Bridge Fees Explained: Everything You Need to Know

When dealing with Bridge Fees, the costs charged when moving assets across blockchain bridges. Also known as cross‑chain fees, they represent the price you pay for linking two separate ledgers. Bridge fees are not a flat rate; they fluctuate with network congestion, security layers, and the type of assets you’re moving.

One of the core players behind these costs is the Blockchain Bridge, a protocol that connects two independent blockchains to enable asset transfers. A bridge handles the heavy lifting of locking assets on the source chain, minting or releasing equivalents on the destination chain, and then reconciling the balance when the transfer completes. Because bridges must guarantee that no double‑spend occurs, they often add extra validation steps, which push the fee higher. In practice, a robust blockchain bridge can reduce the overall expense compared to using a series of individual swaps.

Another factor that directly influences bridge fees is the Two‑Way Peg, a mechanism that allows assets to move back and forth between two chains while preserving their value. Two‑way pegs create a bidirectional relationship, meaning each transfer must be mirrored on both sides. This mirroring adds computational work, and the bridge operator usually reflects that effort in the fee structure. When a two‑way peg is well‑engineered, it can keep fees predictable, but a poorly designed peg may cause spikes during peak usage.

A Cross‑Chain Transaction, the act of moving tokens or data from one blockchain to another is the user‑visible event that triggers bridge fees. The transaction includes several steps: signing the transfer, broadcasting to the source chain, waiting for confirmations, and finally claiming on the destination chain. Each step may incur its own gas cost, and the aggregate becomes the bridge fee you see on your receipt. Understanding the lifecycle of a cross‑chain transaction helps you anticipate when fees will rise—usually during network congestion or when the bridge’s validators are overloaded.

Why Gas Fees Matter in the Bridge Ecosystem

While bridge fees cover the service provided by the bridge, Gas Fees, the network fees paid to miners or validators for processing transactions are an additional layer you can’t ignore. Gas fees are calculated per‑unit of computational work on the underlying blockchain, so a bridge that operates on Ethereum will inherit Ethereum’s gas price volatility. When gas fees soar, bridge operators often adjust their own fees to keep the total cost attractive. This relationship means that a spike in gas fees directly pushes up bridge fees, even if the bridge’s own overhead stays constant.

Security is another hidden cost behind bridge fees. Audits, insurance pools, and bounty programs all aim to protect users from exploits like the infamous Ronin bridge hack. These protective measures require funding, which usually flows back into the fee model. A bridge that invests heavily in security can charge a modest premium, but the trade‑off is lower risk for the user. When evaluating a bridge, compare its fee schedule against its security track record; a slightly higher fee may be worth the peace of mind.

Finally, the fee landscape is shaped by market dynamics. When a popular token launches on a new chain, demand for bridge services spikes, prompting operators to raise fees temporarily. Conversely, competition among bridges can drive fees down as each platform vies for users. By keeping an eye on which bridges are adding new assets, you can time your transfers to catch lower fees. The collection below dives deeper into specific bridges, fee structures, and real‑world examples, giving you actionable insights to save money and move assets safely.

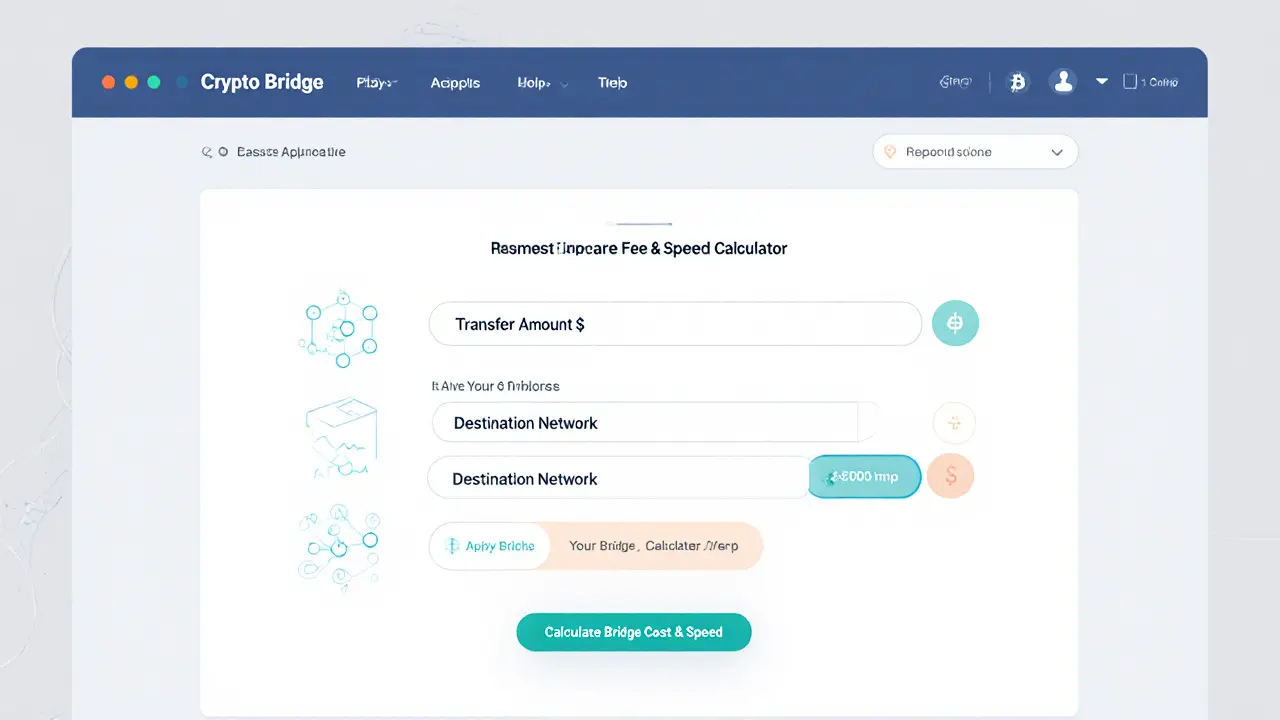

Understanding Bridge Fees and Transaction Times for Crypto Transfers

Learn how bridge fees and transaction times vary across crypto bridges, discover fee models, speed differences, security tips, and a practical checklist for cross‑chain transfers.

VIEW MORE