Bittrex Global Crypto Exchange Review: What Happened and Why It Shut Down

Back in 2025, if you were trading crypto on Bittrex Global, you probably didn’t realize you were using a platform that was already on its last legs. By April 23, 2025, the exchange quietly announced it was shutting down for good. No warning. No grand farewell. Just a notice that both its Liechtenstein and Bermuda branches were entering liquidation under ALPS Trust Ltd. If you had funds there, you were suddenly in a race against time - and fees.

What Was Bittrex Global?

Bittrex Global wasn’t the original Bittrex. The U.S.-based Bittrex, founded in 2014 in Seattle, was built by security-focused engineers who prioritized safety over flashy features. Bittrex Global was its international arm, set up to serve users outside the U.S. It offered spot trading for over 280 crypto pairs, including Bitcoin, Ethereum, Litecoin, and newer tokens like NEO and ETC. But unlike its U.S. sibling, Bittrex Global never offered margin trading, futures, or options. It stuck to simple buy-and-sell trades.That simplicity came at a cost. Every trade - whether you were making or taking liquidity - cost 0.25%. Compare that to Binance’s 0.1% spot fee or Bybit’s 0.01% maker fee, and you’re paying nearly three times more. For active traders, that added up fast. A $10,000 trade meant $25 in fees. On other platforms? Just $10.

Security Was Its Only Real Strength

Here’s the one thing Bittrex Global did right: security. Unlike many exchanges that got hacked over the years - Mt. Gox, Coincheck, BitMart - Bittrex Global never suffered a single breach. Not once. That’s rare. The original U.S. Bittrex built its reputation on cold storage, multi-sig wallets, and strict internal controls. Bittrex Global inherited that culture. Even during its shutdown, the liquidator confirmed all customer funds were still safe on the platform.But security alone doesn’t keep users around. When you’re paying higher fees and missing out on advanced tools like stop-limit orders, trailing stops, or leverage, you’re not getting value. You’re just paying extra for safety that you could get elsewhere.

The Trading Experience: Fast, But Limited

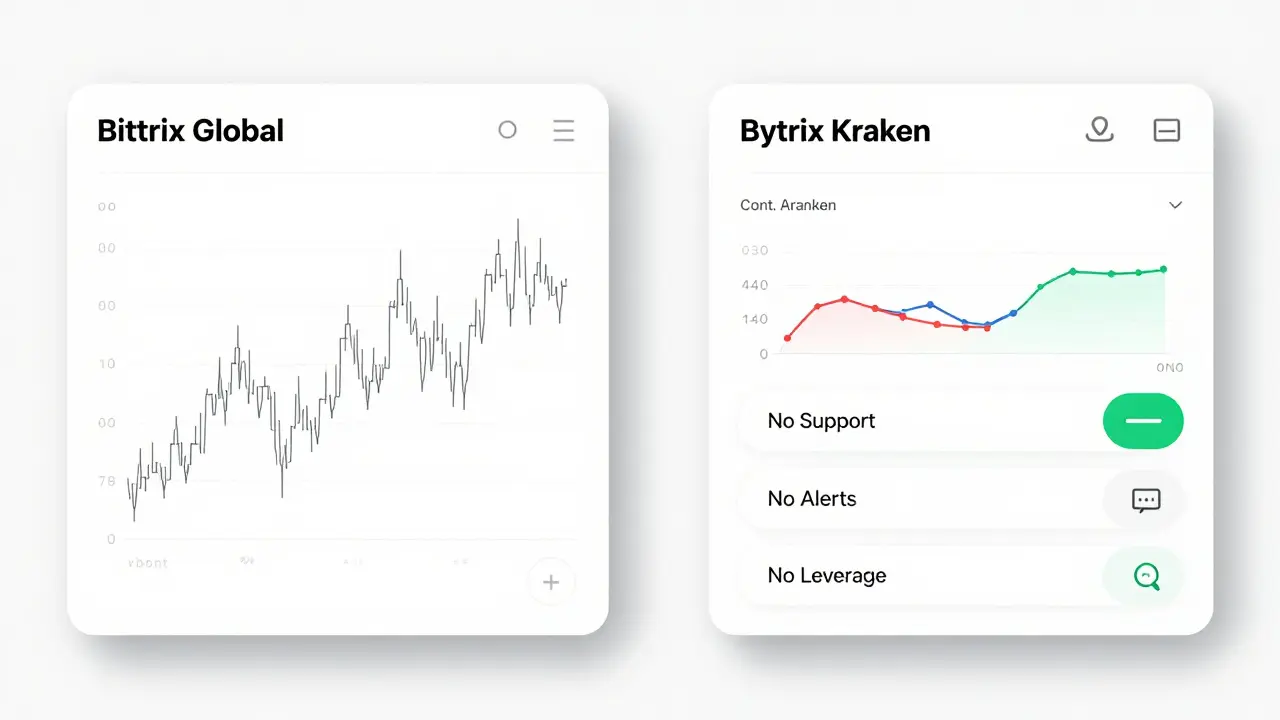

Users who stuck with Bittrex Global often praised its interface. The web platform loaded quickly. The mobile app was smooth, with no lag during high-volume periods. Many Reddit users called it an “underrated crypto exchange” because it just worked - no crashes, no delays, no downtime. For someone who only wanted to buy BTC or sell ETH, it was reliable.But that’s where it ended. No charting indicators beyond basic candlesticks. No custom alerts. No portfolio tracking. No staking. No earning interest on holdings. If you wanted to do anything beyond spot trading, you had to move to another platform. Even basic tools like GTC (good-till-canceled) orders were available, but advanced order types? Gone.

