How Underground Crypto Trading Survives Under the Taliban’s Crypto Ban

Afghanistan Crypto Remittance Calculator

Enter a USD amount to see how it compares between crypto and traditional remittance methods.

When the Taliban took control of Afghanistan in August 2021, the country’s financial system went into free‑fall. Underground cryptocurrency trading in Afghanistan is the clandestine network of peer‑to‑peer crypto exchanges that operate despite the Taliban’s blanket prohibition. The result? A shadow market that now fuels everything from daily groceries to cross‑border business, all while staying under the radar of a regime that calls digital money "haram".

- Crypto became a lifeline after international sanctions froze traditional banking channels.

- The Taliban’s religious ban in August 2022 pushed traders underground but didn’t erase demand.

- Bitcoin and USDT dominate because they are easy to send and receive across borders.

- Local apps like HesabPay built a user base of hundreds of thousands before being shut down.

- Internet blackouts and arrests make the trade risky, yet innovation continues with offline mesh networks.

Why the Taliban Banned Crypto

The Taliban’s leadership bases its rulings on a strict interpretation of Sharia law. In their view, cryptocurrencies lack a tangible asset backing and resemble gambling - both prohibited under Islamic principles. In August 2022 the regime issued a formal decree labeling all crypto activity “haram,” revoking any exchange licenses and ordering an immediate shutdown of mining operations. The decree was framed as protecting the Afghan people from speculative loss, but it also removed a critical avenue for foreign money to enter the country.

The Collapse of Traditional Finance

Before the takeover, Afghanistan’s banking sector already struggled with corruption and limited reach. After the Taliban seized power, international sanctions froze the nation’s foreign reserves, and many banks either closed or stopped processing foreign transfers. For ordinary Afghans, the loss of a reliable banking system meant that salaries, aid payments, and remittances - which previously flowed through SWIFT or informal dollar houses - vanished overnight.

In that vacuum, digital assets filled the gap. A United Nations report from early 2022 warned that up to 97 % of the population could fall below the poverty line. Families that relied on migrant relatives for cash began to ask: how can we receive money if the banks are dead?

How the Underground Market Took Shape

Within weeks of the financial collapse, Afghans turned to peer‑to‑peer (P2P) platforms that matched buyers and sellers over messaging apps. Because the blockchain itself is public, the real challenge for the Taliban is tracking who is sending what, not the existence of the transactions. Traders adapted by using encrypted chats, disposable phone numbers, and even offline “cash‑out” points where a local dealer would exchange Bitcoin for Afghanis.

Two cryptocurrencies dominate the scene:

- Bitcoin - the original store of value, widely accepted for larger transfers and as a hedge against local inflation.

- USDT (Tether) - a stablecoin pegged to the U.S. dollar, favored for everyday purchases because its price rarely swings.

Local Platforms and Their Rise‑Fall

Before the ban, a home‑grown app called HesabPay gained traction by allowing users to link a mobile number to a crypto wallet. In its first three months, the service attracted over 380,000 users, many of whom were diaspora Afghans sending money home. HesabPay built a network of “agents” who could cash out crypto at market rates, effectively creating a physical layer on top of the blockchain.

When the Taliban ordered the shutdown in August 2022, HesabPay’s servers were taken offline, but the agent network survived. Traders simply migrated to encrypted Telegram groups, Signal chats, and even older SMS‑based systems. The lesson is clear: the technology can be killed, but the human infrastructure keeps moving.

Enforcement Tactics and Their Limits

The regime has tried a handful of methods to clamp down on crypto:

- Arrests of known exchange operators - documented as early as August 2022.

- Revoking any remaining exchange licenses - effectively making legal crypto businesses impossible.

- Internet blackouts - in September 2024 the Taliban ordered a near‑nationwide shutdown in five northern provinces, reducing connectivity to less than 1 % of normal levels.

- Targeted raids on “forex dealers” who were suspected of facilitating crypto‑to‑cash conversions.

Despite these moves, the decentralized nature of blockchains makes total eradication nearly impossible. Only a fraction of the network is online at any given time, and many traders operate offline, using QR codes printed on paper or memorized wallet addresses.

Economic and Humanitarian Impact

For a country where traditional remittance channels are blocked, crypto has become a lifeline. After the Taliban’s takeover, crypto inflows surged by roughly 80 % within the first month. Families receiving Bitcoin or USDT from relatives in Europe, the Gulf, or North America can instantly convert the assets into local cash via trusted agents.

