Crypto Lending Benefits

When exploring crypto lending benefits, the advantages you can gain by loaning out digital assets, such as higher returns, flexible access to cash, and portfolio diversification. Also known as crypto loan perks, this concept links directly to crypto lending, the practice of providing loans against cryptocurrency collateral and the broader ecosystem of DeFi platforms, decentralized services that enable peer‑to‑peer lending without banks. In simple terms, crypto lending benefits encompass higher yields, instant liquidity, and risk‑managed exposure.

Key Advantages of Crypto Lending

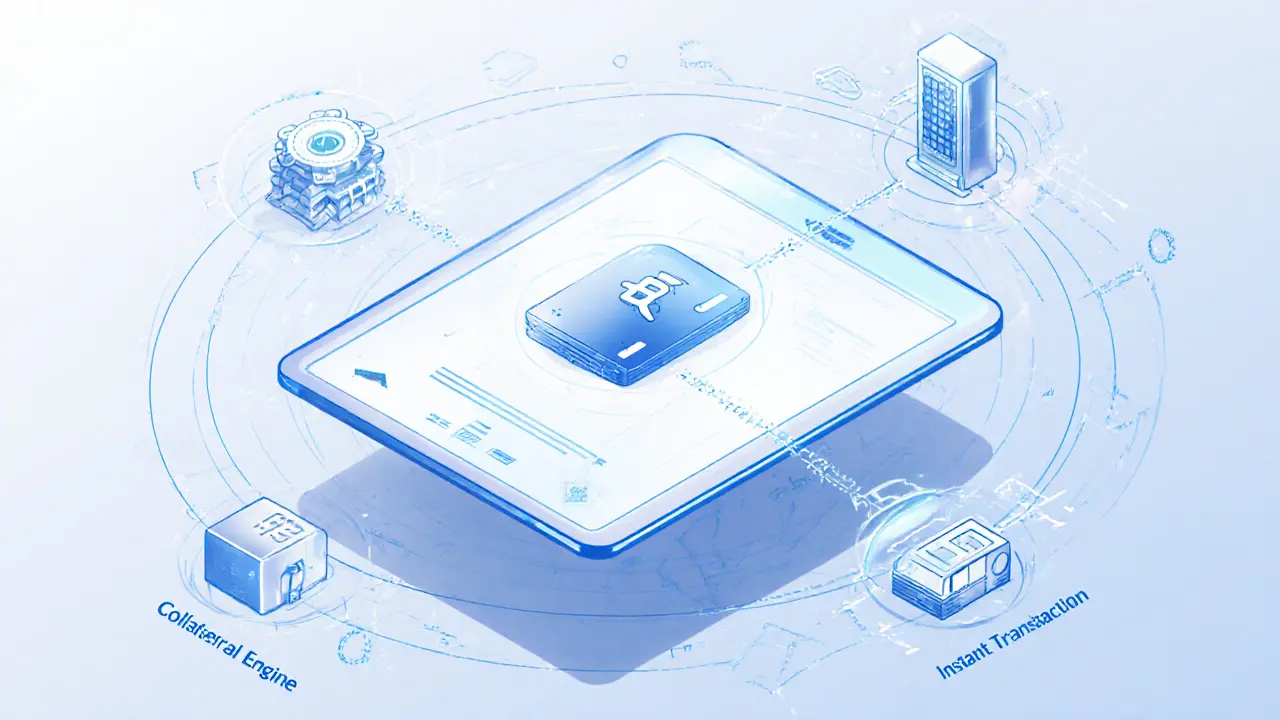

One major benefit is the ability to earn interest rates that often surpass traditional savings accounts. This happens because lenders can set rates based on market demand, and borrowers lock up assets as collateralized loans, loans secured by crypto holdings, reducing default risk. The relationship is clear: higher collateral quality enables lenders to offer competitive rates, while borrowers gain quick cash without selling their positions. DeFi platforms like Aave or Compound make this process automatic, allowing users to deposit assets, set rates, and watch earnings compound daily.

Another advantage is portfolio flexibility. You can keep your crypto exposure for upside potential while still pulling out funds for everyday needs. This dual‑use model means you don’t have to choose between holding or spending—you simply lock assets and tap the loan whenever required. Risk management tools, such as automated liquidation triggers, ensure that if market prices tumble, the loan is repaid via the collateral, protecting lenders. Consequently, crypto lending benefits create a symbiotic loop: lenders earn stable returns, borrowers retain market exposure, and the DeFi infrastructure maintains security.

Below you’ll find a curated list of articles that dig deeper into each of these points—guides on choosing the right platform, calculating effective interest, and safeguarding your collateral. Whether you’re a beginner looking to test the waters or a seasoned trader aiming to maximize yield, the posts that follow break down the practical steps you need to take advantage of crypto lending benefits.

Why DeFi Lending Beats Traditional Loans: Top Benefits Explained

Explore how DeFi lending offers higher yields, full fund control, and innovative tools like flash loans, while comparing risks and benefits against traditional loans.

VIEW MORE