Afghanistan cryptocurrency restrictions – what you need to know

When you hear about Afghanistan cryptocurrency restrictions, a collection of legal rules that forbid or heavily limit digital‑asset trading in Afghanistan. Also known as Afghan crypto ban, it forces users toward unregulated channels and raises compliance risk. This environment isn’t just a local issue; it ripples across global markets. Afghanistan cryptocurrency restrictions affect anyone trying to move Bitcoin, Ether or stablecoins in and out of the country, and they often trigger hidden price gaps and extra fees. Understanding the ban helps you spot why certain exchanges list higher spreads for Afghan users and why peer‑to‑peer trades skyrocket in neighboring regions. Below you’ll see how these rules intersect with broader sanctions and underground markets.

Key related forces shaping the landscape

One major driver is OFAC cryptocurrency sanctions, U.S. Treasury measures that prohibit dealing with designated digital assets and addresses. Also known as U.S. crypto sanctions, they often overlap with Afghan policy, especially when local wallets appear on watchlists. Another phenomenon you’ll encounter is underground crypto premiums, price gaps where black‑market rates exceed official exchange prices because of bans. These premiums emerge as traders compensate for higher risk, limited liquidity, and fear of enforcement. Finally, crypto exchange regulations, the licensing and compliance rules platforms must meet in each jurisdiction dictate whether an exchange can legally serve Afghan customers or must block their accounts. Together these entities create a web where Afghanistan cryptocurrency restrictions drive underground premiums, trigger compliance checks from OFAC, and shape exchange licensing strategies.

For traders, the practical upshot is clear: you need to vet every platform for its stance on Afghan users, watch for unusually high spreads that signal a premium, and keep an eye on sanction watchlists that could freeze assets overnight. Our collection of exchange reviews – from Mandala and XBTS to Wavelength and Gate.io – breaks down fees, security, and whether each service explicitly blocks Afghan IPs. The airdrop guides (StarSharks, DVI, YOOSHI) also note if participants must meet residency checks, which is crucial when the ban limits proof of address. By cross‑referencing these resources, you can build a compliance‑first strategy that avoids costly mistakes while still accessing liquid markets.

Below you’ll find a curated list of articles that dive deeper into each piece of the puzzle. Whether you’re curious about how double‑spending safeguards Bitcoin, want a step‑by‑step tax form guide, or need the latest on OFAC enforcement, the posts are organized to give you actionable insight. Start exploring, pick the reviews that match your risk tolerance, and keep these regulatory nuances in mind as you navigate the crypto space from Afghanistan and beyond.

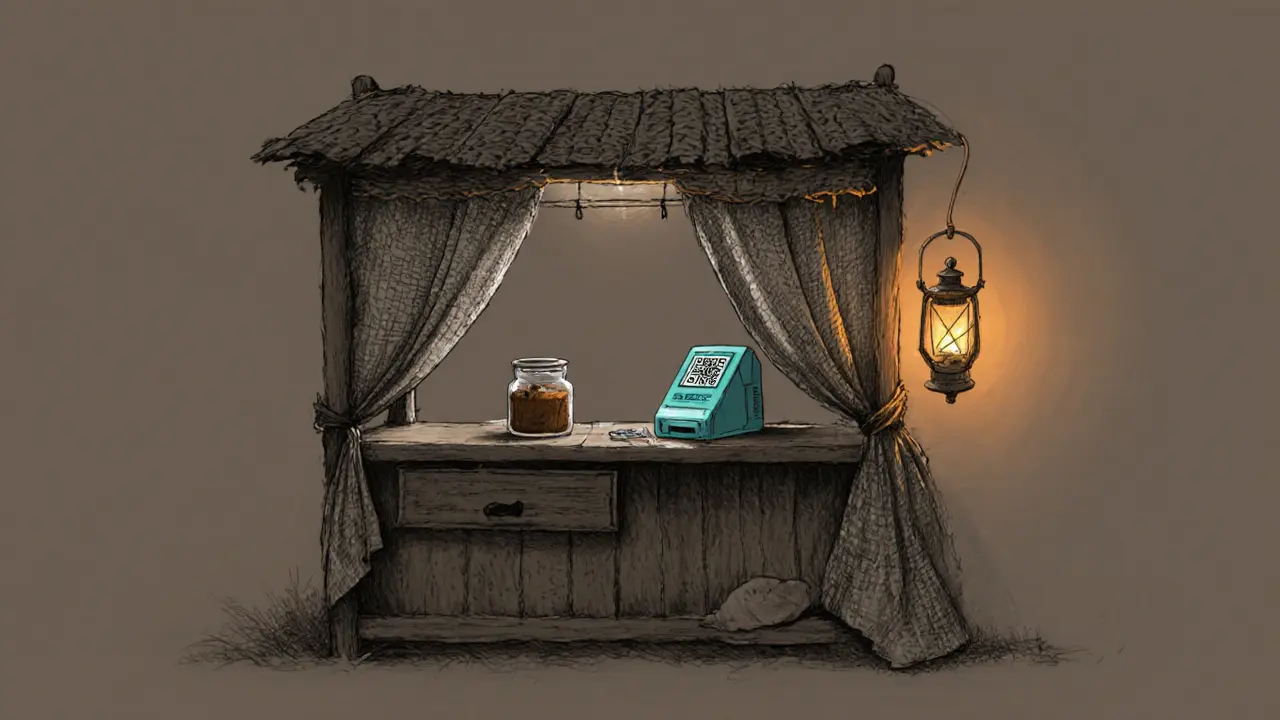

How Underground Crypto Trading Survives Under the Taliban’s Crypto Ban

Explore how Afghan crypto traders survive the Taliban's ban, using Bitcoin, USDT, and hidden networks to move money despite arrests and internet blackouts.

VIEW MORE