SEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

Crypto Regulatory Classification Checker

Determine whether your favorite cryptocurrency is likely classified as a security (regulated by the SEC) or commodity (regulated by the CFTC) based on key regulatory criteria from the Howey Test.

Classification Result

Likelihood:

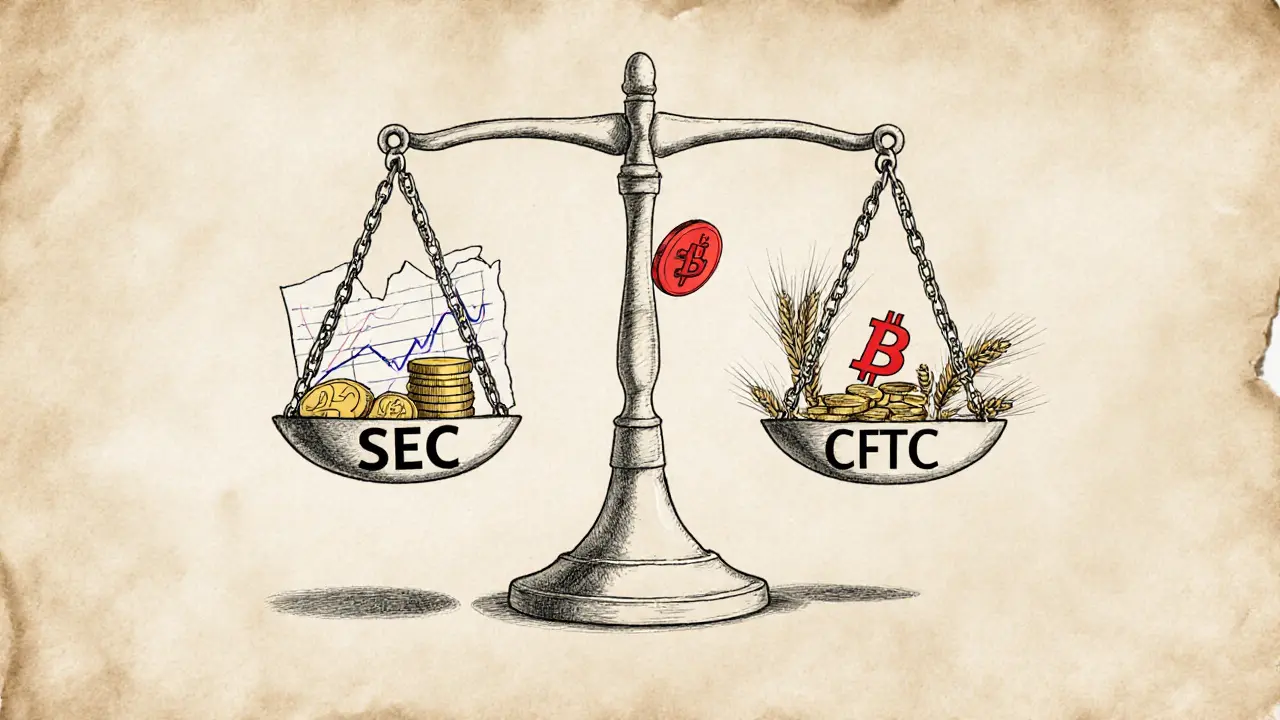

When you buy Bitcoin or trade Ethereum, who’s actually in charge? It’s not as simple as you might think. Two U.S. government agencies - the SEC and the CFTC - are locked in a quiet but high-stakes battle over who gets to regulate cryptocurrencies. One says crypto tokens are securities. The other says they’re commodities. And right now, no one knows for sure which rule applies to your favorite coin.

