What is Doric Network (DRC) Crypto Coin? Tokenizing Real Assets on Blockchain

Fractional Asset Ownership Calculator

Calculate how much of real-world assets you can own with as little as $10 using Doric Network (DRC) tokens.

DRC price: $0.29 (as of latest market data)

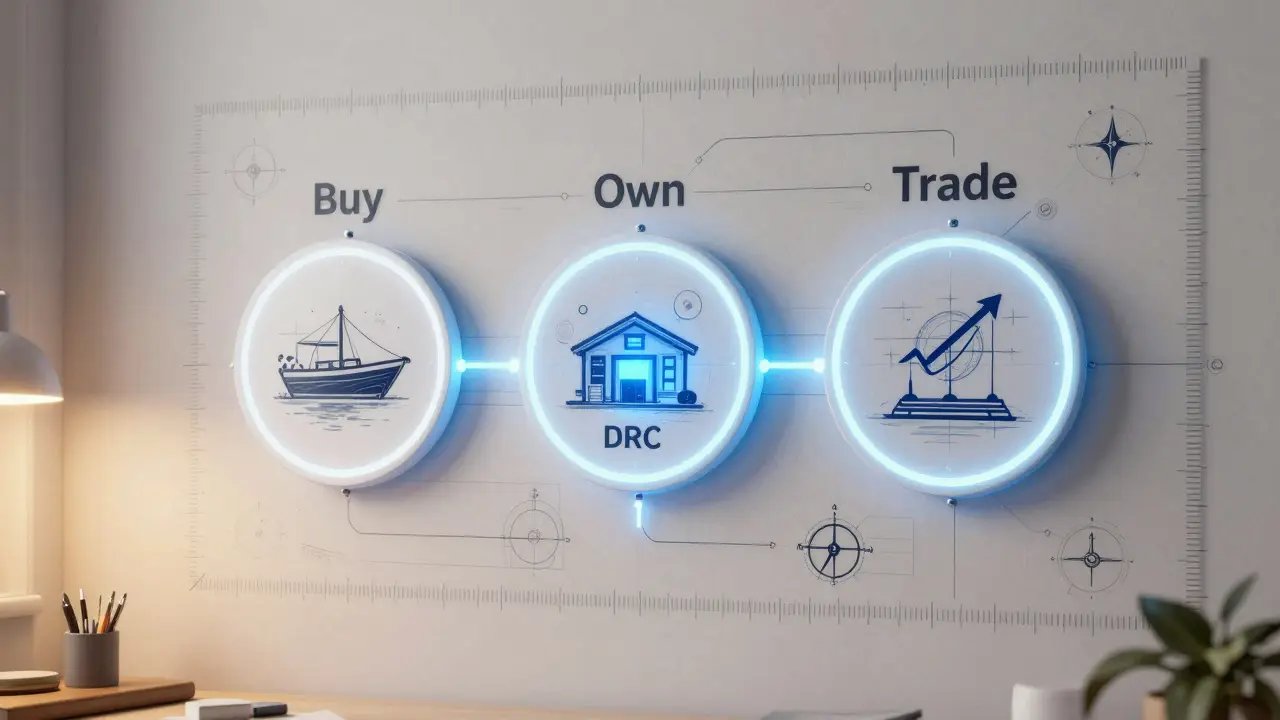

Doric Network (DRC) isn’t just another cryptocurrency. It’s built to turn real-world assets-like buildings, boats, or startups-into digital pieces you can buy and sell with as little as $10. Most crypto coins trade for speculation. DRC is meant to be used inside a system that lets regular people own small slices of expensive things they could never afford before.

What Doric Network Actually Does

Doric Network’s core idea is simple: take something valuable that’s hard to buy into-like a luxury yacht or a commercial property-and break it into thousands of digital tokens. Each token represents a fraction of ownership. Instead of needing $2 million to buy a building, you buy 500 DRC tokens that give you a tiny stake. The goal? To break down walls that keep everyday investors out of high-value markets.

This isn’t theoretical. The project says it’s already enabling people to invest in things like construction projects or manufacturing ventures through its platform. You’re not buying shares in a company-you’re buying a piece of the physical asset itself. That’s different from stocks, ETFs, or even real estate crowdfunding. It’s direct ownership, recorded on a blockchain.

The DRC Token: How It Works

The DRC coin is the fuel of this system. You need it to buy tokenized assets, pay fees, and trade fractions on the Doric marketplace. It’s not just a speculative asset-it’s a utility token built for transactions within the network.

As of December 2023, DRC was trading around $0.29 USD. Prices varied slightly across exchanges: Bitget showed $0.335, CoinGecko had $0.29, and Coinbase listed it at €0.20 in the Netherlands. Trading volume hovered between $100K and $160K daily, which is low compared to major coins but normal for a niche project.

Supply numbers are messy. CoinMarketCap says there are 690 million DRC total, with 388 million in circulation. CoinGecko claims a max supply of 600 million. This inconsistency isn’t unusual in crypto, but it does raise questions about transparency. The fully diluted valuation ranges from $103 million to $231 million depending on the source.

