Global Cryptocurrency Regulations Overview: What’s Legal, What’s Not in 2026

When you buy Bitcoin, trade Ethereum, or hold USDC, you’re not just dealing with technology-you’re navigating a patchwork of laws that change by the country, sometimes by the state. In 2026, there’s no single global rulebook for crypto. Instead, there are conflicting systems, sudden crackdowns, and surprising openings. If you’re holding digital assets, running a business, or just trying to understand why your exchange dropped a coin, you need to know how the world is actually regulating this space.

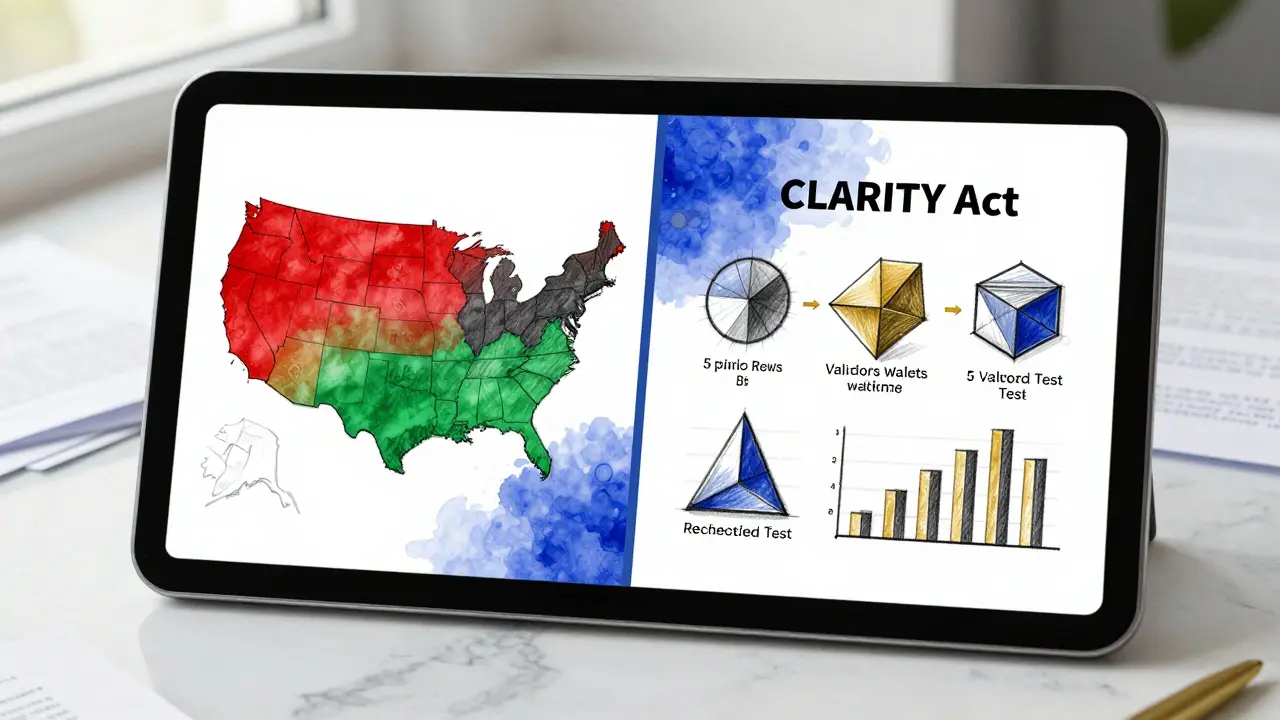

How the World Is Split on Crypto

The global approach to cryptocurrency regulation isn’t just different-it’s polarized. Some countries treat crypto like cash. Others treat it like gambling. A few have banned it entirely.China remains the strictest. Since September 2021, all crypto trading and mining have been illegal. The government shut down 46,000 mining rigs, cutting global hashrate by 20%. Today, Chinese citizens can’t legally buy or trade crypto on domestic platforms. Even holding it carries risk.

Meanwhile, the European Union went the other way. In December 2024, the Markets in Crypto-Assets (MiCA) regulation became fully active. It’s the first unified system covering all 27 EU member states. Under MiCA, every crypto exchange, wallet provider, and stablecoin issuer needs government approval. Stablecoins must back every token with real cash or equivalents-100% reserve. Issuers need at least €2 million in capital. The goal? No more Terra-style collapses. No more rug pulls. No more confusion over who’s responsible when things go wrong.

