Traditional Loans – Your Essential Overview

When dealing with Traditional Loans, loans offered by banks, credit unions, or other regulated lenders that follow standard underwriting rules. Also known as conventional financing, they rely on a borrower’s credit history and the lender’s risk assessment. Interest Rates, the percentage charged on the borrowed amount determine the cost of borrowing, while Credit Scores, numeric representations of creditworthiness decide eligibility and pricing. In short, Traditional Loans combine these elements to create a predictable borrowing experience.

Secured vs. Unsecured: What’s the Difference?

Two major sub‑types shape the traditional loan market. Secured Loans, loans backed by collateral such as a house or car lower the lender’s risk, often resulting in lower interest rates. Unsecured Loans, borrowings without pledged assets, like personal or student loans carry higher rates because the lender relies solely on credit scores and income verification. Both require a clear repayment schedule, typically outlined in an amortization table that shows how each payment splits between principal and interest.

The loan’s term length and repayment structure directly affect total cost. Shorter terms mean higher monthly payments but less interest paid over time, while longer terms spread out payments but increase overall interest. Lenders calculate amortization based on the agreed‑upon interest rate, which can be fixed (unchanging for the loan’s life) or variable (adjusting with market benchmarks). Understanding how these factors interact helps borrowers choose the most affordable option.

Traditional loans sit alongside newer financing models like peer‑to‑peer platforms or crypto‑backed lending. While alternative routes can offer speed or niche assets, they often lack the regulatory safeguards and standardized disclosures of conventional lenders. For risk‑averse individuals, the predictability of a bank‑issued loan—clear terms, regulated interest caps, and consumer protection—remains a strong advantage.

Below you’ll find a curated collection of articles that dive deeper into each of these topics. From step‑by‑step guides on navigating bank applications to detailed comparisons of secured versus unsecured products, the resources are designed to equip you with the knowledge needed to make confident borrowing decisions.

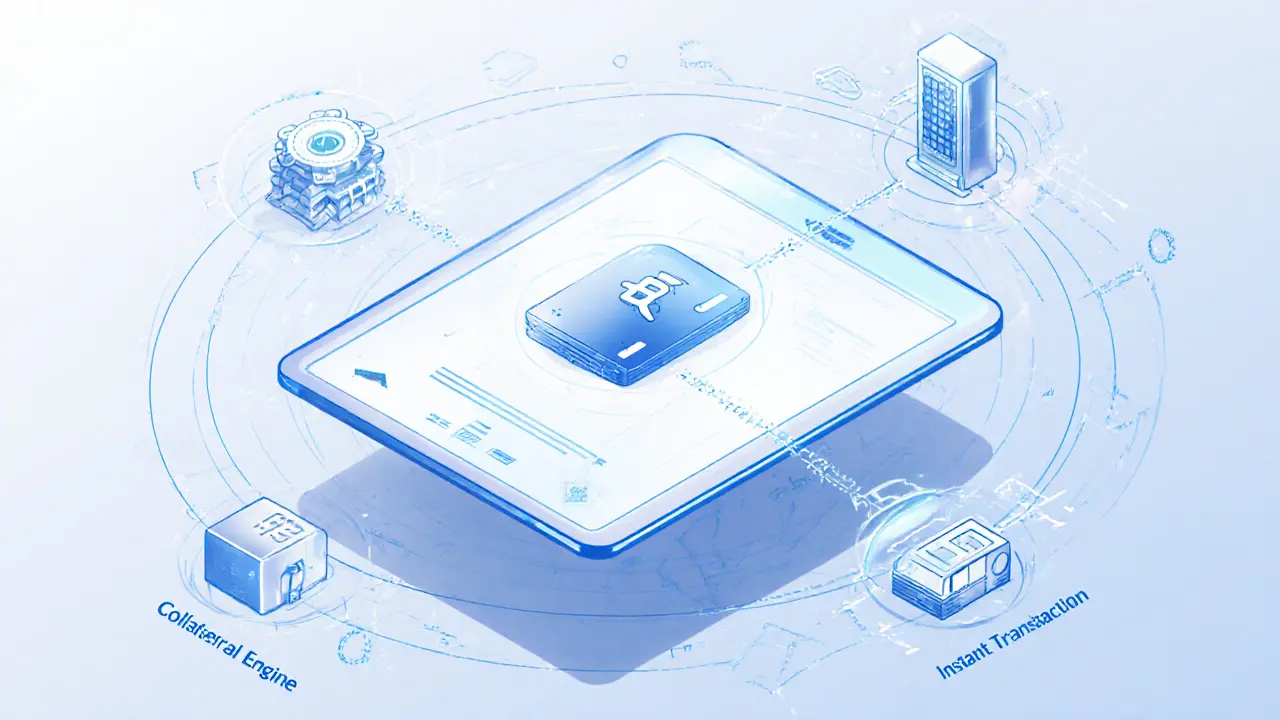

Why DeFi Lending Beats Traditional Loans: Top Benefits Explained

Explore how DeFi lending offers higher yields, full fund control, and innovative tools like flash loans, while comparing risks and benefits against traditional loans.

VIEW MORE