Base DEX Crypto Exchange Review: Uniswap V3 on Base Network Explained

When you want to trade crypto without a middleman, a decentralized exchange (DEX) is your best bet. But not all DEXs are created equal. If you're looking for low fees, fast trades, and a smooth experience - especially if you already use Coinbase - Base DEX might be exactly what you need. This isn’t just another Layer 2 network. It’s a purpose-built platform designed to fix Ethereum’s biggest pain points: high gas fees and slow transactions. And at its heart is Uniswap V3, the most powerful DEX protocol in crypto.

What Is Base and Why Does It Matter?

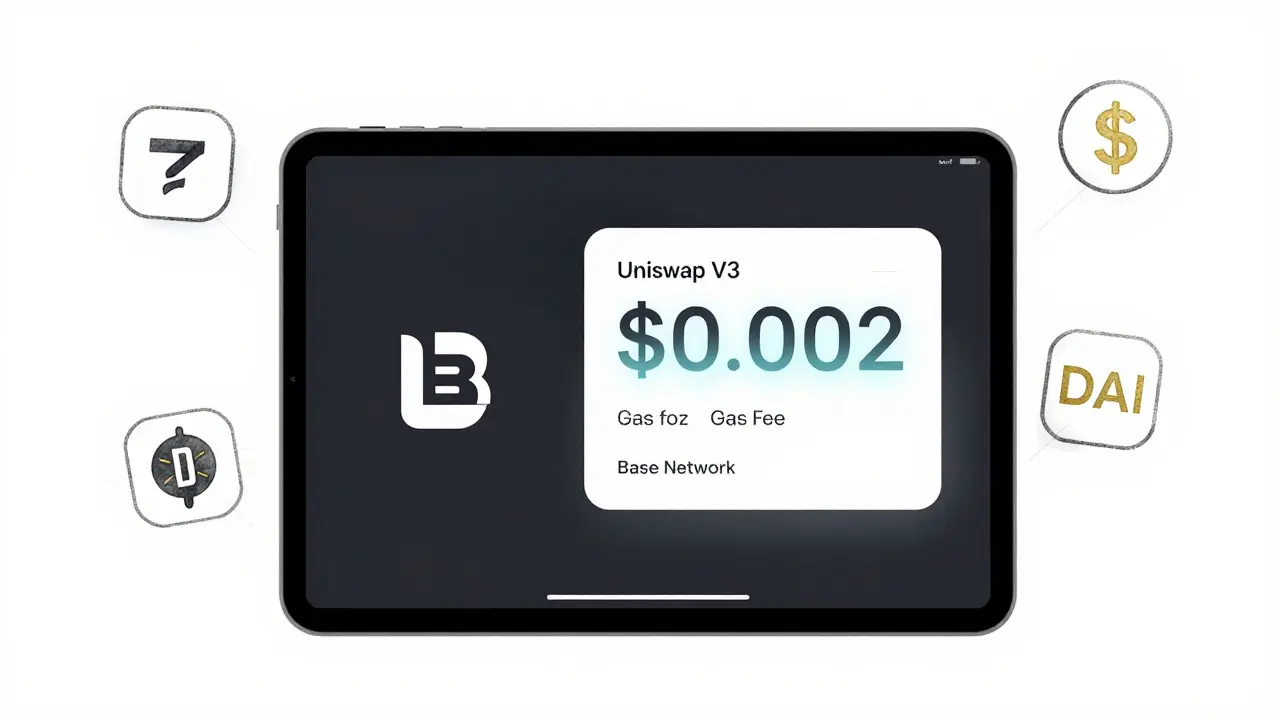

Base is a Layer 2 blockchain built on top of Ethereum, launched in February 2023 by Coinbase. Unlike other Layer 2s that try to be fully decentralized from day one, Base takes a different approach: it starts with strong central backing and gradually moves toward decentralization. It uses Optimism’s OP Stack technology, which means it inherits Ethereum’s security while cutting costs dramatically. On Ethereum mainnet, a simple token swap can cost $2-$5 during peak times. On Base, that same swap costs between $0.001 and $0.005. That’s not a small improvement - it’s a game-changer for everyday users. For someone trading $100 or $500 at a time, those savings add up fast. Base isn’t trying to replace Ethereum. It’s trying to make Ethereum usable for millions who can’t afford to pay $10 in gas just to buy a meme coin.Uniswap V3 on Base: The Real Star of the Show

