OFAC Cryptocurrency Sanctions: What They Mean for Traders and Exchanges

When dealing with OFAC cryptocurrency sanctions, U.S. Treasury restrictions that block certain digital‑asset transactions and freeze assets linked to sanctioned individuals or entities. Also known as U.S. sanctions on crypto, these rules are enforced by the U.S. Treasury Office of Foreign Assets Control (OFAC), the agency that administers and updates the sanctions list for financial and crypto markets. The core idea is simple: if a wallet address appears on the OFAC list, any platform that lets users trade, hold, or move that asset must block the address or face hefty penalties. This definition sets the stage for everything from exchange screening tools to the way tax forms like IRS Form 8949 are filled out for crypto trades.

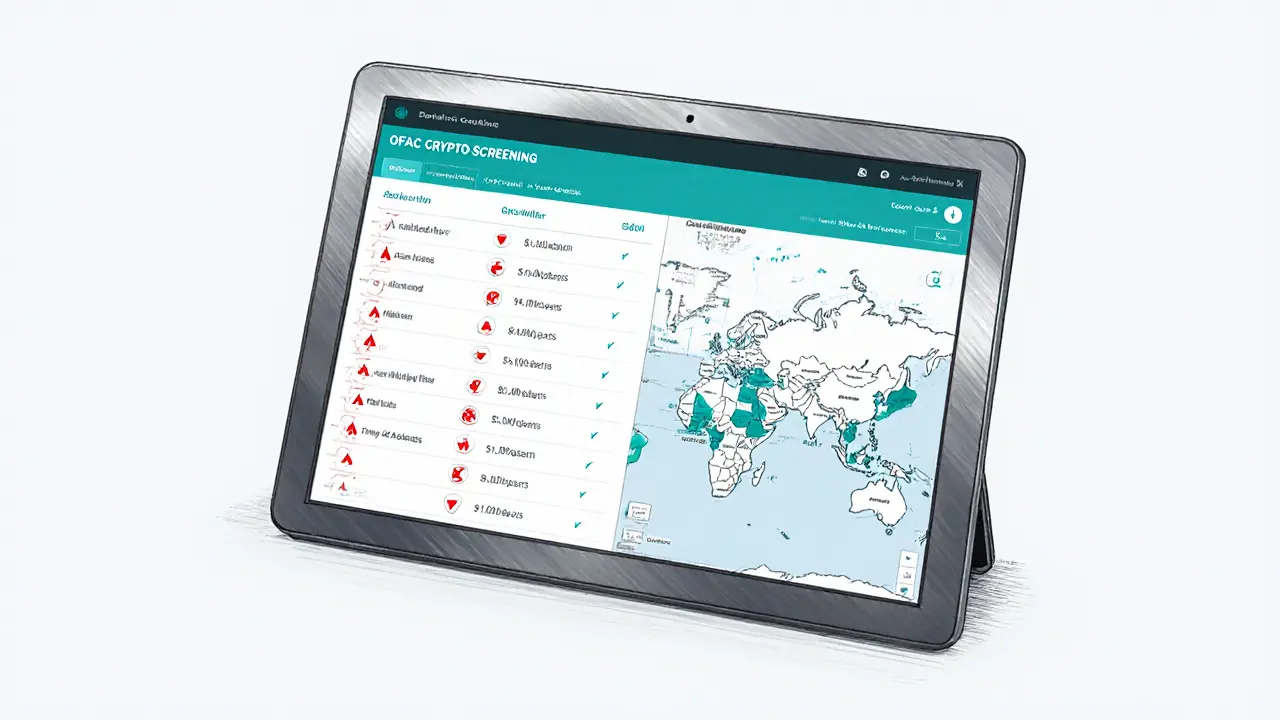

Compliance isn’t optional. Crypto exchange compliance, the suite of policies, software, and reporting mechanisms exchanges use to stay within legal bounds directly depends on the ability to monitor transactions against the OFAC list. In practice, an exchange needs real‑time API checks, AML/KYC procedures, and a clear escalation path for flagged activity. The relationship can be expressed as a semantic triple: OFAC cryptocurrency sanctions require crypto exchange compliance. Another triple ties the global picture together: International sanctions regimes influence how crypto exchanges handle sanctioned addresses. When you add the fact that the international crypto regulations, rules from bodies like the EU, FATF, and regional securities commissions often mirror OFAC’s approach, you see a layered compliance map that traders must navigate. The upshot? Platforms that ignore these signals can see their banks cut off, face legal action, or lose market trust.

On the ground, the impact shows up in surprising places. In jurisdictions where OFAC pressure is high, you’ll notice underground crypto premiums, price gaps where traders pay more for the same asset on black‑market exchanges to avoid sanctioned routes. Russia’s ruble crypto trading restrictions, Thailand’s SEC crypto exchange rules, and China’s ban on crypto all create a patchwork that fuels these premiums. A practical example: a trader trying to move Bitcoin through a U.S.‑based exchange must first verify that the counterparties aren’t on the OFAC list, otherwise the transaction could be delayed or reversed. This reality pushes investors to study compliance checklists, use reputable exchanges, and stay aware of the ever‑changing sanctions list. Below you’ll find a curated set of articles that break down everything from tax filing tips for crypto trades to detailed exchange reviews, giving you the tools to trade safely under OFAC cryptocurrency sanctions.

OFAC Cryptocurrency Sanctions: Compliance Guide 2025

Learn how OFAC's cryptocurrency sanctions work, the compliance steps you need, and what recent enforcement cases teach. Get a ready-to-use checklist and future outlook.

VIEW MORE