Crypto Securities: What They Are and Why Most Are High-Risk Gambles

When people say crypto securities, digital assets that function like stocks but lack regulatory oversight. Also known as tokenized securities, they're often sold as investments with promises of returns, dividends, or ownership stakes—but most never deliver. Unlike real stocks backed by companies, many crypto securities are just tokens built on blockchains with no legal structure, no audits, and no accountability. They look like investments, but they behave like lottery tickets—with the odds stacked against you.

These tokens often get confused with utility tokens or meme coins, but the difference matters. A DeFi token, a cryptocurrency designed to power decentralized finance protocols like KUJI or MOOLA might promise yield, but if there’s no working product, no team, and no liquidity, it’s not finance—it’s speculation. Meanwhile, cryptocurrency scams, fraudulent projects that trick users into buying worthless tokens with fake promises like GDOGE or SFEX thrive by mimicking legitimate offerings. They get listed on CoinMarketCap, run fake airdrops, and vanish when the hype dies. The SEC has warned about this pattern: if a token promises profit based on others’ efforts, it’s a security—and if it’s not registered, it’s illegal.

What you’ll find here aren’t investment tips. They’re real stories of what happens when crypto projects fail. You’ll read about tokens that vanished after a listing, exchanges that disappeared overnight, and airdrops that turned into wallet-draining traps. These aren’t edge cases—they’re the norm. If you’re holding a token with no team, no whitepaper, and no trading volume, you’re not investing. You’re gambling. And the house always wins.

Below, you’ll see exactly how these crypto securities are built, how they fool people, and why most of them are dead on arrival. No fluff. No hype. Just what actually happened—and what you should do next.

SEC Howey Test for Cryptocurrency: What It Is and How It Affects Digital Assets

The SEC's Howey Test determines whether cryptocurrency tokens are securities. Learn how it works, why Bitcoin is exempt, and how it's affecting crypto projects, investors, and regulators in 2025.

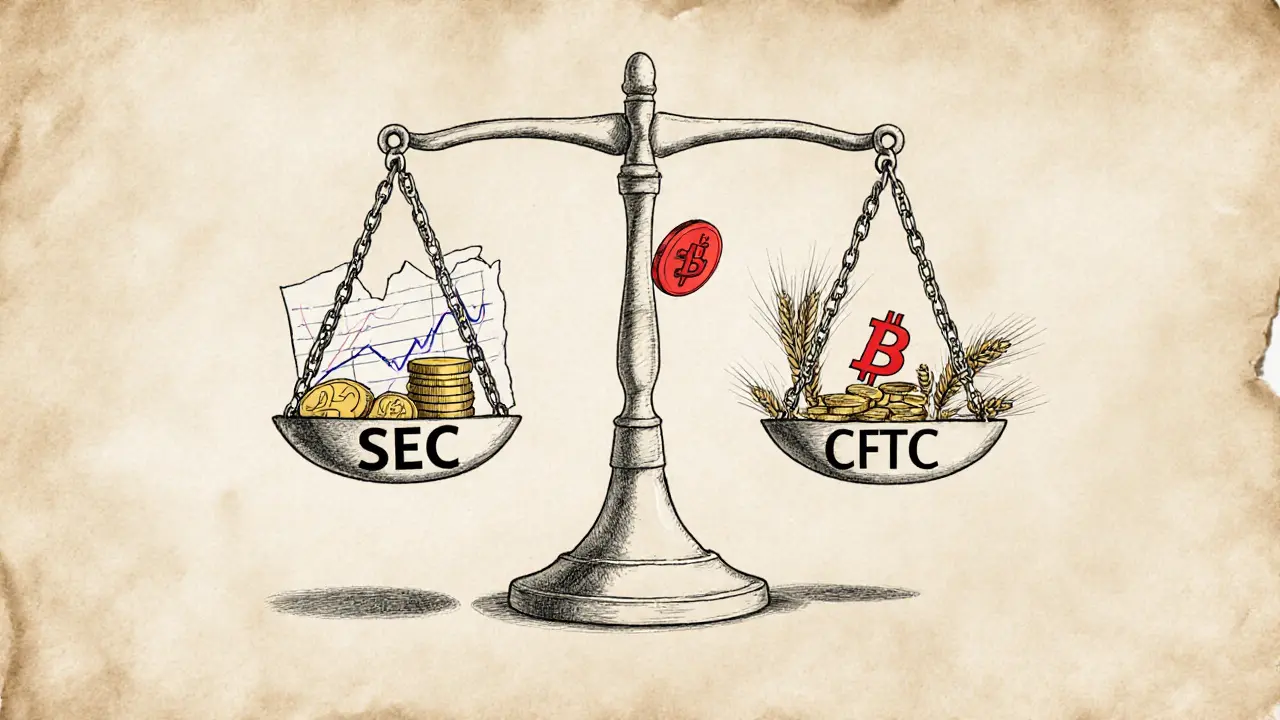

VIEW MORESEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

The SEC and CFTC are fighting over who regulates crypto - securities or commodities. This battle affects Bitcoin, Ethereum, exchanges, and your investments. Here's how it works and why it matters.

VIEW MORE