DEX Review: Honest Insights on Decentralized Exchanges and How to Choose One

When you trade crypto without a middleman, you’re using a decentralized exchange, a platform that lets you swap cryptocurrencies directly from your wallet, without needing to trust a company with your funds. Also known as a DEX, it’s the backbone of DeFi—letting you trade tokens, earn yield, and interact with smart contracts, all without signing up or handing over your private keys. Unlike centralized exchanges like Binance or Coinbase, a DEX doesn’t hold your money. That means no hacks on their servers, no account freezes, and no KYC forms. But it also means you’re on your own if something goes wrong.

Not all DEXes are built the same. Some, like Uniswap, a popular Ethereum-based DEX that uses automated market makers to set prices, run on Ethereum and can be slow and expensive during busy times. Others, like Jupiter Exchange, a Solana DEX aggregator that finds the best rates across multiple decentralized platforms, are fast and cheap because they run on newer blockchains. Then there are DEX aggregators that search dozens of sources at once to give you the best price—think of them as Google Shopping for crypto swaps. And let’s not forget Leonicorn Swap, a Binance Smart Chain DEX that competes directly with PancakeSwap, offering lower fees and unique token rewards.

What you’ll find in this collection are real, no-fluff DEX reviews. We looked at platforms like Mandala Exchange, XBTS.io, and Wavelength to see how they handle security, fees, and multi-chain support. We checked if their native tokens actually add value or just push more trading volume. We tested whether their interfaces are beginner-friendly or just confusing. And we dug into why some DEXes thrive while others vanish—often because they promised low fees but delivered high slippage, or claimed to be secure but left users exposed to front-running bots.

There’s no perfect DEX. The one that’s right for you depends on what chain you’re using, how much you’re trading, and how much risk you’re willing to take. If you’re swapping small amounts of ETH or SOL, speed and cost matter most. If you’re locking in large positions, security and liquidity depth are everything. And if you’re new to DeFi, you’ll want something that doesn’t require you to read a whitepaper just to press a button.

This isn’t a list of the top 10 DEXes. It’s a collection of what actually works, what doesn’t, and why. You’ll see reviews of real platforms people are using right now—not theoretical models or marketing hype. Whether you’re trying to avoid high gas fees on Ethereum, find a DEX that supports your favorite memecoin, or understand how a DEX aggregator cuts your slippage in half, you’ll find clear, practical answers here.

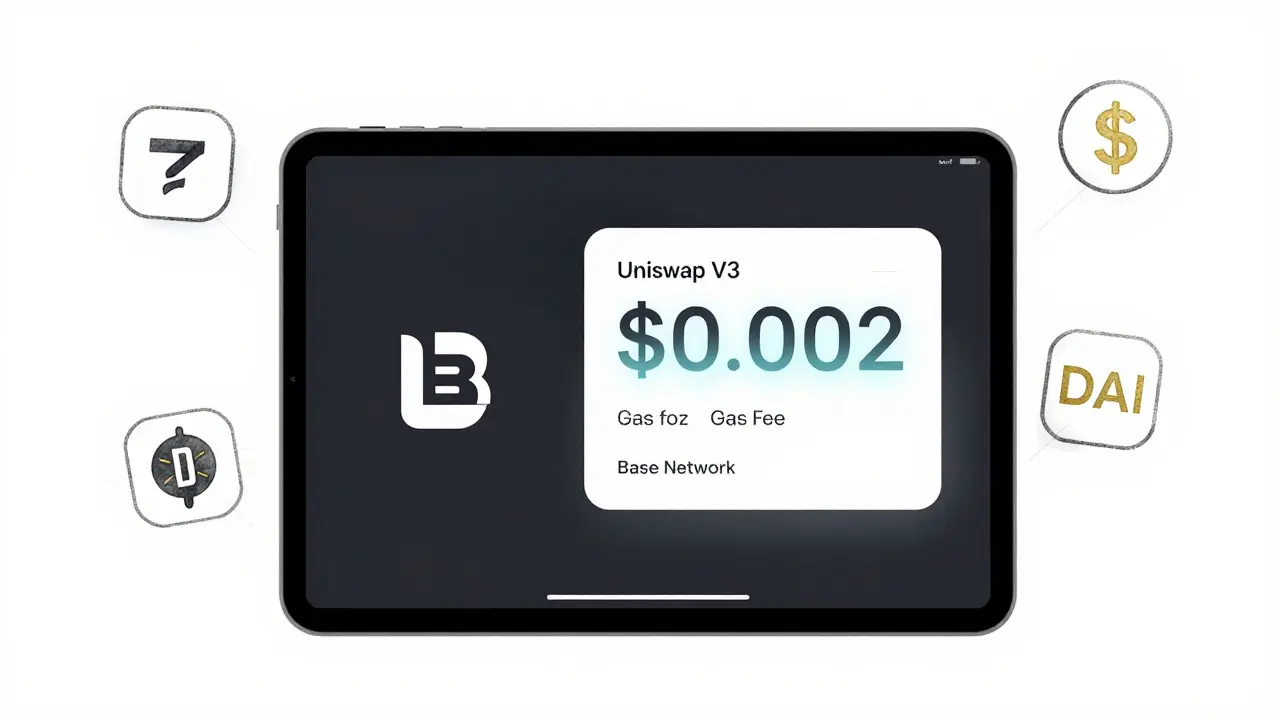

Base DEX Crypto Exchange Review: Uniswap V3 on Base Network Explained

Base DEX, powered by Uniswap V3, offers near-zero fees and fast trades on Coinbase's Layer 2 network. Ideal for retail traders and Coinbase users, it balances cost, speed, and security - but isn't fully decentralized yet.

VIEW MOREKava Swap Crypto Exchange Review: Is It Worth Using in 2025?

Kava Swap is a fast, fee-free DEX built for the Kava blockchain, but its tiny liquidity and limited token selection make it useful only for users already in the Kava ecosystem. Outside of KAVA and USDX trades, it's not worth the hassle.

VIEW MORE