Uniswap V3 is the dominant DEX on Base. It’s not a new version built just for Base - it’s the same Uniswap V3 you’d find on Ethereum, Optimism, or Arbitrum. But on Base, it shines. The key upgrade from Uniswap V2 to V3 is concentrated liquidity. Instead of spreading your tokens across every possible price range, you choose exactly where you want to provide liquidity. This means your capital works harder. On Ethereum mainnet, this can be complex and expensive. On Base, with fees near zero, it becomes practical for retail traders. In October 2024, Uniswap V3 on Base was handling $210 million in daily volume. That’s 4.3% of all Uniswap trades across every chain. And it’s growing fast - 17.3% month-over-month growth in active wallets as of late 2024. That’s not just hype. Real people are using it.How It Works: Three Simple Steps

You don’t need to be a coder to use a Base DEX. Here’s how most people get started:- Connect your wallet - MetaMask, Coinbase Wallet, or TrustWallet work best. Make sure you’ve added the Base network manually if your wallet doesn’t auto-detect it.

- Bridge your ETH or tokens - If you’re coming from Coinbase’s centralized exchange, you can bridge directly through their app. The process takes 2-4 hours on average. Some users report delays, especially during high traffic.

- Trade - Go to Uniswap’s Base interface, pick your tokens, and swap. The interface looks identical to Uniswap on Ethereum. No learning curve.

Who Is This For? (And Who Should Stay Away)

Base DEXs are perfect for:- Retail traders making swaps under $5,000

- Coinbase users who want to move into DeFi without leaving their ecosystem

- Stablecoin traders - swaps between USDC, DAI, and USDT are nearly free and instant

- Newcomers to crypto - the low cost reduces the fear of losing money on failed trades

- Institutional traders - liquidity is still shallow for trades over $50,000. Slippage can hit 28% on large orders

- Traders of obscure tokens - low-cap coins often have tiny pools. One Reddit user reported 12% slippage swapping a small altcoin

- Users who demand full decentralization - Coinbase still controls the sequencer node. That’s a central point of failure

Speed, Security, and Reliability

Base isn’t just cheap - it’s fast. Block times average 0.8 seconds. That’s 15 times faster than Ethereum mainnet. Transactions confirm almost instantly. You’ll see your trade complete before you finish reading this sentence. Security-wise, Base uses Ethereum’s proof-of-stake consensus. That means your funds are as safe as they are on Ethereum itself. Uniswap’s smart contracts on Base have been audited three times - by OpenZeppelin, Trail of Bits, and CertiK. No major exploits to date. The only real security concern isn’t technical - it’s political. Coinbase owns Base. If they decide to delist a token, change fee structures, or pause withdrawals, they technically can. That’s not how DeFi is supposed to work. But for now, most users are willing to trade a little decentralization for convenience.Compared to Other DEXs

Here’s how Base DEXs stack up against the competition:| Feature | Uniswap V3 (Base) | Uniswap V3 (Ethereum) | PancakeSwap V3 (BSC) | Orca (Solana) |

|---|---|---|---|---|

| Average Swap Fee | $0.001-$0.005 | $1.50-$5.00 | $0.0005 | $0.002 |

| 24-Hour Volume (Oct 2024) | $210M | $980M | $1.2B | $750M |

| Block Time | 0.8 seconds | 13 seconds | 3 seconds | 0.4 seconds |

| Liquidity Depth (for $50k trades) | Moderate (28% slippage) | High (3% slippage) | Low (15%+ slippage) | High (5% slippage) |

| Decentralization Level | Low (Coinbase controls sequencer) | High | Medium | High |

| Best For | Retail traders, Coinbase users | Large trades, maximum liquidity | Low-cost BSC tokens | Speed, Solana ecosystem |

What’s Next for Base DEX?

The biggest change coming is the planned shift to a Base Chain DAO in Q1 2025. That means Coinbase will hand over control of the sequencer to a decentralized governance system. If that happens, Base will finally become a true DeFi protocol - not just a Coinbase product. Jump Trading is also launching a derivatives DEX on Base in January 2025. That could bring institutional capital and deeper liquidity. If it works, Base could become the go-to for both retail and professional traders. But there’s a risk. If Coinbase delays decentralization too long, or if they make unpopular decisions, users might leave. A Galaxy Digital analysis warned that up to 65% of volume could vanish if Base loses trust.

User Experience: Real Talk from the Community

Reddit users love Base for one reason: it’s cheap. One top post with over 3,200 upvotes says: “I used to avoid trading because gas ate half my profit. Now I swap daily for pennies.” Trustpilot reviews give it 4.3/5 stars. Most complaints? Bridge delays and low liquidity for small tokens. But the positive feedback is overwhelming: “I bought my first crypto token on Base. Didn’t panic. Didn’t lose money. That’s huge for a beginner.” Coinbase’s own data shows 63% of Base users came from their centralized exchange. That’s a massive win for onboarding. It’s not just a DEX - it’s a gateway.Final Verdict: Is Base DEX Worth It?

