules. This tag page gathers everything you need to navigate that space.

One key player beside the SEC itself is cryptocurrency regulation, the body of laws that governments apply to crypto activities. In the U.S., the SEC leads the charge, but other agencies like the CFTC and FinCEN also influence how assets are classified. SEC digital assets are a subset of this broader regulatory landscape, and understanding the jurisdictional scope helps you avoid costly missteps.

Whenever you launch or trade a token that might be deemed a security, you’ll run into SEC filing, the formal paperwork like Form D, S‑1 or 10‑K that the commission requires. The filing process defines who can invest, what disclosures are needed, and the timeline for approval. In practice, SEC digital assets require an SEC filing before they can be offered to the public, and the filing itself shapes the token’s marketing and distribution strategy.

Another piece of the puzzle is crypto exchanges, platforms where digital assets are bought, sold, and stored. Exchanges that list SEC digital assets must obtain proper licensing, implement AML/KYC checks, and stay up‑to‑date with compliance audits. Their decision to list or delist a token directly affects market liquidity and investor access, making exchange policies a critical factor for anyone dealing with regulated tokens.

Key Considerations for Investors and Issuers

First, pin down whether your token is a security. The Howey Test remains the go‑to framework: if investors expect profits from the efforts of others, the token likely falls under SEC jurisdiction. Second, prepare your paperwork early. Filing delays can stall fundraising and expose you to enforcement actions. Third, choose an exchange that’s already SEC‑compliant; that saves you the headache of retrofitting compliance later. Finally, stay tuned to changes in cryptocurrency regulation – new guidance from the SEC or state securities boards can shift the landscape overnight.

All of these angles – regulation, filing, exchange dynamics, and practical tips – are covered in the articles below. Dive into the guides to see how each element plays out in real‑world scenarios and get the tools you need to move forward confidently.

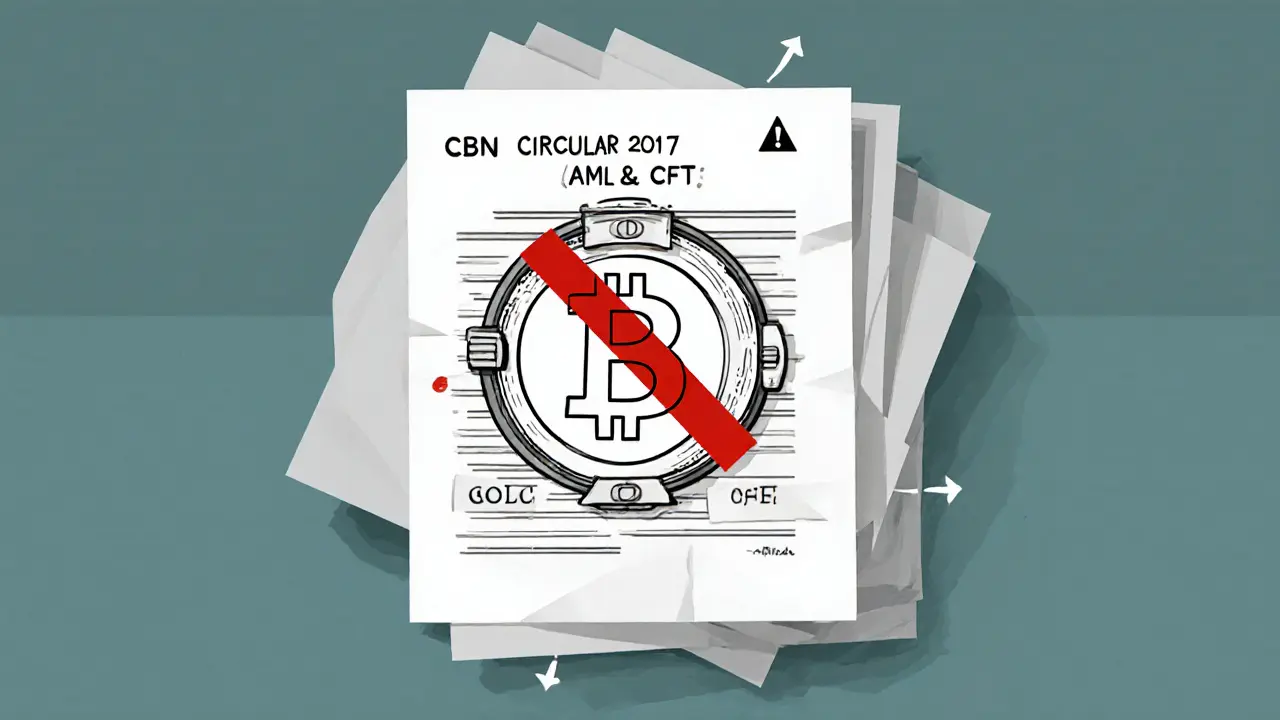

Nigeria’s Crypto Policy: From CBN Ban to VASP Guidelines (2017‑2025)

Explore how Nigeria's Central Bank shifted from a 2017 crypto ban to regulated VASP guidelines by 2025, covering key policies, compliance steps, and market impact.

VIEW MORE