Darkex Exchange Review 2025 - Features, Security, and Comparison

Darkex Exchange Feature Comparison Tool

Safe Mode Demo

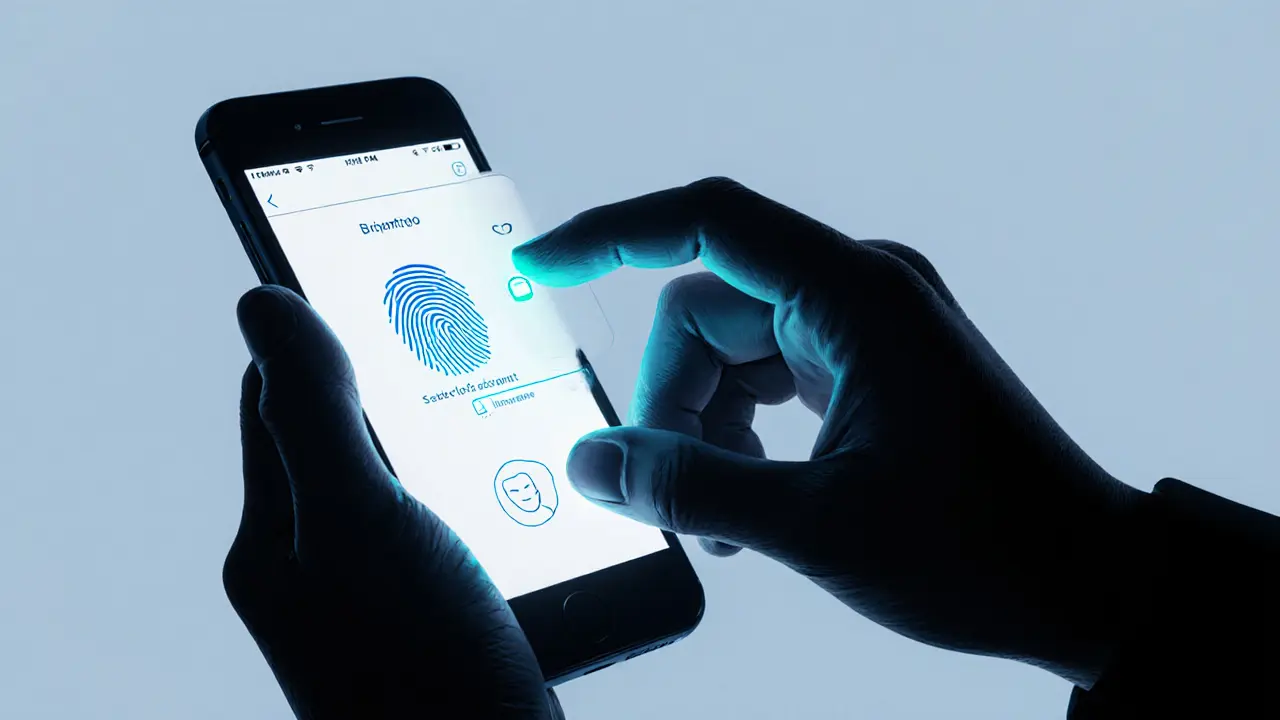

Try out Darkex's innovative biometric security feature.

Fee Estimator

Estimate trading costs based on your volume.

Safe Mode Simulation

Current Status: Account Active

When suspicious activity is detected, your account will be locked and require biometric verification to unlock.

Trading Fee Estimator

Based on typical tiered structures (maker/taker)

Darkex vs Top Exchanges Comparison

| Feature | Darkex Exchange | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Launch Year | 2024 | 2017 | 2012 | 2011 |

| Supported Coins | 200+ (incl. BTC, ETH, SOL, AVAX) | 600+ | 250+ | 200+ |

| Trading Products | Spot, Futures, Margin, Staking, Lending, DeFi | Spot, Futures, Options, Savings | Spot, Staking, Earn | Spot, Futures, Margin |

| Security Highlight | Safe Mode (biometric lock) | SAFU fund, 2FA | 2FA, Insurance vault | 2FA, Cold storage 95% |

| Liquidity Claim | Aggregated deep pools (unverified) | Largest global pool | High US liquidity | Strong EUR/US pools |

| Regulatory Status | Registered in Georgia; blocked in Turkey | Licensed in multiple jurisdictions | US-registered, EU license | US & EU regulated |

| Fee Transparency | Not publicly disclosed | Tiered maker/taker, clear table | Fixed spread, clear fees | Tiered, published |

Key Takeaways

- Darkex Exchange launched in 2024, positioning itself as a next‑generation CEX with deep liquidity claims.