Customer Support Was Broken

This is where Bittrex Global fell apart. No live chat. No phone line. Just a ticket system. And tickets? They often vanished into a black hole.Users reported waiting days - sometimes weeks - for replies. One trader on CoinSutra said they submitted a support ticket about a frozen account and never got a response. Another user on Reddit described being locked out of their account with zero explanation. Account suspensions happened without warning, and there was no clear path to appeal.

Compare that to Kraken or Coinbase, where support teams respond within hours - even on weekends - and Bittrex Global’s system looked outdated. In 2025, when crypto is already volatile enough, losing access to your funds without recourse is a dealbreaker.

Why Did It Shut Down?

The writing was on the wall. Bittrex Global was competing against giants like Binance, Bybit, and HTX - all offering lower fees, derivatives, staking, and 24/7 support. Meanwhile, regulatory pressure was rising. The EU, U.S., and other jurisdictions tightened rules on crypto exchanges. Compliance costs were climbing. Bittrex Global’s business model - high fees, low volume, no derivatives - couldn’t sustain those costs.Industry analysts from 99bitcoins.com pointed out that exchanges focused only on spot trading were being squeezed out. Without revenue from futures or leverage trading, they couldn’t afford to invest in better tech, support, or marketing. Bittrex Global’s 0.25% fee might have looked profitable on paper, but it scared away volume. Less volume meant less liquidity. Less liquidity meant fewer traders. It was a slow death spiral.

The Liquidation Process: A Race Against Time

By February 2025, the liquidator ALPS Trust Ltd. re-enabled withdrawals for users in Liechtenstein. But there was a catch: a 1% monthly fee on every asset you left on the platform. Minimum charge? $50 per asset, per month. So if you had 3 different coins sitting there, you’d pay $150 in fees every 30 days - even if you weren’t trading.That’s not a fee. That’s a penalty. And it forced users to act fast. If you didn’t withdraw your BTC, ETH, or altcoins by the end of March, you were losing value every single day. The liquidator didn’t offer help. No tutorials. No guidance. Just a notice: “Withdraw now or pay more.”

And yet, despite the chaos, no funds were lost. That’s the one silver lining. Your crypto was still there. You just had to move it before the fees ate it alive.

What About the Original Bittrex?

Don’t get confused. The U.S.-based Bittrex is still running. It’s a separate company, with its own team, servers, and compliance structure. It still offers spot trading, and it still has a strong security record. But it doesn’t serve international users the same way Bittrex Global did. If you’re outside the U.S., you can’t sign up for the original Bittrex anymore. So if you’re looking for a Bittrex experience now, you’re out of luck.Who Was Bittrex Global For?

Honestly? It was only ever right for one kind of trader: someone who wanted to buy and hold a few major coins, didn’t care about fees, and trusted security above everything else. If you were a passive investor with $500 in BTC and didn’t trade often, it might’ve been fine.But if you were active, if you wanted to use stop-losses, if you traded multiple times a day, if you needed help when something went wrong - you were better off anywhere else. The platform was a relic from an earlier era of crypto, clinging to a model that no longer worked.

What You Can Learn From Bittrex Global’s Collapse

Bittrex Global’s shutdown isn’t just a story about one exchange dying. It’s a lesson for every crypto user.- Don’t trust reputation alone. Security matters, but so does support, fees, and features.

- High fees kill volume. Even if you think you’re getting safety, you’re paying for it in lost profits.

- Support is part of security. If you can’t reach help when you need it, your funds aren’t truly safe.

- Don’t leave funds on exchanges longer than you need to. Even “secure” platforms can vanish overnight.

If you’re still using any exchange that doesn’t offer live support, transparent fee structures, or regular updates - it’s time to move. The crypto world moves fast. Exchanges that don’t evolve don’t survive.

Where to Go Now

If you used Bittrex Global and need to find a replacement, here are three solid options:- Bybit: Low fees (0.1% spot), strong mobile app, and 24/7 support. Offers futures, staking, and copy trading.

- Kraken: Trusted in the U.S. and EU, great customer service, and strong compliance. No derivatives, but excellent for spot trading.

- HTX (formerly Huobi): Low fees, wide coin selection, and decent support. Popular in Asia and growing globally.

All three have better fee structures, faster support, and more features than Bittrex Global ever did. And none of them are shutting down anytime soon.

