Pool Fees: What They Are and Why They Matter

When you hear Pool Fees, the charges that liquidity providers collect for letting you trade through a shared pool of assets. Also called LP fees, they are a core component of decentralized finance. Pool fees directly affect your profit margin, especially on high‑frequency swaps. In simple terms, pool fees encompass the cost of using a liquidity pool and they are determined by the automated market maker (AMM) algorithm that runs the pool. This relationship creates a semantic triple: Pool Fees → are → a cost of liquidity pool usage.

Key Players Behind the Numbers

Understanding Liquidity Pools, collections of token pairs that enable automated trades without order books is essential because they set the base rate for pool fees. These pools are powered by Automated Market Makers, smart contracts that price assets based on supply and demand curves. The AMM model requires a fee parameter, often between 0.1% and 0.3%, to reward providers and deter arbitrage. Another piece of the puzzle is Gas Fees, the blockchain transaction costs you pay to execute a swap. While gas fees are separate from pool fees, they influence the total expense of a trade, forming the triple: Gas Fees → affect → overall transaction cost. Finally, the broader ecosystem of Decentralized Exchanges, platforms that host many liquidity pools and AMMs ties everything together, as each DEX may set its own fee structure, adding another layer of comparison for traders.

So, how do these entities shape your experience? Pool fees are higher on low‑liquidity pools because the AMM needs to compensate providers for added risk. Conversely, deep pools with massive volume can afford lower fees while still offering attractive yields. Gas fees surge during network congestion, so even a low pool fee can become pricey if the underlying blockchain is busy. When you evaluate a swap, you should look at the combined pool fee + gas fee to gauge true cost. Many of our articles break down fee calculators, compare fee tiers across popular DEXs, and show how to optimize trades by timing swaps when gas prices drop. Below, you’ll find practical guides, reviews, and step‑by‑step tutorials that help you navigate pool fees, choose the right liquidity pools, and keep your trading costs in check.

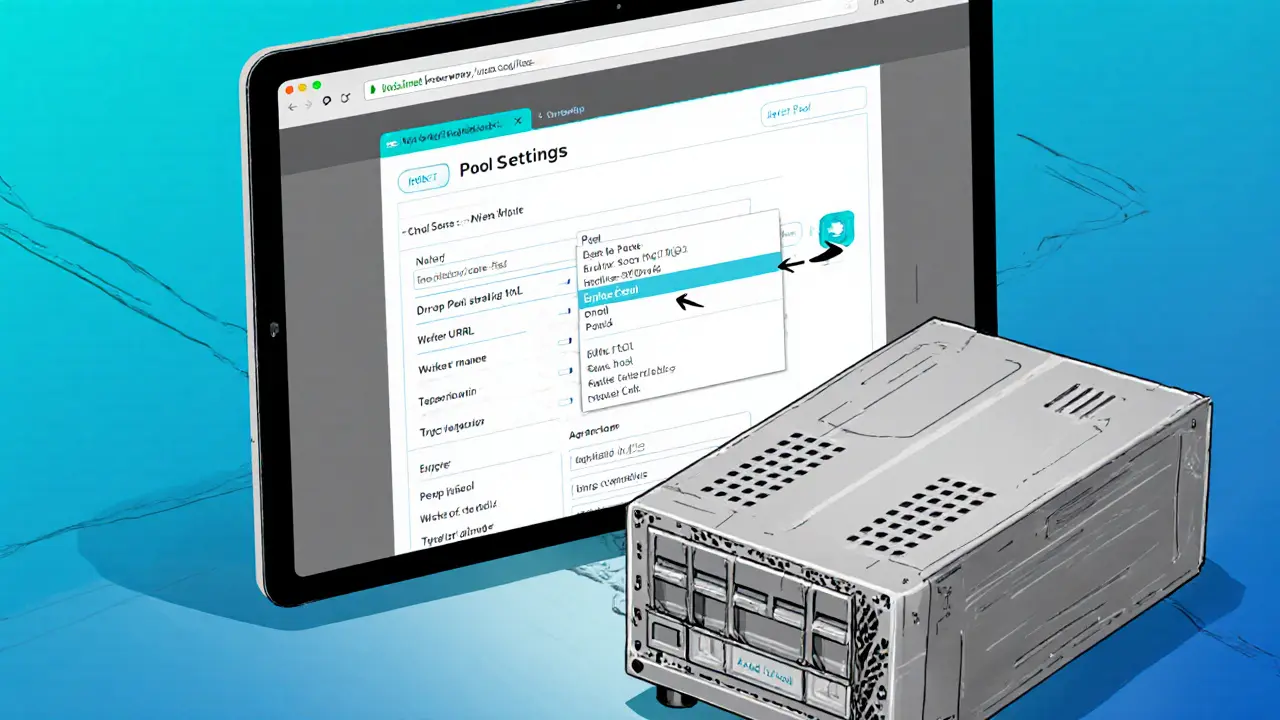

How to Switch Mining Pools Efficiently: A Step‑by‑Step Guide for Miners

Learn how to switch mining pools safely and profitably. This guide covers why to switch, key criteria, step‑by‑step configuration, automation, monitoring, and FAQs.

VIEW MORE