Aster Crypto Exchange Review: Features, Tokenomics & Trading Experience

ASTER Token Price Tracker

Current ASTER Price

$1.65

As of October 2025

All-Time High

$2.42

September 24, 2025

Investment Calculator

Price Prediction Model

Market Trend Visualization

Interactive chart would appear here (simulated)

Based on historical data, ASTER showed a 20x surge from launch to $2.42 in September 2025, followed by a 30% correction to $1.63-$1.69 in early October. Technical indicators suggest a possible rebound near $1.50 support.

Aster exchange is a multi‑chain decentralized perpetual exchange launched in 2025 that aims to bring professional‑grade trading tools to the DeFi world while keeping the self‑custody benefits users expect from a DEX. If you’ve been hunting for a platform that lets you trade perpetual contracts, spot pairs, hidden orders and even grid strategies without handing over your keys, Aster might have landed on your radar. Below we break down how the platform works, what the native ASTER token brings to the table, and whether the exchange lives up to its hype.

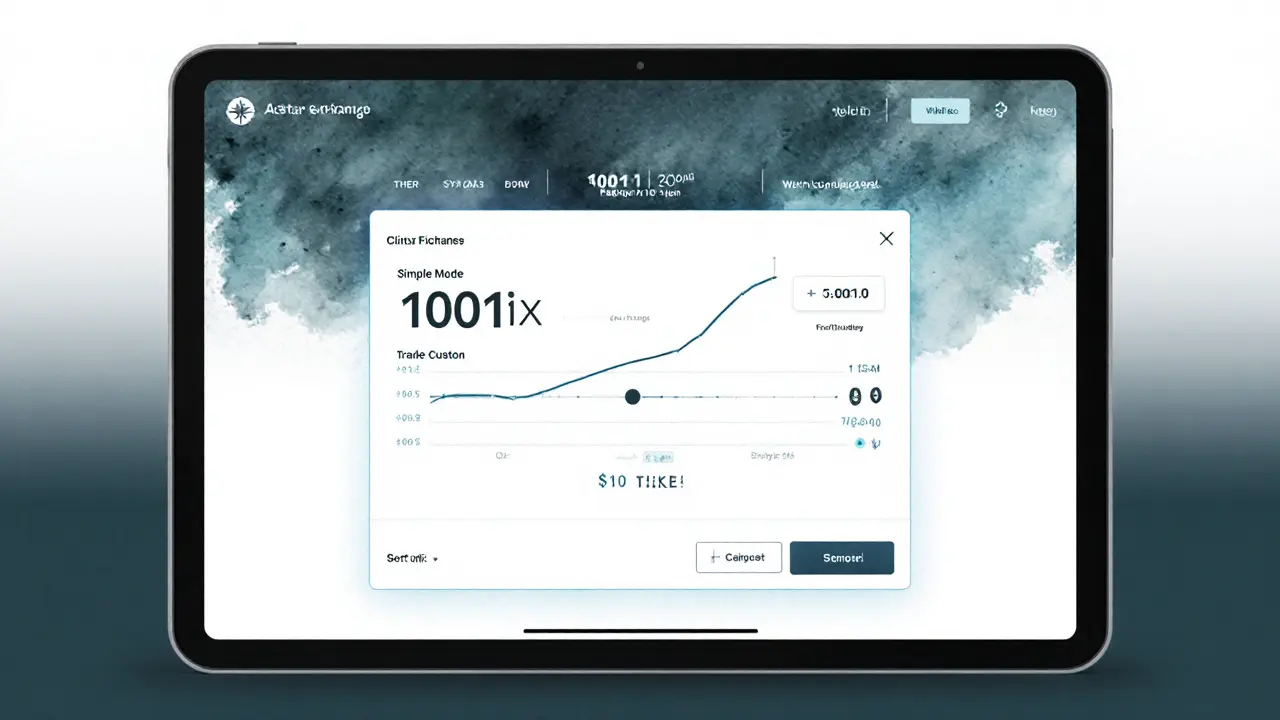

Platform Overview - Simple Mode vs. Pro Mode

The UI offers two distinct pathways. Simple Mode (recently renamed “1001x”) presents a one‑click experience: you select an asset, set a leverage level, and hit trade. It’s built for newcomers who want exposure to perpetual contracts without getting tangled in order‑type jargon.

