Crypto Remittances and the Taliban

When working with crypto remittances, digital transfers that use blockchain to move money across borders without traditional banks. Also known as crypto cross‑border payments, they have become a quick lifeline for people in regions where banks are scarce.

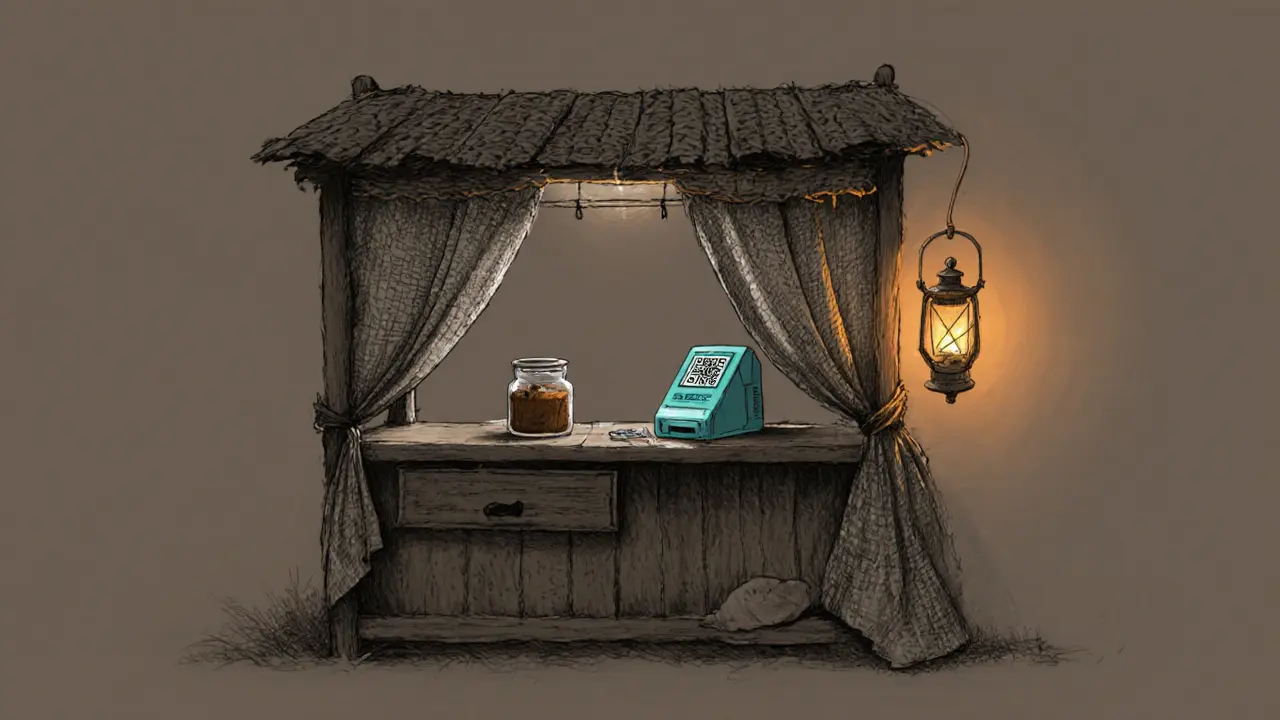

The Taliban, the de‑facto governing authority in Afghanistan since 2021 has taken a cautious stance on crypto activity. While the group claims to allow private use, official statements often restrict public exchanges and ban large‑scale trading platforms. This creates a paradox: the need for fast money flows exists, yet the regime’s policies limit legal channels. As a result, many Afghans turn to informal networks, which drives underground crypto premiums, the price gaps that appear when official markets are blocked. These premiums can reach double‑digit percentages, turning everyday remittances into costly ventures.

Internationally, OFAC sanctions, U.S. Treasury measures that freeze assets and prohibit dealings with designated parties add another layer of complexity. Any crypto wallet linked to a sanctioned entity triggers compliance alerts, forcing exchanges to freeze accounts. For users trying to send money to families under Taliban rule, this means their transactions may be delayed or rejected if they pass through a sanctioned gateway. The interplay between sanctions and local restrictions pushes users toward peer‑to‑peer services that operate outside conventional monitoring.

What to Expect When Sending Crypto to Taliban‑Controlled Areas

Understanding these dynamics helps you plan smarter moves. First, choose a blockchain with low fees and fast confirmations—Ethereum’s high gas costs can make small remittances expensive, while networks like Solana or Polygon keep the price down. Second, verify that the receiving wallet isn’t tied to a sanctioned address; tools that scan blockchain activity can spot red flags before you send. Third, be aware that even seemingly private transfers may attract underground premiums, especially if you rely on informal brokers. By accounting for the Taliban’s regulatory climate, OFAC’s enforcement, and the hidden cost of underground markets, you can reduce risk and keep more of the money flowing to the intended recipients.

Below you’ll find a curated selection of articles that dive deeper into each of these topics—from detailed exchange reviews to guides on navigating sanctions and mitigating underground premiums. Use them to sharpen your strategy and stay ahead of the ever‑changing crypto remittance landscape.

How Underground Crypto Trading Survives Under the Taliban’s Crypto Ban

Explore how Afghan crypto traders survive the Taliban's ban, using Bitcoin, USDT, and hidden networks to move money despite arrests and internet blackouts.

VIEW MORE