OFAC Cryptocurrency Sanctions: Compliance Guide 2025

OFAC Crypto Compliance Risk Assessment

This tool estimates your organization's risk of OFAC sanctions violations based on key factors from the 2025 compliance framework. Input your business details to receive a risk score and tailored recommendations.

Key Takeaways

- OFAC applies strict‑liability sanctions to any crypto activity involving U.S. persons or the U.S. financial system.

- Compliance requires real‑time wallet screening, blocked‑asset handling, and regular reporting.

- Recent cases (ShapeShift, Garantex) illustrate the cost of weak geolocation and monitoring controls.

- Effective programs combine onboarding checks, transaction monitoring, and periodic audits.

- Compare OFAC’s approach with FATF, EU, and UK regimes to spot gaps in your own controls.

What OFAC Does for Crypto

When the U.S. Treasury’s Office of Foreign Assets Control (OFAC) administers and enforces economic and trade sanctions targeting individuals, entities, and digital assets decided in 2018 to extend its reach to blockchain addresses, the landscape changed overnight. The October 2021 Sanctions Compliance Guidance for the Virtual Currency Industry made it crystal clear: any transaction that touches a U.S. person, a U.S.‑incorporated entity, or a U.S.‑based service provider must obey the same rules that apply to traditional banking.

In plain English, if you run an exchange, a wallet app, or a DeFi interface and any of your users are located in the United States-or you process payments through a U.S. bank-OFAC’s sanctions apply to every crypto move, no matter the amount.

Core Compliance Obligations

OFAC’s framework rests on five pillars that appear in FAQ646 and the 2021 guidance:

- Management Commitment: Board‑level oversight with written policies.

- Risk Assessment: Quarterly analysis of crypto‑specific sanction exposure.

- Internal Controls: Automated screening of wallets, on‑chain addresses, and counterparties.

- Testing & Auditing: Independent verification at least once a year.

- Training: Mandatory courses for all staff handling crypto transactions, aiming for 92% completion rates.

The most important keyword you’ll hear in every policy is "OFAC cryptocurrency sanctions". It signals that the compliance program must treat digital assets with the same legal weight as fiat.