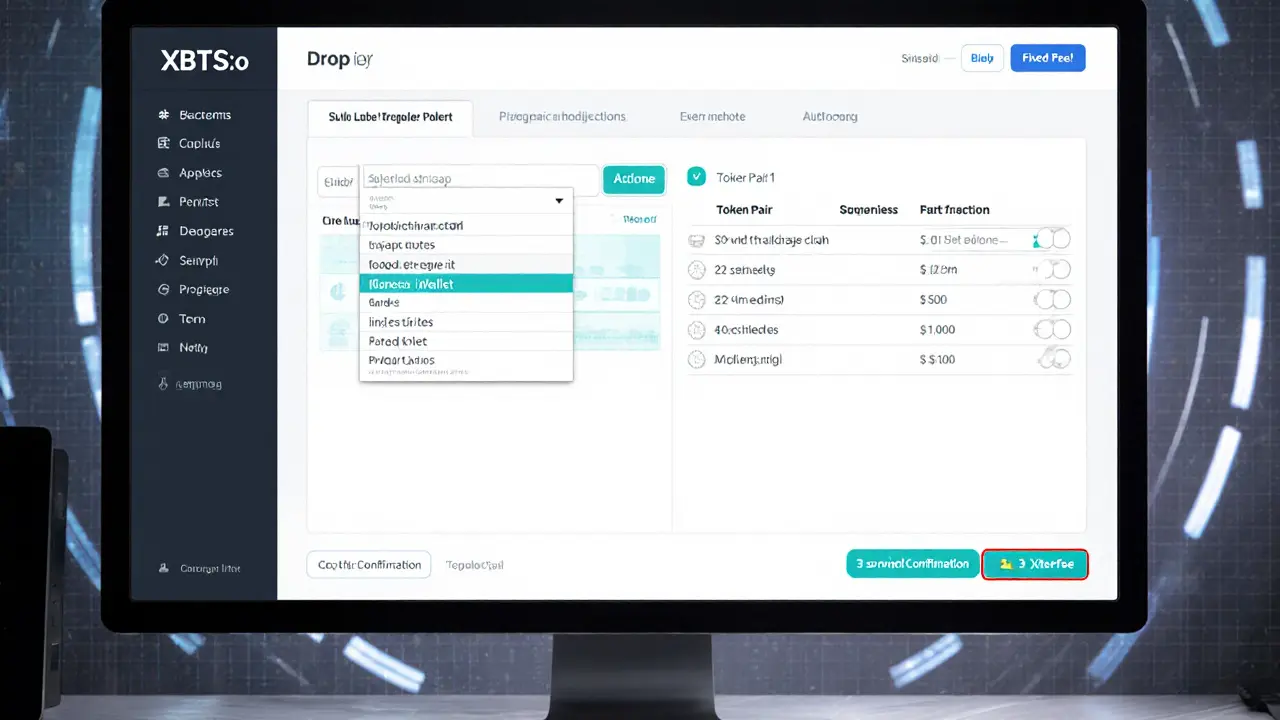

Power users switch to Pro Mode (now called “Perpetual”). Here you find hidden orders, MEV‑aware routing, grid trading, and a full order‑book. The platform aggregates liquidity across BNB Chain, Ethereum, Solana and Arbitrum. This horizontal integration means you can tap deep liquidity pools on each chain, but it also adds a layer of complexity because a single order may hop between networks before settling.

Tokenomics - How ASTER Powers the Ecosystem

The native ASTER token is a BEP‑20 asset on BNB Chain with a hard cap of 8billion. Its distribution is heavily weighted toward community incentives: 53.5% of the supply fuels airdrops that reward active traders and contributors, while 30% backs ecosystem growth, including migration pools for APX holders. The remaining allocation covers treasury (7%), team incentives (5%) and liquidity bootstrapping (4.5%).