How It All Started

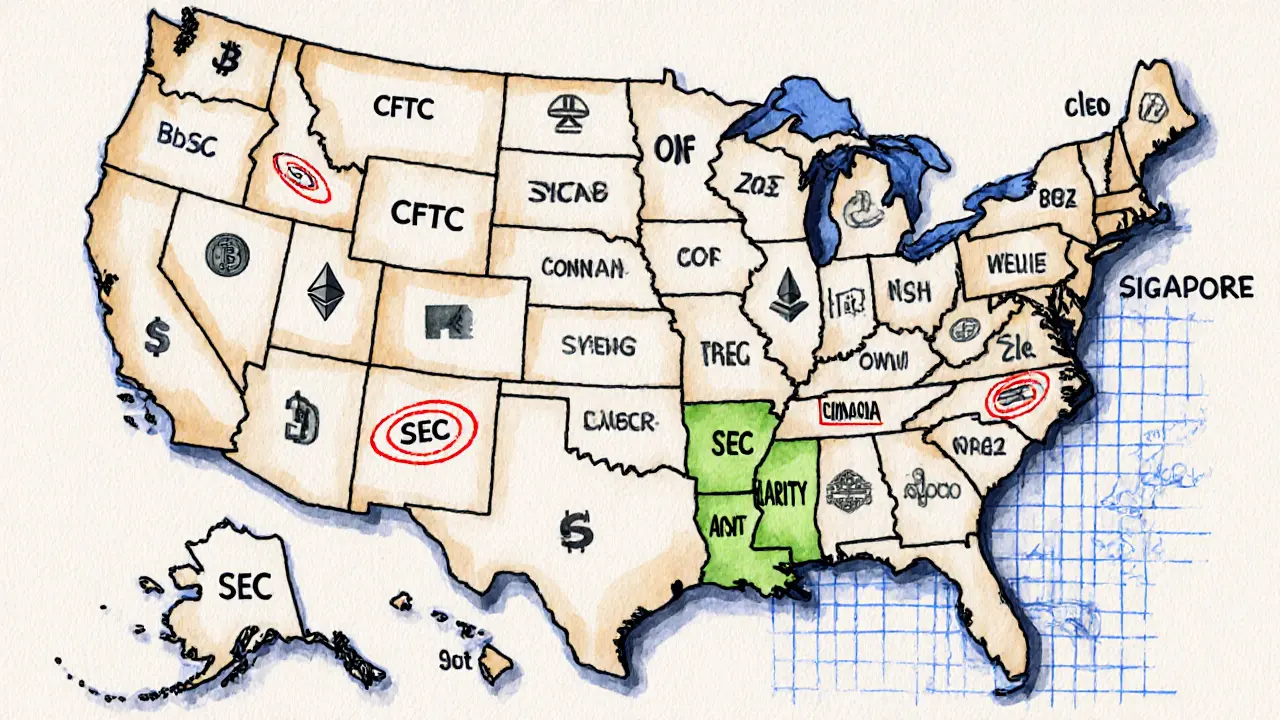

The fight began in 2015, when the CFTC stepped in after a Bitcoin trading platform called Coinflip, Inc. got caught running an unregulated options market. The CFTC didn’t just shut them down - it made a bold declaration: Bitcoin is a commodity. That meant it fell under the CFTC’s authority, which was built to oversee things like oil, wheat, and gold futures. The CFTC’s logic was simple: if you can buy, sell, or trade it like a good in a market, it’s a commodity. But the SEC had a different idea. Since 2017, they’ve been using a 1946 Supreme Court case called SEC v. W.J. Howey Co. to decide whether a digital asset is a security. The Howey Test asks three things: Did someone invest money? Was it in a common enterprise? And were they expecting profits mainly from someone else’s work? If the answer is yes, then it’s a security - and the SEC has full power to regulate it. That’s where the conflict exploded. Bitcoin? Most courts now agree it’s a commodity. Ethereum? Also mostly treated as a commodity. But what about Solana, Cardano, or a new token launched last week? The SEC says: “Probably a security.” The CFTC says: “Probably not - unless it’s being traded as a future or option.”What Each Agency Can Actually Do

The difference isn’t just theory - it’s legal power. The CFTC can regulate derivatives: futures, options, swaps. That’s why they approved Bitcoin futures in 2017 and Ether futures in 2023. They can also go after fraud and market manipulation in spot markets, but they don’t have broad oversight over exchanges that just let you buy and sell crypto directly. The SEC, on the other hand, controls everything tied to securities. That means they regulate stock exchanges, broker-dealers, and investment companies. If a crypto exchange lists a token the SEC says is a security, and it doesn’t register as a national exchange, the SEC can sue. That’s exactly what happened in June 2023, when the SEC sued Coinbase for operating an unregistered securities exchange, broker, and clearing agency. The result? Crypto platforms are stuck in the middle. Kraken and Gemini now follow both sets of rules - just to be safe. That means hiring two legal teams, running two compliance systems, and paying double the fees. According to a 2024 Deloitte survey, U.S. crypto firms spend an average of $2.7 million a year just to navigate this mess. Nearly half of that cost comes from trying to satisfy both agencies at once.Who’s Winning? The Courts Weigh In

The courts have been the real battleground. In 2018, a federal judge in New York ruled in CFTC v. McDonnell that virtual currencies are “goods” - meaning commodities. In 2023, Judge Katherine Polk Failla sided with the SEC in SEC v. Coinbase, saying the agency had a plausible case that some tokens traded on Coinbase were securities. But then came the twist. On February 27, 2025, the SEC dropped the case entirely. No explanation. No admission of error. Just a joint filing to dismiss. Market watchers saw it as a major shift. Was the SEC backing down? Or just changing tactics? The answer might be both. Under new leadership, the SEC appears to be pulling back from broad enforcement against established cryptocurrencies like Bitcoin and Ether. But they’re still aggressively targeting new tokens, DeFi protocols, and platforms that don’t register. Meanwhile, the CFTC has quietly expanded its reach - approving spot Ethereum ETFs in April 2025, a move that stretched their authority beyond futures into direct asset trading.