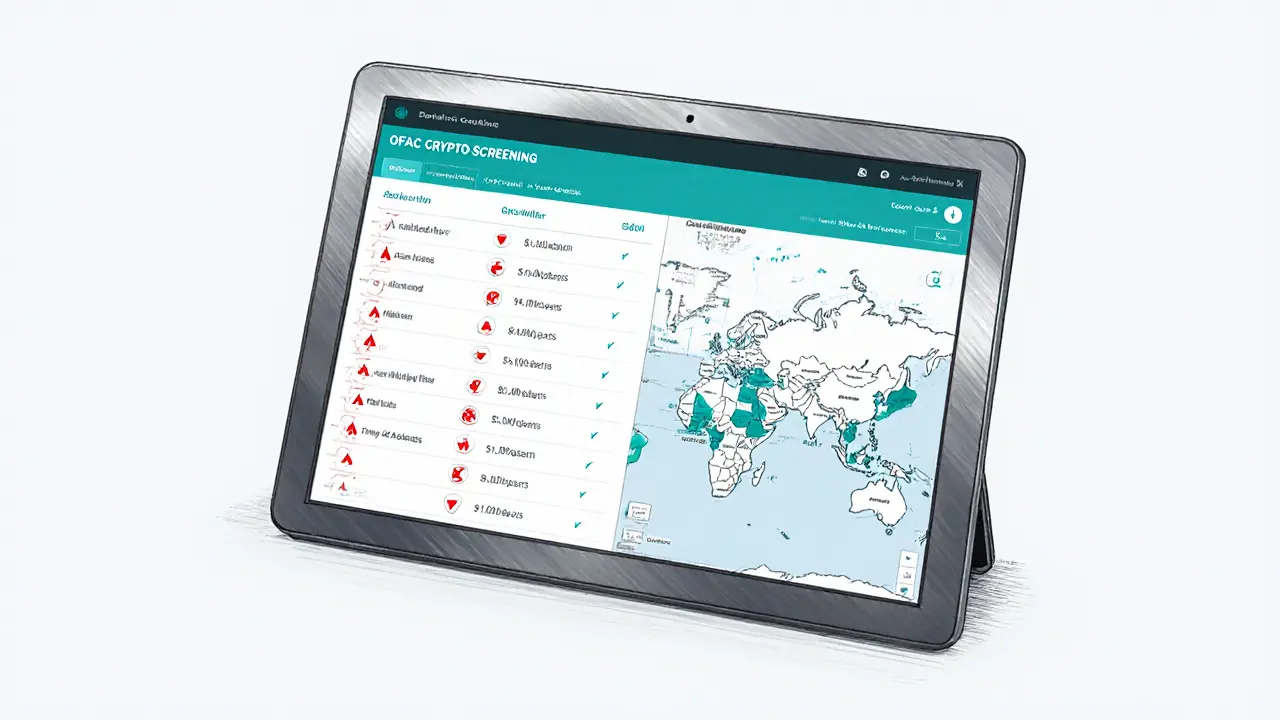

Technical Controls: From Wallet Blocking to Real‑Time Screening

OFAC gives two options for handling a blocked wallet:

- Block each address individually, tagging it as a Blocked SDN Digital Currency wallet.

- Consolidate all blocked assets into a single designated wallet (the same concept, but easier to audit).

Both routes demand that the assets stay frozen until OFAC lifts the restriction. Importantly, holders are not forced to convert the crypto into fiat; the digital form remains blocked.

To meet the real‑time requirement, most firms integrate blockchain‑analytics platforms. The market leaders in 2025-Chainalysis, Elliptic, and TRM Labs-offer APIs that pull the latest SDN address list (1,247 crypto‑related entries as of October142025) and apply custom risk rules.

Typical integration steps:

- Connect the analytics API to your transaction processing pipeline.

- Map incoming wallet hashes against the SDN address database.

- For a match, automatically route the transaction to a blocked‑wallet queue and generate an OFAC‑required report.

- Retain the blocked crypto in a “quarantine” address until a formal release notice arrives.

Because blockchain data is immutable, you can also pull historical transaction graphs to prove that a blocked address never moved funds after the sanction date-a handy defense if regulators question your controls.

Lessons from Recent Enforcement Actions

The September202025 ShapeShift settlement is a case study in “what not to do.” ShapeShift let users in Cuba, Iran, Sudan, and Syria exchange roughly $12.6million in crypto without any geolocation filter. The $750,000 penalty demonstrated that even without intent, OFAC will hit you if your platform lacks basic IP‑blocking and wallet‑screening.

Contrast that with the August142025 Garantex redesignation. The exchange processed over $100million linked to illicit activity, and OFAC not only sanctioned Garantex but also its successor, six affiliated firms, and key executives. The action showed OFAC’s willingness to apply “network sanctions” that reach beyond the primary entity.

On the success side, Kraken’s 2025 upgrade to Chainalysis Reactor cut false‑positive rates from 18% to 4.3% in six months, though the implementation cost topped $450,000. Binance’s 2025 transparency report claims 99.98% screening accuracy across 1.2million daily transactions after spending $2million on an in‑house analytics stack.

These examples teach three practical rules:

- Geolocation checks are a non‑negotiable first line of defense.

- Invest in a reputable analytics vendor and tune risk rules regularly.

- Maintain detailed audit trails; they are your best evidence in a regulator’s audit.

How OFAC Stacks Up Against Other Regimes

| Aspect | OFAC (U.S.) | FATF Travel Rule | EU 6AMLD | UK OFSI |

|---|---|---|---|---|

| Scope of transactions | All amounts involving sanctioned persons | ≥$1,000 beneficiary/originator info | Principles‑based, no amount threshold | Case‑by‑case, softer enforcement |

| Liability model | Strict liability, no reasonable‑measures defense | Strict but relies on data sharing | Mixed, allows “reasonable measures” | Mixed, limited penalties |

| Enforcement frequency (2018‑2025) | 17 crypto actions, $48.7M penalties | Global guidance, no direct fines | Few direct crypto cases | 3 actions, £2.1M penalties |

| Technical focus | Wallet address screening, blocked‑asset handling | Beneficiary/originator data exchange | Risk‑based AML, less crypto‑specific | Traditional AML, limited crypto tools |

OFAC’s advantage is clarity: the law says sanctions apply regardless of transaction size. The downside is the heavy technical burden of monitoring every blockchain address, especially for privacy coins like Monero, where false‑positive rates can climb above 15%.

Building a Practical Sanctions Compliance Program

Below is a step‑by‑step checklist that mirrors what the 2025 Steptoe & Johnson implementation study recommends. Treat each bullet as a gate you must pass before moving to the next phase.

- Kick‑off Risk Assessment - Map all crypto‑related products, identify which ones touch U.S. persons, and assign a risk rating. Expect 4-8weeks.

- Select Analytics Vendor - Compare Chainalysis, Elliptic, TRM Labs on coverage, API latency, and false‑positive handling. Budget $150k-$2M based on volume.