Proof of Authority: The Tech Behind the Scenes

Doric Network doesn’t use Bitcoin-style mining. Instead, it runs on Proof of Authority (PoA). That means only trusted, verified nodes-like known companies or entities approved by the network-can validate transactions. This makes the system faster and cheaper than Proof of Work.

PoA isn’t as decentralized as Bitcoin or Ethereum. But for Doric’s use case, that’s intentional. Asset tokenization needs speed, low fees, and regulatory compliance. PoA delivers that. Transactions settle quickly, which matters when you’re buying a slice of a $5 million warehouse and need to confirm ownership in seconds.

There’s no public data on exact transaction speeds (TPS), but PoA networks like Polygon’s early version handled over 60 TPS. Doric likely operates in a similar range. The trade-off? Less decentralization. If the validator nodes get compromised or act dishonestly, the network could be at risk. But the project assumes trust in its selected validators-mostly financial or legal entities involved in asset management.

Where You Can Use DRC

Right now, most people interact with DRC through exchanges. You can buy, sell, or trade it on platforms like Bitget, LBank, and Coinbase. Some exchanges even offer automated trading tools like futures grid bots or position grids-features designed for volatile crypto markets.

But the real promise isn’t trading. It’s using DRC to buy tokenized assets. Imagine clicking a button to own 0.05% of a new apartment complex in Berlin. Or funding a small boat manufacturer in Croatia with a few hundred dollars. That’s the vision. So far, there’s no public list of tokenized assets live on the platform. No verified case studies. No screenshots of the asset marketplace. That’s a red flag for skeptics.

DRC can also be used for sending money internationally, donating to charities, or staking for passive income. Bitget mentions staking products, but details are vague. No official Doric wallet or staking portal is publicly documented. So right now, most utility happens on third-party exchanges, not on Doric’s own platform.

Market Position and Competition

Doric Network ranks around #4065 on CoinMarketCap. That puts it in the bottom 1% of all cryptocurrencies by market cap. Its value is tiny compared to giants like Bitcoin or Ethereum. But it’s not competing with them.

Doric is trying to carve out space in asset tokenization-a niche that includes Polymath, Securitize, and RealT. These platforms also tokenize real estate or private equity. But Doric’s focus on small-scale, everyday investors is different. While others target accredited investors with $1M+ minimums, Doric says it’s built for people with $50 or $500 to spare.

The global asset tokenization market is projected to hit $16 trillion by 2030. That’s huge. But most of that growth will come from institutions. Doric’s chance lies in being the first to make it easy for non-tech-savvy people to participate.

Is Doric Network Legit? The Big Questions

There’s no regulatory approval listed on Doric’s official channels. No SEC filings. No EU MiCA compliance updates. That’s risky. Tokenizing real assets often falls under securities law. If you’re selling ownership in a building, you’re selling a security. Without clear legal grounding, Doric could face shutdowns in key markets like the U.S. or EU.

There’s also no public roadmap. No GitHub repo. No team bios. No technical whitepaper with code specs. All available info comes from exchange listings and third-party market data. That’s not normal for serious blockchain projects. Even small teams usually have a website, Twitter, or Discord.

And yet-the idea works. Fractional ownership of real assets is a proven model. Platforms like Fundrise and RealtyMogul have done it for years. Doric just wants to do it with blockchain. The technology isn’t the issue. The execution is.

Who Is This For?

If you’re a crypto trader looking for the next 10x coin, DRC isn’t it. The volume is too low. The hype is too quiet. The community is tiny.

If you believe in asset tokenization and want to get in early on a project that targets everyday people-not just hedge funds-then DRC might be worth watching. But treat it like an experimental bet, not an investment.

Right now, Doric Network feels like a prototype with potential. It has the right idea. But without transparency, a working platform, or regulatory clarity, it’s still a promise-not a product.

What’s Next?

The next 12 months will tell the story. Will Doric launch its asset marketplace? Will it list real properties or businesses? Will it partner with legal firms to handle compliance? Will it release a whitepaper or team details?

Until then, DRC is a speculative token trading on exchanges. The dream is real. The execution? Still in progress.

Candace Murangi

December 11, 2025 AT 09:48Albert Chau

December 11, 2025 AT 22:34amar zeid

December 12, 2025 AT 21:05Alex Warren

December 14, 2025 AT 15:47Rakesh Bhamu

December 16, 2025 AT 10:57Stanley Machuki

December 17, 2025 AT 12:02Lynne Kuper

December 17, 2025 AT 20:45Lloyd Cooke

December 18, 2025 AT 17:13Kurt Chambers

December 18, 2025 AT 22:29Kelly Burn

December 19, 2025 AT 05:13John Sebastian

December 19, 2025 AT 13:57Jessica Petry

December 21, 2025 AT 05:30Scot Sorenson

December 21, 2025 AT 22:49Ike McMahon

December 23, 2025 AT 21:29Anselmo Buffet

December 23, 2025 AT 23:05Joey Cacace

December 25, 2025 AT 01:13PRECIOUS EGWABOR

December 25, 2025 AT 21:17