The Legislative Push for Clarity

Congress has been watching. In April 2024, the House passed the CLARITY Act - a bill that would finally draw a line. Under this law:- Any digital asset that’s decentralized, runs on a mature blockchain, and doesn’t give ownership rights to holders would be a digital commodity - regulated by the CFTC.

- Anything else - especially tokens sold to raise money with promises of profit - would be a security - regulated by the SEC.

What This Means for You

If you’re just holding Bitcoin or Ethereum, you probably won’t feel the impact. But if you’re trading newer tokens, staking, or using DeFi apps, you’re playing in a legal gray zone. Many platforms have already pulled U.S. users from certain tokens - not because they’re illegal, but because they can’t tell if the SEC will come after them next. The cost of this uncertainty is real. A CoinDesk survey of 250 crypto executives in January 2024 found that 73% said regulatory confusion was their biggest business challenge. Over 80% of U.S. crypto firms said they delayed product launches because they didn’t know who to answer to. That’s billions in lost investment. And while the U.S. dithers, other countries are moving fast. The European Union launched MiCA in June 2024 - a single, clear rulebook for crypto across all 27 member states. The U.S. crypto market was worth $175 billion in annual transactions in 2024, but U.S. firms captured only 14% of global crypto activity - down from 32% in 2020. Why? Because investors and companies are going where the rules are clear.

What’s Next?

The most likely outcome? A compromise by late 2025. Experts at the Bipartisan Policy Center give it a 68% chance of passing before the 2026 midterms. The deal will probably look like this:- Bitcoin and Ether - officially commodities, under CFTC.

- New tokens sold in ICOs - securities, under SEC.

- Stablecoins - maybe a new category, maybe under the CFTC with banking oversight.

Bottom Line

This isn’t just a bureaucratic fight. It’s about who controls the future of money. The SEC wants to protect investors by treating crypto like stocks. The CFTC wants to let innovation grow by treating it like gold. Both have valid points. But right now, the lack of clear rules is hurting businesses, scaring investors, and pushing innovation overseas. The next 12 months will decide whether the U.S. leads the next financial revolution - or watches from the sidelines while other countries build the future.Is Bitcoin a security or a commodity?

Bitcoin is widely treated as a commodity under CFTC jurisdiction. Courts have consistently ruled that Bitcoin meets the definition of a commodity under the Commodity Exchange Act. The SEC has never claimed Bitcoin is a security, and most legal experts agree it fails the Howey Test because it has no central company or team generating profits for investors.

Why does the SEC care about crypto at all?

The SEC focuses on investments where people put money into a project expecting profits from others’ efforts - the classic definition of a security. Many crypto tokens, especially those sold in ICOs, were marketed with promises of returns, team development, or ecosystem growth. That’s why the SEC sees them as unregistered securities. Their goal is to prevent fraud and protect retail investors from misleading sales.

Can a crypto token be both a security and a commodity?

Technically, yes - but not at the same time under current law. A token might start as a security (during its sale) and later become a commodity if it becomes decentralized and no longer relies on a central team for value. Ethereum is the best example: it was likely a security during its 2014 ICO, but now, after years of decentralization, it’s treated as a commodity by the CFTC and most regulators.

Why do exchanges like Coinbase get sued by the SEC?

The SEC claims Coinbase listed tokens that qualify as securities without registering as a national securities exchange or acting as a broker. Even if the exchange thinks a token is a commodity, the SEC says: “If it’s a security, you need to register.” Coinbase argued the SEC didn’t give clear rules - but the court said that doesn’t excuse compliance. The case was dropped in 2025, but the legal standard remains.

What’s the biggest risk for crypto users right now?

The biggest risk isn’t hacking or price drops - it’s sudden regulatory action. A token you’re holding today could be declared a security tomorrow, and your exchange might delist it overnight. Or your staking rewards could be deemed unregistered securities trading. Until Congress passes clear rules, you’re operating in a legal gray zone with no warning.