Bittrex Global’s story is a warning. In crypto, no platform is immune. Not even the ones with perfect security records. Your money needs more than safety - it needs reliability, responsiveness, and room to grow. If your exchange doesn’t give you that, it’s not protecting you. It’s just holding your cash until it’s too late.

kris serafin

January 13, 2026 AT 04:02Man, I still remember when I moved my BTC off Bittrex Global just before the fees kicked in. That 1% monthly charge was brutal - I had like 3 coins sitting there and was losing $150 a month just for holding. I switched to Bybit and never looked back. 🚀

Valencia Adell

January 14, 2026 AT 12:28Of course it shut down. Anyone who paid 0.25% fees in 2025 deserved to get robbed by their own negligence. You want security? Pay for it with your time and your brain. Not your wallet.

Paul Johnson

January 16, 2026 AT 08:53you think its about fees no its about control the big boys dont want small traders winning they want you to trade futures and get liquidated thats why they pushed out the simple guys like bittrex global

Kelley Ramsey

January 17, 2026 AT 18:45I’m so glad someone finally wrote this! I’ve been saying for years that security isn’t enough - support matters, features matter, and transparency matters. I lost sleep worrying about my account being locked with no way out. Thank you for validating what I felt.

jim carry

January 18, 2026 AT 08:04Let’s be real - Bittrex Global was a museum piece. A beautifully preserved, perfectly secure, utterly useless artifact from the 2018 crypto bubble. They didn’t die because they were bad - they died because they refused to evolve. And that’s the most tragic part. Not the fees. Not the lack of support. The arrogance of clinging to a dead model while the world moved on.

Katrina Recto

January 18, 2026 AT 22:16I held BTC on there for two years. Never traded. Just stored. Never had an issue. Then the shutdown notice came. I withdrew in 48 hours. No drama. No panic. Just clean and quiet. Security worked. The rest? Irrelevant to me.

Veronica Mead

January 20, 2026 AT 08:44It is imperative to note that the cessation of operations by Bittrex Global was not an aberration, but rather an inevitable consequence of non-compliance with evolving financial regulatory paradigms. The platform’s inability to adapt its fee structure to market liquidity demands rendered its operational model untenable. One must, therefore, exercise due diligence in selecting custodial services.

Mollie Williams

January 20, 2026 AT 22:31It’s funny how we romanticize security in crypto. We treat it like a moral virtue - as if holding coins on an exchange that never got hacked makes us somehow virtuous. But safety without agency is just imprisonment. You can have the safest vault in the world, but if the key is locked in a drawer with no one to open it… what good is it? Bittrex Global didn’t fail because it was insecure. It failed because it refused to let people live.

Surendra Chopde

January 21, 2026 AT 12:47From India, I used Bittrex Global for small buys. No KYC hassle, fast deposits. But yeah, the fees hurt. I moved to HTX after the shutdown notice. Their app is better, support replies in 2 hours. Still, I respect Bittrex for never getting hacked. That’s rare.

Tiffani Frey

January 22, 2026 AT 08:24As someone who lived through the Mt. Gox collapse, I can say this: Bittrex Global’s shutdown was almost dignified. At least they didn’t vanish. At least they let you withdraw. At least they didn’t lie. Most exchanges would’ve just disappeared. This? This was a slow, quiet, honest death. And in crypto? That’s a miracle.

Tre Smith

January 23, 2026 AT 05:37Anyone who used Bittrex Global as their primary exchange in 2025 was either naive or deliberately self-sabotaging. The platform was a relic. The fees were predatory. The lack of derivatives meant you were paying premium prices for a service that was already obsolete. This isn’t a cautionary tale - it’s a warning label on a broken toaster.

Ritu Singh

January 25, 2026 AT 04:37They shut it down because the deep state wanted to control crypto liquidity. Bittrex Global was too independent. Too simple. Too honest. They didn’t want retail traders to have clean access without derivatives and tracking. This was a coordinated takedown. The fees? Just a distraction. The real goal? To force everyone into centralized platforms where they can freeze accounts at will.

Jordan Leon

January 27, 2026 AT 03:05There’s a quiet dignity in an exchange that doesn’t chase hype. Bittrex Global didn’t need to offer futures to be valuable. It offered reliability. And in a space full of flashy scams, that’s worth something. Maybe not to traders. But to people who just want to hold.

Rahul Sharma

January 28, 2026 AT 18:52I am from India. I used Bittrex Global for small buys. Fees were high but no problem. No scam. No hack. When they shut down, I withdrew all coins. Now I use Bybit. Good app. Fast. Good support. But I still respect Bittrex for safety.

Gideon Kavali

January 28, 2026 AT 22:40Let me tell you something - this country built the original Bittrex. The U.S. made security a priority. And then we let some offshore shell company with zero accountability take the name and ruin the brand. This isn’t just an exchange shutting down - it’s an American legacy being erased by foreign loopholes and greed.

Allen Dometita

January 29, 2026 AT 00:47Just got my last ETH out before the fee kicked in. Felt like escaping a sinking ship. But hey - at least my coins are safe. I’m now on Bybit, trading with 0.1% fees and actually enjoying it. Life’s too short for 0.25% fees. 🙌

Brittany Slick

January 29, 2026 AT 06:43It’s sad, really - the most secure exchange in crypto got buried under its own silence. No one screamed about the fees. No one screamed about the support. But everyone screamed when the door slammed shut. Maybe if we’d spoken up earlier…