Taliban Crypto Ban: What It Means for Traders and Investors

When dealing with Taliban crypto ban, the prohibition of cryptocurrency activities imposed by the Afghan Taliban government in 2022. Also known as Afghanistan crypto crackdown, it represents a major shift in how digital assets are treated in a country already facing economic isolation.

The ban falls under the broader umbrella of cryptocurrency regulation, government rules that define what is allowed, taxed or prohibited for crypto users. In Afghanistan, the rule requires anyone handling Bitcoin, Ethereum or any other token to stop all transactions, close exchange accounts and avoid promoting crypto services. This regulatory stance directly influences the supply chain of digital assets, forcing local traders to look for work‑arounds or move operations abroad.

At the same time, the United States’ Office of Foreign Assets Control (OFAC, the agency that enforces economic and trade sanctions against targeted countries, entities and individuals) has placed sanctions on individuals and entities linked to the Taliban’s crypto ban. Those sanctions mean that any wallet or exchange that deals with Afghan‑origin funds can be flagged, frozen or reported. For a trader, that adds a compliance layer: you must screen counterparties for OFAC watch‑lists before accepting any crypto from the region.

Why does this matter to you? Because when a jurisdiction blocks legal crypto usage, a black market often springs up. Our Taliban crypto ban creates what analysts call underground crypto premiums, the price gap between official market rates and the higher prices paid on illicit platforms. In 2025, data showed that in banned regions like Afghanistan and even China, premium spreads could exceed 20‑30 %. That premium reflects the risk premium traders demand for navigating sanctions, limited liquidity and potential law‑enforcement crackdowns.

Understanding these dynamics helps you answer three key questions: (1) How does the Taliban’s policy reshape crypto adoption in a cash‑starved economy? (2) What legal risks arise when you interact with Afghan‑origin crypto on global platforms? (3) Which tools can you use to monitor underground premiums and avoid scams? Below we’ll unpack each answer, weaving in real‑world examples from recent exchange reviews, tax guides and compliance checklists that highlight the practical side of operating under strict bans.

How the Ban Affects Market Access and Investor Behaviour

The immediate effect of the ban is a shutdown of local crypto exchanges. Platforms like Binance or local peer‑to‑peer services were forced to halt Afghan users, leaving many with frozen balances. This pushes investors toward cross‑border services that claim to be “unrestricted.” However, those services often lack robust KYC procedures, raising the chances of fraud. In our recent review of the Mandala Exchange (2025), we noted that users from high‑risk jurisdictions faced extra verification steps and higher withdrawal fees, a direct result of global compliance pressures linked to sanctions.