The United States? It’s a mess. No single agency controls crypto. The SEC says most tokens are securities. The CFTC says most are commodities. The IRS treats them as property. And now, three new laws have reshaped the landscape in 2025.

The U.S. Regulatory Shift in 2025

Three laws passed in 2025 changed everything for American crypto users and businesses.The GENIUS Act, signed in July 2025, targets stablecoins. It requires all dollar-pegged stablecoins to hold 100% reserves. Every USDC, USDT, or new token must be fully backed by cash, Treasury bills, or other ultra-safe assets. Issuers must get monthly audits from PCAOB-registered firms. No more pretending your reserves are real. This law helped push institutional stablecoin usage up 42% in just four months. But it also killed 23 smaller stablecoin projects that couldn’t meet the $100 million capital requirement.

The CLARITY Act (pending Senate vote as of January 2026) finally tries to fix the securities vs. commodities mess. It says if a cryptocurrency has:

- A decentralized network with at least 1,000 independent validators,

- Over $1 billion in daily trading volume,

- Token distribution across 10,000 unique wallets,

- No central team controlling development,

- And no promise of profit from others’ efforts,

then it’s a commodity-not a security. That’s a huge win for Bitcoin and Ethereum. The SEC’s own data shows only 38% of the top 100 cryptos would still be considered securities under this test. For the rest, the CFTC takes over. That’s clearer than ever before.

Then there’s the Anti-CBDC Surveillance State Act. Passed in July 2025, it blocks the Federal Reserve from launching a digital dollar unless Congress votes on it. This wasn’t about stopping innovation-it was about stopping surveillance. Lawmakers feared a government-issued digital currency could track every purchase, freeze accounts, or limit spending. The act makes sure that power stays with elected officials, not technocrats.

And the SEC’s Project Crypto launched in March 2025 dropped another bomb: most crypto assets aren’t securities. SEC Chair Gary Gensler said the old Howey test-used since the 1940s-wasn’t built for decentralized networks. The new guidelines say: if a token is truly decentralized and used like a currency or utility, it’s not a security. This reversed years of enforcement actions that scared off startups.

Why Stablecoins Are the Big Battleground

Stablecoins are the bridge between crypto and the real economy. They’re used for payments, remittances, and trading. But they’re also the most dangerous part of crypto-if they’re not backed properly.USDT (Tether) still dominates, moving $703 billion a month. USDC, backed by Circle, hit $1.54 trillion in a single month in June 2025. But new players are rising fast. EURC, Circle’s euro stablecoin, grew 76% month-over-month after MiCA launched. Why? Because it’s the only euro stablecoin that’s fully compliant with EU law. Banks and businesses now trust it.

But here’s the problem: reserve rules vary wildly. The EU and U.S. require 100%. Some emerging markets allow as low as 50%. That’s a huge risk. If a stablecoin issuer only holds half the cash it claims, a panic could trigger a bank run-just like 2008, but digital.

The FSB (Financial Stability Board) is pushing for global 100% reserve rules by Q4 2026. If that happens, the $152 billion stablecoin market will become as safe as bank deposits. But if countries keep dragging their feet, we’ll keep seeing collapses-and losses for everyday users.

What Businesses Face When Operating Globally

If you’re running a crypto exchange, wallet, or DeFi platform, compliance isn’t optional-it’s a full-time job.In the EU, you need to apply to your national regulator with 17 documents. The process takes 28 days on average. You need legal teams, auditors, and cybersecurity experts. But once approved, you can operate across all 27 EU countries with one license.

In the U.S., you need state licenses (some states require 5+), federal registrations with FinCEN, and compliance with SEC or CFTC rules depending on your asset. On average, a crypto firm files 8.3 separate applications. It takes 14.7 months to get fully compliant. That’s nearly twice as long as in the EU. And it costs 3.2 times more in legal fees, according to Harvard Law School.

Japan is the middle ground. Since 2017, all exchanges need a license from the Financial Services Agency. They need ¥100 million in capital ($680,000), real-time fraud detection systems, and daily reporting. It’s strict-but predictable. Over 20 exchanges are licensed, and users trust them.