Will the U.S. lose crypto innovation because of this?

Already, yes. U.S. crypto firms captured only 14% of global crypto volume in 2024, down from 32% in 2020. Companies are moving teams to Singapore, Switzerland, and Dubai because those places have clear rules. The longer Congress waits, the more innovation leaves the U.S. - and the harder it will be to catch up.

Lani Manalansan

November 22, 2025 AT 02:18So basically, the government can’t decide if Bitcoin is gold or stocks? That’s wild. I just buy it because it’s digital money, not because I want to play regulatory whack-a-mole.

And why are we still letting agencies fight over this? It’s 2025. We’ve got AI trading bots that run faster than Congress can pass a bill.

Just give us rules. Even bad ones. At least then I know if I’m breaking the law or just being dumb.

Also, why does the SEC keep suing exchanges like they’re the SEC cops of crypto? They’re not even the ones who invented it.

Meanwhile, Europe just rolled out MiCA like it was a software update. We’re still arguing over whether Ethereum is a commodity or a security. I’m not even mad. I’m just impressed by how slow we are.

It’s like watching two toddlers fight over the last cookie while the whole kitchen burns down.

And yeah, I’m still holding ETH. No regrets. But I’m not staking anything new until Congress stops playing detective.

Also, why does every new token get flagged as a security? That’s not regulation. That’s fear.

Someone needs to tell the SEC: not every coin is a pyramid scheme. Some of us just want to build stuff.

Also, Oregon suing Coinbase? That’s like a single state trying to regulate the internet. Good luck with that.

Can we just vote on this? Like, a national poll? ‘Is Bitcoin a commodity?’ Yes/No. Done. Move on.

Or is this just another way for lawyers to make money?

Anyway, I’m out. Gonna go mine some more Bitcoin while the grown-ups argue about paperwork.

Frank Verhelst

November 22, 2025 AT 05:50Brooo 😭 The SEC is acting like crypto is a high school drama club and they’re the principal who still uses a flip phone.

Meanwhile, the CFTC is out here approving spot ETH ETFs like it’s no big deal. 🤯

Why are we still doing this? We’ve had 10 years of this nonsense. I’m not even mad. I’m just disappointed.

Also, I bought my first Bitcoin in 2017 and I’m still holding. Not because I’m smart. Because I’m stubborn.

And yeah, the U.S. is losing innovation. I’ve got friends in Dubai who laugh at our ‘regulatory clarity.’ 😅

Let’s just pick a side. Pick. A. Side.

And if you’re still using Coinbase for new tokens? You’re asking for trouble. I switched to Binance US for the ones I’m not scared to lose. 🤷♂️

Roshan Varghese

November 22, 2025 AT 22:07lol SEC is just a puppet of Wall Street. they dont care about investors, they care about protecting banks from real money.

crypto is a threat to the fed. thats why theyre trying to strangle it.

you think they give a damn about your 10k in eth? nope. they want to keep you in their debt-based system.

the cftc? same thing. theyre just the other side of the same coin.

the truth? the fed is scared. they know if people start using bitcoin as money, their whole empire crumbles.

thats why theyre creating chaos. to scare you into staying with dollars.

and dont even get me started on the ‘clarity act’ - its a trap. theyll make it so complicated that only big firms can comply.

we’re not being regulated. we’re being eliminated.

hold your bag. dont trade. dont stake. just HODL and watch them panic.

the endgame? CBDCs. they’re coming. and theyll make crypto illegal. mark my words.

if you’re not using a hardware wallet, you’re already owned.

they want you to think this is about rules. its about control.

wake up.

theyre not coming for the rich. theyre coming for the people who dare to think differently.

Dexter Guarujá

November 24, 2025 AT 05:18Let me be clear - this isn’t about regulation. This is about American sovereignty. The SEC and CFTC are fighting over who gets to control the future of money - and the U.S. is the only country with the legal infrastructure to do it right.

Europe? They passed MiCA because they’re scared of losing control. They don’t even have a real crypto scene anymore - just speculators and tax evaders.

Meanwhile, we’ve got the best tech, the best developers, the best universities - and we’re letting bureaucrats tie our hands because they can’t agree on a definition?

Bitcoin is a commodity. End of story. It’s decentralized. It’s not issued by a company. It’s not a security. Why is this hard?

Ethereum? Same thing. It’s not a security - it’s a network. You don’t buy a share of the internet, you use it.

And if you think the SEC’s lawsuit against Coinbase was about investor protection, you’re delusional. It was about power.

And now they’re dropping the case? That’s not a win - that’s a retreat. They know they’re losing.

