Crypto Legal Battle: What’s at Stake in Today’s Regulatory Wars

When you hear crypto legal battle, a growing clash between cryptocurrency projects and government regulators over legality, compliance, and consumer protection. Also known as digital asset regulation, it’s not just about rules—it’s about whether your favorite tokens can survive without being shut down. This isn’t theoretical. In 2023, Binance got hit with a $4.3 billion fine. Kujira Fin vanished from major exchanges. SafeLaunch SFEX trades at $0 because no one trusts it anymore. These aren’t accidents—they’re the result of legal pressure.

The crypto scams, fraudulent projects that promise free tokens or guaranteed returns but disappear after collecting user funds thrive in the gray zones of regulation. Look at GDOGE or Zeus (ZEUS)—both got listed on CoinMarketCap with flashy claims, then collapsed when regulators took notice. The same pattern shows up in fake airdrops like BSW or TopGoal GOAL. No official drop? That’s not a glitch. It’s a red flag regulators are watching. And when a project has no team, no whitepaper, or no real product—like W Coin (WCO) or Degen Forest (MOOLA)—it’s not just risky. It’s legally exposed.

Meanwhile, blockchain law, the legal framework governing decentralized networks, smart contracts, and token sales is changing fast. El Salvador’s Bitcoin experiment failed because it ignored financial oversight. China’s ban didn’t kill P2P trading—it just pushed it underground, where users face real legal danger. Even legitimate tools like ZKSwap or TokenSets walk a tightrope: they’re not exchanges, but regulators still question their structure. The crypto legal battle isn’t about stopping innovation. It’s about forcing projects to prove they’re not gambling dens disguised as tech.

What you’ll find below isn’t a list of headlines. It’s a map of what happens when regulation catches up. From 51% attacks that expose weak blockchains to P2P platforms that skirt bans, every post here shows how legal pressure shapes the real-world value—and survival—of crypto projects. You’ll see which tokens got crushed, which exchanges got exposed, and why the ones still standing had to play by new rules. No fluff. Just what’s real, what’s gone, and what’s still hanging by a thread.

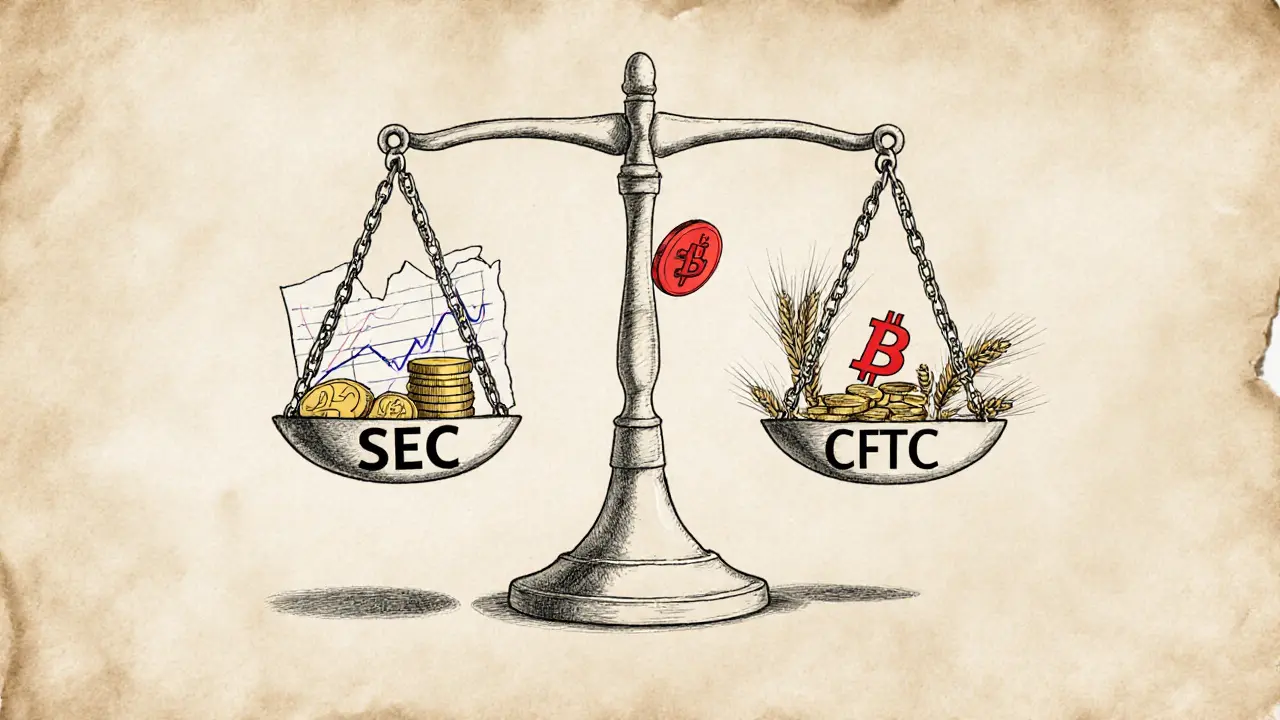

SEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

The SEC and CFTC are fighting over who regulates crypto - securities or commodities. This battle affects Bitcoin, Ethereum, exchanges, and your investments. Here's how it works and why it matters.

VIEW MORE