Emotional Risk Management in Trading: How to Stop Letting Fear and Greed Destroy Your Profits

Most traders lose money not because they don’t know how to read charts or pick entries. They lose because they can’t control their emotions. Fear makes them exit winning trades too early. Greed keeps them in losing ones too long. Ego prevents them from admitting they’re wrong. And after a loss? Revenge trading kicks in-bigger positions, no plan, just rage. This isn’t weakness. It’s biology. Your brain is wired to react to money loss like it’s a physical threat. And in trading, that’s deadly.

Why Emotional Risk Management Isn’t Optional

Traditional risk management tells you to risk only 1% of your account per trade. It sets stop-losses. It calculates position sizes. Sounds smart, right? But here’s the catch: 80-90% of retail traders know these rules. And still, they break them. Why? Because when real money is on the line, logic goes out the window. Your amygdala-the part of your brain that handles fear-takes over. It doesn’t care about your trading plan. It only cares about survival. A 2023 study by Beacon Investing found that professional trading firms that use formal emotional risk management protocols outperform those that don’t by 34% over the long term. That’s not a small edge. That’s the difference between surviving and going broke. And it’s not magic. It’s structure.The Four Core Emotional Triggers in Trading

There are four emotions that wreck trading accounts more than any technical mistake:- Fear of Missing Out (FOMO): You see a price spike. Everyone’s talking about it. You jump in late, hoping to catch the tail end. You ignore your entry rules. Result? You buy high and get crushed when it reverses.

- Fear of Giving Back Profits: You’re up 5%. Instead of letting your trade run, you close it early because you’re scared it’ll disappear. You’re not protecting gains-you’re punishing consistency.

- Revenge Trading: You lose $500. You tell yourself, “I’ll make it back in one trade.” You double your position. You ignore your stop-loss. You lose $1,500. This isn’t trading. It’s gambling with a trading account.

- Overconfidence: You win three trades in a row. You start thinking you’re a genius. You skip your journal. You increase position size. You ignore risk rules. Then the market flips-and you lose everything you gained.

These aren’t just feelings. They’re patterns. And they’re predictable. The key isn’t to eliminate them. It’s to build systems that stop them from controlling you.

The One Percent Rule-And Why It Works

The one percent rule isn’t just about capital preservation. It’s a psychological tool. When you limit each trade to 1% of your account, you remove the emotional stakes. Losing $100 feels different than losing $1,000. Your brain doesn’t panic when the loss is small enough to absorb. Quantified Strategies tracked 800 traders over 18 months. Those who stuck to the one percent rule had a 61% lower chance of quitting trading after a losing streak. Why? Because their emotional system wasn’t overloaded. They could think clearly even after three losses in a row. But here’s the catch: you have to stick to it-even when you’re on a winning streak. That’s when overconfidence creeps in. That’s when you think, “I’m hot. I can risk 3%.” Don’t. Your brain will trick you. The market doesn’t care how good you feel.The Stopwatch Technique: Pause Before You Panic

NinjaTrader studied 2,300 traders who kept trading journals. The most successful ones used a simple trick: when they felt the urge to exit a trade early-or to enter one impulsively-they set a 90-second timer. They didn’t act. They didn’t think. They just waited. For 90 seconds. After 30 days, those traders increased their average trade holding period by 47%. Their profitability rose by 22%. Why? Because 90 seconds is enough time for the amygdala to calm down. Enough time for your prefrontal cortex-the rational part of your brain-to come back online. You don’t need fancy tech. You just need a timer on your phone. Set it. Wait. Then decide.Emotional Stop-Loss Alignment

Here’s the biggest mistake traders make: their emotional stop-loss doesn’t match their financial stop-loss. You set a stop-loss at $85 because your technical analysis says so. But when the price hits $87, you panic. You close it because “it’s going to hit $80.” You’re not following your plan. You’re following your fear. ACY.com studied 1,200 swing traders. Those who aligned their emotional stop with their financial stop reduced trading errors by 63%. How? They wrote down their stop level. They printed it. They stuck it on their monitor. They didn’t move it. Not even once. Your emotional stop-loss is your discipline. If it doesn’t match your technical stop, you’re not trading. You’re guessing.