Yes - if you’re a retail trader, a Coinbase user, or someone tired of paying $5 in gas to buy $100 of ETH. Base DEX isn’t perfect. It’s not fully decentralized. It doesn’t have the liquidity of Ethereum. But it doesn’t need to be. It’s doing something more important: making DeFi accessible. For under $0.01, you can swap tokens, add liquidity, or try yield strategies without worrying about losing half your trade to fees. That’s revolutionary. If you’re ready to move beyond centralized exchanges and want to dip your toes into DeFi without the headache, Base is the easiest, cheapest, and fastest way to start.What to Do Next

1. If you have a Coinbase account, go to the wallet section and bridge some ETH to Base. It’s built right in. 2. Install MetaMask or Coinbase Wallet if you haven’t already. 3. Visit Uniswap on Base (make sure you’re on the Base network). 4. Start with a small swap - $50 of USDC for ETH, for example. 5. Watch how fast it goes through. Then try again tomorrow. The first time you trade on Base, you’ll realize why this matters. It’s not about being the biggest DEX. It’s about being the one that actually works for you.Is Base DEX safe to use?

Yes, for most users. Base inherits Ethereum’s security, and Uniswap’s smart contracts have been audited by three top firms: OpenZeppelin, Trail of Bits, and CertiK. The main risk isn’t technical - it’s that Coinbase controls the sequencer. If Coinbase shuts down or changes rules, your access could be affected. But there’s no history of theft or exploit on Base-based DEXs.

How do I get ETH on Base?

If you use Coinbase, bridge directly from your Coinbase wallet - it’s free and built into the app. If you’re coming from another wallet, use the Base Bridge portal (base.org/bridge). You’ll need ETH on Ethereum mainnet to pay for the bridge transaction. Wait 2-4 hours for confirmation. Avoid large transfers during weekends - delays are more common.

Can I trade any crypto on Base DEX?

You can trade any token that has a liquidity pool on Uniswap V3 on Base. Major tokens like ETH, USDC, DAI, and popular tokens like MKR or AAVE are available. But low-cap or new tokens often have no liquidity. If you can’t find a token, it likely doesn’t have enough trading volume to support swaps. Stick to top 50 tokens for best results.

Is Base better than PancakeSwap?

It depends. PancakeSwap has lower fees and more volume overall, but it’s on BNB Chain, which has weaker security and fewer institutional-grade tokens. Base is more secure (Ethereum-backed), has better token quality, and integrates with Coinbase. If you’re new to crypto or use Coinbase, Base is better. If you trade BSC-native tokens daily, PancakeSwap wins.

Will Base become fully decentralized?

Yes - but not yet. The Base team announced a transition to a Base Chain DAO in Q1 2025. That will remove Coinbase’s control over the sequencer and allow community voting on upgrades. Until then, it’s a semi-centralized DEX. If this transition happens as planned, Base could become one of the most important DeFi networks in 2025.

Do I need to pay gas on Base?

You pay gas, but it’s nearly free - typically $0.001 to $0.005 per swap. That’s 100-1,000 times cheaper than Ethereum mainnet. You still need a small amount of ETH on Base to pay for transactions, but you won’t notice the cost. Most users keep $1-$2 in Base ETH for months.

Why is my bridge taking so long?

Bridge delays happen due to network congestion or low gas fees on Ethereum mainnet. If your bridge is stuck, check the status on Dune Analytics or Base’s official bridge page. Don’t cancel - it can cause permanent loss. Wait 4-6 hours. If it still hasn’t gone through, increase the gas fee on your next attempt and try again. Most delays resolve within 24 hours.

Andy Schichter

January 8, 2026 AT 08:36LeeAnn Herker

January 10, 2026 AT 00:45Caitlin Colwell

January 11, 2026 AT 22:06Charlotte Parker

January 12, 2026 AT 07:14Calen Adams

January 13, 2026 AT 03:19Valencia Adell

January 14, 2026 AT 11:54Jacob Clark

January 14, 2026 AT 19:51Rahul Sharma

January 15, 2026 AT 01:06Mollie Williams

January 16, 2026 AT 22:20Tiffani Frey

January 17, 2026 AT 20:13Paul Johnson

January 17, 2026 AT 23:30Kelley Ramsey

January 19, 2026 AT 00:16Michael Richardson

January 19, 2026 AT 02:27Sabbra Ziro

January 19, 2026 AT 04:39Krista Hoefle

January 20, 2026 AT 02:41Emily Hipps

January 21, 2026 AT 10:05