Digital Asset Sanctions: What They Are and Why They Matter

When navigating the world of crypto, digital asset sanctions, government rules that block or freeze crypto‑related transactions, wallets, or services are a key piece of the puzzle. Also known as crypto sanctions, they shape how exchanges, investors, and developers move value across borders. Digital asset sanctions encompass official lists, asset‑freezing orders, and trade bans that target specific coins, addresses, or entire platforms. The moment a sanction hits, a chain of compliance steps kicks in: exchanges must halt deposits, wallets are flagged, and AML teams scramble to verify user identities. This chain reaction shows why understanding sanctions is not optional—it directly determines whether a trade can settle or gets rejected at the network layer.

How Sanctions Interact with Regulation, Compliance and Tax

In practice, crypto regulation, the set of laws and guidelines that govern crypto activities in a jurisdiction provides the legal backdrop for sanctions. Regulation defines what a sanction‑list looks like, who maintains it (often a treasury or foreign office), and the penalties for non‑compliance. sanctions compliance, the process of checking transactions against sanction lists and reporting suspicious activity is the operational layer that turns legal rules into everyday actions. Companies use screening software, real‑time API checks, and manual reviews to make sure no prohibited address slips through. Meanwhile, tax reporting, the filing of crypto gains, losses, and income to tax authorities often references sanction data because a blocked asset might trigger loss recognition or special filing requirements. In short, you need to understand regulation to set up compliance, and you need compliance data to complete accurate tax reports. This three‑way relationship means a single sanction event can ripple through legal risk, operational cost, and tax liability.

Why does this matter to you right now? The recent wave of sanctions on privacy‑focused coins, Russia’s ruble crypto trading limits, and Thailand’s new exchange licensing rules all illustrate a shifting landscape where governments use sanctions as a lever to control cross‑border capital flows. For everyday traders, that translates into tighter deposit limits, sudden delistings, and the need to keep records of every address you interact with. For developers, it means designing smart contracts that can pause or redirect funds if a sanctioned address appears. Below you’ll find curated articles that break down specific cases—Canada’s Bitcoin ETF approval, how to fill IRS Form 8949, exchange reviews, and more—so you can see the concepts in action and stay ahead of the compliance curve.

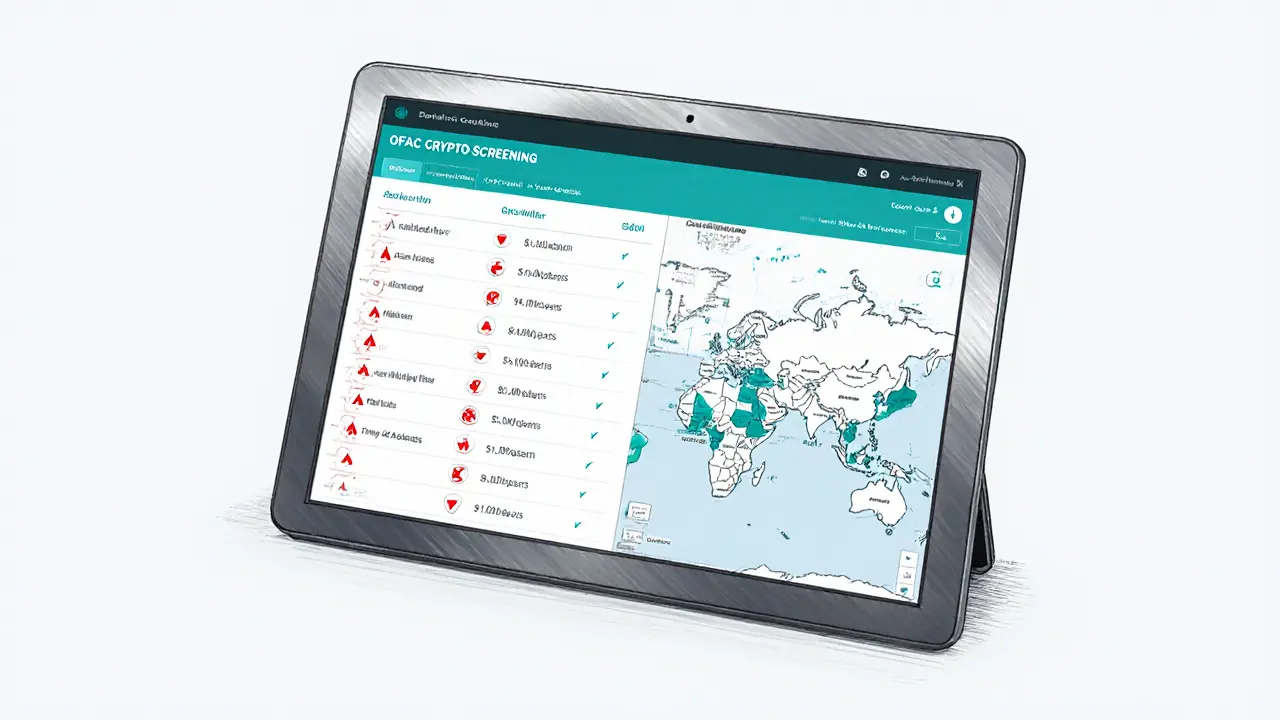

OFAC Cryptocurrency Sanctions: Compliance Guide 2025

Learn how OFAC's cryptocurrency sanctions work, the compliance steps you need, and what recent enforcement cases teach. Get a ready-to-use checklist and future outlook.

VIEW MORE