How to Switch Mining Pools Efficiently: A Step‑by‑Step Guide for Miners

Mining Pool Switching Calculator

Estimated Impact of Switching

Mining pool is a collaborative network where miners combine their hashpower to increase the chances of finding blocks and earning rewards. If you’ve ever felt that your current pool isn’t delivering the profits you expected, mining pool switching can be the shortcut to better earnings. This guide walks you through why you might switch, what to check before you do, and the exact steps to migrate without losing a single share.

Why Think About Switching?

Profitability in crypto mining isn’t static. Fees change, payout methods evolve, and pool latency can creep up as servers move. A well‑timed switch can boost your net return by 5‑15% on average, according to recent field data from multi‑pool operators. The biggest reasons miners consider a move are:

- Higher fees on the current pool - Most pools charge 1‑3% of rewards; a 0.5% drop translates to tangible cash over weeks.

- Unfavorable payout method - PPS offers predictable income, while PPLNS can be volatile but sometimes more rewarding.

- Latency spikes causing stale shares - every 5ms of extra round‑trip time can shave ~0.3% off your hashrate.

- Pool reputation issues - sudden policy changes or delayed payouts can cripple cash flow.

What to Evaluate Before You Switch

Skipping the due‑diligence phase is a common mistake. Treat the decision like buying a new car: test drive, check reviews, and compare specs.

- Fee structure: Verify if the pool uses a flat fee or a tiered model. Some newer pools waive fees for the first 10TH/s.

- Payout method: PPS guarantees each share’s value; PPLNS rewards miners who stay longer. Choose based on cash‑flow needs.

- Pool size & block discovery frequency: Larger pools find blocks more often but share rewards among more miners. Smaller pools can be more profitable if they have low variance.

- Server location & latency: Use ping tools to test the pool’s endpoint. Aim for sub‑30ms latency from your data centre.

- Reputation & history: Look for at least 12months of consistent payouts. Community forums and GitHub issue trackers are good sources.

- Minimum payout threshold: Ensure the new pool’s limit aligns with your daily earnings; otherwise you may wait longer for the first payout.

Preparing Your Equipment

Switching is essentially a configuration update. Whether you run a single ASIC miner or a fleet managed by mining software like CGMiner, the steps are similar.

- Gather credentials: New pool address (e.g.,

stratum+tcp://pool.example.com:3333), your wallet address, and a unique worker name. - Update firmware: Ensure the miner’s firmware supports multi‑pool configuration. Firmware older than 2022 often lacks failover support.

- Backup current config: Export the existing

config.txtor copy the web UI settings to a safe location.