- Integrate Screening Engine - Embed the API into onboarding, deposit, and withdrawal flows. Run parallel tests for 6-10weeks.

- Implement Geolocation & IP Blocking - Use a reputable geolocation service to deny connections from Cuba, Iran, Sudan, Syria, and other sanctioned jurisdictions.

- Set Up Blocked‑Wallet Queues - Create a “quarantine” address labeled as a Blocked SDN Digital Currency wallet. Ensure audit logs capture timestamps and transaction hashes.

- Draft Reporting Templates - OFAC requires periodic reports (FormSF‑xxxxx). Include wallet address, crypto type, amount, and date of block.

- Run Independent Audit - Hire a third‑party firm to test controls annually. Document findings and remediate within 30days.

- Train the Team - Deliver 2‑hour modules covering sanctions basics, wallet screening, and incident response. Track completion to reach 92% compliance.

After about 22-36weeks you’ll have a program that passes a typical OFAC audit. Ongoing maintenance includes weekly SDN list updates (average 37 new crypto addresses per Q22025) and quarterly risk‑review workshops.

Future Outlook: What’s Next for Crypto Sanctions?

OFAC announced a new Digital Asset Sanctions Task Force in September2025, signaling higher enforcement bandwidth. The Treasury’s 2026 budget request adds $28million for crypto enforcement-a 40% jump.

At the protocol level, the Ethereum Foundation’s EIP‑7594 proposal aims to embed on‑chain sanction checks, but community backlash (over 1,200 comments) shows resistance to hard‑coding compliance into decentralized code.

Analysts predict that by 2027, roughly 65% of crypto transactions will undergo real‑time sanction screening, up from 38% in 2025. That shift will push smaller exchanges (under $100M daily volume) to adopt turnkey solutions or face costly penalties.

In short, the regulatory tide is rising, technology is catching up, and a solid compliance backbone will turn a potential liability into a market advantage.

Frequently Asked Questions

Do I need to comply with OFAC if my exchange only serves non‑U.S. customers?

Yes. If your platform processes transactions through a U.S. bank, uses U.S.‑based cloud services, or any of your users are U.S. persons, OFAC’s sanctions apply regardless of where the end‑users reside.

What happens to crypto assets that I block because of a sanction?

The assets must remain in a designated “blocked” wallet until OFAC issues a release. You do not have to convert them to fiat; they stay in their native crypto form but cannot be transferred or liquidated.

How often must I update the SDN address list?

Daily checks are the industry norm. In Q22025, OFAC added 37 new crypto addresses, so a weekly pull can leave you exposed. Most analytics providers push updates via API in real time.

Can privacy coins like Monero be screened for sanctions?

Screening privacy coins is challenging because transaction data is obfuscated. OFAC’s October2025 FAQ clarifies that you must apply “reasonable measures,” such as restricting their use altogether or limiting transfers to vetted counterparties.

What are the biggest penalties for violating OFAC crypto sanctions?

Penalties vary, but recent cases show fines ranging from $750,000 (ShapeShift) to multi‑million settlements (Garantex’s $100M‑scale violations). The Treasury can also freeze assets and bar individuals from the U.S. financial system.

Mandy Hawks

October 14, 2025 AT 08:23Understanding the OFAC framework is essential before building any crypto product.

Jordan Collins

October 15, 2025 AT 05:46The 2025 OFAC compliance guide lays out a clear, step‑by‑step roadmap that any crypto service can follow, starting with a thorough risk assessment of who you serve and what volumes you move. It emphasizes that the moment you touch a U.S. person or use U.S. financial infrastructure, the full weight of strict liability sanctions applies. The guide’s checklist of technical controls-IP geolocation blocking, real‑time wallet screening, and daily SDN list updates-mirrors what we saw in the ShapeShift and Garantex enforcement actions. Integrating a blockchain‑analytics provider like Chainalysis or Elliptic is no longer optional; it’s a baseline expectation for minimizing false positives while staying audit‑ready. The authors also highlight that privacy‑focused coins such as Monero demand a different risk‑tolerance approach, often requiring outright restriction to satisfy “reasonable measures.” Quarterly internal audits and a documented incident‑response plan are described as essential for proving to regulators that you’ve instituted a living compliance program. The cost figures they quote-hundreds of thousands to a few million dollars-should be weighed against the potential multi‑million penalties for non‑compliance. By treating the compliance stack as a modular architecture, firms can upgrade individual pieces (e.g., swap out an analytics vendor) without overhauling the entire system. Finally, the guide points out that OFAC is expanding its enforcement bandwidth, so staying ahead of updates is a strategic advantage rather than a mere box‑checking exercise. Overall, the document is both a technical manual and a strategic playbook for anyone serious about crypto compliance.

