Crypto Bridges: Connecting Blockchains Seamlessly

When working with Crypto Bridges, technology that lets digital assets move between separate blockchain networks. Also known as cross‑chain bridges, they enable users to trade, lend, or stake assets without staying on a single chain.

At the heart of this ecosystem are sidechains, independent ledgers that run alongside a main chain and exchange data through a bridge. These sidechains give projects a sandbox for faster, cheaper transactions while still anchoring to the security of the mainnet. crypto bridges also rely on a two‑way peg, a lock‑mint or burn‑release mechanism that keeps asset supply balanced across chains. In short, crypto bridges encompass sidechains, require two‑way pegs, and make cross‑chain transfers possible.

Security is the biggest concern when moving value across borders. A well‑designed bridge monitors validator signatures, enforces timeout periods, and runs audits to prevent hacks. The blockchain interoperability, the capability of distinct ledgers to exchange data and value reliably you see in projects like Leonicorn Swap or Glide Finance often hinges on how tightly the bridge’s code matches the underlying consensus rules. Any mismatch can create a vector for attackers, as seen in several high‑profile bridge failures.

Why Crypto Bridges Matter for Real‑World Use

From DeFi lending platforms that need to pull collateral from multiple chains to NFT marketplaces that want to showcase art from both Ethereum and Binance Smart Chain, bridges unlock new business models. Traders can arbitrage price gaps across exchanges without converting back to fiat, while developers can build multi‑chain games that let players move assets freely. The flexibility also helps regulators track cross‑border flows, because a bridge’s transaction logs provide a single point of observation for otherwise siloed activity.

Our collection below covers the most relevant angles: how to choose a secure bridge, the mechanics behind two‑way pegs, the role of sidechains in scaling, and the impact of interoperability on emerging sectors like AI tokens and modular blockchains. Whether you’re a beginner looking for a plain‑English guide or a seasoned trader hunting the next arbitrage opportunity, the articles ahead give actionable steps and deep insights into the world of crypto bridges.

Ready to dive deeper? Explore the posts to see practical examples, security checklists, and step‑by‑step tutorials that will help you navigate the bridge landscape with confidence.

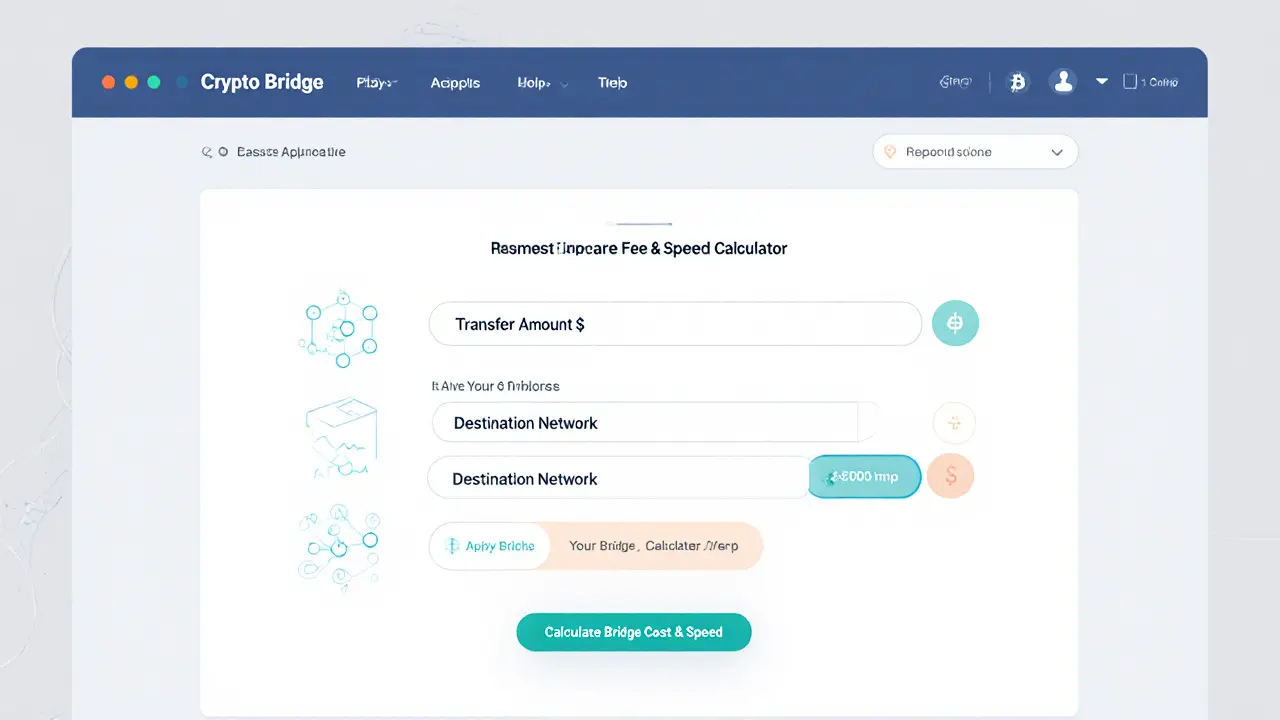

Understanding Bridge Fees and Transaction Times for Crypto Transfers

Learn how bridge fees and transaction times vary across crypto bridges, discover fee models, speed differences, security tips, and a practical checklist for cross‑chain transfers.

VIEW MORE