Singapore offers a faster path. The Monetary Authority of Singapore approves new stablecoins in 14 days. It’s not as strict as the EU, but it’s clear. That’s why many crypto startups now set up legal entities in Singapore-even if they don’t serve customers there.

Who’s Winning and Who’s Losing

The data shows clear winners and losers based on regulation.Winners: Countries with clear, predictable rules. The EU, Japan, Singapore, and now the U.S. (post-2025 laws) are seeing institutional adoption rise 34%. Traditional banks are offering crypto custody, trading, and staking. PwC found that 38% of customers in regulated markets now use crypto services from their bank. That’s up from 12% in unregulated places.

Winners also include stablecoin issuers who followed the rules. Circle’s USDC and EURC are now trusted by Goldman Sachs, JPMorgan, and PayPal. Their volume exploded because they didn’t cut corners.

Losers: Smaller players who couldn’t keep up. The GENIUS Act’s $100 million capital requirement blocked 19 new stablecoin startups. In the U.S., 47% of crypto startups delayed expansion between 2023 and 2025 because of legal uncertainty. Many moved operations overseas.

Losers also include users in countries with no rules. Trustpilot reviews show exchange ratings jumped from 3.7 to 4.5 in regulated markets. In places like Nigeria or Argentina, where rules are unclear, users report more scams, frozen accounts, and lost funds. The IOSCO says 42% of retail investors lost money due to platform failures in unregulated regions.

What’s Coming Next

By 2027, the FSB predicts 92% of global crypto trading will happen on regulated platforms. That’s up from 68% today. Why? Because institutions won’t touch crypto without clear rules.The U.S. Senate is already drafting a bill to create a dedicated framework for digital asset commodities. It’s likely to pass in 2026. That could finally end the SEC-CFTC turf war.

More countries will adopt 100% reserve rules. The FSB is pushing for global data sharing by Q2 2026. That means regulators will see cross-border flows in real time. If a stablecoin issuer in one country moves funds to another, regulators will know.

And the biggest shift? Crypto is no longer seen as a threat to financial systems. The Bank for International Settlements says well-designed regulation could reduce systemic risk by 47% while keeping 89% of crypto’s innovation. That’s a huge change from 2020, when regulators feared crypto would collapse the banking system.

What does this mean for you? If you’re a user, you’ll see fewer scams, more trusted platforms, and clearer rules. If you’re a business, compliance will still be hard-but it’ll be predictable. And if you’re watching from the sidelines? The Wild West is over. Crypto is becoming part of the financial system. The question isn’t whether it’s regulated anymore. It’s whether you’re ready for it.

CHISOM UCHE

January 15, 2026 AT 20:54Let’s unpack the MiCA framework’s structural implications: the 100% reserve mandate isn’t just about solvency-it’s a systemic risk mitigation layer that redefines trust architecture in DeFi. The PCAOB audit requirement for stablecoin issuers introduces a regulatory feedback loop that mirrors traditional banking oversight, but with blockchain transparency baked in. This isn’t regulation as constraint-it’s infrastructure standardization for institutional adoption. The real innovation? The legal clarity around decentralized networks under the CLARITY Act. Once you codify decentralization thresholds, you’re not regulating tokens-you’re regulating governance models. That’s a paradigm shift.

Sarah Baker

January 17, 2026 AT 20:44This is the moment crypto finally grows up. 🥹 After years of chaos, we’re seeing real rules that protect people-not just corporations. The fact that USDC and EURC are now trusted by Goldman Sachs? That’s not luck. That’s integrity. If you’re still scared of crypto, ask yourself: are you scared of the tech… or scared of change? It’s time to get on board. We’re not just surviving the transition-we’re leading it.

Pramod Sharma

January 18, 2026 AT 00:20Regulation is just control with a better PR team.

Christina Shrader

January 18, 2026 AT 20:57It’s quiet, but monumental. The shift from ‘Is this legal?’ to ‘How do we scale this responsibly?’-that’s the real win. No fireworks, no hype. Just steady, thoughtful progress. That’s how systems heal.