Andrew Mc Adam

October 16, 2025 AT 04:00I think the guide is solid but watch out for the typo in the risk calculation section – they wrote "score = 91" instead of a proper comparison. That little slip can actually cause confusion when you’re trying to interpret the risk level thresholds. Also, the flowchart they propose is a bit dramatic in its language, but the underlying steps are practical. Make sure you double‑check the API integration docs; some endpoints change without notice. Overall, good effort, just needs a bit of polish.

Marques Validus

October 17, 2025 AT 02:13Yo this guide drops mad jargon like a hot mixtape its all about geolocation filtering analytics APIs and SDN list frequency but it kinda blurs where the real pain points are especially for low‑volume startups who can’t swing a $2M analytics budget we need more bite sized options for them

Michael Bagryantsev

October 18, 2025 AT 00:26Totally hear you, Marques. For smaller projects, modular open‑source tools can fill the gap, and a community‑driven blacklist can supplement the official SDN feed. The key is to keep detailed logs so you can prove due diligence if regulators ever knock.

Jason Clark

October 18, 2025 AT 22:40Oh, great, another “must‑have” analytics platform. Because nothing says “innovation” like paying a six‑figure fee to a third party to read your blockchain data. If you’re still using a spreadsheet to track SDN updates, maybe you should consider a different line of work.

Jim Greene

October 19, 2025 AT 20:53Love how the guide breaks everything down! 👍 It makes the scary world of sanctions feel a lot more manageable. Keep up the good work! 😊

Steve Cabe

October 20, 2025 AT 19:06Frankly, if you’re not implementing daily SDN updates and geolocation blocking you’re practically inviting a fine. The U.S. isn’t going to be lenient with anyone who thinks they can skim the rules.

shirley morales

October 21, 2025 AT 17:20The guide reads like a textbook-dense and pretentious.

Millsaps Crista

October 22, 2025 AT 15:33Don’t let the dry tone scare you-this is exactly the play‑by‑play you need to stay compliant and avoid costly penalties. Let’s keep the momentum going!

Matthew Homewood

October 23, 2025 AT 13:46From a philosophical perspective, the guide forces us to confront the tension between decentralization ideals and state‑enforced compliance, reminding us that innovation cannot exist in a vacuum.

Shane Lunan

October 24, 2025 AT 12:00meh looks ok but kinda boring.

Brian Elliot

October 25, 2025 AT 10:13I appreciate the thoroughness, especially the emphasis on audit trails. Those logs will be a lifesaver if OFAC ever knocks on your door.

Della Amalya

October 26, 2025 AT 07:26This guide is a marathon, not a sprint. Every section feels like a checkpoint in a larger quest to tame the ever‑shifting regulatory beast. The authors did well to include concrete examples-like the ShapeShift settlement-that ground the theory in real‑world consequences. I especially liked the table comparing OFAC to other regimes; it gives a quick sanity check when you’re deciding which jurisdiction’s rules to prioritize. However, the narrative sometimes drifts into melodrama, making it harder to skim for the actionable bits. A tighter editorial hand could prune the excess while preserving the essential guidance.

Teagan Beck

October 27, 2025 AT 05:40Nice overview, very helpful.

Kim Evans

October 28, 2025 AT 03:53Thanks for the clear breakdown! :) The emojis really make it feel friendly.

Russel Sayson

October 29, 2025 AT 02:06The most dramatic part of this guide is the stark reminder that OFAC will not hesitate to levy multi‑million penalties. If you think compliance is optional, think again. The author paints a vivid picture of the regulatory landscape, from the relentless influx of new SDN entries to the ruthless enforcement actions that have crippled entire platforms. By weaving together real‑world case studies with actionable checklists, the guide transforms a bureaucratic nightmare into a battle‑plan. It forces us to confront the reality that every address you touch could be a landmine, and only a disciplined, technology‑driven approach can keep you safe. The emphasis on daily updates, automated screening, and immutable audit logs isn’t just best practice-it’s survival. In short, the guide is both a warning and a roadmap, demanding that we treat compliance as a core component of product design rather than an afterthought.

Isabelle Graf

October 30, 2025 AT 00:20Another guide full of buzzwords and no real insight. Typical.

Kevin Duffy

October 30, 2025 AT 22:33Great job! 🎉 This will definitely help many teams stay on the right side of the law.