Transaction Times: What Determines Speed on the Blockchain?

When working with Transaction Times, the period between submitting a transaction and seeing it confirmed on a blockchain. Also known as tx latency, it directly influences how quickly you can move funds, trade assets, or interact with smart contracts. Gas Fees, the cost paid to miners or validators to prioritize and process a transaction are one of the biggest levers: higher fees usually push a transaction to the front of the queue. Block Time, the average interval at which a new block is added to the chain sets a baseline—if blocks are generated every 10 seconds, the fastest possible confirmation can’t be quicker than that. Lastly, Network Congestion, the level of pending transactions competing for space in upcoming blocks can stretch times from seconds to minutes, especially during market spikes. In short, Transaction Times encompass these factors and more, forming a web where each element pushes or pulls the overall speed.

Key Factors that Shape Transaction Times

Order Types, instructions like market or limit orders that dictate how and when a trade is executed add another layer: a market order seeks immediate execution, often at the cost of higher gas, while a limit order can sit idle until price conditions match, potentially waiting for a less congested moment. Sidechains, parallel blockchains that offload traffic from the main chain aim to shorten transaction times by offering faster block times and lower fees, though they introduce bridge security considerations. Scalability solutions like rollups or sharding also influence the equation, as they can increase throughput, reducing both block time and congestion. Meanwhile, validator performance, consensus algorithm (Proof‑of‑Work vs Proof‑of‑Stake), and even geographic node distribution affect how quickly a transaction propagates across the network. Understanding how these pieces interact helps you decide whether to bump your gas, switch to a sidechain, or choose a different order type for the best speed‑cost balance.

Below you’ll find a curated set of articles that break each of these components down in plain language. From deep dives on gas versus transaction fees to sidechain mechanics and order‑book strategies, the collection gives you actionable tips to cut waiting time and save money. Dive in to see how real‑world examples illustrate the impact of network congestion, how to fine‑tune gas settings on popular exchanges, and which order types work best under different market conditions. Armed with this context, you’ll be ready to make faster, smarter moves in the crypto space.

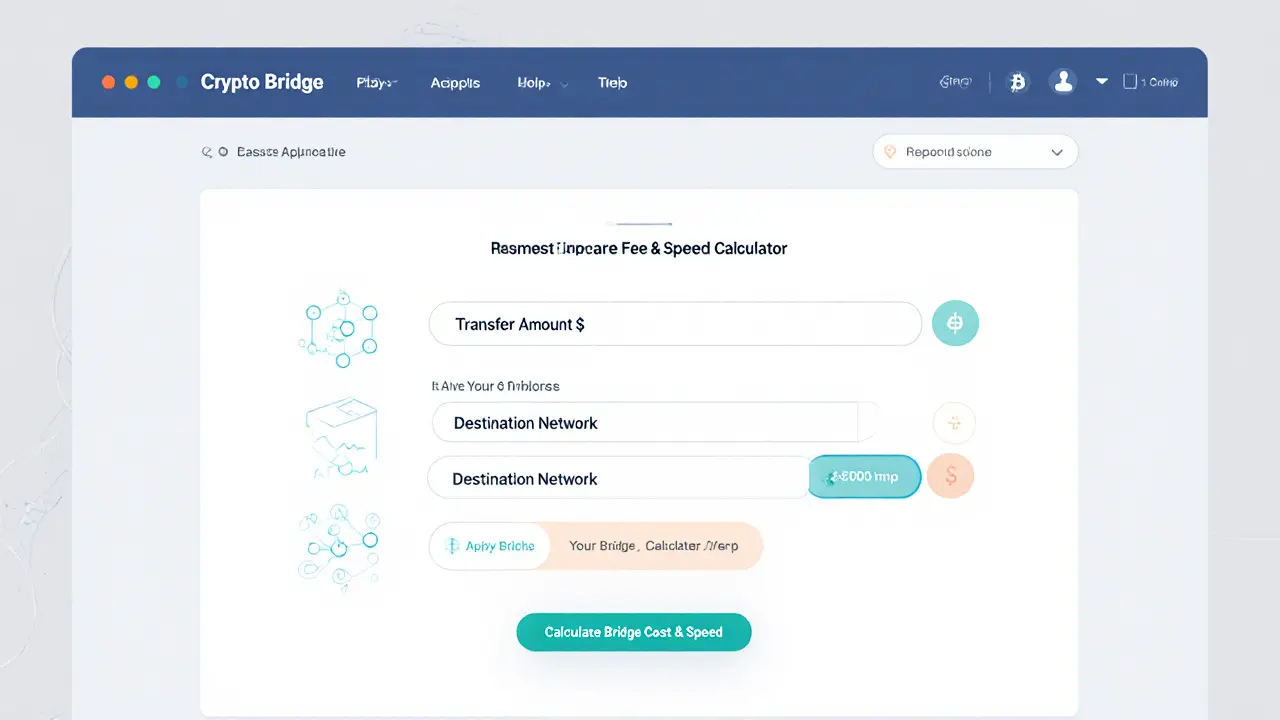

Understanding Bridge Fees and Transaction Times for Crypto Transfers

Learn how bridge fees and transaction times vary across crypto bridges, discover fee models, speed differences, security tips, and a practical checklist for cross‑chain transfers.

VIEW MORE