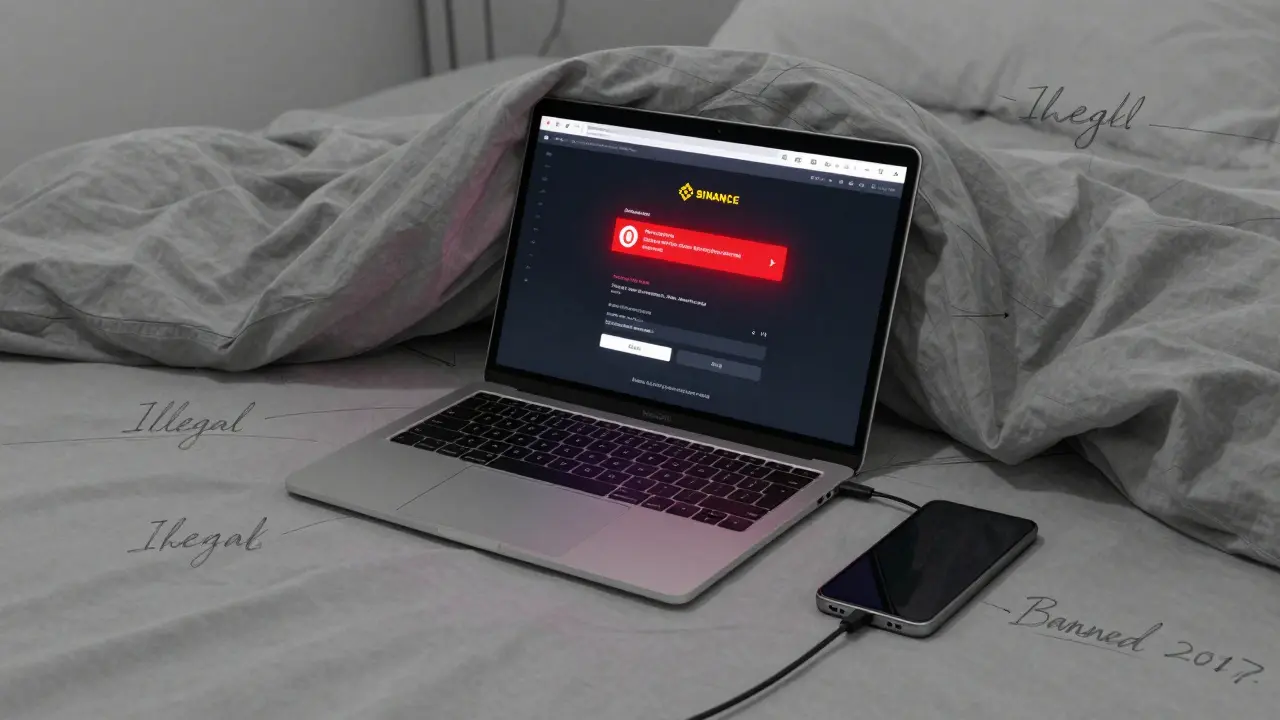

Risk of Crypto Trading for Bangladesh Citizens: Legal, Financial, and Operational Dangers

If you're a citizen of Bangladesh and thinking about trading Bitcoin, Ethereum, or USDT, you need to understand one thing upfront: crypto trading is illegal. Not just discouraged. Not just unregulated. Illegal. The Bangladesh Bank banned all cryptocurrency activities in 2017, and since then, the government has only tightened the screws. Yet, thousands still trade. Why? Because the money’s there. But the risks? They’re not just financial-they’re life-altering.

Legal Risks: You Could Go to Jail

The Bangladesh Bank’s 2017 circular made it clear: no one can buy, sell, hold, or mine cryptocurrency. Violating this rule means breaking the Anti-Money Laundering Act. That’s not a fine. That’s prosecution. People have been arrested for using crypto apps, transferring funds through P2P agents, or even holding wallets with small amounts of Bitcoin. In 2024, a Dhaka-based trader was sentenced to two years in prison for facilitating USDT transactions worth $12,000. He didn’t profit much. He just helped friends. The court didn’t care. Here’s the twist: enforcement is patchy. You can still download Binance and KuCoin from the Google Play Store in Bangladesh. No ID checks. No warnings. But that doesn’t mean you’re safe. Banks monitor international card transactions. If you use your Visa or Mastercard to buy crypto, the transaction gets flagged. The bank reports it. The police show up. And once you’re on their radar, it’s hard to disappear. The 2025 regulatory update made things worse. Now, to open a local exchange account, you need biometric verification-fingerprint and facial scan. That’s fine if you’re legal. But for crypto traders? It’s a trap. Over 30% of users quit local platforms overnight. Now they’re on Telegram. No ID. No KYC. Just direct transfers to strangers. That’s where the real danger starts.Financial Risks: No Safety Net, No Recourse

