Why DeFi Lending Beats Traditional Loans: Top Benefits Explained

DeFi vs Traditional Loans Comparison Tool

DeFi Lending

Blockchain-based lending with smart contracts, no intermediaries, and global accessibility.

BenefitsTraditional Loans

Bank-based credit products requiring credit checks and custodial arrangements.

Traditional Model| Feature | DeFi Lending | Traditional Loans |

|---|---|---|

| Intermediary | Smart contracts (automated) | Bank or credit union |

| Access Requirement | Internet connection & crypto wallet | Credit check, ID verification, residency |

| Control of Funds | User retains custody until approved transaction | Custodial - bank holds funds |

| Interest Rates | Variable, often 5-20%+ depending on pool | Fixed or variable, usually 1-10% for consumers |

| Collateral Type | Crypto assets, typically over-collateralized | Credit assessment, sometimes property or vehicle |

| Speed of Disbursement | Seconds to minutes (block confirmations) | Days to weeks |

| Advanced Features | Flash loans, yield farming, composable dApps | None |

| Regulatory Protection | None official; risk managed by code audits | Deposit insurance, consumer protection laws |

Estimate your risk level based on your experience with DeFi and crypto assets:

Risk Analysis Result

Key Takeaways

- DeFi lending lets you keep full control of your funds and access services with just an internet connection.

- Higher potential yields come from crypto‑based interest rates and yield‑farming strategies.

- Automation via smart contracts trims processing time and removes middlemen.

- Features like flash loans and composable dApps give you tools you won’t find in a bank.

- Risks include market volatility, code bugs, and an evolving regulatory landscape.

When you hear the term DeFi lending, picture a financial system that runs on code, not paperwork. It’s a world where you loan or borrow crypto assets directly from a smart contract, skipping banks, credit checks, and endless forms. Below we break down why that model is shaping up to be a serious alternative to a traditional loan.

What is DeFi Lending?