Mindfulness: The 10-Minute Daily Reset

Blueberry Markets partnered with a neuroscience lab to track brain activity in traders. After 8 weeks of 10-minute daily meditation, traders showed a 16% increase in prefrontal cortex activity (rational thinking) and a 27% drop in amygdala activation (fear response). You don’t need to sit cross-legged for an hour. Just sit quietly. Breathe. Focus on your breath. When your mind wanders to yesterday’s loss or tomorrow’s trade, gently bring it back. That’s it. This isn’t spiritual. It’s science. Your brain is a muscle. If you never train it to stay calm under pressure, it won’t. Meditation is mental weightlifting.Trade Journaling: Your Emotional Autopsy Tool

Edgewonk analyzed 15,000 trader journals. The traders who kept detailed entries-especially about how they felt before, during, and after each trade-reduced their average drawdowns by 37% and improved win rate consistency by 29%. Your journal isn’t for tracking P&L. It’s for tracking your emotions. Ask yourself after every trade:- What was I feeling right before I entered?

- Did I stick to my plan-or did I deviate?

- What emotion drove my exit?

- Did I feel regret? Relief? Euphoria?

Write it down. No filter. After 30 days, you’ll start seeing patterns. You’ll know exactly when you’re most vulnerable. That’s power.

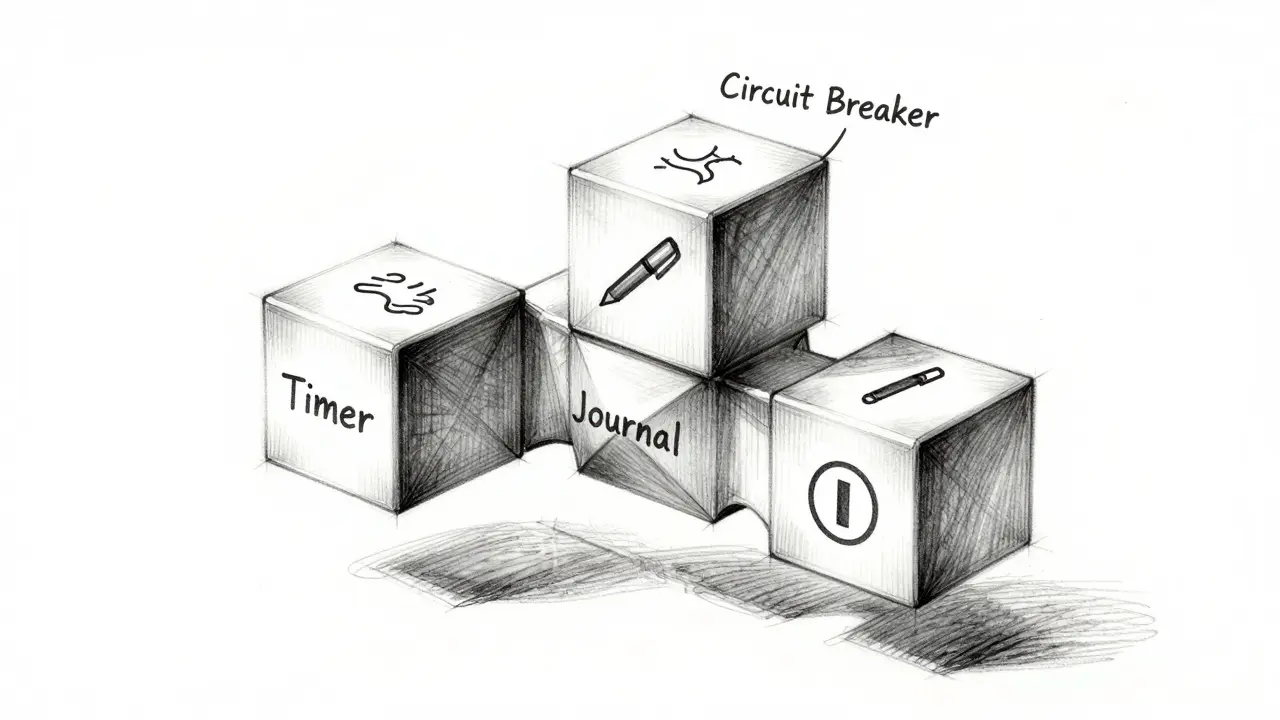

The Circuit Breaker: When You Need to Walk Away

The hardest part of emotional risk management isn’t learning the techniques. It’s sticking to them during a losing streak. NinjaTrader found that 83% of traders abandon their emotional protocols after three consecutive losses. That’s when revenge trading spikes. That’s when accounts blow up. Beacon Investing introduced a simple fix: the circuit breaker. Set a rule: if you lose 5% of your account in a week, you stop trading for 48 hours. No exceptions. Traders who used this cut emotional decision-making during losing streaks by 76%. Why? Because it forces a reset. It stops the spiral before it becomes a crash. You don’t need to be perfect. You just need to pause.What Happens During Market Crashes?