Andre Suico

January 19, 2026 AT 11:10While the EU’s MiCA framework provides a robust regulatory baseline, the U.S. approach-fragmented yet evolving-demonstrates a dynamic tension between innovation and oversight. The CLARITY Act’s criteria for decentralization are empirically sound, yet implementation will require significant coordination between federal agencies. Notably, the Anti-CBDC Surveillance State Act reflects a constitutional safeguard rarely seen in digital currency policy. This is not merely regulatory evolution-it is institutional recalibration.

Bill Sloan

January 20, 2026 AT 17:17YESSSS this is what I’ve been waiting for!! 🚀 The SEC finally getting it? The FSB pushing global standards? I’m not crying, you’re crying. Crypto went from ‘get rich or get scammed’ to ‘here’s your FDIC-level safety with blockchain speed.’ I just bought my first stablecoin-backed bond. 2026 is the year crypto stops being a gamble and starts being a tool. Let’s go!!

ASHISH SINGH

January 22, 2026 AT 07:37100% reserves my ass. The Fed’s got a backdoor. MiCA? A psyop to get you to trust the system even harder. They let stablecoins live so they can track every damn transaction under the guise of ‘consumer protection.’ And don’t get me started on the CLARITY Act-1000 validators? That’s just a fancy way of saying ‘only the rich can run nodes.’ This isn’t freedom. It’s velvet prison. They’re not regulating crypto-they’re domesticating it. And we’re clapping like trained dogs.

Callan Burdett

January 22, 2026 AT 21:12Man, I used to think crypto was wild. Now I see it’s just Wall Street with better graphics. But hey-if it’s safer and I can use it to pay for coffee without my bank freezing my account? I’ll take it. Still weird to think my crypto wallet is now more regulated than my local credit union.

Anthony Ventresque

January 24, 2026 AT 08:39I’ve been holding BTC since 2019. The fact that we’re even having this conversation-about legal clarity, institutional trust, and global standards-feels surreal. It’s like watching your rebellious kid grow up and get hired by the company they used to protest against. Not perfect, but… it’s working. I’m proud.

Nishakar Rath

January 24, 2026 AT 19:43Who cares about MiCA or the CLARITY Act? The real story is the 23 stablecoin projects that died because they couldn’t afford $100 million. That’s not regulation-that’s corporate consolidation. The FSB wants 100% reserves? Great. Now only 3 companies control 90% of the market. And you call that progress? This isn’t innovation. It’s a monopoly in a suit

Jason Zhang

January 26, 2026 AT 00:16Okay but… the fact that the SEC just admitted most tokens aren’t securities? That’s like the Pope saying atheism is fine. The entire legal house of cards just collapsed and nobody noticed. We’ve been fighting the wrong enemy this whole time. The regulators didn’t catch up-they surrendered.

Katherine Melgarejo

January 27, 2026 AT 20:17So… we’re all just waiting for the government to give us a gold star for not being criminals anymore? Cute.

Patricia Chakeres

January 28, 2026 AT 04:12Of course they’re pushing 100% reserves. It’s not about safety-it’s about control. The moment stablecoins become as safe as bank deposits, the Fed will quietly launch its own CBDC and call it ‘the upgraded version.’ This isn’t progress. It’s a Trojan horse wrapped in compliance paperwork. And you’re all applauding.

Anna Gringhuis

January 28, 2026 AT 09:59Let’s be real: the real winners here aren’t the big players-they’re the users in Nigeria and Argentina who finally have a chance to access real financial tools. For too long, we treated crypto as a speculative asset. Now it’s becoming a lifeline. That’s what matters. The rest is just paperwork.

Michael Jones

January 29, 2026 AT 10:17Well-structured analysis. The harmonization of regulatory frameworks across jurisdictions-particularly the alignment of reserve requirements and audit standards-is a critical milestone in the maturation of digital asset markets. The reduction in legal ambiguity will likely catalyze further innovation in tokenized securities and cross-border DeFi protocols.

Lauren Bontje

January 30, 2026 AT 03:33Why are we letting Europe dictate crypto rules? MiCA is a socialist fantasy wrapped in blockchain jargon. The U.S. should’ve banned this nonsense outright. Now we’re just importing EU bureaucracy and calling it ‘progress.’ Meanwhile, real Americans are getting crushed by compliance costs while the EU gets to bank on our innovation. This isn’t regulation-it’s surrender.