Bitcoin Regulation: What It Means for You and How It Shapes Crypto Markets

When we talk about Bitcoin regulation, government rules that control how Bitcoin is bought, sold, taxed, or used. Also known as crypto regulation, it’s no longer just a debate among technologists—it’s a real force shaping where you can trade, who can hold Bitcoin, and whether your wallet stays safe. Countries aren’t just watching Bitcoin anymore—they’re writing laws about it. Some treat it like money. Others treat it like property. A few, like El Salvador, even made it legal tender. But most major economies are still figuring out how to handle it without crashing markets or losing control.

Bitcoin regulation doesn’t just affect big exchanges. It hits P2P crypto, peer-to-peer trading networks that let people bypass banks and government controls hard. In places like China, where crypto is banned, traders still find ways to use USDT and encrypted apps to move Bitcoin. But that’s risky. If the rules tighten, your trades could freeze overnight. And if you’re using a platform like HyperBlast or Cryptobuyer Pro—both flagged as unregulated or outright scams—you’re already playing with fire. Regulation isn’t just about stopping fraud; it’s about forcing platforms to prove they’re real. That’s why you see so many posts here about fake airdrops, dead tokens like GDOGE and SFEX, and exchanges that vanish when the SEC shows up.

What you’re seeing in these posts isn’t random noise—it’s the fallout of crypto regulation, the growing legal framework that determines which projects survive and which get wiped out. Projects like Chainbase and ZKSwap are building with compliance in mind: transparent teams, real infrastructure, and clear use cases. Meanwhile, meme coins like ZEUS and WCO have no team, no whitepaper, and no chance under scrutiny. Regulation doesn’t kill innovation—it kills guesswork. And that’s why posts about 51% attacks, order books, and DeFi platforms like TokenSets matter. They’re tools for traders who want to stay ahead, not just gamble.

Bitcoin regulation is moving faster than most people realize. The next time you see a new airdrop, a new exchange, or a "guaranteed" return, ask: Is this built to last, or just built to disappear before the next rule drops? The posts below show you exactly what’s working, what’s failing, and why—no fluff, no hype. You’ll see real examples of how regulation kills scams, protects users, and reshapes the market. And you’ll know exactly what to watch for next.

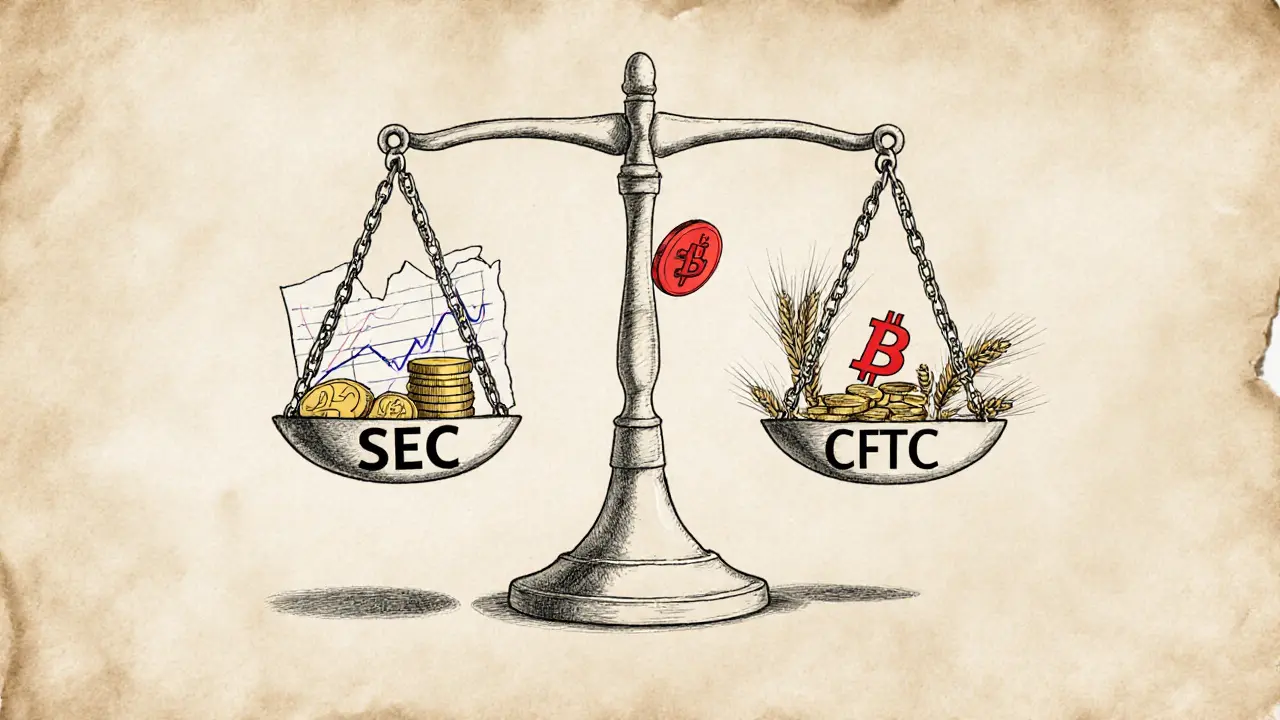

SEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

The SEC and CFTC are fighting over who regulates crypto - securities or commodities. This battle affects Bitcoin, Ethereum, exchanges, and your investments. Here's how it works and why it matters.

VIEW MORE