CFTC Crypto Jurisdiction: What It Means for Your Trades

When you trade Bitcoin futures or swap Ethereum options, you’re likely under the watch of the CFTC crypto jurisdiction, the U.S. Commodity Futures Trading Commission’s authority over derivatives and futures markets involving digital assets. Also known as crypto derivatives regulation, it’s the reason some exchanges must verify your identity, limit leverage, or avoid offering certain tokens altogether. But here’s the catch: the CFTC doesn’t control spot trading, stablecoins, or most DeFi protocols. That’s where the SEC steps in—or doesn’t. This gap is why some tokens get listed on U.S. exchanges while others vanish overnight.

The CFTC’s power kicks in when a crypto asset is treated as a commodity, a physical or digital good traded on futures markets, like gold, oil, or Bitcoin. Also known as digital commodity, it’s the legal label that gives the CFTC the right to police manipulation, fraud, and unregistered trading platforms. Bitcoin and Ethereum are officially commodities under their rules. But tokens like SOL or ADA? They’re in a gray zone. The CFTC has gone after exchanges like Binance and KuCoin for offering unregistered futures, but it hasn’t moved on most DeFi apps. Why? Because those platforms don’t hold user funds—they’re code. And code doesn’t answer to regulators the way a company does.

What does this mean for you? If you’re trading BTC or ETH futures on a U.S.-licensed platform like CME, you’re protected by CFTC rules—no hidden fees, no wash trading, and no fake volume. But if you’re using a non-U.S. exchange to trade meme coins or leveraged tokens, you’re outside their reach. That’s not just risky—it’s unregulated. The CFTC has fined companies over $1 billion for violating these rules, but they can’t touch offshore platforms or anonymous traders. That’s why so many crypto projects move operations overseas: to avoid the CFTC’s oversight entirely.

You’ll see this play out in the posts below. Some articles cover how exchanges got shut down for ignoring CFTC rules. Others show how traders use offshore platforms to bypass restrictions. There are deep dives into which tokens fall under commodity status—and which ones slip through. You’ll find real cases: the Binance fines, the KuCoin settlements, the failed attempts to regulate stablecoins. And you’ll see why the CFTC’s jurisdiction is powerful, but incomplete. It’s not about banning crypto. It’s about controlling where the money flows. And right now, a lot of it flows where they can’t follow.

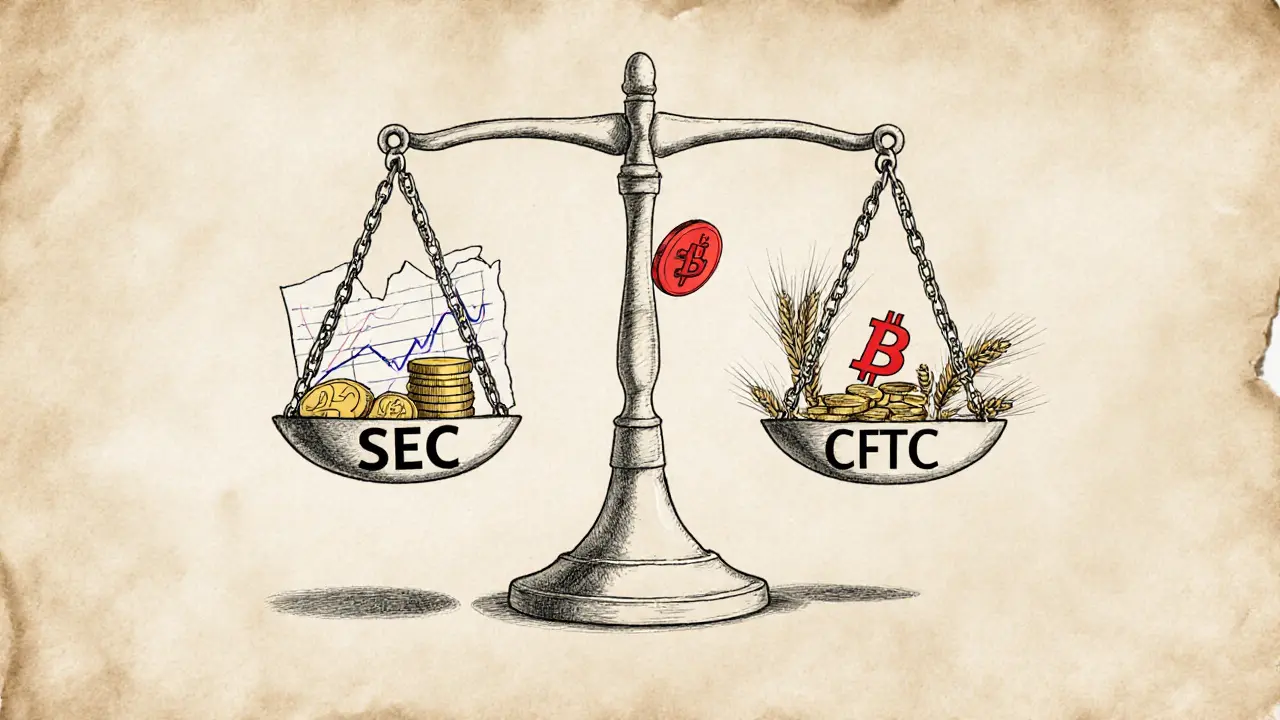

SEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

The SEC and CFTC are fighting over who regulates crypto - securities or commodities. This battle affects Bitcoin, Ethereum, exchanges, and your investments. Here's how it works and why it matters.

VIEW MORE