Beyond individual households, whole micro‑businesses rely on digital payments to buy inventory from Pakistani suppliers in Peshawar. Traders report that without crypto, they would have to resort to costly physical smuggling of cash, which increases security risks and reduces profit margins.

Humanitarian NGOs have taken note. In 2023, the UN World Food Programme began experimental pilots that accepted USDT donations to fund food packages in Kabul’s outskirts. While the pilots remain small, they showcase how crypto can bypass the Taliban’s banking restrictions and deliver aid directly.

Adaptations: Offline Networks and Mesh Solutions

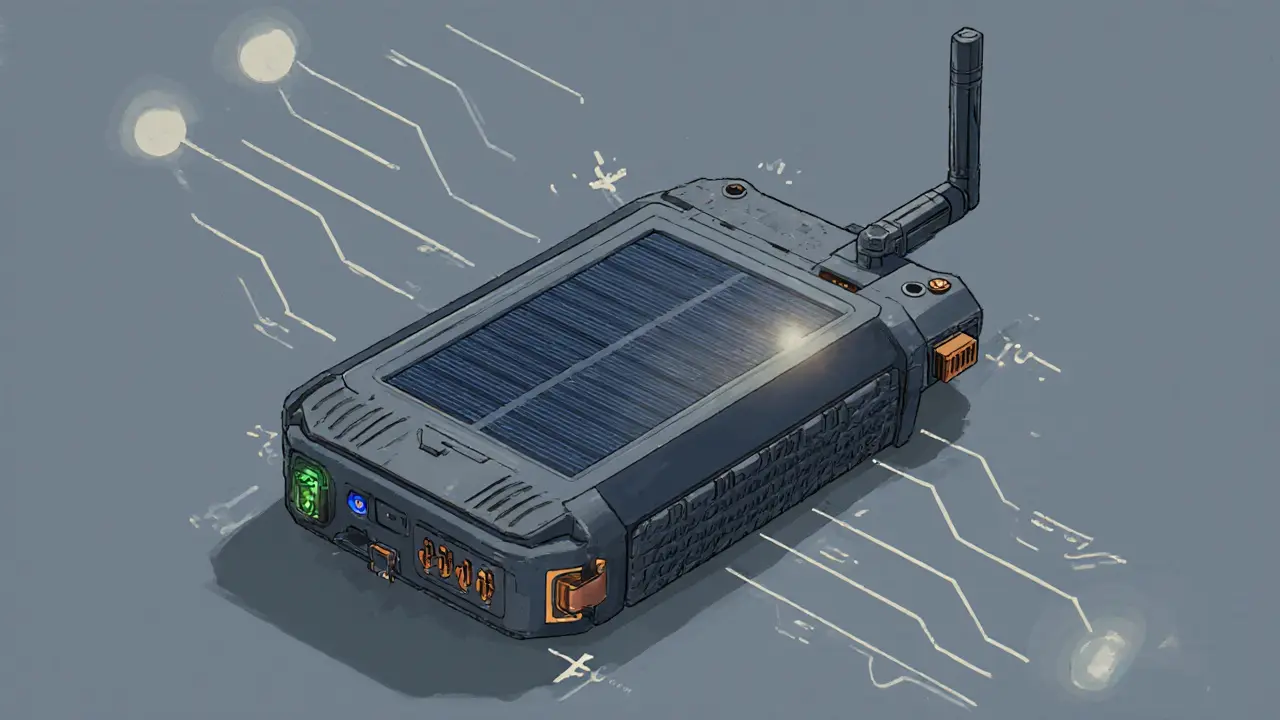

When the internet is cut, traders have turned to mesh networking - a system where smartphones connect directly to each other, forming a local “intrAnet.” These networks let users broadcast wallet addresses and transaction hashes without ever touching the global internet.

