Blockchain Analytics: Understanding Data, Tools, and Trends

When working with blockchain analytics, the practice of gathering and interpreting data directly from blockchain networks to spot trends, assess risk, and guide investment decisions. Also known as on‑chain analysis, it helps traders, regulators, and developers see what’s really happening across multiple chains. blockchain analytics isn’t just about tracking prices – it dives into transaction volumes, wallet activity, smart‑contract calls, and network health metrics. This foundation lets you answer questions like: which tokens are really moving, how fast are blocks confirming, and where might liquidity dry up.

One major sub‑topic is sidechains, parallel blockchains that connect to a main chain via bridges, offering faster or cheaper transactions. Monitoring sidechain bridges is essential because any delay or breach can skew on‑chain metrics and create arbitrage opportunities. Another key area is modular blockchains, architectures that separate execution, settlement, and data‑availability layers for scalability and security. Their layered design changes how data is published, meaning analysts must adapt their pipelines to capture each layer’s performance. DeFi lending, crypto‑based borrowing and lending platforms that generate yield and risk metrics is another output that relies heavily on clean on‑chain data – interest rates, collateral ratios, and liquidation events all flow from blockchain records. Finally, crypto‑tax compliance, such as filling IRS Form 8949, depends on accurate transaction histories that only robust blockchain analytics can provide. Together, these entities form a network of inputs and outputs: blockchain analytics encompasses on‑chain data analysis, requires sidechain bridge monitoring, is shaped by modular blockchain architecture, and powers DeFi lending metrics.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas. From a detailed look at Canada’s first Bitcoin ETF and how it reshapes market data, to step‑by‑step guides on filing crypto taxes, and reviews of exchanges that stress security and fee transparency, the posts give concrete examples of blockchain analytics in action. Whether you’re a trader trying to spot hidden volume, a developer building a bridge, or an investor assessing DeFi yields, the resources ahead will show you how to turn raw blockchain data into actionable insight. Let’s explore the range of topics and see how the concepts we just covered play out across real‑world scenarios.

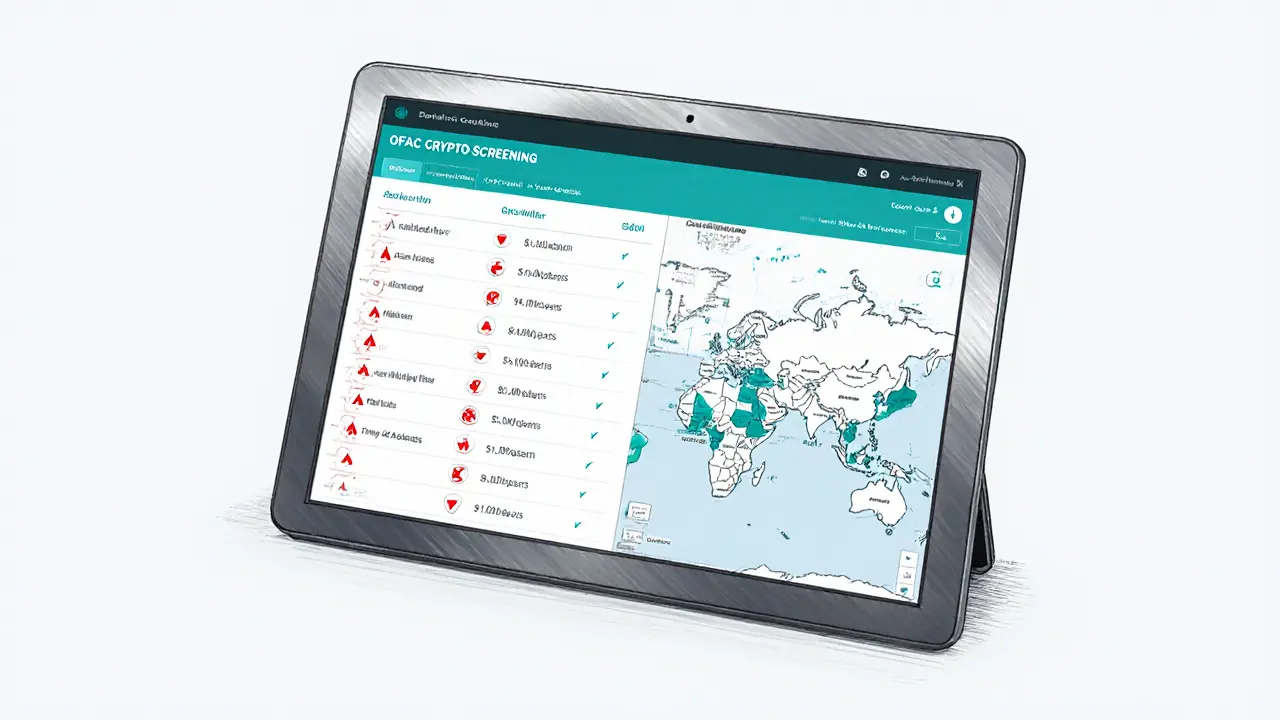

OFAC Cryptocurrency Sanctions: Compliance Guide 2025

Learn how OFAC's cryptocurrency sanctions work, the compliance steps you need, and what recent enforcement cases teach. Get a ready-to-use checklist and future outlook.

VIEW MORE