But here’s the real problem: we’re letting foreign countries dictate our future. Singapore? Dubai? They’re not innovating. They’re just stealing our talent.

Fix the law. Or get out of the way.

Because if we don’t lead, we’ll be the ones begging for access to our own technology.

And that’s not just bad policy. That’s national surrender.

Jennifer Corley

November 25, 2025 AT 15:29Let’s be honest - most of these ‘decentralized’ tokens aren’t decentralized at all. They’re just VC-funded projects with a whitepaper and a Discord server.

And yes, the SEC is overreaching. But so are the CFTC’s claims that everything is a commodity.

Look at Solana. Who’s running it? A team of 30 people. Who’s marketing it? A bunch of influencers. Who’s making the profits? The founders.

That’s not a commodity. That’s a security.

And don’t even get me started on staking. You’re not ‘staking’ - you’re lending your tokens to a centralized entity for yield. That’s a loan. That’s a security.

So yes, the SEC is being aggressive. But they’re not wrong.

The problem isn’t the SEC. It’s the fact that 90% of crypto projects are scams.

And if you think the CFTC’s approval of spot ETH ETFs means anything - you’re ignoring that they’re still operating in a legal gray zone.

And now Oregon is suing? Good. Maybe other states will follow.

This isn’t about innovation. It’s about accountability.

And until people stop pretending that a token with a Discord mod and a Telegram group is ‘decentralized,’ we’re going to keep having this fight.

So yes, the SEC is the villain. But they’re the villain we need.

Because if we don’t regulate the garbage, the whole industry dies.

And I don’t want to be the one who says ‘I told you so’ when your portfolio crashes because you bought a token with no team, no roadmap, and no code audit.

Natalie Reichstein

November 26, 2025 AT 10:34You people are missing the point.

This isn’t about Bitcoin or Ethereum.

This is about the death of trust.

People used to believe in institutions. Now? They believe in anonymous devs on Twitter.

The SEC is trying to protect you from yourself.

The CFTC is trying to protect innovation.

But both are failing - because neither understands that crypto isn’t about regulation.

It’s about identity.

It’s about people saying: ‘I don’t trust banks. I don’t trust governments. I don’t trust Wall Street.’

So they buy Bitcoin.

And now the government says: ‘We’ll regulate that.’

But you can’t regulate trust.

You can’t force someone to believe in a system they don’t trust.

And if you try? You just push them further away.

So yes, the SEC is suing. The CFTC is approving ETFs.

But the real winner? The people who left.

They’re not in the U.S. anymore.

They’re in Singapore.

They’re in Switzerland.

They’re building the future - and we’re stuck here arguing about paperwork.

And the saddest part?

We had the chance to lead.

And we chose bureaucracy over belief.

Now we’re just spectators.

And we deserve it.

Kaitlyn Boone

November 27, 2025 AT 16:47So the SEC dropped the Coinbase case? Classic move.

They knew they couldn’t win. But they didn’t want to lose either.

So they just… vanished.

Like a ghost.

Meanwhile, the CFTC quietly approved spot ETH ETFs - and now everyone’s acting like it’s a win.

It’s not.

It’s a power grab.

And the worst part? No one’s asking why the CFTC can regulate spot markets now.

They’ve never had that authority.

But suddenly? They do.

Because they’re scared.

They’re scared that if they don’t act, the SEC will lose all credibility.

And if the SEC loses credibility?

Then the whole system collapses.

So they’re playing chicken.

And we’re the ones who lose.

Because now we don’t know if we’re safe.

And that’s worse than any regulation.

Uncertainty kills innovation.

And we’re drowning in it.

James Edwin

November 28, 2025 AT 01:40I’ve been in crypto since 2015. I’ve seen this movie before.

Back then, the SEC said Bitcoin was a scam. Then they said it was a commodity. Then they said it was a security. Then they said it was both.

Now they’re dropping cases like they’re out of coffee.

Here’s what’s really happening: they’re waiting for Congress to fix it.

Because they know they can’t do it alone.

And honestly? Good.

Let Congress fight.

Let the lawyers argue.

Meanwhile, I’m just building.

I’m not waiting for permission.

I’m not waiting for a rulebook.

I’m building tools that work - whether the SEC likes it or not.

And if they come after me?

I’ll fight.

But I won’t stop.

Because this isn’t about them.

It’s about us.

And we’re not going anywhere.

Kris Young

November 29, 2025 AT 08:35Bitcoin is a commodity. Ethereum is a commodity. All other tokens? Probably securities. Simple.

Why is this so hard?

Because people overcomplicate it.