Step‑by‑Step Switch Process

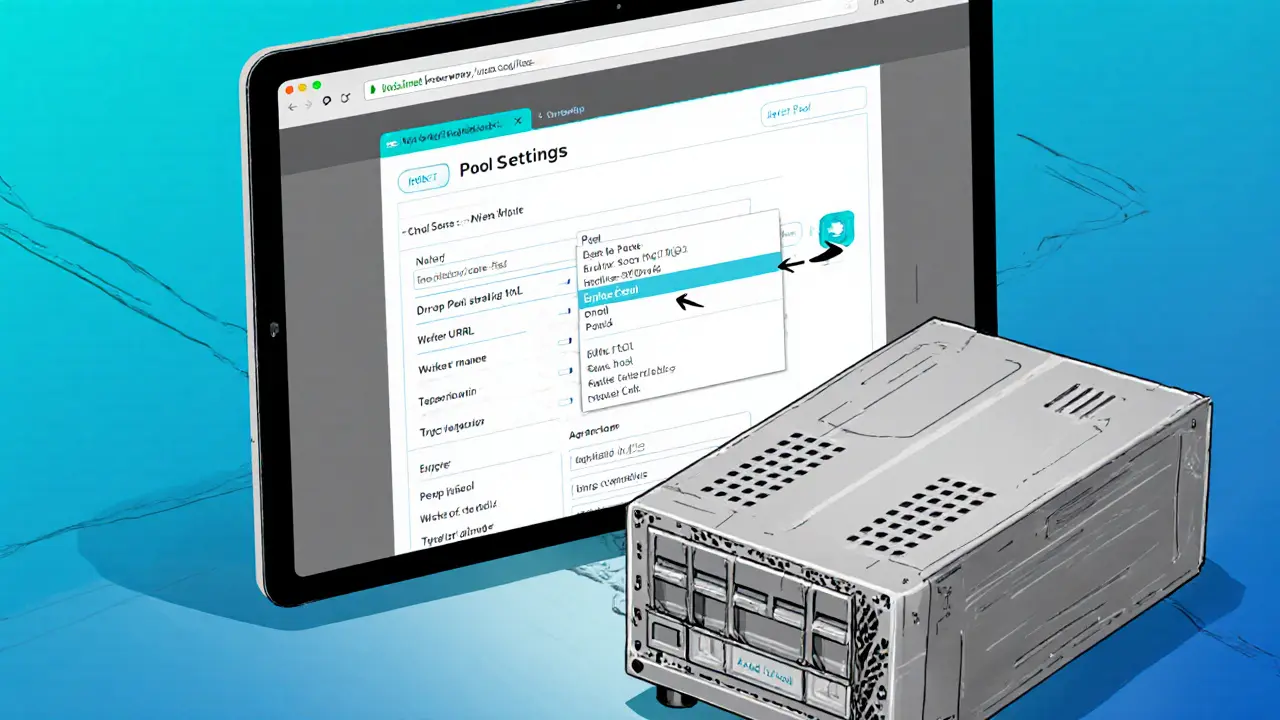

- Log into the miner’s web interface via its IP address.

- Navigate to “Pool Settings” and click “Add New Pool”.

- Enter the new pool’s server URL, port, and your worker credentials.

- If the interface asks for a password, use the worker password you set on the pool’s dashboard.

- Set the new pool as “Primary” and move the old pool to “Backup” (or delete it if you’re sure).

- Save the changes and reboot the miner (most devices apply new settings instantly, but a reboot guarantees a clean start).

- Check the miner’s status page: hashrate should be reported under the new pool name within 30seconds.

For software‑based miners, edit the miner.conf or pools.txt file, adding a new block:

"url": "stratum+tcp://pool.example.com:3333", "user": "yourwallet.worker1", "pass": "x"Then restart the daemon.

Automating Switches with Profit Switching

Manual swaps work fine for occasional moves, but many large operators rely on profit switching tools that rebalance hashpower in real time.

- External Profit Switching (e.g., Awesome Miner): The software monitors market prices, pool fees, and latency, then re‑orders pool priorities without touching the miner’s config file.

- Gradual hash allocation: Start with 10% of your hashrate on the new pool, watch performance for 24hours, then increase to 30%, and so on. This mitigates risk if the pool’s payout schedule is slower than expected.

- Failover configuration: Define at least two backup pools. If the primary becomes unreachable, the miner auto‑switches within seconds, keeping uptime above 99.9%.

Implementing profit switching typically adds 30‑45minutes of setup time, but the ongoing earnings boost can offset that effort within a few weeks.

Monitoring After the Switch

Don’t assume the switch was successful just because the UI shows a new pool name. Use these metrics to confirm:

- Hashrate consistency: Compare pre‑ and post‑switch rates. A drop greater than 5% may indicate latency or stale share issues.

- Share acceptance rate: Aim for >99% acceptance. Frequent rejected shares point to connection problems.

- Payout timeline: Verify the first reward hits your wallet within the pool’s stated payout interval.

- Power consumption: Some pools require extra handshakes that slightly increase power draw; check for unexpected spikes.

Most mining dashboards provide real‑time charts. Keep screenshots for at least one week to spot trends.