Most Bangladeshi crypto traders don’t use exchanges. They use agents. These are people-sometimes shopkeepers, sometimes students-who buy and sell crypto in cash. You give them 100,000 BDT. They give you 0.5 BTC. Or USDT. The rate? Whatever they say. No contracts. No receipts. No accountability. One trader in Chittagong lost $8,000 when his agent vanished after a weekend transaction. He had no proof. No bank record. No app transaction ID. Just a WhatsApp chat saying, “Send to this account.” The police told him, “You broke the law. We can’t help.” Even if you’re careful, you’re still exposed. Crypto prices swing wildly. USDT is supposed to be stable, but in Bangladesh’s underground market, it trades at a 2-5% premium. That’s a hidden tax. You think you’re getting $100 worth of crypto. You’re actually paying $105. And if the agent decides to run, your money’s gone forever. There’s also the risk of bank account freezes. If your bank detects unusual international transfers or frequent cash deposits matching crypto agent patterns, they can lock your account without warning. No notice. No appeal. Just “suspicious activity.” You can’t pay rent. You can’t buy groceries. You’re cut off from the financial system.Operational Risks: Trading in the Shadows

The underground crypto market in Bangladesh is growing-fast. Offshore platforms report a 200% surge in BDT deposits from Bangladesh in 2025. That’s billions of taka flowing out. And the government knows it. To avoid detection, traders use VPNs, burner phones, and cash-based P2P networks. But each layer adds risk. A fake Telegram group can steal your wallet keys. A “trusted” agent might be a scammer. A “secure” wallet app might be malware disguised as Binance. Mining? Totally banned. Grid operators say they’ve shut down 12 illegal crypto farms in Dhaka and Chittagong since 2024. But warehouse owners? They’re retrofitting buildings with better cooling. The power bills are high, but the profit? Higher. If you’re caught mining, you’re not just fined. You’re charged with energy theft-a criminal offense. And here’s the kicker: the more you try to hide, the more dangerous it gets. Telegram groups are full of fake traders offering “guaranteed returns.” They take your money. They disappear. No one’s monitoring them. No one’s stopping them. And if you report it? You admit you broke the law.

Bharat Kunduri

January 17, 2026 AT 10:44bro just got arrested for sending 500 bucks in usdt to his cousin lmao police came to his door with a warrant like he robbed a bank

Chris O'Carroll

January 17, 2026 AT 23:44so let me get this straight - you can’t trade crypto in bangladesh but you can still download binance from the play store? that’s like banning alcohol but leaving the liquor store open with a sign that says ‘we know you’re gonna buy it anyway’

Christina Shrader

January 19, 2026 AT 07:54the part about bank freezes hit me hard. imagine losing access to your salary account because you tried to make a better life for yourself. this isn’t just about crypto - it’s about systemic oppression.

Kelly Post

January 20, 2026 AT 14:23the tax trap is the most sinister part. you’re punished whether you pay or don’t pay. if you report, you admit guilt. if you don’t, you’re a criminal. no middle ground. no grace. just a government that wants blood, not compliance.

Andre Suico

January 20, 2026 AT 17:00the comparison to india and pakistan is spot on. regulation doesn’t have to mean prohibition. india created a framework - even if imperfect - that allows for accountability and consumer protection. bangladesh chose fear over function.

Chidimma Okafor

January 22, 2026 AT 11:44the socioeconomic fallout is not an afterthought - it is the core tragedy. when dollars flee, local economies wither. small businesses starve. the taka depreciates. and the people who suffer most? those who never touched a wallet, never clicked a button - just live in a country where the system is broken beyond repair.

Bill Sloan

January 23, 2026 AT 19:55telegram groups full of fake traders? bro that’s the new internet mafia. i’ve seen the screenshots - ‘guaranteed 200% returns in 72 hours’ with a photo of a guy in a suit holding a stack of cash. it’s like a scam carnival with no bouncers. 😔

ASHISH SINGH

January 24, 2026 AT 13:20the real story? the government’s scared because crypto is the only thing keeping the youth from full rebellion. if you can’t trust your banks, your jobs, your currency - you turn to something outside the system. they’re not banning crypto to protect the economy - they’re banning it to protect their power

Vinod Dalavai

January 25, 2026 AT 08:13my cousin in dhaka used to trade with a guy who ran a small tea shop. he’d give cash, get usdt. one day the guy just vanished. no one saw it coming. now my cousin’s working two jobs to pay off his mom’s medical bills. it’s not a game. it’s survival.

Tony Loneman

January 27, 2026 AT 04:08you say it’s illegal? sure. but so is breathing in some countries. the real question isn’t legality - it’s whether the system is worth obeying. if your government is so afraid of decentralized money, maybe it’s the system that’s broken, not the people trying to escape it.

Callan Burdett

January 28, 2026 AT 16:33the fact that mining farms are still running despite grid crackdowns? that’s resilience. people are risking jail for this because they see a future where money isn’t controlled by bureaucrats in suits. i respect that.

Anthony Ventresque

January 28, 2026 AT 20:57i wonder how many of these traders are students trying to send money home to their families. if you’re making $500 a month as a grad student, and crypto gives you $100 extra - that’s groceries, that’s medicine. is the state really going to jail someone for that?

Nishakar Rath

January 29, 2026 AT 12:34the nbr taxing crypto profits is the most hypocritical thing ever. they want your money but they won’t give you legal protection? so you’re supposed to pay taxes on something they made illegal? what kind of logic is this