Bitcoin: no central team. No promises. No profit-sharing. Commodity.

Ethereum: same.

New token sold in ICO with roadmap and team promising returns? Security.

That’s it.

Why do we need a 10,000-word article to say that?

Just make the law. Then enforce it.

Stop letting lawyers write the rules.

And stop pretending that every new token is the next Bitcoin.

Most aren’t.

And that’s okay.

But we need to know which ones are which.

Clarity is not a luxury.

It’s survival.

LaTanya Orr

November 30, 2025 AT 11:55I think we’re asking the wrong question.

It’s not ‘Is Bitcoin a security or a commodity?’

It’s ‘What kind of society do we want to build?’

Do we want a world where money is controlled by institutions?

Or one where it’s owned by individuals?

The SEC wants control.

The CFTC wants markets.

But neither is asking: what do people actually want?

Because what people want… is freedom.

Not regulation.

Not oversight.

Just the ability to move money without asking permission.

And that’s why crypto exists.

Not because it’s better technology.

But because it’s better freedom.

So maybe the real fight isn’t between the SEC and CFTC.

It’s between control and liberty.

And I know which side I’m on.

Ashley Finlert

December 2, 2025 AT 02:49There is a quiet, devastating tragedy unfolding in plain sight - and no one is talking about it.

For over a decade, the United States of America has been the epicenter of technological revolution - from Silicon Valley to Wall Street to the open-source coders in basements across the nation.

And now? We are being outpaced not by superior innovation, but by superior clarity.

The European Union enacted MiCA - a single, coherent, forward-looking regulatory framework - and in doing so, they declared: ‘We believe in innovation, and we will govern it with dignity.’

Meanwhile, here, we have two agencies locked in a bureaucratic duel over definitions written in 1946.

One agency sees a security. The other sees a commodity.

Neither sees a movement.

And so, the architects of this future - the developers, the engineers, the dreamers - are leaving.

Not because they are afraid.

But because they are tired.

Tired of waiting.

Tired of explaining.

Tired of being told that their life’s work is ‘too risky’ to exist without permission.

And now, as the last of our brightest minds depart for Singapore, Zurich, and Dubai, we are left with a question - not of law, but of legacy.

Will we be remembered as the nation that built the internet?

Or the nation that lost the future because it couldn’t decide what to call a coin?

Chris Popovec

December 2, 2025 AT 14:40Let me break this down in jargon so you can’t pretend you’re confused.

SEC: uses Howey Test - which was designed for orange groves in 1946 - to classify digital assets. That’s not regulation. That’s legal archaeology.

CFTC: claims jurisdiction over spot markets despite zero statutory authority. That’s not authority. That’s regulatory overreach.

Both are using outdated frameworks to regulate a decentralized, permissionless, global system.

Meanwhile, the real threat? The Fed’s CBDC. That’s the true centralized control mechanism.

But no one’s talking about that.

Because if you focus on the SEC vs CFTC, you don’t notice the real enemy: the U.S. government’s desire to eliminate financial privacy.

And guess what? They’re using this ‘regulatory chaos’ as cover to justify CBDCs.

‘We need to regulate crypto because it’s dangerous.’

But crypto is the only thing keeping you from being a financial slave.

So yes, the SEC is a clown.

The CFTC is a liar.

And Congress? They’re all in on it.

Don’t be fooled by the ‘CLARITY Act.’ It’s a Trojan horse.

They’re not giving you clarity.

They’re giving you control.

And when they take your crypto?

They’ll say it was for your own good.

Marilyn Manriquez

December 3, 2025 AT 06:05Regulation is not the enemy. Uncertainty is.

Clarity enables innovation.

Confusion enables fear.

And fear drives capital away.

The United States has the talent, the capital, the infrastructure - and yet, we are losing ground because we cannot agree on a simple definition.

Bitcoin is a commodity.

Ethereum is a commodity.

Other tokens? If they promise returns, they are securities.

That is not complicated.

Why do we need 20 different bills?

Why do we need 100 lawyers?

Why do we need to wait until 2026?

Because we are afraid.

Afraid of change.

Afraid of disruption.

Afraid of losing control.

But the world is changing.

And if we do not lead with wisdom - we will be left behind with outdated laws and empty buildings.

Let us choose clarity.

Let us choose courage.

Let us choose the future.

taliyah trice

December 5, 2025 AT 01:51i just hold btc and eth. dont care who regulates it. just dont take it away.

