VASP Guidelines – What Every Crypto Provider Needs to Know

When working with VASP guidelines, a set of rules that virtual asset service providers must follow to stop money laundering and terrorist financing. Also known as Virtual Asset Service Provider regulations, they shape how crypto businesses operate worldwide. VASP guidelines are the foundation of any compliant crypto operation.

The Travel Rule, a requirement that VASPs share sender and recipient information for transactions above a regulatory threshold directly influences how these guidelines are applied. In practice, the Travel Rule forces exchanges to collect and transmit KYC data, turning abstract compliance duties into concrete workflow steps.

AML regulations, anti‑money‑laundering laws that demand monitoring, reporting and risk assessment are embedded within VASP guidelines. This relationship means every VASP must build transaction monitoring systems, file suspicious activity reports and maintain up‑to‑date risk registers. In short, VASP guidelines encompass AML regulations.

For a crypto exchange, adhering to VASP guidelines isn’t optional – it’s a business imperative. Crypto exchanges, platforms that match buyers and sellers of digital assets rely on these rules to stay licensed, keep users’ funds safe, and avoid costly enforcement actions. In effect, crypto exchanges require VASP guidelines to meet financial‑crime compliance standards.

Why the Guidelines Matter for Your Operations

Financial‑crime compliance teams use VASP guidelines as a checklist for building robust AML programs. The guidelines dictate record‑keeping periods, thresholds for transaction reporting, and the technology stack needed for real‑time screening. When a VASP follows the guidelines, it reduces the risk of being flagged by regulators and gains trust from partners and investors.

Compliance isn’t a one‑time project; it evolves with new sanctions, emerging threats, and updates to the Travel Rule. Staying aligned means regularly reviewing policy documents, training staff, and testing system integrations. The guidelines also require VASPs to cooperate with law‑enforcement requests, which can speed up investigations and protect the broader ecosystem from illicit activity.

Below you’ll find a curated collection of articles that break down each piece of the puzzle – from how the Travel Rule works in practice to real‑world exchange reviews that show compliance in action. Whether you’re a start‑up looking for a compliance roadmap or an established platform fine‑tuning your risk framework, the posts ahead give you actionable insight and clear examples.

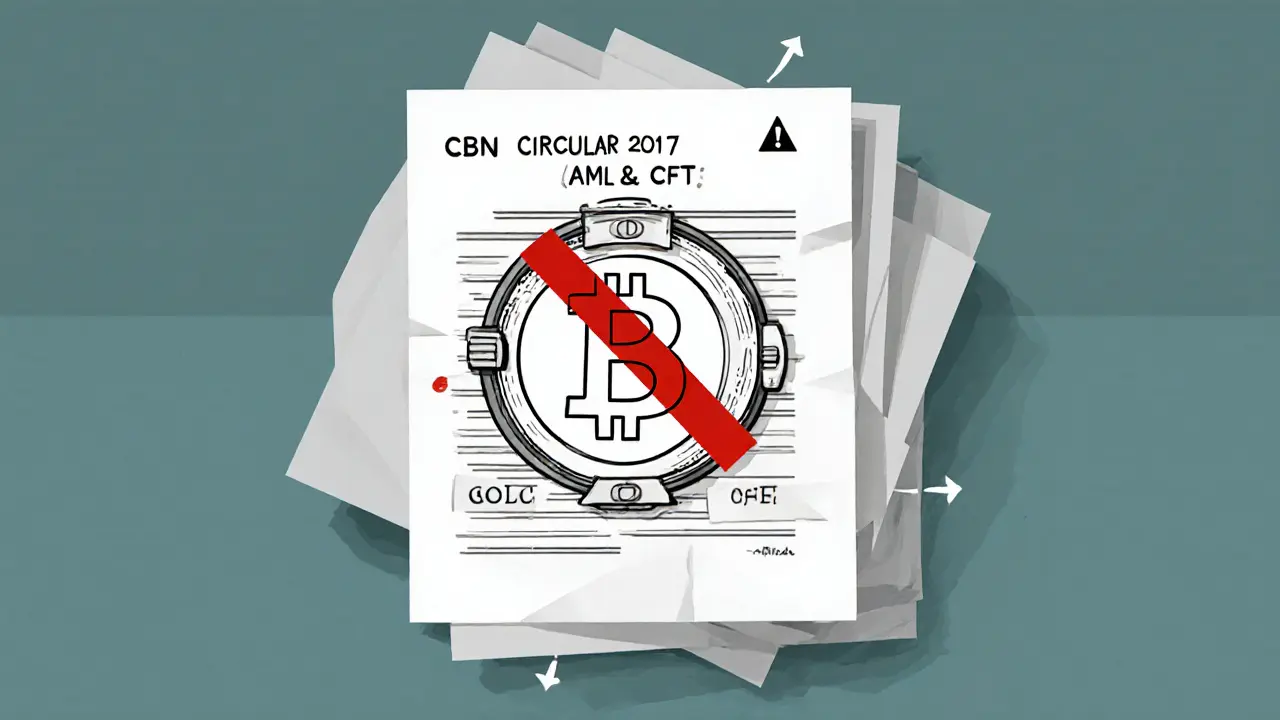

Nigeria’s Crypto Policy: From CBN Ban to VASP Guidelines (2017‑2025)

Explore how Nigeria's Central Bank shifted from a 2017 crypto ban to regulated VASP guidelines by 2025, covering key policies, compliance steps, and market impact.

VIEW MORE