Compliance Program: Your Blueprint for Regulatory Success

When working with Compliance Program, a structured set of policies, procedures, and controls that ensures an organization meets legal and regulatory requirements. Also known as regulatory compliance framework, it helps manage risk, avoid penalties, and build trust with customers and regulators. A solid compliance program isn’t just paperwork; it’s the living backbone of any business that deals with money, data, or digital assets. In the crypto world, where rules shift fast, having a clear framework means you can respond to new guidance without scrambling. Think of it as a playbook that tells every team member how to stay on the right side of the law while still moving fast. Below we’ll break down the core pieces you need to stitch together a program that actually works.

Why a Robust Compliance Program Matters

The first pillar of any compliance program is Regulatory Compliance, the ongoing process of monitoring and adhering to laws, rules, and standards set by authorities.. This pillar requires continuous tracking of updates from bodies like the SEC, FINTRAC, or the Chinese Ministry of Finance. When you pair regulatory compliance with Anti‑Money‑Laundering (AML), a set of procedures designed to detect and prevent the financing of illegal activities, you create a safety net that stops bad actors before they slip through. Know Your Customer (KYC), the identity verification step that validates who a user really is ties into AML by providing the data needed for transaction monitoring. Together these concepts form the core triple: a compliance program encompasses regulatory compliance, requires AML controls, and mandates KYC verification. Ignoring any of these leads to gaps that regulators love to spot, and those gaps often turn into hefty fines.

Beyond the basics, a well‑rounded compliance program also covers internal audit, risk assessment, and tax reporting. Internal audit enables businesses to test whether policies are being followed and to spot weak spots before an external regulator does. In crypto, tax reporting is a hot topic; filling out IRS Form 8949 correctly, for example, can be the difference between a clean year and a costly audit. By embedding tax‑aware procedures into the compliance framework, firms can automate data capture, reduce manual errors, and keep the tax man happy. Risk assessment tools help prioritize which controls need the most attention, whether it’s monitoring large crypto transfers on a new exchange or checking that an airdrop token complies with securities law. The result is a feedback loop where each component reinforces the others, making the whole program stronger.

The articles below illustrate how these pieces play out in real life. You’ll see how Canada’s first Bitcoin ETF was launched under a strict compliance umbrella, how Thailand’s SEC now demands licensing and reporting from exchanges, and why Russia’s ruble‑crypto restrictions force firms to rethink their internal controls. There are also step‑by‑step guides on filing Form 8949, reviews of exchanges that emphasize security and compliance, and deep dives into airdrop regulations. Whether you’re a trader, an exchange operator, or just curious about how the crypto ecosystem stays in line with the law, this collection gives you actionable insights, concrete examples, and practical checklists to build or improve your own compliance program.

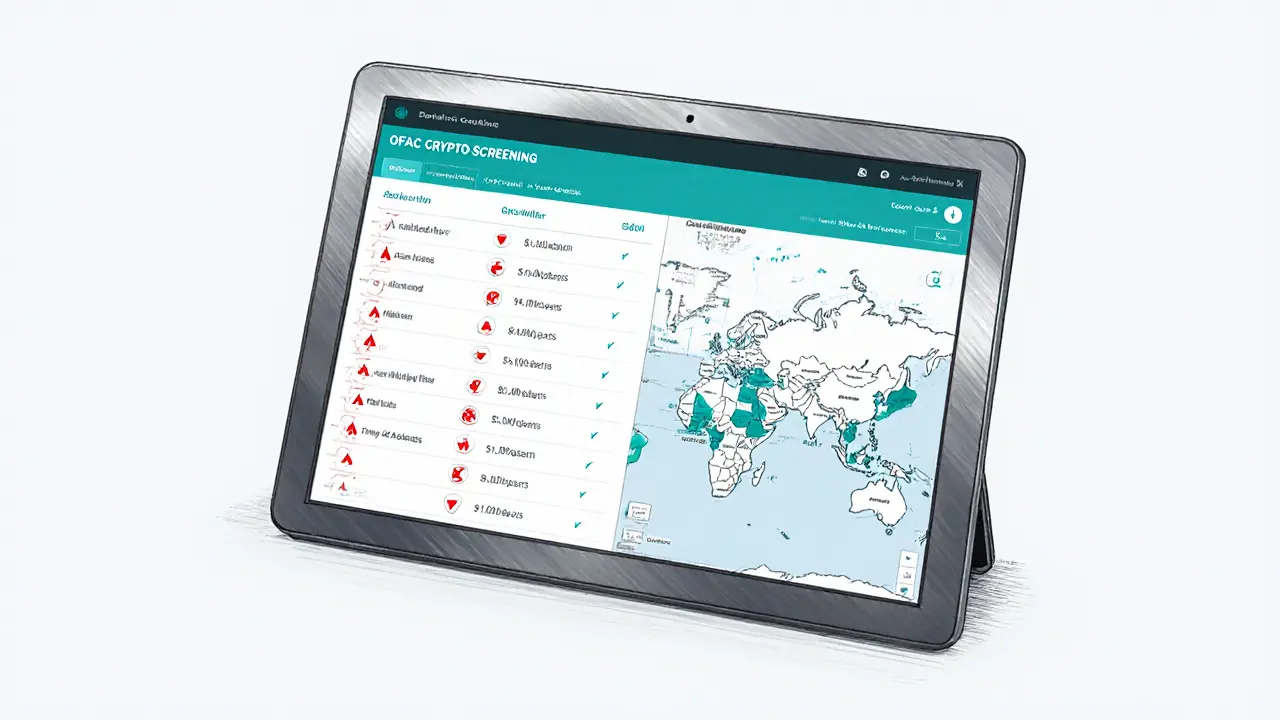

OFAC Cryptocurrency Sanctions: Compliance Guide 2025

Learn how OFAC's cryptocurrency sanctions work, the compliance steps you need, and what recent enforcement cases teach. Get a ready-to-use checklist and future outlook.

VIEW MORE