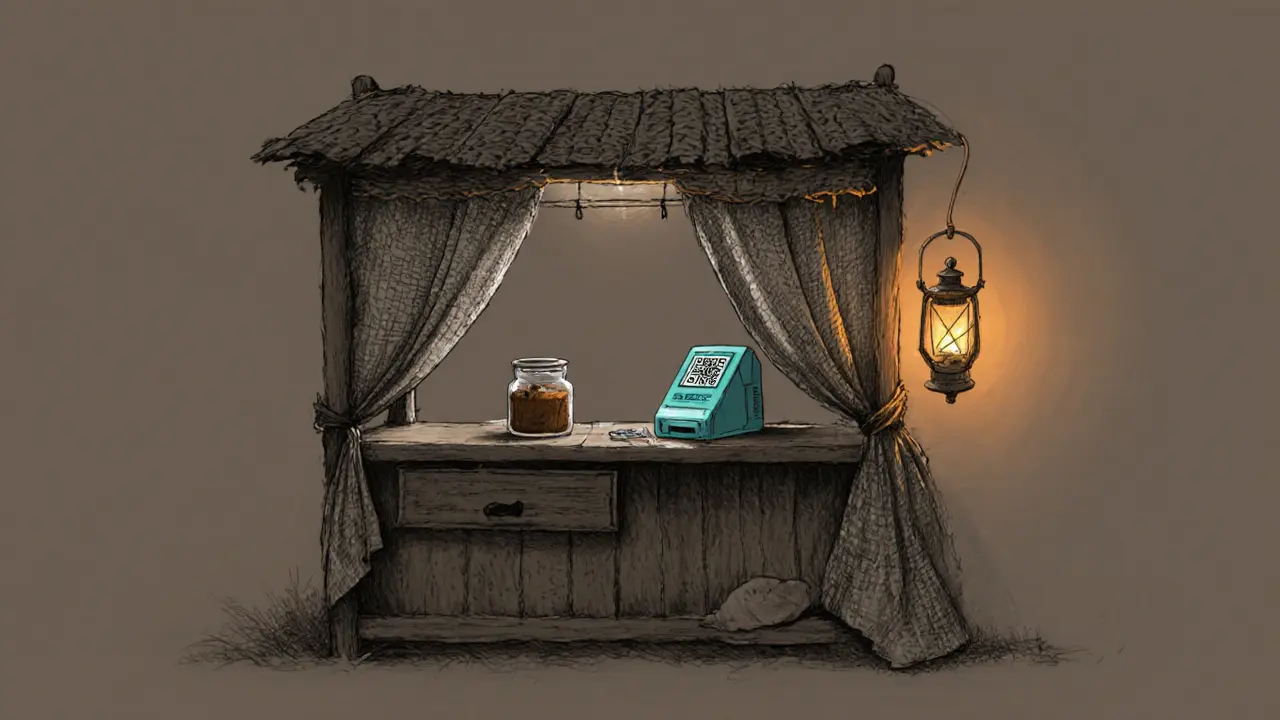

Another adaptation is the rise of “cash‑in” kiosks hidden inside legitimate businesses - barber shops, tea houses, or market stalls. A customer hands over a QR code for a Bitcoin address; the kiosk operator confirms receipt on a hidden device and hands over Afghanis the next day.

These workarounds keep the market fluid, but they also increase the risk of fraud. Without a regulated exchange, traders must rely on personal reputation, community vetting, and sometimes a small escrow fee paid to a trusted third party.

Future Outlook: Risks and Opportunities

Looking ahead, several factors will shape the underground crypto scene:

- International pressure. If sanctions ease and foreign banks reopen, the incentive to operate underground could shrink. Conversely, harsher sanctions may push more users toward crypto.

- Technological upgrades. Wider 4G/5G rollout (if allowed) would boost transaction speed, but the Taliban may deliberately stall such upgrades.

- Legal crackdowns. The Taliban has shown it can order province‑wide internet blackouts. A future nationwide shutdown could force the market entirely offline, accelerating mesh‑network adoption.

- Community resilience. Afghan diaspora groups have already set up support channels on platforms like Reddit and Discord, offering tutorials on wallet security and best practices for staying anonymous.

What’s clear is that the Taliban crypto ban has not eliminated demand. As long as Afghan families need money from abroad and the banking system stays crippled, digital assets will remain a crucial, albeit risky, conduit.

Quick Takeaways

- The Taliban’s religious ban in 2022 forced crypto trading underground, but the market rebounded quickly.

- Bitcoin and USDT are the primary coins because they’re easy to send and relatively stable.

- Local apps like HesabPay built a massive agent network that survived the crackdown.

- Internet blackouts and arrests limit visibility but cannot fully stop decentralized trades.

- Crypto now underpins remittances, cross‑border commerce, and some humanitarian aid.