Key numbers to note:

- Instant unlock of 704million ASTER (8.8% of total) when the airdrop claim window opened on 17Sep2025.

- Vesting schedule spreads the leftover 91.2% over roughly 80months, subject to governance votes.

- Eligibility hinges on Rh or Au points from early‑stage community programs, plus “Aster Gems” awards and loyalty thresholds for Pro traders.

ASTER serves three core purposes: fee discounts for token‑holders, staking for governance voting, and a liquidity‑providing incentive that aligns trader activity with token demand.

Market Performance - Volatility, Peaks, and Current Levels

Since its public debut in early September 2025, ASTER has been a roller‑coaster. The token rocketed 20× to an all‑time high of $2.42 on 24Sep2025, then topped $1.85 within a week-a 200% surge from launch price. A swift 30% pullback followed, leaving the token hovering around $1.63-$1.69 as of early October 2025.

Technical analysis on the 4‑hour chart shows an ascending triangle that broke down at the $1.80 resistance, triggering a ~17% drop. RSI has dipped into oversold territory, and MACD is flirting with a bullish crossover, suggesting a possible bottom near the $1.50 support zone. Still, broader market risk remains high, so traders should treat any rebound as tentative.

Competitive Landscape - Aster vs. Hyperliquid

Most readers compare Aster to Hyperliquid, another DeFi‑focused perpetual exchange that runs on its own proprietary blockchain. Below is a quick side‑by‑side snapshot:

| Feature | Aster exchange | Hyperliquid |

|---|---|---|

| Architecture | Horizontal liquidity aggregation across BNB, Ethereum, Solana, Arbitrum | Vertical integration on a dedicated Hyperliquid chain |

| Trading modes | Simple (1001x) & Pro (Perpetual) with hidden orders, grid | Standard perpetual contracts only |

| Collateral options | Yield‑generating assets (asBNB, USDF) accepted | Only native stablecoins and ETH |

| Liquidity depth | Dependent on cross‑chain pools; may fragment order flow | Concentrated on own chain; higher single‑order capacity |

| Fees | Ultra‑low on Aster Chain; variable on bridged networks | Fixed low‑fee model on proprietary chain |

In short, Aster wins on flexibility and collateral efficiency, while Hyperliquid excels at raw liquidity and simplicity. Your choice will depend on whether you value multi‑chain exposure or a single, ultra‑liquid market.

Technical Edge - MEV‑Aware Routing & Aster Chain

One of Aster’s standout innovations is its MEV‑aware routing engine. When you place a trade, the system scans each supported chain for the best price‑impact‑adjusted route, then bundles the transaction to sidestep front‑running bots. This reduces slippage, especially on thinly‑liquified pairs.

Behind the scenes runs Aster Chain, a privacy‑focused Layer‑1 built for sub‑cent transaction fees and fast block finality. While still in early beta, the chain temporarily hosts order‑matching engines that can handle up to 10,000TPS-a figure that comfortably supports institutional‑grade order flow.

Governance - Token‑Based Decision Making

ASTER holders vote on proposals ranging from fee‑structure tweaks to new asset listings. Governance proposals are submitted via the on‑chain DAO portal, where voting power equals the number of tokens staked. The model aligns incentives: higher token stakes give you a louder voice, and successful proposals often funnel additional reward streams back to stakers.

As the ecosystem expands, demand for ASTER could rise, creating a feedback loop that rewards early participants.

Future Outlook - Price Targets & Adoption Scenarios

Analysts are split. Short‑term forecasts peg the average 2025 price near $1.38 with a possible peak of $2.07, while bullish long‑term models see the token climbing to $9.82 by 2030 if multi‑chain adoption accelerates. The more realistic scenario hinges on three factors:

- How quickly traders migrate from centralized perpetuals to Aster’s cross‑chain offering.