Charan Kumar

December 6, 2025 AT 00:30USA always overcomplicate things

in india we just say if it makes money from others work then its security

if its just digital gold then its commodity

why make it hard

also why usa always think they know best

eu did it better

we dont need 1000 page law

just one rule

and move on

Peter Mendola

December 7, 2025 AT 03:04SEC dropped the case because they lost. Not because they changed their mind.

And now they’re pretending it was a tactical retreat.

It wasn’t.

They were outmaneuvered.

And now they’re trying to rebrand their failure as ‘strategy.’

Meanwhile, the CFTC is quietly expanding its reach - because they know the SEC’s legal position is crumbling.

This isn’t a battle for regulation.

It’s a battle for legitimacy.

And the SEC is losing.

Badly.

And the worst part?

No one’s calling them out for it.

Because everyone’s too busy pretending this is about ‘investor protection.’

It’s not.

It’s about power.

And they’re running out of it.

Terry Watson

December 8, 2025 AT 21:36Let’s talk about what’s really happening - because no one’s saying it.

The SEC isn’t trying to protect investors.

They’re trying to protect the traditional financial system.

Because if people start using crypto as money - banks die.

Stock exchanges die.

Brokerages die.

And the SEC? They’re the guardians of that system.

So they’re fighting not to regulate crypto.

But to kill it.

And the CFTC? They’re not the good guys.

They’re just the ones who realized they can profit from it.

So they’re trying to claim the market - not to protect it.

But to monetize it.

And we’re the ones stuck in the middle.

Waiting for a law that will never come.

Because the people who control the system don’t want it to change.

And they’re willing to let innovation die to keep it that way.

So don’t call this a regulatory battle.

Call it a war.

And we’re the collateral damage.

Sunita Garasiya

December 10, 2025 AT 08:03Oh wow, the SEC dropped the case? How dramatic. Did they finally realize they were suing a ghost?

Or did they just get tired of losing in court every time?

Meanwhile, the CFTC just approved spot ETH ETFs - and suddenly everyone’s acting like it’s a miracle.

It’s not.

It’s just another agency trying to look relevant.

And the CLARITY Act? Please.

It’s a political stunt. Written by lobbyists. Signed by politicians who don’t know what a blockchain is.

And yet, we’re supposed to believe this is ‘clarity’?

It’s like giving a toddler a Swiss watch and calling it a tool.

Meanwhile, real people are just holding Bitcoin and laughing.

Because they know - this isn’t about law.

It’s about fear.

And fear doesn’t stop innovation.

It just makes it go somewhere else.

And guess where?

Singapore.

Dubai.

Switzerland.

Not here.

So congrats, USA.

You won the battle.

And lost the war.

Mike Stadelmayer

December 11, 2025 AT 02:27Been holding since 2016. Didn’t care who regulated it then. Don’t care now.

Bitcoin’s still Bitcoin.

Ethereum’s still Ethereum.

And I’m still here.

They can argue all they want.

I’ll just keep stacking sats.

And if they take it?

Well… I guess I’ll have to move to a country that doesn’t treat innovation like a crime.

Norm Waldon

December 11, 2025 AT 04:17Of course the SEC dropped the case - because they were being watched.

Every move they make is being monitored by foreign governments.

China is building its own digital currency.

Russia is banning crypto but mining it anyway.

And the U.S.? Still arguing over whether a token is a stock or a potato.

This isn’t about law.

This is about global dominance.

And we’re losing.

Because we’re too busy playing politics to see the bigger picture.

And when the world moves on?

They won’t come back.

They’ll build their own system.

And we’ll be stuck with our old rules and empty exchanges.

And you’ll wonder why your 401(k) is worthless.

Because we didn’t act.

Because we were too scared.

Because we thought regulation was about control.

But it’s not.

It’s about survival.

And we’re not surviving.

neil stevenson

December 12, 2025 AT 16:09Bro. I just bought BTC in 2021. I don’t care who regulates it. I just want to know if I can buy it tomorrow.

Can I? Yes?

Good.

Can’t?

Then I’ll go to Binance.

And you know what?

They don’t care about your SEC vs CFTC drama.

They just want my money.

And honestly?

So do I.

Samantha bambi

December 14, 2025 AT 15:14It’s funny how the same people who scream ‘decentralization!’ when it suits them turn into corporate lawyers when it’s time to pay taxes.

And yet, they’re the ones who think they deserve to be regulated.

Why?

Because they want the benefits of crypto - without the responsibility.

They want to trade tokens.

They want to earn yield.

They want to be protected.

But they don’t want to be responsible for their own choices.

And that’s the real problem.

Not the SEC.

Not the CFTC.

Us.

We’re the ones who turned freedom into a entitlement.