Frequently Asked Questions

Is cryptocurrency really illegal in Afghanistan?

Yes. Since August 2022 the Taliban has declared all crypto trading, mining, and usage "haram" and banned it under national law. However, enforcement is uneven, and many people continue to trade peer‑to‑peer in secret.

Which cryptocurrencies are most common in the underground market?

Bitcoin and USDT (Tether) dominate. Bitcoin is used for larger, long‑term value storage, while USDT is preferred for day‑to‑day purchases because its price tracks the U.S. dollar closely.

How do Afghans actually trade crypto without internet?

Many rely on mesh networks, SMS‑based wallets, or in‑person cash‑out kiosks hidden in regular shops. Traders also use encrypted messaging apps that can function on low‑bandwidth connections.

Can foreign donors send money to Afghanistan via crypto?

Yes. NGOs and diaspora families commonly send Bitcoin or USDT from abroad, which can then be exchanged for local currency through trusted agents. The method bypasses frozen banks and sanctions.

What are the biggest risks for someone trading crypto underground?

Risks include arrest, loss of funds through fraud, and sudden internet blackouts that cut off access to wallets. Using reputable agents, keeping private keys offline, and employing multi‑signature wallets can mitigate some of these dangers.

Natasha Nelson

October 24, 2025 AT 08:27Wow, the ingenuity of those Afghan traders is just mind‑blowing!!! Even under a total ban they’ve built a whole hidden economy that keeps families fed and businesses running!!! 🌟

Sarah Hannay

November 4, 2025 AT 21:13While admiration is natural, it is essential to acknowledge that such clandestine activity directly contravenes national law and carries severe penalties; therefore, any endorsement must be tempered with caution.

Richard Williams

November 16, 2025 AT 11:00Everyone needs a quick reminder: if you’re thinking about supporting friends in Afghanistan, crypto can be a lifeline-but only when you choose reputable agents and protect your keys.

Abby Gonzales Hoffman

November 28, 2025 AT 00:47The underground crypto scene in Afghanistan has become a sophisticated ecosystem that rivals traditional finance in many respects. Traders have organized around trusted community hubs, often hidden in ordinary storefronts such as barbershops or tea houses. Each hub maintains a printed ledger of wallet addresses, allowing clients to deposit Bitcoin or USDT without ever touching the internet. Because the blockchain is public, the real challenge lies in obscuring the identity of the parties involved, which is why encrypted messaging apps are the preferred communication channel. Mesh networks have emerged as a resilient fallback, enabling phones to relay transaction hashes directly between devices. Offline QR codes can be generated on paper, scanned later when a connection is available, and then settled in cash the next day. The agent model works on reputation; a newcomer is usually introduced by a known associate who vouches for their reliability. Some agents even charge a modest escrow fee to hold funds temporarily while the buyer confirms receipt. Humanitarian groups have begun leveraging this structure, using stablecoins like USDT to fund food parcels without bureaucratic delays. The risk of fraud remains high, but the community mitigates it through peer verification and shared social proof. Moreover, diaspora networks in Europe and the Gulf act as bridges, funneling remittances through trusted contacts abroad. The Taliban’s periodic internet blackouts have only accelerated the adoption of these low‑tech solutions. As a result, the market’s liquidity has proven remarkably resilient despite governmental crackdowns. Ultimately, the survival of this system underscores the deep need for financial inclusion in a country where conventional banks are essentially non‑existent. It also highlights the adaptability of decentralized technology when faced with authoritarian resistance.

Rampraveen Rani

December 9, 2025 AT 14:33Crypto stays alive 😎

ashish ramani

December 21, 2025 AT 04:20It is noteworthy that the persistence of such networks illustrates the limitations of regulatory enforcement in the digital age.

Gabrielle Loeser

January 1, 2026 AT 18:07In guiding newcomers, it is crucial to stress the importance of cold‑storage solutions and multi‑signature wallets to safeguard assets against both state actors and local scammers.

Cyndy Mcquiston

January 13, 2026 AT 07:53We don’t need fancy talk.

Stephanie Alya

January 24, 2026 AT 21:40Oh great, another “miracle” that crypto will magically solve poverty while the Taliban pretends it doesn’t exist 😂. Sure, just hand over your private keys to a stranger in a barber shop and expect a stable income. The reality is far messier, but hey, at least it’s more exciting than waiting in line at a frozen bank.