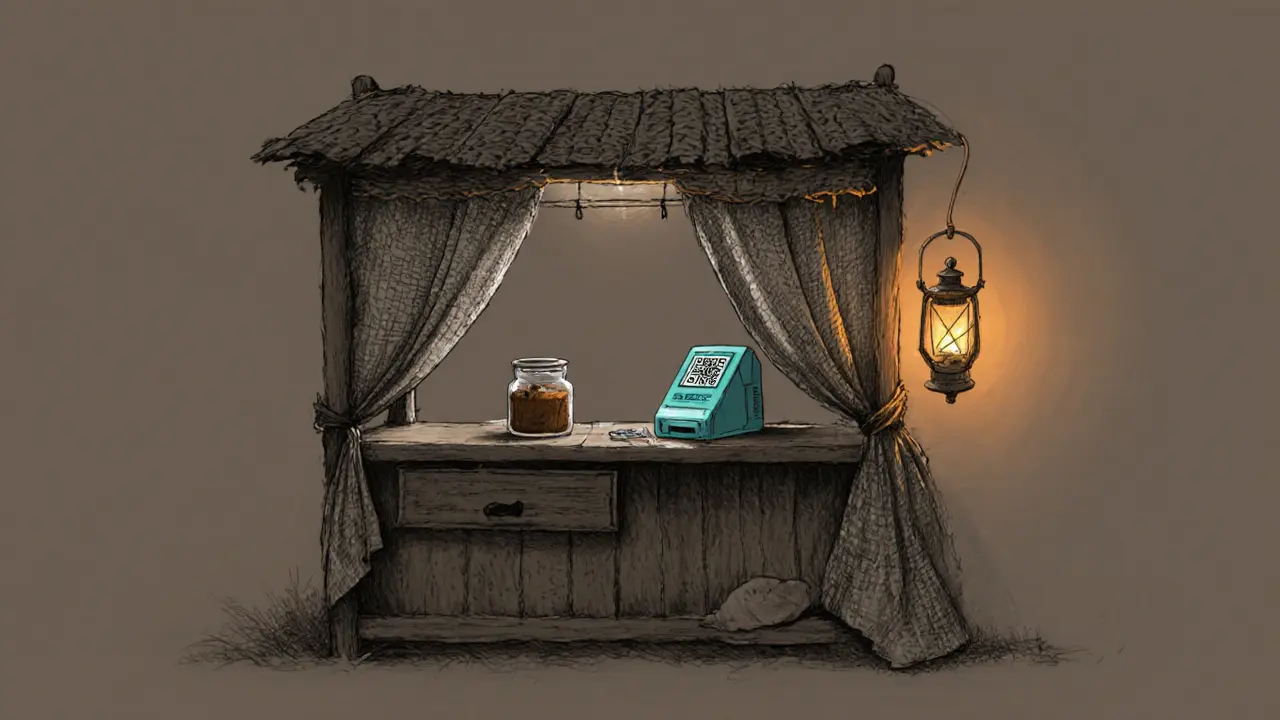

At the same time, the ban fuels a demand for alternative stores of value. Bitcoin’s reputation as a borderless asset means many Afghans still try to buy it through informal channels, like crypto‑friendly friends abroad or underground marketplaces. The price they pay on these channels usually reflects the underground premium we mentioned earlier. This premium can be quantified: a study of 2024 transaction data showed that the average Bitcoin price in Afghan underground markets was about $1,200 higher than the spot price on major exchanges.

For investors outside Afghanistan, this creates an arbitrage opportunity—but also a compliance nightmare. If you spot a price gap, you must decide whether the potential profit outweighs the risk of violating OFAC sanctions or local AML laws. Many firms mitigate this risk by using automated screening tools that flag wallet addresses originating from high‑risk IP ranges, a practice we detail in our OFAC compliance guide (2025).

Beyond price, the ban influences the overall sentiment toward crypto in the region. Surveys conducted after the ban showed a 40 % drop in perceived safety of crypto investments among Afghan residents. This sentiment shift reduces the inflow of new capital and slows the development of local blockchain projects, which in turn limits the ecosystem’s growth potential.

When you combine the regulatory crackdown, the sanctions environment, and the rise of underground premiums, you get a complex risk matrix. Our analysis of the underground crypto premiums (2025) highlighted three main risk vectors: legal exposure, price volatility, and operational security. Each vector ties back to one of the entities we introduced—cryptocurrency regulation, OFAC sanctions, and underground premiums—creating a clear semantic network that helps you map the landscape.

In the sections that follow, you’ll discover how to navigate this landscape. We’ll show you practical steps for compliance, ways to monitor price premiums, and a roundup of tools that can help you stay on the right side of the law while still accessing crypto opportunities. Whether you’re a trader, a compliance officer, or just curious about how the Taliban’s policy reshapes the global crypto scene, the articles below give you the insights you need.

Now that you understand the core forces behind the Taliban crypto ban, explore the detailed reviews, guides and analyses we’ve gathered. They cover exchange security, tax reporting, sanctions compliance, and the hidden market dynamics that arise when a government says “no” to digital money.

How Underground Crypto Trading Survives Under the Taliban’s Crypto Ban

Explore how Afghan crypto traders survive the Taliban's ban, using Bitcoin, USDT, and hidden networks to move money despite arrests and internet blackouts.

VIEW MORE