Chinese Crypto Mining Exodus: Where Bitcoin Miners Relocated

Bitcoin Mining Migration Calculator

After the Chinese crackdown, miners relocated to countries with favorable conditions. This tool helps visualize how different locations compare in terms of:

- Energy cost efficiency

- Environmental impact

- Regulatory support

The analysis considers the key factors that influenced migration decisions.

Select parameters and click "Analyze Mining Conditions" to see detailed insights.

Top Migration Destinations (2021-2022)

| Region | Hashshare | Electricity Cost | Energy Source |

|---|---|---|---|

| Kazakhstan | 8.2% | $0.04-$0.05/kWh | Coal (~70%) |

| Texas, USA | ~6% | $0.03-$0.04/kWh | Mixed (Wind + Natural Gas) |

| Russia (Siberia) | 5% | $0.045-$0.055/kWh | Hydro & Natural Gas |

| Pakistan | 2-3% | $0.05-$0.06/kWh | Hydro & Coal |

When the Chinese crypto mining exodus the mass departure of Bitcoin miners from China in 2021 hit the news, most people wondered where all those power‑hungry machines went. The answer reads like a world‑tour of cheap electricity, friendly rules, and big‑scale farms. In the next few minutes you’ll see why the crackdown happened, which countries caught the bulk of the hashpower, and what the move means for the Bitcoin network, energy grids, and the environment.

Key Takeaways

- China’s share of global Bitcoin hashpower fell from ~75% to under 50% in 2021.

- Kazakhstan surged to become the second‑largest mining nation, holding about 8% of global hashrate.

- Texas attracted roughly half of the 5.2GW of new mining capacity installed in the U.S.

- Miners chose destinations based on three factors: cheap electricity, supportive regulations, and available grid capacity.

- The migration improved Bitcoin’s decentralization but raised new environmental and policy questions.

Why the Chinese Crackdown Was Different

Before 2021, most of the world’s Bitcoin mining rigs were tucked into power‑intensive provinces like Sichuan and Inner Mongolia. The government’s first moves targeted heavy‑industry use of hydropower during rainy seasons, but the 2021 wave was a full‑blown ban on mining itself. Unlike earlier measures that focused on exchanges, the new rules came from top‑level committees and demanded that local authorities shut down or relocate every mining farm.

The policy hit where it hurt: electricity bills. Mining farms were consuming gigawatts of power, prompting officials to protect the grid for households and industry. The crackdown was fast, severe, and directed at miners, which forced operators to pack up their ASIC rigs and look abroad.

The Mobility Advantage of ASIC Miners

Mining hardware is surprisingly portable. An ASIC (Application‑Specific Integrated Circuit) miner is essentially a box that plugs into a power outlet and a network cable. When a farm decides to move, operators disconnect the units, load them onto trucks or containers, and ship them to the next power‑rich location. This modularity made the ASIC miners specialized chips designed solely for Bitcoin proof‑of‑work the perfect cargo for a rapid, cross‑border migration.

Within months, entire farms resurfaced in Central Asia, North America, and even parts of Eastern Europe. The speed of the shift proved that Bitcoin mining is one of the few industrial sectors that can relocate at the scale of a global supply‑chain move.

Kazakhstan - The Unexpected Front‑Runner

Data from the Cambridge Centre for Alternative Finance an independent research unit that tracks global crypto activity shows Kazakhstan’s global hashshare leapt from 1.4% in 2019 to over 8% by early 2021. The country’s abundant coal‑fired power plants and low industrial electricity rates (often under $0.04kWh) were the main lure.

Because the grid could already handle large loads, Kazakh operators simply plugged in the incoming ASICs and started mining. By October 2021, Kazakhstan ranked second worldwide in total Bitcoin mining capacity, surpassing even the United States for a brief period.

However, the rapid influx also sparked concerns: the extra load raised the nation’s carbon footprint, and local regulators began drafting policies to curb excessive emissions. The trade‑off between cheap coal power and climate impact is still being debated in Astana.