- The stability and security of the bridging protocol that stitches together BNB, Ethereum, Solana and Arbitrum.

- Whether the DAO can allocate treasury funds to meaningful ecosystem growth rather than speculative burns.

If all three align, ASTER could enjoy sustained demand from both traders and liquidity providers.

Pros & Cons - Quick Reference Checklist

- Pros

- Multi‑chain liquidity aggregation offers diverse trading pairs.

- Hidden orders and grid trading give advanced users more strategy depth.

- Yield‑bearing assets accepted as collateral increase capital efficiency.

- MEV‑aware routing reduces typical DeFi slippage.

- Strong community incentives via airdrops and DAO governance.

- Cons

- Cross‑chain bridges add points of failure and potential latency.

- Token price volatility remains high; short‑term traders face risk.

- Aster Chain is still in beta, limiting some institutional confidence.

- Learning curve for Pro Mode can be steep for newcomers.

Final Takeaway

If you value self‑custody, want to use yield‑generating collateral, and don’t mind navigating a few extra steps to tap multiple chains, Aster exchange offers a compelling blend of DeFi freedom and professional‑grade trading tools. Its tokenomics provide strong community upside, but the price swings and bridge complexity mean you should allocate only what you can afford to lose. Keep an eye on Aster Chain’s rollout and upcoming DAO proposals-those will shape the platform’s long‑term relevance.

Frequently Asked Questions

What chains does Aster support?

Aster aggregates liquidity from BNB Chain, Ethereum, Solana and Arbitrum. The platform routes each order to the chain offering the best price‑impact‑adjusted execution.

Can I use yield‑earning assets as collateral?

Yes. Aster accepts assets like asBNB and USDF, allowing you to earn yield on the same tokens you post as margin.

What is the difference between Simple Mode and Pro Mode?

Simple Mode (1001x) offers a one‑click perpetual trade with preset leverage, ideal for beginners. Pro Mode (Perpetual) unlocks the full order‑book, hidden orders, grid bots and MEV‑aware routing for experienced traders.

How does Aster’s token governance work?

ASTER holders stake their tokens to vote on DAO proposals. Voting power equals the number of staked tokens, and successful proposals can allocate treasury funds, adjust fee tiers, or initiate new asset listings.

Is Aster safe to use on my hardware wallet?

Because Aster is a non‑custodial DEX, you retain private keys. The platform supports standard wallets like MetaMask, Trust Wallet and Ledger. However, the cross‑chain bridges introduce additional smart‑contract risk, so always enable a hardware wallet when possible.

karsten wall

March 18, 2025 AT 10:19Delving into the Aster ecosystem reveals a tapestry of interwoven mechanisms that merit a granular dissection. The bifurcated UI-Simple Mode versus Pro Mode-constitutes a layered abstraction, allowing participants to graduate from novice exposure to sophisticated arbitrage strategies. From a liquidity aggregation standpoint, the cross‑chain orchestration across BNB Chain, Ethereum, Solana, and Arbitrum introduces a vector of capital efficiency but simultaneously augments systemic risk via bridge dependencies. Tokenomics further entrench this dynamic: the 8 billion ASTER cap, coupled with a 53.5 % airdrop allocation, creates a potent demand curve predicated on active participation incentives. Vesting schedules diluting the residual 91.2 % over roughly 80 months impose a deceleration of supply shock, yet governance‑driven vesting adjustments could perturb market equilibrium. The MEV‑aware routing engine operationalizes a game‑theoretic mitigation of front‑running, enhancing order execution fidelity, especially in thinly‑liquified pairs. Aster Chain’s sub‑cent fee tier and 10,000 TPS throughput earmark it for institutional order flow, albeit the beta status tempers confidence. Moreover, the DAO governance model aligns token‑holder voting power with staked ASTER, fostering a feedback loop where protocol upgrades potentially amplify token utility. In practice, traders must weigh the merits of yield‑bearing collateral-such as asBNB and USDF-against the latent volatility that has manifested in a 30 % correction post‑ATH. The comparative analysis with Hyperliquid underscores Aster’s versatility at the expense of consolidated liquidity depth. Ultimately, the platform’s success hinges on three pivotal axes: migration velocity from centralized perpetuals, bridge robustness, and judicious treasury deployment. Should these vectors coalesce favorably, the projected long‑term price trajectory could justify the heightened risk profile. Conversely, any fissure in cross‑chain security or governance efficacy may invert the upside into pronounced downside, rendering the token's speculative allure precarious.