No system works perfectly during black swan events. During the March 2020 crash, even traders with perfect emotional protocols made 28% more emotional decisions. Why? Because volatility spiked past VIX 45. Your brain goes into survival mode. Logic shuts down. That’s not failure. That’s reality. The goal isn’t to be emotionless. It’s to know your limits. When VIX goes above 45, reduce position size. Avoid new entries. Stay in cash. Wait for calm. Oanda’s analysis of 500,000 trades confirmed this: emotional risk management works best when VIX is between 15 and 35. Outside that range, you’re fighting biology.

What the Pros Know That Retail Traders Don’t

Jack Schwager interviewed over 100 top traders for his book Market Wizards. Every single one had a formal emotional risk management system. Not one said, “I just trust my gut.” Dr. Brett Steenbarger, a leading trading psychologist, says: “Traders who neglect emotional risk management are playing with psychological fire. The markets will eventually expose and exploit their emotional vulnerabilities.” And here’s the brutal truth: traders who believe they’re immune to emotion? They’re the most dangerous. Edgewonk’s data shows they suffer 41% deeper drawdowns than those who admit they’re vulnerable.How to Start Today

You don’t need to overhaul your life. Start small. Pick one technique. Do it every day for 14 days.- Week 1: Write down your emotional state before every trade. Just one sentence. “I felt anxious because I’m scared of losing.”

- Week 2: Set a 90-second timer before every trade. Wait. Then act.

- Week 3: Implement the one percent rule. No exceptions.

- Week 4: Add 10 minutes of meditation. Use a free app like Insight Timer.

After 30 days, you’ll notice something: you’re not as reactive. You’re more patient. You’re making fewer impulsive moves. That’s progress.

The Future: Biometrics and AI

The next wave of emotional risk management isn’t just about journaling or meditation. It’s about real-time feedback. Companies like ACY.com are testing heart rate variability (HRV) monitors. If your heart rate spikes during a trade, the system alerts you: “You’re stressed. Pause.” NinjaTrader’s Emotional Endurance Training simulates high-pressure scenarios-sudden crashes, fake news, flash crashes-to build mental resilience. Early users saw a 44% improvement in emotional control after just 20 sessions. Dr. Steenbarger predicts EEG-based neurofeedback will be mainstream by 2027. Imagine a headset that tells you, “Your amygdala is firing. Take a breath.” But here’s the thing: tech won’t fix you. Only you can do that. Tools just help you see the problem.Final Thought: This Is a Lifelong Practice

Emotional risk management isn’t a checklist you complete. It’s a daily habit. Like brushing your teeth. You don’t do it once and call it done. You do it every day-even when you’re winning. The market doesn’t care if you’re smart. It cares if you’re consistent. And consistency comes from controlling your emotions-not suppressing them, but managing them. If you want to survive in trading, you need two things: a solid plan, and the discipline to follow it. The plan is easy. The discipline? That’s the real edge.What’s the biggest mistake traders make with emotions?

The biggest mistake is thinking they can control their emotions by sheer willpower. Emotions aren’t weaknesses-they’re biological responses. Trying to ignore them makes them stronger. The solution isn’t to fight them, but to build systems that prevent them from taking over-like timers, circuit breakers, and trade journals.

Can emotional risk management guarantee profits?

No. No system guarantees profits. But emotional risk management drastically improves your odds. Traders who use it reduce drawdowns by 37%, increase win rate consistency by 29%, and are 34% more likely to achieve long-term profitability, according to Beacon Investing’s 2023 data. It doesn’t make you a genius. It keeps you in the game long enough to let your edge work.

How long does it take to see results from emotional risk management?

Most traders see small improvements after 14 days, but real change takes 45-60 days. That’s how long it takes your brain to form new neural pathways. Don’t quit if you don’t see results in a week. The first two weeks are the hardest. Stick with it. Your future self will thank you.

Do I need to meditate to manage emotions in trading?

No, but it’s one of the most effective tools. If meditation doesn’t work for you, try deep breathing for 5 minutes before trading. Or go for a walk. The goal isn’t to meditate-it’s to reset your nervous system before you trade. Any method that calms your fight-or-flight response counts.

What if I lose money even after using emotional risk management?