Texas, USA - A Renewable‑Friendly Hotspot

Across the Pacific, Texas became the second biggest magnet for displaced miners. The state’s deregulated electricity market, combined with a pro‑mining legislative climate, offered miners a predictable environment. Energy prices in West Texas can dip below $0.03kWh, and the grid already blends wind and solar, making the region attractive for those looking to claim a greener image.

According to industry reports, Texas now hosts roughly half of the 5.2GW of new mining capacity being built across the United States. The state’s large‑scale farms not only generate hashpower but also provide grid services: during peak demand, miners can voluntarily shut down or switch to lower‑consumption modes, helping stabilize the network.

Other Notable Destinations

While Kazakhstan and Texas grabbed the headlines, several other regions saw significant inflows:

- Russia: Leveraging its vast hydro‑electric resources in Siberia, Russia attracted miners looking for cheap, renewable‑heavy power.

- Pakistan: Low industrial electricity tariffs (around $0.05kWh) and a growing interest in crypto-friendly policies made it a growing hub.

- Iran: Despite international sanctions, Iran’s subsidized electricity attracted a modest but steady stream of miners.

Each destination balanced cost, regulatory risk, and infrastructure capacity. The pattern shows that miners act like profit‑maximizing entrepreneurs: they chase the cheapest, most reliable power while avoiding jurisdictions that could suddenly ban them.

Energy, Environment, and Regulation - The Triple Challenge

Three forces shaped the migration:

- Electricity cost - the single biggest expense for any mining operation.

- Regulatory clarity - miners need certainty that local laws won’t change overnight.

- Grid capacity - without enough megawatts, even cheap power can’t be used.

In Kazakhstan, cheap coal keeps costs low but spikes carbon emissions. In Texas, lower prices are paired with a growing share of renewables, yet the state’s grid has faced reliability issues during extreme weather. Policymakers in both regions are now looking at ways to tax mining based on energy consumption or to incentivize the use of renewable power.

The shift also forced the Bitcoin network to become more resilient. When hashpower was concentrated in one country, a single policy change could threaten network security. Now that the hashrate is spread across multiple continents, the system is less vulnerable to regional disruptions.

What the Exodus Means for Bitcoin’s Future

From a network perspective, the migration achieved two things:

- Decentralization: With no single country controlling more than half of the global hashrate, the risk of a government‑level attack dropped dramatically.

- Infrastructure upgrades: Destination countries are investing in grid enhancements to accommodate mining, which can benefit other industries that need reliable power.

Looking ahead, experts from Galaxy Digital a research firm that tracks crypto market trends predict that the next wave of relocation will be driven by renewable‑only zones and by regions that offer tax breaks for “green mining”. Countries like Canada’s Alberta province and Norway’s hydro‑rich north are already courting miners with low‑carbon incentives.

For miners, the lesson is clear: stay agile, keep an eye on energy policy, and build modular farms that can be moved quickly. For the broader ecosystem, the exodus shows that regulatory pressure can reshape the geography of a decentralized network without silencing it.

Comparison of Top Relocation Destinations (2021‑2022)

| Region | Global hashshare (2022) | Average industrial electricity cost (USD/kWh) | Primary energy source | Regulatory stance |

|---|---|---|---|---|

| Kazakhstan | 8.2% | 0.04‑0.05 | Coal (≈70%) | Permissive, but environmental scrutiny rising |

| Texas, USA | ~6% | 0.03‑0.04 | Mixed (wind+natural gas) | Pro‑mining legislation, supportive utilities |

| Russia (Siberia) | 5% | 0.045‑0.055 | Hydro & natural gas | Neutral‑to‑supportive, some local licensing |

| Pakistan | 2‑3% | 0.05‑0.06 | Hydro & coal | Emerging crypto‑friendly policies |

Next‑Step Checklist for Mining Operators

- Map electricity tariffs in prospective regions - look for <$0.05kWh.

- Verify that local regulations explicitly allow proof‑of‑work mining.

- Assess grid reliability - ensure backup generators or demand‑response options.

- Consider renewable‑energy contracts to future‑proof against carbon taxes.