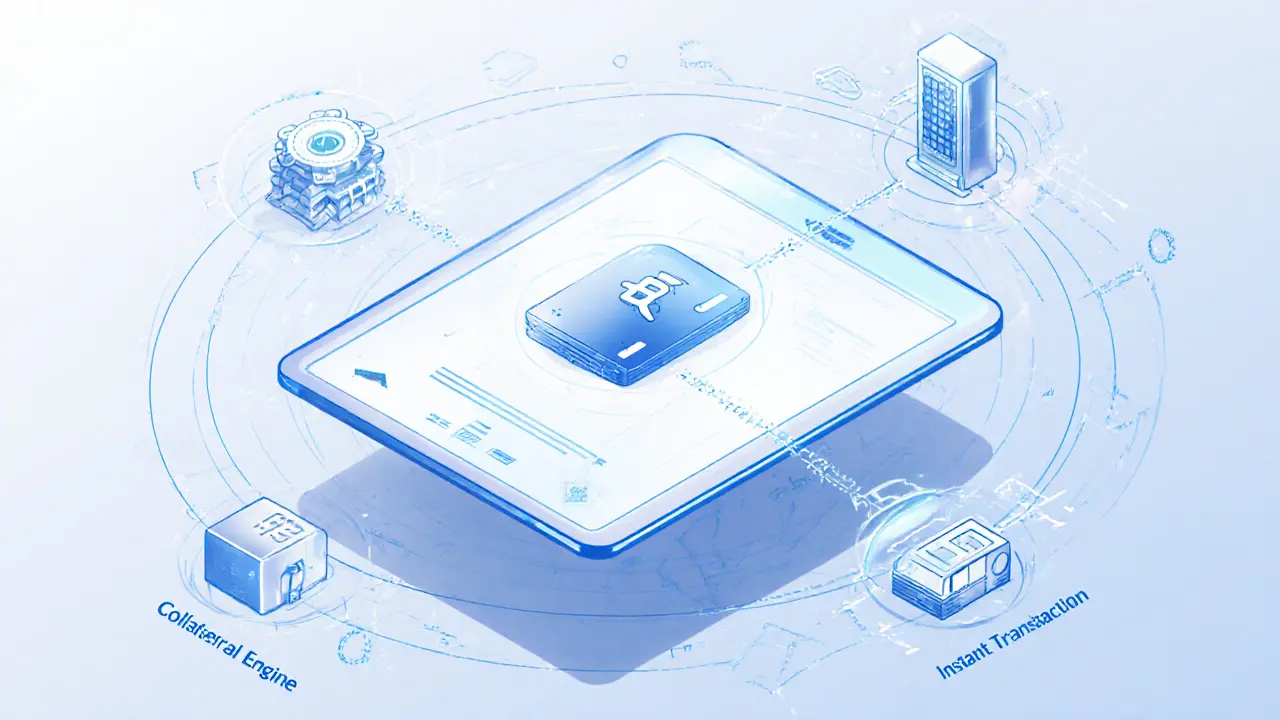

DeFi lending is a blockchain‑based lending ecosystem that uses self‑executing smart contracts to match lenders with borrowers without intermediaries. The contracts enforce interest rates, collateral requirements, and repayment schedules automatically.

In contrast, traditional loans are credit products offered by banks or other financial institutions that rely on credit assessments, paperwork, and human processing. Those loans often require a lengthy approval process, and the borrower cedes control of the funds to the lender until the debt is repaid.

Full Control and Global Accessibility

With DeFi, the only prerequisite is an internet connection and a crypto wallet. Your assets never leave the wallet unless you approve a transaction. This contrasts sharply with the traditional model, where you hand over cash to a bank, which then holds it in a custodial account.

Because the protocol lives on a public ledger, anyone-whether in Nairobi, Buenos Aires, or a remote village-can access the same lending pools. No credit score, no residency check, just a public address and enough collateral.

Flexibility and Interoperability

DeFi platforms are built as composable smart contracts that can be linked together like Lego bricks. Want to switch from one interface to another? Just connect a new dApp front‑end to the same contract. Want to add a new feature, say automated liquidations? Developers can fork the code and improve it without seeking permission from a central authority.

Traditional loans don’t offer that. Banks roll out a single product, and any change requires regulatory approval, internal reviews, and often a new set of forms for the customer.

Higher Yields and the Search for Yield

During low‑interest‑rate cycles, the Bank for International Settlements (BIS) found that users flock to DeFi pools hoping for better returns. On platforms like Aave a leading DeFi lending protocol for crypto assets, liquidity providers earn interest that can dwarf the 0.5‑2% you’d see in a savings account.

Yield isn’t just passive interest. By supplying assets to a pool and then redeploying the earned tokens into other protocols (a practice known as yield farming strategic reinvestment across DeFi apps to boost returns), borrowers can compound earnings far beyond traditional banking products.

Advanced Features Unavailable in Traditional Banking

Two standout tools illustrate DeFi’s edge:

- Flash loans instant, uncollateralized loans that must be repaid within a single blockchain transaction. They’re used for arbitrage, self‑liquidation, or complex collateral swaps-something you’ll never see on a bank’s loan menu.

- Yield farming (see above) integrates with other DeFi protocols, letting you earn extra tokens on top of the interest you already collect.

These instruments are programmable, highly composable, and open to anyone who can write or interact with the code.

Risk Profile and Regulatory Landscape

DeFi’s lack of centralized oversight means there’s no FDIC‑type insurance protecting your deposits. You’re dependent on the correctness of the contract code and the stability of the underlying crypto assets. Market volatility can trigger rapid liquidations if collateral value drops below required ratios.

Regulators are still catching up. While traditional banks must obtain state or federal charters and meet capital‑adequacy standards, DeFi platforms operate under a “code‑is‑law” model. That offers speed and innovation, but also leaves users exposed to legal uncertainty and potential enforcement actions.

