DeFi Lending

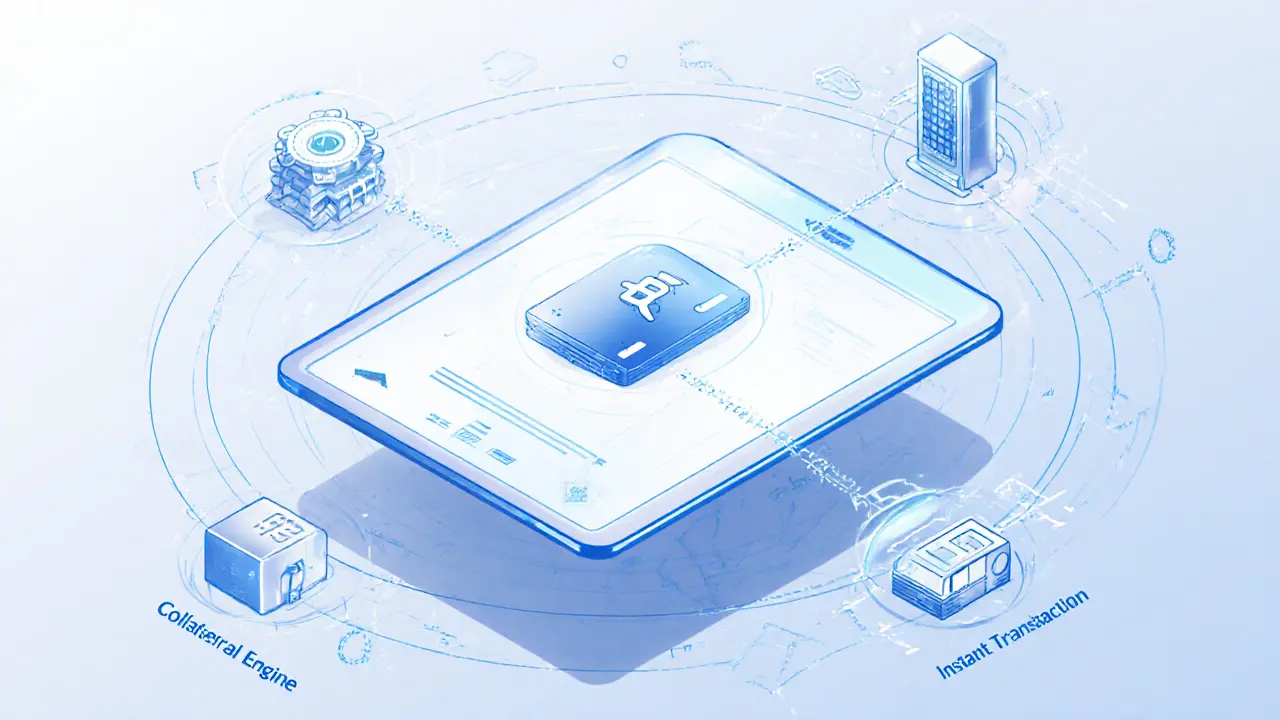

When working with DeFi lending, the practice of borrowing and lending crypto assets without a traditional bank, using blockchain protocols. Also known as Decentralized Finance lending, it relies on Liquidity pools, shared reserves that let lenders deposit assets and borrowers pull funds automatically, Collateralization, the process of locking up crypto as security for a loan, usually over‑collateralized to protect lenders, Smart contracts, self‑executing code that enforces loan terms, interest rates, and repayments without human intervention, and Yield farming, strategies that move assets across pools to capture the highest returns. In short, DeFi lending encompasses these building blocks, requires trustless automation, and is influenced by market volatility and token economics.

Why DeFi lending matters today

Traditional banks charge fees and set strict credit checks, but DeFi lending opens the market to anyone with an internet connection. DeFi lending lets you earn interest on idle crypto, borrow without selling, and diversify income streams. Platforms like Aave, Compound, and Maker use the same smart‑contract engine to calculate rates in real time, so borrowers pay what the market dictates while lenders capture excess yields. The underlying liquidity pools grow as more participants add assets, creating a network effect that lowers borrowing costs. Meanwhile, collateralization rules keep the system solvent, even when prices swing wildly, and yield‑farming tactics let power users chase higher APYs by shifting assets between protocols.

Risk management is a core part of the ecosystem. Because loans are over‑collateralized, a sudden drop in the value of the pledged asset can trigger liquidations—automated sales that protect lenders but can wipe out borrower positions. Smart contracts are immutable once deployed, so any bug or exploit can jeopardize funds across the entire pool. That’s why many projects run audits, offer insurance funds, and provide dashboards that track health metrics like collateral ratios and liquidation thresholds. Understanding these safeguards helps you decide which pools match your risk appetite and how much capital to commit.

Our collection covers everything you need to master DeFi lending, from step‑by‑step guides on using major platforms to deep dives on tokenomics, security audits, and yield‑farming strategies. Below you’ll discover practical tutorials, platform reviews, and up‑to‑date analysis that equip both beginners and seasoned traders to navigate the fast‑moving world of decentralized credit.

KLend Crypto Exchange Review: Not an Exchange - Here's What It Really Is

KLend is often mistaken for a crypto exchange, but it's actually an unverified DeFi lending protocol with no trading features, no liquidity, and no user activity. Here's why you should avoid it as an exchange.

VIEW MOREWhy DeFi Lending Beats Traditional Loans: Top Benefits Explained

Explore how DeFi lending offers higher yields, full fund control, and innovative tools like flash loans, while comparing risks and benefits against traditional loans.

VIEW MORE