Keith Cotterill

March 18, 2025 AT 11:26Another overrated token hype cycle, clearly.

C Brown

March 18, 2025 AT 12:32While everyone fawns over the glossy UI, the reality is that most users will get burned by the bridge latency, and the whole cross‑chain premise feels like a gimmick designed to pad the hype machine; still, the drama of watching the ASTER price swing 30 % in a week is entertaining, and for those who love riding a roller‑coaster, this could be the perfect playground.

mukund gakhreja

March 18, 2025 AT 13:39Sure, the MEV‑aware routing sounds fancy, but at the end of the day it's just another layer of code that could crash under load, and anyone thinking otherwise is ignoring the inherent risk of multi‑chain bridges.

Darrin Budzak

March 18, 2025 AT 14:46The platform’s dual‑mode approach does make it accessible for newcomers while still offering depth for pros.

Latoya Jackman

March 18, 2025 AT 15:52ASTER’s token distribution intends to reward active participants, yet the volatility remains a concern for risk‑averse investors.

CJ Williams

March 18, 2025 AT 16:59🚀 Wow, the cross‑chain liquidity aggregation is a game‑changer! It really brings together the best of all worlds, and the community incentives are 🔥. Keep pushing forward, team! 😊

Raj Dixit

March 18, 2025 AT 18:06Dont overcomplicate, just use simple mode and avoid the bridge hassles.

Andrew McDonald

March 18, 2025 AT 19:12Impressive UI, but the actual utility feels forced-like they’re trying too hard to be different. :)

Michael Ross

March 18, 2025 AT 20:19The overview provides a balanced view of pros and cons without leaning toward promotion.

Deepak Chauhan

March 18, 2025 AT 21:26From an analytical perspective, the tokenomics architecture appears meticulously structured, albeit the practical implications remain to be observed. 😐

Lisa Strauss

March 18, 2025 AT 22:32It’s encouraging to see such community‑driven incentives, and the transparent DAO voting could really empower token holders.

Eugene Myazin

March 18, 2025 AT 23:39Seeing a platform that embraces cultural diversity across chains is refreshing; it could set a precedent for future DeFi projects.

Noel Lees

March 19, 2025 AT 00:46Love the energy behind the token’s community rewards – it’s exactly the kind of positive feedback loop that fuels growth. :)

Sabrina Qureshi

March 19, 2025 AT 01:52Honestly, this whole thing feels like a hype train that’s already leaving the station!!!

dennis shiner

March 19, 2025 AT 02:59Sure, the fees are low, but the real cost is your sanity.

Mangal Chauhan

March 19, 2025 AT 04:06In evaluating Aster’s proposition, one must acknowledge the collaborative mentorship embedded within its community, which, when coupled with the rigorous technical framework, creates an environment conducive to both novice education and advanced strategy deployment. The formalized DAO processes further amplify this synergy, granting stakeholders a structured avenue for influence.

Darius Needham

March 19, 2025 AT 05:12The cross‑chain approach is ambitious, and the cultural outreach could broaden user adoption across regions.

Narender Kumar

March 19, 2025 AT 06:19Behold, the grand theater of decentralized finance, where every token seeks its spotlight upon the stage of market cap.

Anurag Sinha

March 19, 2025 AT 07:26Some say the bridges are safe but what if the hidden nodes are controlled by shadow entities? The whole system could be a puppet show, strings pulled by unseen hands; i think we should stay alert for the next big exploit that will expose the fragility of this multi‑chain illusion. Remember the 2022 wormhole incident-history repeats.