Side‑by‑Side Comparison

| Feature | DeFi Lending | Traditional Loans |

|---|---|---|

| Intermediary | None-smart contracts execute automatically | Bank or credit union |

| Access Requirement | Internet connection & crypto wallet | Credit check, ID verification, residency |

| Control of Funds | User retains custody until they approve a transaction | Custodial - bank holds funds |

| Interest Rates | Variable, often 5‑20%+ depending on pool | Fixed or variable, usually 1‑10% for consumers |

| Collateral Type | Crypto assets, typically over‑collateralized | Credit assessment, sometimes property or vehicle |

| Speed of Disbursement | Seconds to minutes (block confirmations) | Days to weeks |

| Advanced Features | Flash loans, yield farming, composable dApps | None |

| Regulatory Protection | None official; risk managed by code audits | Deposit insurance, consumer protection laws |

Practical Tips for Getting Started

- Choose a reputable platform. Look for audits, community size, and total value locked (TVL) - Aave, Compound, and Maker are among the most established.

- Set up a non‑custodial wallet (e.g., MetaMask or Trust Wallet). Keep your seed phrase offline.

- Start with a modest amount of crypto you can afford to lose. Test the deposit and withdraw flow.

- Understand collateral ratios. Most pools require 150‑200% over‑collateralization to protect against price swings.

- Consider using a hardware wallet for larger positions to reduce hacking risk.

Future Outlook

The DeFi market surged to over $80billion in total value locked in 2021 and continues to grow despite regulatory chatter. As more institutional players enter, we can expect tighter integration with traditional finance (e.g., crypto‑backed loans for real‑world purchases) while retaining the core benefits of control, yield, and innovation.

Frequently Asked Questions

Can I lose my crypto if the smart contract has a bug?

Yes. Smart contracts are immutable once deployed. If a vulnerability is discovered, attackers can drain funds. That’s why using audited platforms and limiting exposure is crucial.

Do I need a credit check to borrow on DeFi?

No. Borrowing is permissionless as long as you provide enough crypto collateral. The system relies on over‑collateralization, not credit scores.

What is a flash loan and who should use it?

A flash loan is an uncollateralized loan that must be repaid within a single blockchain transaction. It’s mainly for developers and traders who need instant liquidity for arbitrage or complex contract interactions.

How does yield farming boost returns?

Yield farming moves earned tokens into other DeFi protocols that offer additional incentives (often their own native token). By stacking incentives, you can compound returns far above the base interest rate.

Is DeFi lending regulated?

Regulation is still evolving. Most platforms operate without a formal banking license, relying on the jurisdiction‑free nature of blockchain. Users should stay aware of local laws and potential future compliance requirements.

Rob Watts

July 8, 2025 AT 02:41DeFi lending lets you lock up crypto and watch the funds move in seconds.

Alex Gatti

July 9, 2025 AT 20:21Ever considered that smart contracts cut out the middleman and save you fees? It opens doors for anyone with internet access.

John Corey Turner

July 11, 2025 AT 14:01DeFi lending offers unparalleled speed, letting borrowers access capital in seconds rather than days.

By using smart contracts, the process eliminates the need for manual paperwork and human approval.

This automation reduces operational costs, which can translate into more competitive interest rates for users.

The global nature of blockchain means that geographical boundaries no longer restrict who can lend or borrow.

Anyone with an internet connection and a crypto wallet can participate, democratizing access to credit.

Over‑collateralization protects lenders from market volatility while still allowing borrowers to leverage their assets.

Advanced features such as flash loans enable arbitrage opportunities that were impossible in traditional finance.

Yield farming can complement borrowing activities, allowing users to earn passive income on idle collateral.

However, the lack of regulatory oversight introduces unique risks that participants must understand.

Smart contract bugs or exploits can lead to total loss of funds, underscoring the importance of code audits.

Users should diversify across multiple protocols to mitigate platform‑specific failures.