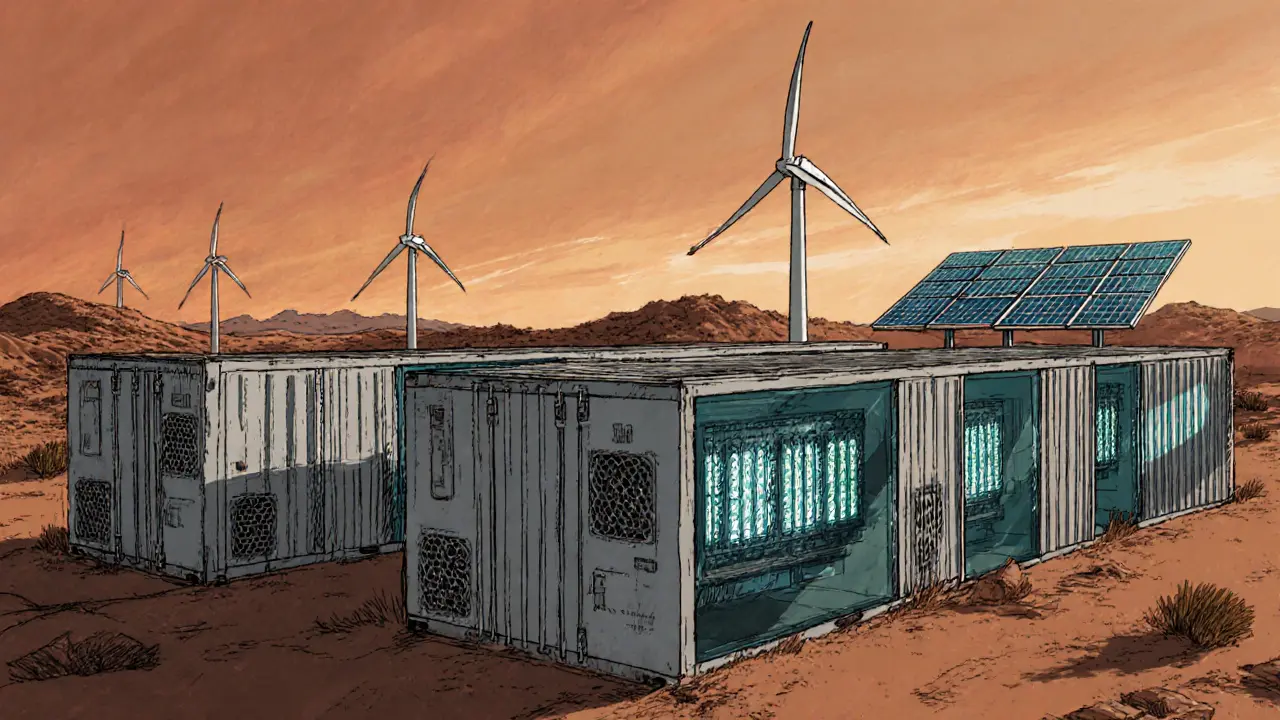

- Plan modular farm design: rack‑mount ASICs, prefabricated containers, and remote monitoring.

Quick Recap

The Chinese crypto mining exodus wasn’t just a news story; it was a massive, coordinated shift of physical hardware that reshaped where Bitcoin is secured. Kazakhstan and Texas emerged as the biggest winners, each bringing different strengths - cheap coal versus renewable‑mix power. The move lowered concentration risk, spurred infrastructure upgrades, and set a template for future migrations driven by policy or energy prices. If you’re watching the crypto space, the takeaway is simple: mining follows money, power, and peace of mind.

Frequently Asked Questions

Did the exodus actually lower Bitcoin’s overall security?

Security comes from decentralization. By spreading hashpower across more countries, the network became less vulnerable to a single government’s actions, which generally improves security.

Why did miners choose Kazakhstan over cheaper options in other Asian countries?

Kazakhstan offered a perfect mix of ultra‑low industrial electricity, existing grid capacity, and a regulatory environment that didn’t immediately ban mining. Those factors outweighed marginal cost differences elsewhere.

Is mining in Texas actually greener than in Kazakhstan?

Texas gets about 22% of its power from wind and solar, while Kazakhstan relies heavily on coal. So, on a per‑kilowatt‑hour basis, Texas mining tends to have a lower carbon footprint, though the exact impact depends on how miners schedule their rigs.

