Profit Switching: Boosting Crypto Returns with Smart Moves

When you hear Profit Switching, the practice of moving funds between assets or platforms to capture the highest short‑term gain, you might think it’s a buzzword for pros only. It’s actually a simple idea: shift capital from a low‑return spot to a higher‑return one, as soon as the opportunity shows up. Think of it like swapping a low‑interest savings account for a higher‑yield one, but in crypto you’re juggling many markets at once. Below you’ll see how this approach can fit into everyday trading.

One of the classic engines behind profit switching is Arbitrage, buying an asset at a lower price on one exchange and selling it at a higher price on another. When price gaps appear between Binance, Gate.io, or a local P2P market, a quick arbitrage trade can lock in a risk‑free profit. Profit switching leans on these gaps, but it also watches for less obvious spreads—like the difference between a spot price and a DeFi lending rate. By constantly scanning for the best spread, you turn static holdings into an active income stream.

To actually move money, you need the right order type. Market Orders, orders that execute immediately at the best available price are the go‑to tool when a price gap is fleeting. With a market order you can snap up a cheap asset before the spread narrows. On the flip side, Limit Orders, orders that set a specific price target and wait until the market reaches it let you position for larger moves without constant monitoring. Profit switching combines both: market orders to capture sudden arbitrage, limit orders to set up longer‑term switches when a better rate is predicted.

Another powerful lever is DeFi Lending, platforms where you earn interest by depositing crypto assets. Some lending protocols offer rates that outpace traditional exchanges, especially for stablecoins during high demand. If you can deposit a token on a high‑yield pool, then switch that token back to a trading pair when the market offers a better upside, you’re effectively stacking returns. This interplay between lending yields and spot price movements is a core part of profit switching for many traders.

Why It Works Across Different Crypto Tools

Profit switching isn’t tied to a single coin or exchange. It works with Bitcoin, Ethereum, emerging tokens like STEMX, or even niche assets from airdrop projects. The key is a clear view of where the best returns live at any moment. That means keeping an eye on exchange fees, withdrawal limits, and security features—topics covered in our reviews of Gate.io, Glide Finance, and Darkex. When fees are low, a profit switch can net more; when fees bite, you might hold off. The strategy also benefits from sidechains and modular blockchains, which lower transaction costs and speed up moves, letting you react faster to market changes.

In practice, successful profit switching feels like a game of constant observation and quick action. You set up alerts for price gaps, monitor lending rates, and have a few pre‑filled market and limit orders ready to go. The more you automate, the less you miss. That’s why many traders use bots or scripts that watch the order books of multiple platforms and execute a profit switching trade the moment a profitable spread appears. Whether you’re a beginner using a simple spreadsheet or a pro running sophisticated bots, the core idea stays the same: move capital to wherever it earns the most, right now.

Below you’ll find a hand‑picked collection of guides, reviews, and deep dives that cover everything from buying crypto with fiat in China to the latest DeFi lending benefits. These resources will help you understand the tools, platforms, and market nuances needed to make profit switching a reliable part of your trading arsenal.

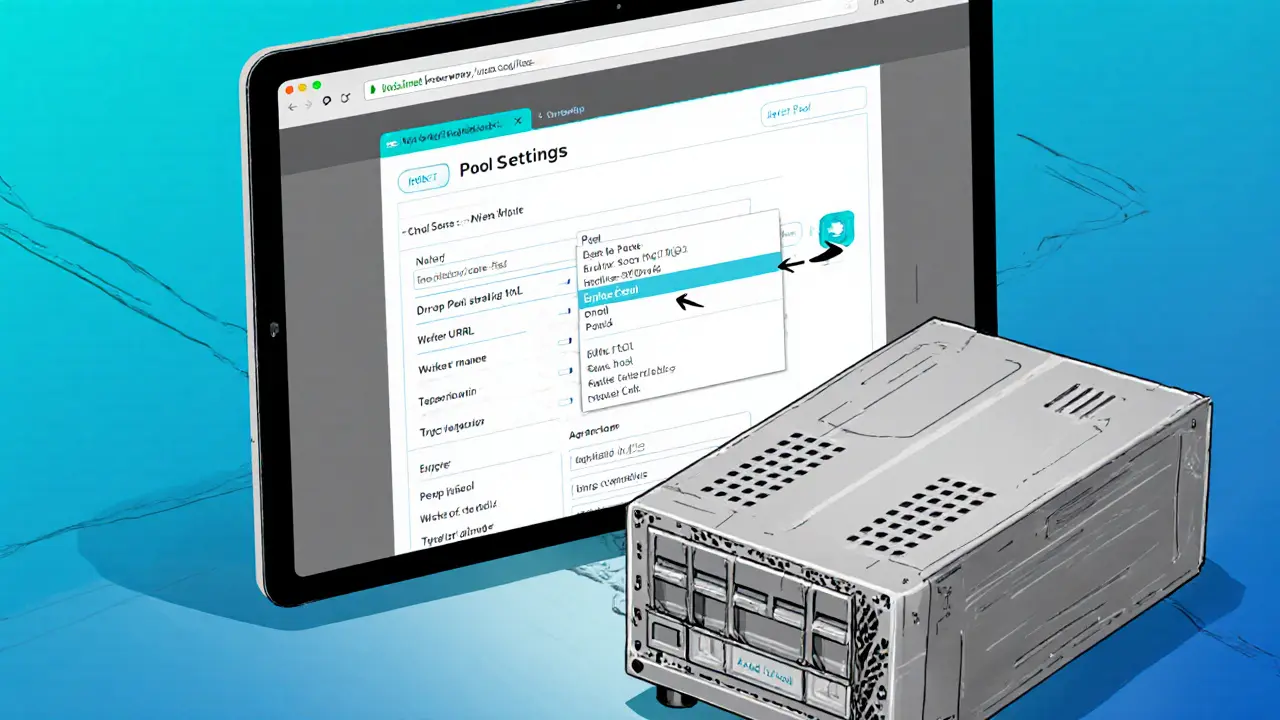

How to Switch Mining Pools Efficiently: A Step‑by‑Step Guide for Miners

Learn how to switch mining pools safely and profitably. This guide covers why to switch, key criteria, step‑by‑step configuration, automation, monitoring, and FAQs.

VIEW MORE