Losing is part of trading. Even the best traders lose. Emotional risk management doesn’t stop losses-it stops you from turning small losses into catastrophic ones. If you lose, review your journal. Did you follow your plan? If yes, then it’s just a normal loss. If no, then you found your next area to improve. That’s how you get better.

Shaun Beckford

January 19, 2026 AT 01:21Let me tell you something - this whole ‘emotional risk management’ thing is just Wall Street’s way of telling you to meditate your way to riches while they quietly short your account. Fear and greed? Yeah, they’re biological. But so is the fact that your broker gets paid whether you win or lose. The real edge isn’t in timers or journals - it’s in knowing who’s stacking the deck.

Sarah Baker

January 20, 2026 AT 07:58OH MY GOD THIS IS SO TRUE I’VE BEEN THERE. I lost $8k in two weeks because I kept chasing a trade after I’d already lost my stop. I cried in my car afterward. But then I started the 90-second timer - just one minute and thirty seconds of breathing before I clicked buy or sell. And guess what? My trades got calmer. My sleep got better. I’m not a genius - I’m just not letting my panic run the show anymore. You got this.

Pramod Sharma

January 20, 2026 AT 10:17Emotions are data. Not enemies. The market reflects your inner state. Work on yourself, not the chart.

Liza Tait-Bailey

January 21, 2026 AT 16:26so i tried the 90 sec timer and honestly at first i just sat there thinking about what i had for lunch and then i forgot why i was even waiting. but after like 3 days it kinda clicked. i dont know if its the timer or just me getting older but im way less impulsive now. also i started writing one sentence after each trade like ‘felt like a greedy idiot’ and it’s weirdly helpful. not sure why but it is.

Nishakar Rath

January 23, 2026 AT 12:121% rule? lol. you think the market cares if you risk 1% or 10%? you’re still a retail schmuck with a laptop and a dream. the only thing that matters is timing and guts. all this meditation and journaling is just a distraction for people who don’t have the stomach to actually win. i risk 15% on every trade and i’m still here. your fear is your enemy - not your brain.

kristina tina

January 25, 2026 AT 06:50I was skeptical too. I thought meditation was for hippies. But after two weeks of 10 minutes a day - just breathing, no apps, no bells - I noticed something: I stopped yelling at my screen after a loss. I stopped deleting my journal entries when I messed up. I stopped treating every trade like a life-or-death moment. It’s not magic. It’s just… space. And space is everything.

Anna Gringhuis

January 26, 2026 AT 16:51Wow. Another ‘trading guru’ pretending psychology is a checklist. Let me guess - you also sell a $297 ebook on ‘The 7 Secrets of Emotional Discipline’? Newsflash: if your system requires you to write down your feelings every day, you probably shouldn’t be trading in the first place. The market doesn’t care if you’re ‘aligned’ - it cares if you’re right. And being right has nothing to do with breathing.

Dustin Secrest

January 26, 2026 AT 17:04There’s an interesting paradox here. The more you try to control your emotions, the more you become attached to the idea of control - which, ironically, becomes its own emotional burden. Maybe the real discipline isn’t in the timer or the journal, but in accepting that you will never fully master your impulses. And that’s okay. You just need to outlast them.

Bill Sloan

January 28, 2026 AT 10:49Just tried the circuit breaker after losing 5% this week. Walked away for 48 hours. Went hiking. Didn’t look at a chart. Came back and saw the market had bounced 3% without me. I didn’t miss a thing. Honestly? Best 2 days I’ve had in months. I’m not a robot. I’m a human. And sometimes, humans need to step away.

Callan Burdett

January 29, 2026 AT 05:21Bro. I used to think I was a genius until I lost $12k in a week because I thought ‘this time it’s different’. Then I started writing one sentence after every trade. One. Sentence. ‘Felt like a dumbass for ignoring my stop.’ ‘Wanted to prove I was right so I doubled down.’ After 30 days? I stopped seeing myself as a trader. I started seeing myself as a student. That’s when the money started coming back.

Anthony Ventresque

January 29, 2026 AT 19:04I like this. Not because it’s perfect, but because it’s honest. I’ve tried everything - indicators, algorithms, signals - but nothing stuck until I started paying attention to how I felt before I clicked. It’s not about being calm. It’s about being aware. And awareness? That’s the only edge you can’t buy.

Katherine Melgarejo

January 29, 2026 AT 22:38so i tried the 90 second timer and ended up watching a cat video instead. then i traded anyway. then i lost. then i cried. then i did it again. now i just stare at my screen for 90 seconds and think ‘what would my 70 year old self say?’ turns out he’d be like ‘dude, just wait’.