Can miners move again if another country cracks down?

Yes. The modular nature of ASIC equipment means a farm can be packed up and shipped in weeks. The biggest hurdles are customs, transport costs, and finding a location with cheap, reliable power.

What should new miners consider when choosing a location today?

Look for low electricity rates, clear mining‑friendly regulations, and a grid that can handle large loads without frequent brownouts. Also, factor in potential future carbon taxes or sustainability incentives.

Darrin Budzak

May 17, 2025 AT 21:23Interesting how the Chinese crackdown reshaped the mining map – you can really see the power of cheap electricity and regulatory friendliness in action.

karsten wall

May 18, 2025 AT 11:16Indeed, the relocation phenomenon underscores the intrinsic elasticity of ASIC deployment architectures, which by design favor rapid redeployment across geopolitical boundaries.

From a systemic perspective, the hashpower diffusion mitigates concentration risk, thereby enhancing the Nakamoto consensus robustness.

Moreover, the disparity in marginal electricity costs between coal-dominant Kazakhstan and renewable-blended Texas creates a bifurcated incentive landscape.

Operators leveraging arbitrage opportunities can dynamically allocate resources to optimize for cost per terahash.

The regulatory heterogeneity – permissive in Kazakhstan versus pro‑mining statutes in Texas – further amplifies strategic decision matrices.

Energy policy shifts, such as carbon pricing, will inevitably modulate the long‑term sustainability of these hubs.

In Kazakhstan, the low price point (<$0.05/kWh) is offset by the elevated carbon intensity of coal, prompting a potential future transition toward hybrid renewable mixes.

Conversely, Texas offers a more balanced mix, with wind and natural gas reducing the carbon footprint while maintaining sub‑$0.04/kWh rates.

From an economic modeling standpoint, the net present value (NPV) of mining projects in these regions diverges based on both CAPEX and OPEX variances.

Investors must therefore incorporate stochastic models for electricity price volatility and regulatory risk premiums.

Furthermore, the grid integration challenges – especially concerning peak demand events in Texas – necessitate demand‑response strategies from miners.

In practice, many operators adopt curtailment protocols, thereby contributing ancillary services to the grid.

Such symbiotic relations can be quantified via load‑following coefficients in power system analysis.

Overall, the exodus illustrates a microcosm of how decentralized computation reallocates in response to macro‑level policy stimuli, reinforcing Bitcoin’s resilience.

Keith Cotterill

May 19, 2025 AT 01:09One must, with due consideration, acknowledge the sheer audacity of the Chinese ruling class; they, in their infinite wisdom, chose to choke the very engine of innovation-still, the market, ever resilient, found new pastures, albeit with a modicum of bureaucratic disarray, and, of course, the prevailing narrative remains unaltered.

C Brown

May 19, 2025 AT 15:03Oh wow, look at that, miners hopping around like they're on a world tour – because nothing says "stable investment" like packing ASICs into a suitcase and shipping them off to the nearest cheap‑power buffet.

mukund gakhreja

May 20, 2025 AT 04:56Sure, the shift was quick, but let's not pretend the underlying infrastructure wasn't a mess – you need solid grid capacity, not just cheap kilowatts, to keep those machines humming.

Latoya Jackman

May 20, 2025 AT 18:49The technical constraints are clear: without sufficient transmission capacity, even the lowest electricity rates cannot be fully utilized, leading to under‑performance of mining rigs.

CJ Williams

May 21, 2025 AT 08:43🚀 Wow, the migration stats are mind‑blowing! 🌍 Seeing Kazakhstan and Texas dominate the hash‑share chart makes me think the crypto world is finally getting its global swagger! 💪💰

Raj Dixit

May 21, 2025 AT 22:36Honestly, people should stop glorifying cheap coal – it's a short‑term fix that hurts the planet.

Andrew McDonald

May 22, 2025 AT 12:29Well, if you think the best solution is to just hop borders like tourists, maybe you haven't read the full policy briefs – 📚 it's not that simple.

Michael Ross

May 23, 2025 AT 02:23Short‑term gains rarely translate to long‑term stability.

