Bridge Speed

When talking about Bridge Speed, the rate at which assets move across a blockchain bridge, usually measured in seconds or minutes. Also known as cross‑chain transfer latency, it tells you how quickly a token can jump from one ledger to another. Another core piece of the puzzle is the blockchain bridge, a protocol that connects two independent networks and facilitates token swaps (sometimes called a cross‑chain gateway). The bridge often leans on a two‑way peg, a locking‑and‑minting system that secures assets on the source chain while issuing equivalents on the destination chain. Finally, a sidechain, an auxiliary chain that runs alongside a mainnet and links back via a bridge, provides the environment where most speed tricks happen. Understanding how these pieces fit together lets you gauge whether a transfer will be instant or drag on for hours. Bridge speed is the metric that ties them all together.

Key Factors Shaping Bridge Speed

First, the underlying consensus mechanism matters. Proof‑of‑Work chains often need multiple confirmations, which adds minutes to every transfer. Proof‑of‑Stake or delegated models can finalize blocks in seconds, shaving off latency. Next, the bridge’s design influences speed. A custodial bridge that holds assets in a central pool can release tokens almost instantly, but it trades speed for trust. Trustless bridges, which rely on smart contracts and multi‑signature verification, add extra steps and therefore more time. Security is the other side of the coin: the more checks you stack—like fraud proofs, relayer signatures, and on‑chain audits—the slower the bridge becomes. That’s why many projects opt for a hybrid approach, using a lightweight cross‑chain security, a set of safeguards that balance risk and performance model that offers decent protection without grinding the transfer to a halt.

Sidechains play a huge role in tweaking bridge speed. Because they run their own consensus, a sidechain can process transactions far faster than a saturated mainnet. When a sidechain is linked via a two‑way peg, assets spend only a brief moment locked on the main chain before being minted on the sidechain, cutting overall latency dramatically. However, the peg itself can become a bottleneck if the lock‑and‑mint process isn’t optimized—think of a busy toll booth where cars line up. Developers mitigate this by batching locks, using off‑chain relayers, or adopting optimistic rollups that assume transfers are valid and only check later. Each of these implementation steps directly impacts bridge speed, creating a trade‑off matrix where you balance cost, security, and latency.

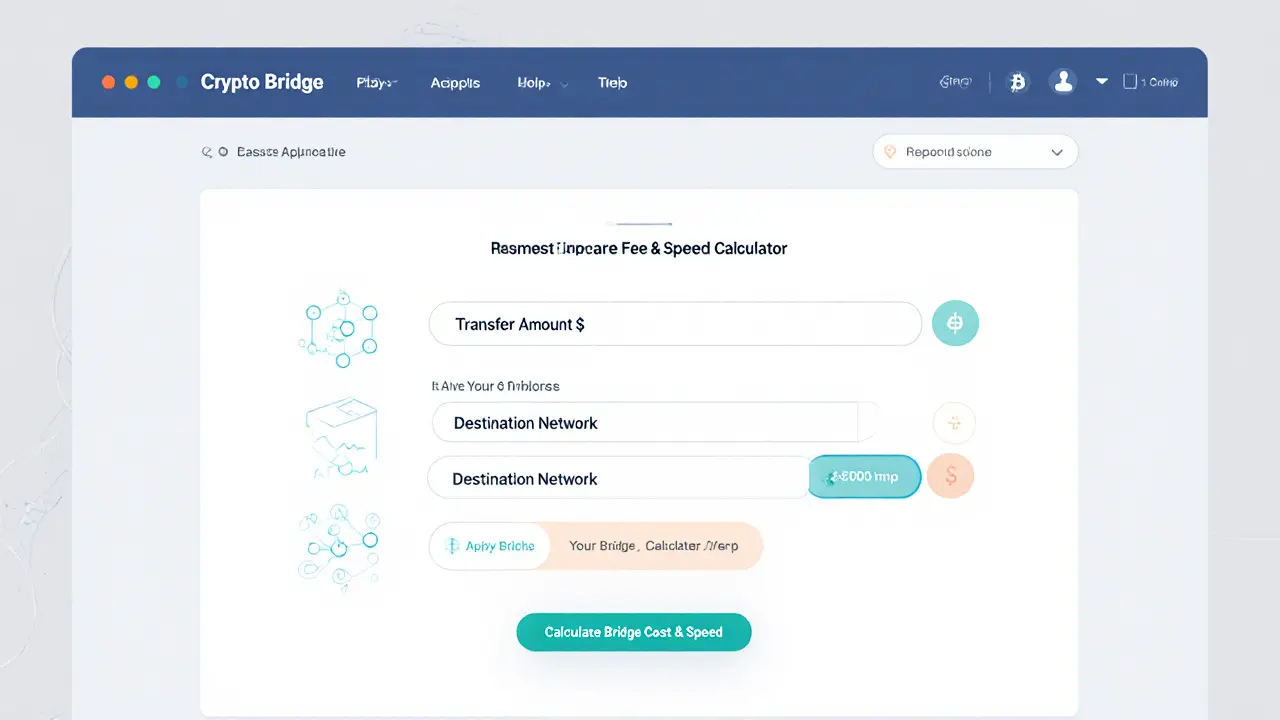

Performance measurement is another practical angle. Most projects publish average transfer times, but those numbers hide variance. Real‑world speed depends on network congestion, validator participation, and even the time of day. Users looking for the fastest routes often compare bridge dashboards, checking metrics like “median confirmation time” and “peak throughput.” Tools that simulate transfers can also forecast speed before you commit funds, letting you pick the path with the lowest expected delay. By staying aware of these metrics, you can avoid surprise delays and plan trades or arbitrage more effectively.

All of this background sets the stage for the articles below. In the list you’ll find deep dives into sidechain mechanics, side‑by‑side bridge comparisons, step‑by‑step guides for configuring fast transfers, and analysis of security‑versus‑speed decisions. Whether you’re a developer fine‑tuning a bridge or a trader chasing the next quick swap, the posts ahead give you the context and actionable tips you need to make informed choices about bridge speed.

Understanding Bridge Fees and Transaction Times for Crypto Transfers

Learn how bridge fees and transaction times vary across crypto bridges, discover fee models, speed differences, security tips, and a practical checklist for cross‑chain transfers.

VIEW MORE