Cross-Chain Transfers Explained

When working with cross-chain transfers, the movement of assets or data between separate blockchains. Also known as blockchain interoperability, it lets users shift tokens from Ethereum to Binance Smart Chain, move NFTs across layers, or connect private ledgers with public networks. Understanding this process is essential for anyone wanting to maximize liquidity without being locked into a single chain.

Key Building Blocks Behind Cross-Chain Moves

A sidechain, a parallel blockchain that runs alongside a mainnet and is linked via a two-way peg acts as a fast, low‑cost runway for transactions before they settle on the main network. Blockchain bridges, software or smart‑contract systems that lock assets on one chain and mint equivalents on another provide the actual tunnel that moves value across chains. The two-way peg, a mechanism that ensures assets can be locked and released in a 1:1 ratio between chains guarantees that the supply stays consistent, preventing inflation or loss. Together, these components create an ecosystem where cross-chain transfers become a routine part of daily trading, DeFi yield farming, and NFT swapping.

Interoperability protocols like Cosmos IBC or Polkadot's XCMP influence how smooth and secure these transfers are. They define the standards that bridges and sidechains must follow, shaping everything from latency to security guarantees. When you pick a bridge, you’re also choosing the underlying protocol’s risk profile—some rely on centralized validators, others on cryptographic proofs. Knowing the trade‑offs helps you avoid costly mistakes, like locked funds on a bridge that later gets hacked. In practice, users start by selecting a bridge that supports the tokens they need, verify the fees, and check the bridge’s audit status. Then they lock the original asset on the source chain, wait for the bridge to mint the wrapped version, and finally move the wrapped token to the destination chain’s wallet. This flow repeats across countless use cases: moving stablecoins to a low‑fee chain for payments, shifting liquidity to a high‑yield farm, or bridging game assets to new metaverse platforms. The collection below dives deeper into each piece of the puzzle. You’ll find guides on sidechain mechanics, bridge security reviews, two‑way peg implementations, and real‑world examples of cross-chain strategies. Whether you’re a developer building a new bridge or a trader looking for the cheapest route, these articles give you the context and actionable steps you need to make confident cross‑chain moves.

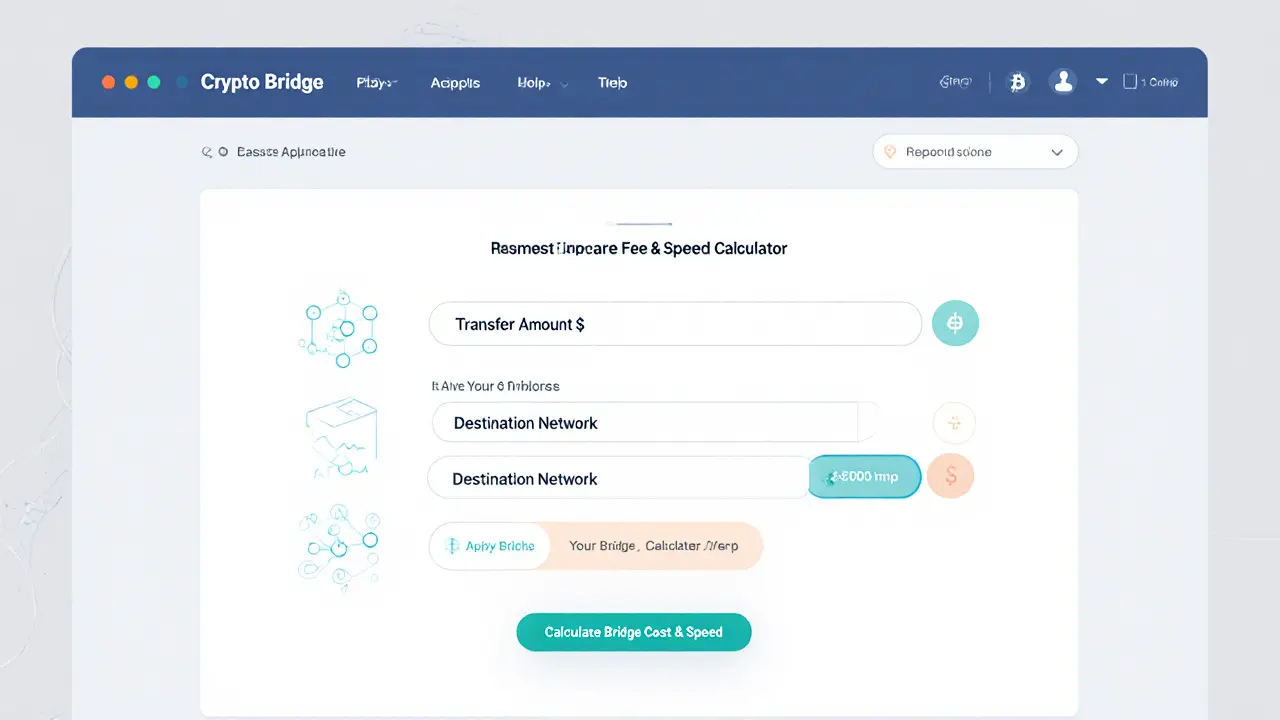

Understanding Bridge Fees and Transaction Times for Crypto Transfers

Learn how bridge fees and transaction times vary across crypto bridges, discover fee models, speed differences, security tips, and a practical checklist for cross‑chain transfers.

VIEW MORE