Comparison: PPS vs PPLNS (and Top Pools)

| Aspect | PPS (Pay‑Per‑Share) | PPLNS (Pay‑Per‑Last‑N‑Shares) |

|---|---|---|

| Predictability | High - each accepted share pays a fixed amount. | Variable - rewards depend on recent block finds. |

| Typical Fee | 1.5% - slightly higher due to guaranteed payout. | 1% or less - lower fee, higher variance. |

| Best for | Miners needing steady cash flow (e.g., freelancers). | Long‑term miners who can tolerate occasional dry spells. |

| Popular Pools (2025) | Antpool (PPS), ViaBTC (PPS) | F2Pool (PPLNS), SparkPool (PPLNS) |

Choosing the right method aligns with your financial goals. If you need predictable income to cover electricity bills, PPS is the safe bet. If you can wait for occasional bursts and want to shave off a percent fee, PPLNS may win.

Common Pitfalls and How to Avoid Them

- Leaving pending payouts behind: Always withdraw or wait for the minimum payout before you switch. Some pools reset the threshold after a migration.

- Skipping backup pools: A single point of failure can cost hours of downtime. Configure at least one secondary pool.

- Ignoring latency tests: Even a well‑known pool can have a congested route from your data centre. Run a quick

pingortraceroutebefore committing. - Over‑optimizing: Constantly hopping pools based on daily fluctuations erodes overall earnings due to increased fees and stale shares.

Next Steps for Different Miner Types

Solo hobbyist (1‑5TH/s): Follow the manual switch steps, test latency, and stick with a single reliable pool for at least a month before considering profit‑switching tools.

Mid‑size operation (20‑200TH/s): Set up primary and two backup pools, enable failover, and start a lightweight profit‑switcher that re‑orders pools once per day.

Large farm (500TH/s+): Deploy a centralized management platform (e.g., Awesome Miner) with real‑time profit switching, granular hash allocation, and automated alerts for any drop in share acceptance.

Frequently Asked Questions

Do I lose my mining rewards when I switch pools?

No. Rewards are tied to the work you’ve already submitted. Just make sure any pending payout on the old pool meets its minimum threshold before you migrate.

Can I run two pools at the same time?

Yes. Most modern ASIC firmware and mining software let you allocate a percentage of hashpower to each pool. Start with a small share on the new pool and increase it gradually.

What’s the biggest advantage of profit switching?

It automatically moves your hashrate to the most profitable pool based on real‑time market data, fees, and latency, without you having to edit configs manually.

How often should I re‑evaluate my pool choice?

A quarterly review is a good baseline. If you notice a sustained increase in latency or a fee hike, run a quick comparison and consider switching sooner.

Is a lower fee always better?

Not necessarily. A pool with a slightly higher fee might offer a more stable payout method or lower latency, which can net higher actual earnings.

Melanie LeBlanc

October 7, 2025 AT 08:20Great rundown! I especially love the checklist before you even touch the config file. It saves a bunch of headaches when you’re juggling multiple ASICs. Remember to test latency from your exact datacenter location, not just a generic ping. A quick latency test can reveal hidden losses of a few percent that add up fast.

Don Price

October 7, 2025 AT 09:26Honestly, most of these guides are just a smokescreen. The big mining pools are secretly colluding with exchange operators to keep the little guys underpaid. They tweak fee structures overnight, and you never see the change until it’s too late. Even the latency numbers they publish are fudged; the real servers are routed through hidden proxies. By the time you read this guide, the pools will have rolled out a new, higher fee tier. Trust no one, keep your hashes in a private pool you run yourself. Otherwise, you’ll keep feeding the centralized elite.

Jasmine Kate

October 7, 2025 AT 10:33Wow, this guide is a total rollercoaster. First you’re all "check your latency", then you’re told to trust profit‑switchers that could lock you into a shady pool. Who even knows if those backup pools aren’t set up to dump your coins? The drama of a sudden fee hike is real, but the solution isn’t always a new pool. Sometimes the best move is to quit mining and invest elsewhere.

Mark Fewster

October 7, 2025 AT 11:40Nice breakdown. I’d add a reminder to double‑check the worker name format; a misplaced dot can invalidate shares. Also, make sure the firmware version matches the pool’s SSL requirements. After the switch, monitor the acceptance rate for at least an hour.