The composability of DeFi primitives encourages innovative financial products that adapt to market needs.

As the ecosystem matures, we see the emergence of insurance schemes that cushion against unexpected events.

Despite these advancements, volatility in crypto asset prices can still impact loan stability.

Educating borrowers about risk management remains a cornerstone for sustainable growth.

Ultimately, DeFi lending represents a paradigm shift that challenges the very foundations of conventional banking.

Eva Lee

July 13, 2025 AT 07:41Leveraging decentralized liquidity pools you can achieve sub‑second settlement times, which is a paradigm shift compared to traditional banking’s batch processing cycles. The protocol’s algorithmic risk parameters dynamically adjust collateralization ratios, thereby mitigating systemic exposure.

Adarsh Menon

July 15, 2025 AT 01:21Oh great, another “revolutionary” DeFi thing that’ll probably crash tomorrow.

Promise Usoh

July 16, 2025 AT 19:01In the broader macroeconomic context, the advent of permissionless lending platforms could democratise access to capital, albeit with heightened volatility.

Tyrone Tubero

July 18, 2025 AT 12:41Only the truly enlightened can appreciate the elegance of composable finance, while the masses remain shackled to legacy credit scores.

Cathy Ruff

July 20, 2025 AT 06:21DeFi is just a hype bubble and you’re all blind followers.

Marc Addington

July 22, 2025 AT 00:01America can’t afford foreign crypto schemes.

Scott McReynolds

July 23, 2025 AT 17:41What excites me most about DeFi is the empowerment of individuals who were previously excluded from credit markets. By removing gatekeepers, borrowers can negotiate terms directly with lenders, fostering a more efficient ecosystem. The transparency of blockchain also builds trust that traditional institutions often lack. Moreover, the ability to earn yields on idle assets adds a new dimension to personal finance. As the technology matures, we’ll likely see even more innovative products emerge.

Kimberly Kempken

July 25, 2025 AT 11:21While everyone praises DeFi’s decentralization, the reality is that code is controlled by a handful of developers who dictate the rules.

Laurie Kathiari

July 27, 2025 AT 05:01It’s amusing how some people claim DeFi is risk‑free when the only safety net is a smart contract audit that can never cover every edge case.

Bhagwat Sen

July 28, 2025 AT 22:41Listen up, the real power of DeFi lies in its composability – you can stack flash loans, yield farms, and token swaps all in one transaction.

Amy Harrison

July 30, 2025 AT 16:21DeFi is like the coffee of finance – it wakes you up and keeps you going! ☕️🚀

Natalie Rawley

August 1, 2025 AT 10:01Let me break it down for you: traditional loans take weeks because they’re stuck in bureaucracy, whereas DeFi is instant because it lives on code that never sleeps.

Katherine Sparks

August 3, 2025 AT 03:41In conclusion, the shift towards decentralized lending represents a significant evolution in financial services, and I encourage all participants to conduct thorough due diligence before engaging. 😊

stephanie lauman

August 4, 2025 AT 21:21The mainstream narrative about DeFi’s benefits is a front for a coordinated effort to destabilise fiat economies, orchestrated by shadowy technocrats.

Kortney Williams

August 6, 2025 AT 15:01I appreciate the community’s effort to share knowledge about risk assessment tools; they really help newcomers navigate the space responsibly.

Cynthia Rice

August 8, 2025 AT 08:41DeFi isn’t magic, it’s code.

Shaian Rawlins

August 10, 2025 AT 02:21While I see where the frustration comes from, dismissing the entire ecosystem overlooks the genuine utility it provides to underserved borrowers. The transparency of blockchain transactions offers a level of auditability that traditional banks rarely achieve. Moreover, many protocols have instituted insurance funds to mitigate smart‑contract risks. It’s not a perfect system, but it’s evolving faster than legacy finance ever could. Keeping an open mind helps us shape better financial tools for everyone.