- Unique Safe Mode uses biometric locks to freeze accounts during suspicious activity.

- Supports over 200 crypto assets and offers spot, futures, margin, staking, and lending.

- Regulatory headwinds exist - notably a block in Turkey - and user‑review data is still sparse.

- Compared with Binance, Coinbase and Kraken, Darkex matches most product offerings but lacks transparent fee schedules.

What is Darkex Exchange?

When examining Darkex Exchange is a Dubai‑based centralized cryptocurrency exchange launched in 2024, offering spot, futures, margin and DeFi products. The platform is legally registered under Darkex Exchange, LLC in the Tbilisi Technology Park Free Industrial Zone, Georgia (Tbilisi Technology Park).

Its public narrative emphasizes “next‑generation” speed, deep liquidity pools and a suite of educational resources called Darkex Academy.

Core Trading Products

Darkex offers a fairly complete toolbox for both retail and institutional traders:

- Spot trading for over 200 coins, including BTC, ETH, SOL and AVAX.

- Futures contracts with up to 10× leverage.

- Margin trading via leveraged tokens.

- Staking services for high‑yield PoS assets.

- Crypto lending and DeFi investment options.

The platform also supports multiple fiat on‑ramps, allowing users to deposit USD, EUR, GBP and several regional currencies.

Security Features - The “Safe Mode” Edge

Security is the headline claim for Darkex. Its proprietary Safe Mode automatically locks all account functions when suspicious behavior is detected. Account recovery then requires biometric data (fingerprint or facial recognition) entered on a trusted device.

Beyond Safe Mode, Darkex states it follows "global security standards" and employs end‑to‑end encryption for data in transit. The mobile app, updated on January 16, 2025, implements the same encryption layer and offers a one‑tap data‑deletion request.

Fees and Pricing - What We Know

Official fee tables have not been published, which is unusual for a platform targeting institutional clients. In practice, users report a maker‑taker model similar to other major exchanges, but exact percentages remain undisclosed. Traders should expect a tiered structure that rewards higher volume, as is standard across the industry.

Because the fee schedule is opaque, potential users should test small trades first to gauge real‑world costs.

Liquidity Claims and Real‑World Performance

Darkex markets itself as having “superior liquidity” compared to Binance, Coinbase and Kraken. However, independent volume data is not publicly available yet. The exchange claims to aggregate liquidity from multiple external sources, but without verifiable numbers it’s hard to confirm the advantage.

For high‑frequency traders, the lack of transparent order‑book depth may be a red flag. Casual investors will likely see similar slippage to other mid‑size exchanges.

Regulatory Landscape

Compliance is a mixed bag. The platform is registered in Georgia, which offers a crypto‑friendly regulatory environment, but it has faced hurdles elsewhere. On September 11, 2024, Turkey's Capital Markets Board (SPK) blocked access to Darkex along with 15 other sites for offering unlicensed leveraged forex and crypto services to Turkish residents.

Darkex has publicly pledged to work toward a licensing agreement with the SPK, but no timeline has been disclosed. Users in jurisdictions with strict licensing rules should verify local compliance before depositing sizable funds.

User Experience - Onboarding, Support, and Education

The sign‑up flow is straightforward: email verification, two‑factor authentication, and optional biometric enrollment for Safe Mode. The platform provides a knowledge base at darkex.zendesk.com and a dedicated support address ([email protected]).

Educational content lives inside Darkex Academy, which offers short videos on trading basics, risk management and how to use the exchange’s advanced tools. The Academy is comparable to Coinbase Learn but lacks interactive quizzes.