Deepak Chauhan

May 23, 2025 AT 16:16In the grand tapestry of global energy economics, the relocation of mining equipment serves as a poignant illustration of adaptive market mechanisms, albeit one fraught with regulatory nuance.

Lisa Strauss

May 24, 2025 AT 06:09It’s encouraging to see the community highlighting both the opportunities and the environmental responsibilities that come with this shift.

Eugene Myazin

May 24, 2025 AT 20:03Cool to see how the hashpower is spreading out – more diversity, more resilience, and hey, maybe a chance for greener mining too.

Noel Lees

May 25, 2025 AT 09:56Exactly! The next wave should definitely focus on renewable‑only zones 😊. Have you looked into the power‑purchase agreements in Alberta?

Sabrina Qureshi

May 25, 2025 AT 23:49Wow!!! This whole migration thing is just a massive rollercoaster of emotions, finance, and geopolitics!!!

dennis shiner

May 26, 2025 AT 13:43Yeah, because moving giant ASIC boxes across continents is *so* easy 😒.

Mangal Chauhan

May 27, 2025 AT 03:36From a mentorship perspective, the exodus serves as a profound case study in strategic agility and resource optimization.

It illustrates how decentralized entities, unshackled from centralized governance, can dynamically reallocate computational assets in response to macro‑level policy perturbations.

The decision matrix employed by miners incorporates multifaceted variables: electricity price elasticity, regulatory certainty, grid reliability coefficients, and carbon intensity metrics.

When the Chinese authorities introduced stringent bans, the cost function for operating within its borders sharply increased, rendering previous equilibrium states unsustainable.

Consequently, the saddle point shifted toward jurisdictions offering sub‑$0.04/kWh rates and a permissive regulatory environment, such as Kazakhstan and Texas.

However, this migration is not merely an economic calculus; it carries substantial externalities.

In coal‑heavy regions, the marginal increase in carbon emissions offsets any short‑term fiscal advantage, prompting climate stakeholders to demand stricter oversight.

Conversely, regions like Texas, with a blended renewable portfolio, mitigate environmental impacts while preserving low operational expenditures.

Strategically, miners have adopted load‑following protocols, participating in demand‑response programs that provide ancillary services to local grids, thereby generating auxiliary revenue streams.

This symbiotic interaction underscores the potential for mining operations to function as flexible demand assets within broader energy markets.

From an investment standpoint, the diversification of hash‑power across multiple geopolitical nodes reduces systemic risk, enhancing network resilience against localized regulatory shocks.

Future projections suggest that as nations introduce green incentives and carbon pricing mechanisms, the optimal locations will increasingly align with low‑carbon, high‑renewable penetration zones.

Policymakers therefore face a bifurcated challenge: to attract economic activity while safeguarding environmental objectives.

In summary, the Chinese mining exodus exemplifies the intricate interplay between technology, policy, and market forces, offering valuable lessons for stakeholders aiming to navigate the evolving energy‑crypto nexus.

Darius Needham

May 27, 2025 AT 17:29Great points! I'm curious how upcoming carbon credit schemes might further influence mining site selection.

Narender Kumar

May 28, 2025 AT 07:23Behold, the saga of silicon titans wandering the globe, seeking the whispered promise of cheap currents, like mythic heroes questing for El Dorado, only to confront the stark reality of grid constraints and political whims.

Anurag Sinha

May 28, 2025 AT 21:16What if the real reason behind the “crackdown” was a covert operation by shadowy cabals to control the global hash‑rate? I mean, look at the timing-too perfect, right? The whole thing reeks of a staged distraction while they build a secret mining super‑facility in the Siberian tundra. And don’t even get me started on the alleged “environmental concerns” – just a smokescreen! 🤔

karyn brown

May 29, 2025 AT 11:09Honestly, the hype around “green mining” is just a glossy marketing spin-if you care about the planet, stop praising cheap coal and start demanding real renewable commitments.

Megan King

May 30, 2025 AT 01:03Totally agree, we should keep pushing for cleaner energy sources while still supporting miners transitioning to better tech.

Rachel Kasdin

May 30, 2025 AT 14:56America's vast lands and abundant resources make it the natural leader in this new mining era-let's keep the momentum and ensure our policies stay friendly to growth.