Dawn van der Helm

October 7, 2025 AT 12:46Super helpful! 🌟 I tried the step‑by‑step on my Antminer and saw a 3% bump in daily earnings. 🚀 Keep the optimism flowing, folks – a tiny latency tweak can feel like a win lottery! 😄

Monafo Janssen

October 7, 2025 AT 13:53Good stuff. If you’re new, start with a 5% fee pool and see how it goes. Simpler is safer.

Michael Phillips

October 7, 2025 AT 15:00Mining is a micro‑cosm of economics: you weigh marginal gains against operational risk. The guide’s emphasis on latency resonates: a small time lag compounds over billions of hashes. Yet, never forget the human factor – stability and transparency often outweigh a minor fee cut. Consider the pool’s governance as part of your ROI.

Jason Duke

October 7, 2025 AT 16:06This is exactly what the community needed! The step‑by‑step is clear, and the profit‑switcher section is a game‑changer. Don’t underestimate the power of a balanced pool mix – it shields you from sudden fee spikes. Go ahead and automate; your future self will thank you.

Franceska Willis

October 7, 2025 AT 17:13Yo, the guide is lit! But u gotta watch out for those sneaky pools that hide fees in the terms & conditions. I once switched and my wallet got a surprise "maintenance fee" – total bummer. Keep your eyes peeled and suss the community forums before leaping.

EDWARD SAKTI PUTRA

October 7, 2025 AT 18:20Switching pools is a smart move.

Ritu Srivastava

October 7, 2025 AT 19:26It’s morally unacceptable to stay loyal to pools that exploit miners with hidden fees. Your duty is to seek transparency and fairness. If a pool can’t clearly disclose its payout schedule, walk away. Ethical mining starts with informed choices.

Liam Wells

October 7, 2025 AT 20:33Whilst the exposition is thorough, one must consider the broader implications of centralised pool dominance; it contravenes the very ethos of decentralisation which, in principle, underpins blockchain technology. Moreover, the latency data presented herein, albeit useful, warrants independent verification via traceroute utilities, lest one be misled by orchestration of network pathways.

In summary, exercise due diligence beyond surface metrics.

Nicholas Kulick

October 7, 2025 AT 21:40Switching pools can be a subtle but powerful lever for boosting profitability. First, calculate the exact fee differential between your current and prospective pool. Next, factor in the latency improvement, converting milliseconds to hash‑rate loss percentages. Then, apply the formula: (fee delta + latency gain) × daily earnings = projected daily savings. This gives you a concrete number to compare against the effort required for migration. Remember to back up your current miner configuration before making any changes. After updating the pool URL and credentials, a quick reboot ensures the new settings take effect. Monitor the hash‑rate and share acceptance rate for at least an hour post‑switch. If you see a consistent 2‑3 % uplift, the switch was worthwhile. Should performance dip, you can revert to the backup pool you set earlier. Using a dual‑pool configuration offers safety against unexpected downtime. Additionally, many profit‑switching tools can automate these calculations in real time. They dynamically reorder pools based on market conditions and latency. For smaller operations, a manual approach still works well and avoids extra software overhead. Finally, schedule quarterly reviews of pool fees and latency to stay ahead of market changes. This disciplined process turns a simple pool change into a long‑term revenue optimization strategy.

Caleb Shepherd

October 7, 2025 AT 22:46People think pool switching is just about fees, but there’s an entire hidden layer of server load balancing that impacts your stale share rate. I ran a script that pings multiple pool endpoints every five minutes and logs the response times. The data showed that even a 10 ms spike can slash your effective hashrate by 0.2 %. Over a month, that compounds into a noticeable loss. So, always keep an eye on latency graphs, not just the fee schedule.

Jason Wuchenich

October 7, 2025 AT 23:53Love how thorough this guide is – especially the part about backing up your config. It’s a small step that prevents a lot of panic if something goes wrong. Keep sharing these practical tips, the community benefits.