Crypto Compliance: Navigating Rules, Regulations, and Best Practices

When dealing with crypto compliance, the process of meeting legal and regulatory standards for digital‑asset activities, traders, developers, and exchanges must understand several moving parts. Regulation, government‑issued rules that define what is allowed in the crypto space sets the baseline, while Anti‑Money Laundering (AML), procedures designed to prevent illicit fund flows and Know Your Customer (KYC), identity‑verification steps for users are the operational tools that turn policy into practice. In short, crypto compliance encompasses regulation, requires AML checks, and depends on KYC to verify participants. These three pillars shape how exchanges list tokens, how investors move money, and how governments enforce sanctions. For example, a Chinese exchange that follows local regulation will block fiat‑to‑crypto routes that lack proper KYC, while a Russian platform may need to report large trades to satisfy AML obligations.

Key Areas Shaping Crypto Compliance

Beyond the core trio, tax compliance and licensing add another layer of complexity. Many jurisdictions treat crypto gains as taxable events, so crypto taxation, the legal duty to report and pay tax on digital‑asset transactions becomes a mandatory checklist for traders. At the same time, exchange licenses—whether a Singapore money‑service‑business licence or a European crypto‑asset service provider (CASP) registration—determine who can legally operate and what consumer protections are required. These licensing regimes influence the design of AML and KYC workflows, because a licensed exchange must prove it can spot suspicious activity and verify user identities.

Regulatory bodies also shape market behavior through sanctions and blacklist lists. When the U.S. Treasury adds a wallet address to its sanctions list, compliant platforms must freeze the assets, illustrating how sanctions compliance, adherence to international embargoes and watch‑lists directly impacts daily operations. Meanwhile, emerging concepts like "green compliance"—verifying that mining operations meet environmental standards—are beginning to intersect with traditional AML/KYC checks, especially for proof‑of‑work networks where energy use is under scrutiny.

All these pieces—regulation, AML, KYC, tax, licensing, sanctions, and even sustainability—form an interconnected web that defines what it means to stay compliant in the crypto world. Below you’ll find a curated set of guides, reviews, and deep‑dives that break down each facet, from how China’s fiat‑to‑crypto rules work to practical steps for switching mining pools safely. Whether you’re a beginner looking for a plain‑English overview or an experienced trader needing the latest compliance updates, the articles ahead give you actionable insights to navigate the ever‑changing landscape of crypto compliance.

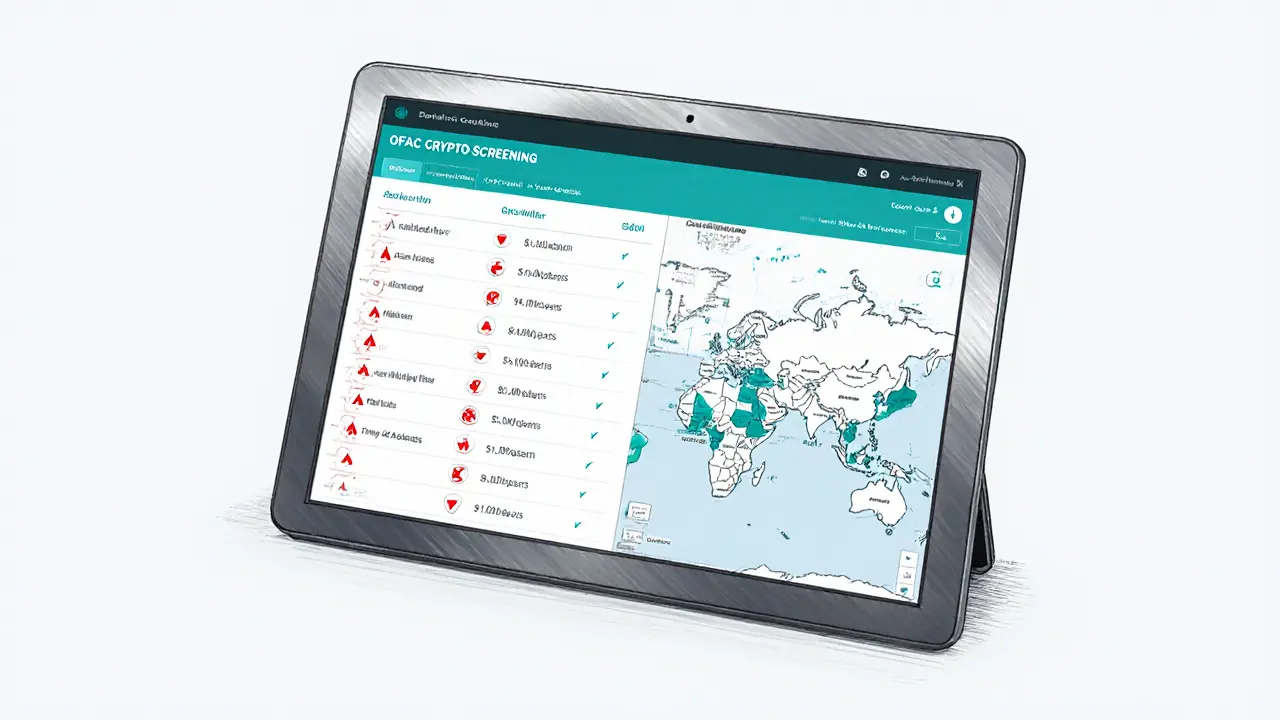

OFAC Cryptocurrency Sanctions: Compliance Guide 2025

Learn how OFAC's cryptocurrency sanctions work, the compliance steps you need, and what recent enforcement cases teach. Get a ready-to-use checklist and future outlook.

VIEW MOREThailand SEC Crypto Exchange Regulations 2025: What You Need to Know

A clear guide to Thailand SEC crypto exchange regulations in 2025, covering licensing steps, prohibited assets, impact on local and foreign platforms, and compliance checklist.

VIEW MORE