Underground Crypto Premiums in Afghanistan

When talking about underground crypto premiums, the extra cost traders pay on hidden platforms after official exchanges are shut down. Also known as crypto price premium, it shows the gap between the official rate and the rate you see on the street‑level market.

In Afghanistan, a country where crypto trading faces strict bans and limited banking infrastructure, the premium often doubles or triples the listed price. The reason isn’t hype; it’s a direct result of banned jurisdictions, regions where governments forbid or heavily regulate crypto activity

What drives the hidden price gap?

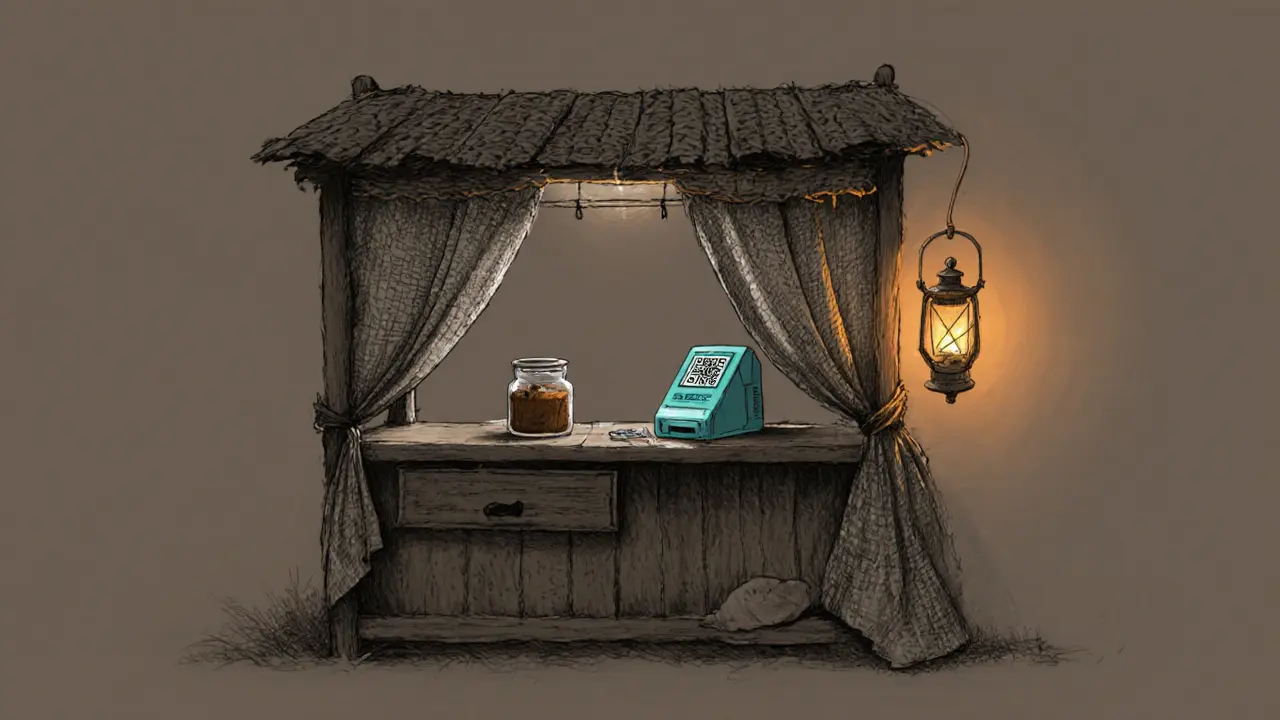

First, regulatory enforcement, actions like raids, fines, or shutdown orders, shrink the supply of legal venues. When legal venues disappear, traders turn to peer‑to‑peer groups, local “cash‑in‑hand” desks, or overseas platforms that operate under the radar. Those channels charge a markup to cover risk, lack of liquidity, and the cost of staying hidden.

Second, the black market exchanges, unofficial trading hubs that match buyers and sellers outside regulated frameworks, act as price setters. They don’t have to follow official KYC or AML rules, so they can move larger blocks quickly, but they also need to compensate for the danger of being discovered. That compensation appears as a premium.

The premium isn’t static; it reacts to three main forces. When a new crackdown hits, the premium spikes because supply contracts overnight. When a stable P2P network forms, the premium softens as competition increases. And when international sanctions ease, more formal exchanges slip back into the market, pulling the premium down.

For a trader in Kabul, the premium matters in two practical ways. One, it raises the breakeven point for any trade—if you buy at a 30% premium and the market later drops to the official rate, you could lose the entire spread. Two, it creates arbitrage opportunities for those who can navigate both hidden and legal channels. Successful arbitrage requires fast settlement, reliable escrow, and an understanding of the local risk landscape.

Understanding the premium also helps you gauge market sentiment. A soaring premium often signals distrust in the government’s ability to protect crypto assets, while a shrinking premium can indicate that the underground market is stabilizing or that new legal avenues are emerging.

Technical tools can make premium tracking easier. Real‑time price aggregators that pull data from local Telegram groups, WhatsApp circles, and overseas exchanges give you a live view of the spread. Pair that with a simple spreadsheet calculating the percentage difference, and you have a dashboard that warns you before you overpay.

Risk management is non‑negotiable. Always verify the counterparty’s reputation on community forums, use multi‑signature escrow when possible, and keep only a fraction of your portfolio in high‑premium trades. If the premium looks too good to be true, it probably is a scam that exploits the same lack of regulation you’re trying to work around.

Policy shifts are another driver. When the Afghan government hints at a crypto‑friendly licensing regime, the premium often contracts as traders anticipate a legal route. Conversely, a sudden ban on VPN usage or a crackdown on “money‑changing” booths can send the premium rocketing within hours.

In practice, most traders treat the underground premium as a cost of doing business, much like shipping fees in e‑commerce. By factoring it into profit calculations, you avoid surprise losses. For example, a 20% premium on Bitcoin might still be worthwhile if the expected price appreciation exceeds 30% over the same period.

Finally, remember that the underground market is not monolithic. Different neighborhoods, ethnic groups, and online forums each have their own pricing conventions. Some may quote premiums in local afghani, others in USD. Aligning with the right sub‑market can reduce friction and improve price accuracy.

All these factors—regulatory enforcement, black‑market exchanges, risk management, and community dynamics—intertwine to shape the underground crypto premium you’ll see in Afghanistan today. Below you’ll find a curated set of articles that break down each piece in more detail, from deep‑dive exchange reviews to step‑by‑step guides on navigating the hidden market safely.

How Underground Crypto Trading Survives Under the Taliban’s Crypto Ban

Explore how Afghan crypto traders survive the Taliban's ban, using Bitcoin, USDT, and hidden networks to move money despite arrests and internet blackouts.

VIEW MORE