And now we’re mad when the system doesn’t protect us from ourselves.

Anthony Demarco

December 14, 2025 AT 16:54They’re not fighting over crypto.

They’re fighting over who gets to tax it.

Because if the SEC wins, they get to tax it like stocks.

If the CFTC wins, they get to tax it like commodities.

And Congress? They’re just waiting for the outcome so they can raise the rate.

This isn’t about regulation.

It’s about revenue.

And we’re just the cattle they’re trying to brand.

Lynn S

December 14, 2025 AT 18:44Let me be blunt: you are all naive.

The SEC is not your friend.

The CFTC is not your savior.

They are both part of the same system that has been exploiting you for decades.

And now, they are using crypto as a new tool to extend their control.

Do you really think they want you to be free?

Or do you think they want you to be compliant?

Because if you believe in decentralization - then you should not be asking for regulation.

You should be building alternatives.

Not begging for permission.

And if you’re still using Coinbase?

You’re not a crypto user.

You’re a bank customer with a different name.

Jack Richter

December 15, 2025 AT 14:34Yeah ok.

sky 168

December 15, 2025 AT 19:18Just hold the good stuff. BTC. ETH.

Ignore the noise.

They’ll figure it out.

Or they won’t.

Either way - you’re still you.

And your coins? Still yours.

Devon Bishop

December 15, 2025 AT 20:39Wait, so if ETH is a commodity now, does that mean staking is legal? I thought that was a security? I’m confused.

Also, is USDT a commodity? It’s not a token, it’s a dollar.

Someone explain this to me. I’m trying to be good.

But this is like trying to follow a recipe written in Morse code.

sammy su

December 16, 2025 AT 01:03Just keep your coins safe.

Don’t trust exchanges.

Don’t trust regulators.

Trust your keys.

And if they take your money?

Then you were never really holding crypto anyway.

Just remember - the real power isn’t in the law.

It’s in your wallet.

Khalil Nooh

December 16, 2025 AT 17:17They say the U.S. leads the world in innovation.

But right now, we’re leading in bureaucracy.

And that’s not a badge of honor.

It’s a funeral.

Because every day we wait, another developer leaves.

Another startup moves.

Another investor says ‘no.’

And we call it ‘regulatory caution.’

It’s not caution.

It’s cowardice.

And one day, we’ll wake up and realize - the future wasn’t stolen.

It was given away.

By us.

For nothing.

jack leon

December 18, 2025 AT 08:49This isn’t a battle.

This is a funeral.

And the corpse? It’s American innovation.

The SEC? The coroner.

The CFTC? The pallbearer.

And Congress? The guy who forgot to bring the flowers.

Meanwhile, the world is moving on.

Building.

Creating.

Leading.

And we?

We’re still arguing over whether a coin is a stock or a potato.

And we wonder why no one respects us anymore.

It’s not because we’re weak.

It’s because we stopped believing in ourselves.

And now? The future doesn’t need us.

It’s already gone.

Lani Manalansan

December 19, 2025 AT 07:59Wait, so if the SEC dropped the case, does that mean Coinbase won? Or did they just get bored?

Also, I just saw a tweet from a CFTC commissioner saying ‘spot ETH ETFs are the future.’

But didn’t they say they didn’t have jurisdiction over spot markets?

So… are they lying?

Or just making it up as they go?

Either way - I’m not trusting either agency again.

And if you are?

You’re the reason this mess keeps happening.

Chris Popovec

December 19, 2025 AT 16:27They’re not lying.

They’re redefining jurisdiction through executive fiat.

That’s how authoritarian systems work.

Not by law.

By precedent.

And once they set the precedent?

They own you.

That’s why they’re moving so fast.

Because they know the clock is ticking.

And if Congress passes the CLARITY Act?

They lose their power.

So they’re racing to create facts on the ground.

And we’re just watching.

Like sheep.

Terry Watson

December 20, 2025 AT 13:39It’s not about jurisdiction.

It’s about fear.

The CFTC is terrified that if they don’t act, the SEC will collapse under its own incompetence.

And then who’s left to regulate the market?

No one.

And then crypto becomes truly decentralized.

And that’s the nightmare.

So they’re stepping in - not to protect the market.

But to prevent the system from collapsing.

They’re not regulators.

They’re firefighters.

And the fire? Is the truth.

Marilyn Manriquez

December 22, 2025 AT 07:02Perhaps we should stop asking who regulates crypto.

And start asking: who deserves to regulate it?

Do we want regulators who fear innovation?

Or those who understand it?

Because the answer to that question - will determine whether we live in the future…

Or the past.