Community sentiment is hard to gauge: FxVerify shows zero verified reviews, and the Google Play listing provides no rating data. Social media accounts exist on X, LinkedIn, Telegram and Instagram, but engagement metrics are not publicly disclosed.

How Darkex Stacks Up - Comparison Table

| Feature | Darkex Exchange | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Launch Year | 2024 | 2017 | 2012 | 2011 |

| Supported Coins | 200+ (incl. BTC, ETH, SOL, AVAX) | 600+ | 250+ | 200+ |

| Trading Products | Spot, Futures, Margin, Staking, Lending, DeFi | Spot, Futures, Options, Savings | Spot, Staking, Earn | Spot, Futures, Margin |

| Security Highlight | Safe Mode (biometric lock) | SAFU fund, 2FA | 2FA, Insurance vault | 2FA, Cold storage 95% |

| Liquidity Claim | Aggregated deep pools (unverified) | Largest global pool | High US liquidity | Strong EUR/US pools |

| Regulatory Status | Registered in Georgia; blocked in Turkey | Licensed in multiple jurisdictions | US-registered, EU license | US & EU regulated |

| Fee Transparency | Not publicly disclosed | Tiered maker/taker, clear table | Fixed spread, clear fees | Tiered, published |

Pros and Cons

- Pros

- Broad asset coverage and diverse product suite.

- Innovative biometric Safe Mode adds a layer of protection.

- Dedicated education hub via Darkex Academy.

- Mobile app regularly updated (last update Jan2025).

- Cons

- Fee structure is opaque, making cost planning difficult.

- Limited third‑party reviews; user sentiment data scarce.

- Regulatory setbacks in Turkey highlight compliance risks.

- Liquidity claims lack independent verification.

Final Verdict - Should You Trade on Darkex?

If you’re a tech‑savvy trader who values cutting‑edge security and wants to experiment with a fresh platform, Darkex offers an appealing mix of products and a biometric lock that most older exchanges don’t have. However, the lack of transparent fees and limited user feedback make it a higher‑risk choice for large‑scale capital deployment.

For casual investors or those focused on cost efficiency, sticking with established players like Binance or Coinbase-where fees and liquidity are publicly documented-might be safer until Darkex publishes more concrete performance data.

Frequently Asked Questions

Is Darkex Exchange safe for beginners?

The platform’s Safe Mode and biometric authentication provide strong protection against unauthorized access. However, beginners should start with small amounts because the fee structure isn’t public and community support is still limited.

What cryptocurrencies can I trade on Darkex?

More than 200 assets are listed, including major coins like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX) and a range of altcoins and DeFi tokens.

How does Darkex’s Safe Mode work?

When the system detects suspicious activity, it locks all trading and withdrawal functions. To unlock, the user must authenticate via fingerprint or facial recognition on a registered device, preventing attackers from moving funds.

Are there any regulatory issues I should worry about?

Darkex is registered in Georgia, but it was blocked in Turkey in 2024 for offering unlicensed leveraged services. Users should verify that the exchange is compliant in their own country before depositing large sums.

How can I contact Darkex support?

Support is reachable via email at [email protected] and through a knowledge base at darkex.zendesk.com. Response times are typically within 24hours.

John Dixon

October 3, 2025 AT 21:25Brody Dixon

October 4, 2025 AT 06:36Mike Kimberly

October 4, 2025 AT 13:53angela sastre

October 4, 2025 AT 22:29Patrick Rocillo

October 5, 2025 AT 03:05Aniket Sable

October 5, 2025 AT 18:06Santosh harnaval

October 6, 2025 AT 03:02Claymore girl Claymoreanime

October 6, 2025 AT 06:47Will Atkinson

October 6, 2025 AT 18:23monica thomas

October 7, 2025 AT 09:18Edwin Davis

October 7, 2025 AT 19:52emma bullivant

October 8, 2025 AT 18:24Michael Hagerman

October 9, 2025 AT 15:35Laura Herrelop

October 9, 2025 AT 22:59Nisha Sharmal

October 10, 2025 AT 22:22Karla Alcantara

October 11, 2025 AT 16:33