SEC Crypto Regulation: What It Means for Traders and Investors

When you hear SEC crypto regulation, the U.S. Securities and Exchange Commission’s rules and enforcement actions targeting digital assets. Also known as crypto oversight, it’s not just paperwork—it’s what decides whether a token is a security, a commodity, or nothing at all. This isn’t theoretical. If you’ve bought a coin listed on Binance or traded on a decentralized exchange, the SEC’s decisions already impact your holdings.

Crypto exchanges, platforms where users buy, sell, or trade digital assets. Also known as crypto trading platforms, it’s the frontline of SEC enforcement. Many have been forced to delist tokens or shut down U.S. services entirely because the SEC says those tokens are unregistered securities. Kujira Fin, GDOGE, and W Coin didn’t get banned because they were scams—they got caught in the crossfire of a regulatory gray zone. The SEC doesn’t care if a project has a whitepaper or a Discord channel. If it looks like an investment contract, it’s treated like one.

SEC enforcement, the actions the commission takes to punish or block crypto projects it believes violate securities laws. Also known as crypto crackdowns, it’s not random. Look at the cases against Ripple, Coinbase, and Kraken. The pattern? The SEC goes after platforms that let users trade tokens without proving they’re not securities. Airdrops like SafeLaunch SFEX or TopGoal GOAL? If they promised future profits, they’re likely violating rules—even if the project was just a meme. Even post-quantum cryptography or blockchain data networks like Chainbase aren’t safe if their tokens are sold as investments.

You won’t find a clear rulebook. The SEC doesn’t publish a list of banned tokens. Instead, they sue first and explain later. That’s why so many projects vanish overnight. If you’re holding a low-cap token with no team, no utility, and no exchange listing, you’re not just taking market risk—you’re taking legal risk too. The SEC doesn’t need to prove fraud. They just need to prove you bought something expecting profit from others’ efforts.

That’s why this collection of articles matters. You’ll see real cases—like how Kujira Fin’s KUJI token crashed after regulatory pressure, or how GDOGE died after a CoinMarketCap listing raised red flags. You’ll learn why platforms like Cryptobuyer Pro got exposed as scams not just because they were fake, but because they ignored basic compliance. You’ll see how P2P trading in restricted countries still works, not because it’s legal, but because people found ways around the system.

This isn’t about fear. It’s about awareness. The SEC isn’t trying to kill crypto. It’s trying to control it. And if you’re trading, holding, or investing, you need to know where the lines are drawn—before you cross them.

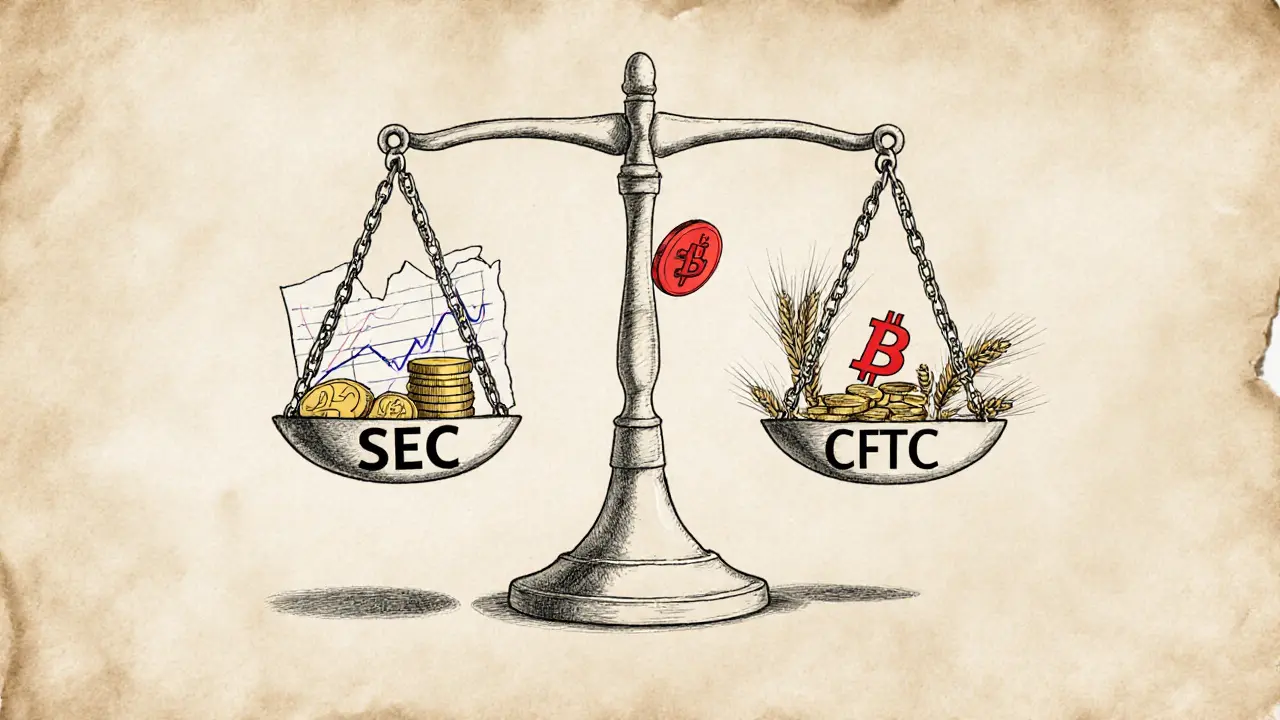

SEC vs CFTC: How the Crypto Regulatory Battle Is Shaping the Future of Digital Assets

The SEC and CFTC are fighting over who regulates crypto - securities or commodities. This battle affects Bitcoin, Ethereum, exchanges, and your investments. Here's how it works and why it matters.

VIEW MORE